Online Insurance Auto Quote

In today's fast-paced world, convenience and efficiency are key factors when it comes to managing our daily lives. The insurance industry, understanding this need, has revolutionized the way we obtain auto insurance quotes, offering a seamless and user-friendly experience through online platforms. This article explores the ins and outs of Online Insurance Auto Quotes, shedding light on the process, benefits, and considerations for those seeking a modern approach to insurance coverage.

The Rise of Online Insurance Auto Quotes

The traditional method of acquiring auto insurance involved numerous phone calls, meetings with agents, and piles of paperwork. However, with the advent of technology, the insurance landscape has transformed significantly. Online insurance auto quotes have emerged as a game-changer, providing an accessible and efficient way for individuals to compare and purchase auto insurance policies.

This shift towards digital insurance services has not only benefited consumers but has also created a more competitive market, driving insurers to offer better rates and more comprehensive coverage options. As a result, obtaining an auto insurance quote online has become a popular choice for many, offering a quick and hassle-free experience.

The Convenience Factor

One of the primary advantages of online insurance auto quotes is the unparalleled convenience it offers. Individuals can now access multiple insurance providers and compare policies from the comfort of their homes or on the go. Whether it's during a lunch break or late at night, the process is flexible and adaptable to modern lifestyles.

Additionally, the online platform provides a transparent and straightforward comparison of insurance options. Users can easily view and analyze different policies, their coverage limits, and associated costs, empowering them to make informed decisions without the pressure of an in-person sales pitch.

| Insurance Provider | Coverage Type | Premium Cost |

|---|---|---|

| Insurer A | Comprehensive | $120/month |

| Insurer B | Liability Only | $85/month |

| Insurer C | Full Coverage | $135/month |

The table above provides a glimpse of the kind of information readily available when comparing auto insurance quotes online. Such transparency ensures that consumers can make choices based on their specific needs and budget constraints.

Streamlined Application Process

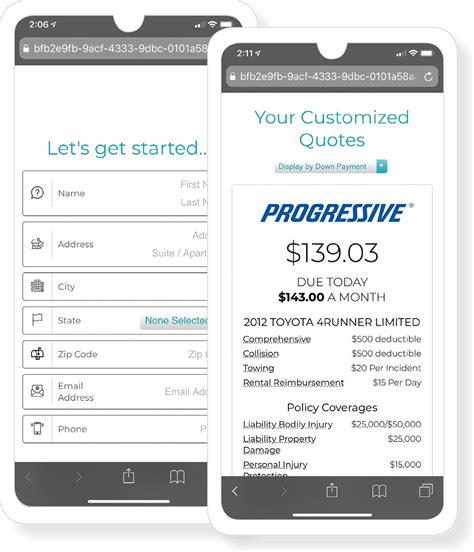

Online insurance auto quotes streamline the application process, reducing the time and effort required to obtain coverage. Users provide basic information such as their vehicle details, driving history, and desired coverage options, and within minutes, they receive a personalized quote.

This digital approach eliminates the need for extensive paperwork and reduces the risk of errors. The process is designed to be user-friendly, guiding individuals through each step with clear instructions and instant feedback. As a result, consumers can quickly assess their options and decide on the best policy for their needs.

Understanding the Online Insurance Quote Process

Navigating the online insurance quote process is straightforward and intuitive. Here's a step-by-step breakdown to guide you through the journey:

Step 1: Choose a Reputable Online Platform

Begin by selecting a trusted online insurance platform. There are numerous options available, including direct insurance company websites and independent comparison sites. Consider factors such as user reviews, the range of insurance providers offered, and the platform's overall user experience.

Some popular online insurance platforms include PolicyGenius, Geico, and The Zebra, each offering a comprehensive range of insurance options and user-friendly interfaces.

Step 2: Provide Vehicle and Driver Information

Once you've chosen a platform, you'll be prompted to input details about your vehicle and driving history. This information is crucial for insurers to assess your risk profile and provide an accurate quote.

Typical details required include the make, model, and year of your vehicle, as well as information about your driving record, such as any accidents or traffic violations. Providing accurate and honest information is essential to ensure you receive a fair and precise quote.

Step 3: Select Coverage Options

The next step involves choosing the type and level of coverage you desire. Auto insurance typically consists of liability coverage, which is mandatory in most states, and optional coverage such as collision, comprehensive, and personal injury protection.

Each insurance provider offers different coverage options and limits. It's crucial to understand your needs and budget before selecting the coverage that best suits your requirements. Some platforms even provide tools to help you assess your coverage needs based on your driving habits and preferences.

Step 4: Receive and Compare Quotes

After providing the necessary information, the platform will generate quotes from multiple insurance providers. These quotes will detail the coverage limits, deductibles, and premium costs for each policy. Take the time to carefully review and compare the quotes to find the best fit for your needs.

