Online Quote Car Insurance

In today's fast-paced world, finding the right car insurance has become easier and more convenient than ever with the advent of online quote systems. This innovative approach allows individuals to quickly and efficiently obtain personalized insurance quotes without the need for lengthy meetings or complicated paperwork. By leveraging the power of the internet, insurance providers have revolutionized the way we access and compare car insurance options, empowering consumers to make informed decisions with just a few clicks.

The Evolution of Car Insurance Quotes

The traditional method of obtaining car insurance quotes involved visiting multiple insurance agents or brokers, a time-consuming and often tedious process. However, the rise of online platforms has transformed this experience, offering a seamless and efficient alternative. Online quote systems have become a game-changer, providing a user-friendly interface that simplifies the insurance comparison process.

With just a few simple steps, individuals can now access a wealth of insurance options tailored to their specific needs. This evolution has not only saved time but has also fostered a more competitive insurance market, driving providers to offer better rates and more comprehensive coverage.

The Advantages of Online Quote Car Insurance

The benefits of obtaining car insurance quotes online are numerous and far-reaching. Here's a closer look at some of the key advantages:

Convenience and Accessibility

Online quote systems eliminate the need for physical meetings or appointments. You can access insurance quotes from the comfort of your home, office, or even on the go using your mobile device. This level of convenience is especially beneficial for busy individuals or those with limited mobility.

Speed and Efficiency

Unlike traditional methods, online quotes are generated almost instantaneously. You can quickly compare multiple insurance providers and their respective policies within minutes. This rapid turnaround time ensures that you can make timely decisions and secure the coverage you need without unnecessary delays.

Personalized Options

Online quote systems are highly customizable. By inputting your specific details and preferences, you can receive tailored insurance quotes that align with your unique needs. Whether you're seeking comprehensive coverage, liability-only insurance, or something in between, the online platform can provide you with precise options to consider.

Cost Comparison

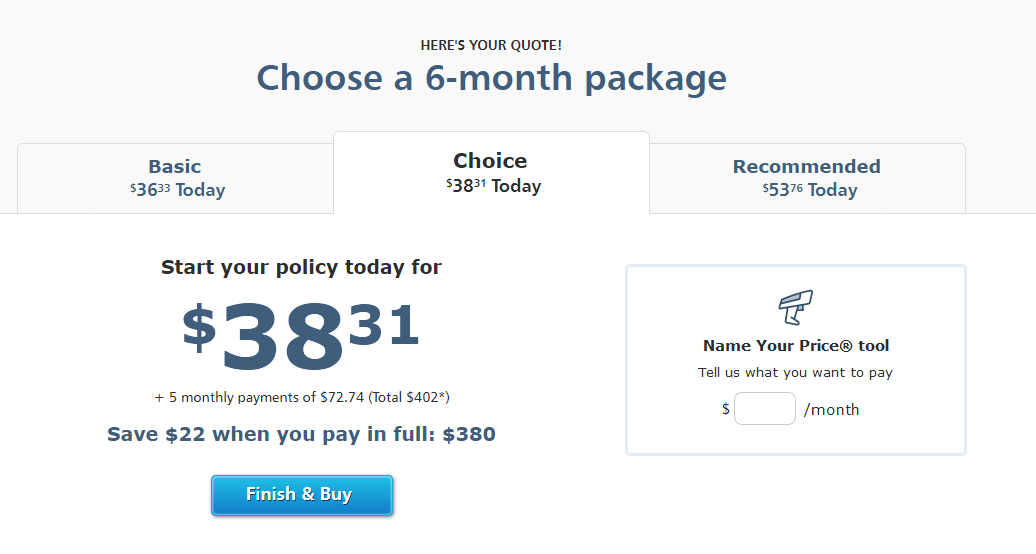

One of the most significant advantages of online quote car insurance is the ability to compare costs effortlessly. With just a few clicks, you can review and contrast insurance premiums from various providers, ensuring you find the most cost-effective option without compromising on coverage. This feature empowers consumers to make informed choices and potentially save substantial amounts on their insurance expenses.

User-Friendly Experience

Online insurance platforms are designed with a user-centric approach, making the quote process straightforward and intuitive. Clear instructions, interactive tools, and helpful resources guide users through the process, ensuring a seamless and stress-free experience. Whether you're a tech-savvy individual or new to online insurance, these platforms are engineered to be accessible and easy to navigate.

Additional Benefits

Online quote systems often offer additional features and benefits. Some platforms provide educational resources to help you better understand insurance terminology and coverage options. Others may offer exclusive discounts or promotional rates that are only available online. These added perks further enhance the value and convenience of obtaining car insurance quotes through digital channels.

How to Get Started with Online Quote Car Insurance

Getting started with online quote car insurance is a straightforward process. Here's a step-by-step guide to help you navigate this digital journey:

-

Research Reputable Insurance Providers: Begin by identifying a list of reputable insurance companies that offer online quote systems. You can start with well-known brands or seek recommendations from friends and family. Ensure that the providers you select are licensed and have a good reputation in the market.

-

Gather Necessary Information: Before initiating the quote process, gather all the relevant information you'll need. This includes personal details such as your name, address, date of birth, and driver's license number. Additionally, have your vehicle's make, model, and year handy, along with any existing insurance details if you're looking to switch providers.

-

Access the Online Quote System: Visit the insurance provider's website and locate the online quote section. Most websites have dedicated pages or links for this purpose, making it easy to find. Some providers may even offer mobile apps for a more convenient quote experience.