Consider factors such as the financial stability and reputation of the insurance provider, the level of coverage offered, and any additional perks or discounts available. Online insurance platforms often provide reviews and ratings from other users, which can be valuable in making an informed decision.

Step 5: Finalize Your Selection and Purchase

Once you've decided on the best policy, you can proceed to purchase it directly through the online platform. The process is typically secure and straightforward, allowing you to complete the transaction quickly and conveniently.

After purchasing the policy, you'll receive confirmation and important documents via email. It's essential to review these documents carefully and store them for future reference. You may also have the option to download and print these documents for easy access.

Benefits and Considerations of Online Insurance Auto Quotes

Online insurance auto quotes offer numerous advantages, but it's essential to consider certain factors to ensure a smooth and positive experience.

Benefits

Efficiency and Speed: Online quotes provide a swift and efficient way to obtain multiple insurance options, saving time and effort compared to traditional methods.

Transparency and Comparison: The online platform allows for easy comparison of different policies, ensuring you can make informed decisions based on coverage and cost.

User-Friendly Interface: Reputable online insurance platforms are designed with user experience in mind, making the process intuitive and straightforward for individuals of all technical backgrounds.

Access to a Wide Range of Providers: Online platforms often partner with multiple insurance companies, giving you a broader selection of policies and providers to choose from.

Considerations

Accuracy of Information: It's crucial to provide accurate and honest details when obtaining an online quote. Misleading or incorrect information can result in an inaccurate quote and potential issues when it comes to claiming insurance.

Understanding Coverage Limits: While online quotes provide a convenient way to compare policies, it's essential to thoroughly understand the coverage limits and exclusions of each policy. Take the time to read through the policy documents and seek clarification if needed.

Customer Service and Claims Process: While online insurance quotes are convenient, it's essential to consider the insurer's customer service and claims handling process. Ensure the provider offers a robust support system and a seamless claims process to provide peace of mind in the event of an accident or incident.

Future Trends in Online Insurance Auto Quotes

The world of online insurance auto quotes is constantly evolving, driven by advancements in technology and changing consumer preferences. Here’s a glimpse into the future of this industry:

Artificial Intelligence and Personalized Quotes

Artificial Intelligence (AI) is expected to play a significant role in the future of online insurance quotes. AI-powered platforms will utilize machine learning algorithms to analyze vast amounts of data, including driving behavior, traffic patterns, and weather conditions, to provide highly personalized quotes.

This technology will enable insurers to offer more accurate and tailored policies, taking into account individual driving habits and risk profiles. As a result, consumers can expect more precise quotes that better reflect their unique circumstances.

Integration of Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is expected to become more prevalent in the insurance industry. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive, will allow insurers to offer policies based on actual driving data rather than traditional risk factors.

This approach will provide consumers with more control over their insurance costs, as their driving behavior will directly impact their premiums. It also encourages safer driving habits, as insurers may offer discounts for low-risk driving behaviors.

Enhanced Digital Security and Data Privacy

As online insurance platforms become more widespread, ensuring the security and privacy of user data will be a top priority. Insurers will need to implement robust cybersecurity measures to protect sensitive information and prevent data breaches.

Additionally, with the increasing awareness of data privacy concerns, insurance providers will need to be transparent about their data collection and usage practices. Consumers will expect clear explanations of how their data is being used and the ability to control and manage their personal information.

Frequently Asked Questions (FAQ)

Are online insurance auto quotes accurate and reliable?

+Online insurance quotes are designed to provide accurate and reliable estimates based on the information you input. However, it’s crucial to ensure the accuracy of your details to receive precise quotes. Additionally, the quote may not account for all unique circumstances, so it’s essential to review the policy documents thoroughly before purchasing.

Can I customize my coverage options when getting an online quote?

+Yes, most online insurance platforms allow you to customize your coverage options. You can select the type and level of coverage you desire, such as liability-only or comprehensive coverage. This flexibility ensures you can tailor your policy to your specific needs and budget.

How can I ensure I’m choosing the right insurance provider when comparing online quotes?

+When comparing online quotes, consider factors such as the insurer’s financial stability, reputation, and customer service. Look for reviews and ratings from other customers, and ensure the provider offers a comprehensive policy that meets your coverage needs. Additionally, consider the insurer’s claims process and response time to ensure a smooth experience in the event of an accident.

What happens after I purchase an auto insurance policy online?

+After purchasing an auto insurance policy online, you’ll receive confirmation and important policy documents via email. It’s essential to review these documents carefully and store them for future reference. You may also have the option to download and print these documents for easy access. The insurer will then activate your policy, and you’ll be covered according to the terms and conditions outlined in your policy.

Online insurance auto quotes have transformed the way we obtain auto insurance, offering convenience, transparency, and efficiency. With the right platform and a clear understanding of your needs, you can navigate the process seamlessly and find the perfect auto insurance policy. Embrace the digital revolution in insurance and take control of your coverage today.