-

Provide Accurate Information: Fill out the online form with accurate and honest information. Be transparent about your driving history, any previous claims, and the coverage you're seeking. Providing accurate details ensures that the quotes you receive are tailored to your specific needs and circumstances.

-

Compare Quotes: Once you've received quotes from multiple providers, take the time to carefully compare them. Evaluate the coverage limits, deductibles, and any additional perks or discounts offered. Consider not only the cost but also the reputation and financial stability of the insurance company. Seek recommendations and reviews from trusted sources to make an informed decision.

-

Choose the Right Coverage: Based on your comparison, select the insurance policy that best suits your needs and budget. Review the policy details thoroughly, ensuring you understand the coverage, exclusions, and any fine print. Don't hesitate to reach out to the insurance provider if you have any questions or concerns.

-

Purchase Your Policy: After selecting your preferred insurance policy, complete the purchase process online. Most providers offer secure payment gateways for a seamless transaction. Once your payment is processed, you'll receive confirmation and details of your new insurance coverage.

Tips for Maximizing Your Online Quote Experience

To make the most of your online quote car insurance experience, consider the following tips:

-

Shop Around: Don't settle for the first quote you receive. Compare quotes from multiple providers to ensure you're getting the best deal. The more options you explore, the better your chances of finding the perfect coverage at the most competitive price.

-

Understand Your Coverage Needs: Before seeking quotes, take the time to understand your specific coverage requirements. Consider factors such as the value of your vehicle, your driving history, and any additional coverage options you may need (e.g., rental car coverage, roadside assistance, etc.). This knowledge will help you make more informed decisions during the quote process.

-

Be Honest and Transparent: Providing accurate and truthful information is crucial when obtaining online quotes. Misrepresenting your driving history or vehicle details can lead to complications or even policy cancellations down the line. Be honest to ensure you receive accurate quotes and avoid any potential issues.

-

Explore Discounts and Perks: Many insurance providers offer discounts and additional perks to attract customers. Look out for these incentives, such as safe driver discounts, multi-policy discounts, or loyalty rewards. Taking advantage of these opportunities can further reduce your insurance costs and enhance your overall coverage experience.

-

Read Reviews and Testimonials: Before finalizing your insurance decision, take the time to read reviews and testimonials from other customers. This will give you valuable insights into the provider's reputation, customer service, and overall satisfaction levels. Online review platforms and social media groups can be excellent resources for gathering feedback and making an informed choice.

The Future of Online Quote Car Insurance

The landscape of online quote car insurance is continually evolving, driven by technological advancements and changing consumer preferences. Here's a glimpse into the future of this industry:

Artificial Intelligence and Machine Learning

The integration of AI and machine learning technologies is expected to revolutionize the online quote process. These innovative tools can analyze vast amounts of data, including driving behavior, traffic patterns, and accident trends, to provide even more accurate and personalized insurance quotes. This technology will empower insurance providers to offer highly tailored coverage options, catering to individual driving habits and preferences.

Enhanced Data Security

As online quote systems become more prevalent, data security will be a top priority for insurance providers. Advanced encryption technologies and secure digital platforms will be employed to safeguard customer information, ensuring a safe and trusted environment for users to share their personal details.

Personalized Customer Service

The future of online quote car insurance will likely involve a more personalized customer service experience. Insurance providers may utilize chatbots and virtual assistants to offer real-time assistance and guidance throughout the quote process. These digital assistants can provide instant answers to common queries, simplifying the experience for customers and reducing the need for human intervention in basic interactions.

Integration with Connected Vehicles

With the rise of connected vehicles and telematics, insurance providers may leverage this technology to offer more dynamic and data-driven insurance quotes. By analyzing driving behavior and vehicle performance data, insurance companies can offer tailored coverage options and incentives to promote safer driving practices.

Simplified Claims Process

The online quote experience is expected to extend beyond policy procurement, offering a more seamless and efficient claims process. Insurance providers may develop digital tools and platforms that allow customers to initiate and track their claims online, providing real-time updates and streamlining the entire claims journey.

Tailored Insurance Packages

In the future, online quote systems may become even more sophisticated, allowing customers to create personalized insurance packages based on their specific needs. This level of customization will empower individuals to choose the exact coverage they require, ensuring they aren't overpaying for unnecessary features.

FAQs

How accurate are online car insurance quotes?

+Online car insurance quotes are highly accurate when provided with truthful and complete information. Insurance providers use sophisticated algorithms to generate quotes based on your personal details and driving history. However, it's important to note that the final premium may vary slightly once the insurer verifies your information.

Can I get multiple quotes from different providers on a single platform?

+Yes, many online insurance platforms allow you to compare quotes from multiple providers simultaneously. This feature simplifies the comparison process, saving you time and effort in searching for and evaluating different insurance options.

What information do I need to provide to get an online quote?

+To obtain an accurate online quote, you'll typically need to provide personal details such as your name, address, date of birth, and driver's license number. Additionally, you'll need to share information about your vehicle, including the make, model, and year. Some providers may also require details about your driving history and any existing insurance coverage.

Are there any additional fees or charges for obtaining online quotes?

+No, obtaining online quotes is typically free of charge. Insurance providers understand the value of providing convenient and accessible options to potential customers, so they don't impose additional fees for using their online quote systems.

Can I customize my insurance coverage through online quotes?

+Absolutely! Online quote systems allow you to tailor your insurance coverage to your specific needs. You can choose the type of coverage (e.g., liability, comprehensive, collision), adjust deductibles, and add optional coverages like rental car reimbursement or roadside assistance. This level of customization ensures you get the right coverage at the right price.