Out Of Pocket Insurance Definition

Understanding the concept of out-of-pocket (OOP) expenses is crucial in the world of health insurance. These expenses represent the financial responsibility that individuals bear when accessing healthcare services. The out-of-pocket cost is a critical component of insurance plans, impacting both policyholders and insurers alike. Let's delve into the intricacies of this term and explore its significance in the healthcare landscape.

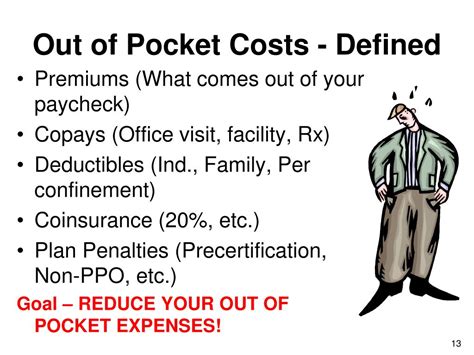

Out-of-Pocket Costs: Unraveling the Basics

In the realm of health insurance, out-of-pocket expenses refer to the portion of medical costs that an insured individual must pay directly, without reimbursement from the insurance provider. These costs typically include deductibles, copayments, and coinsurance, each playing a distinct role in determining the financial liability of the policyholder.

Deductibles are the initial expenses an individual must incur before their insurance coverage kicks in. For instance, if you have a $1,000 deductible, you will need to pay the first $1,000 of your medical bills before your insurance starts covering the remaining costs. Copayments, on the other hand, are fixed amounts paid by the policyholder for specific services, like a $20 copay for a doctor's visit.

Coinsurance represents the percentage of costs the insured person shares with the insurance company. For example, a 20% coinsurance means you pay 20% of the covered expenses, while the insurer covers the remaining 80%.

The Impact of Out-of-Pocket Costs

Out-of-pocket expenses have a significant influence on healthcare accessibility and financial planning. Higher OOP costs can deter individuals from seeking necessary medical care, especially those with limited financial resources. Conversely, lower OOP costs can encourage preventive care and timely treatment, leading to better health outcomes and potentially reducing long-term healthcare expenses.

Factors Influencing OOP Costs

The amount of out-of-pocket expenses varies depending on several factors, including:

- Insurance Plan Type: Different plans have varying OOP structures. Some plans offer low premiums with higher deductibles, while others provide higher premiums and lower deductibles.

- Healthcare Utilization: The frequency and nature of medical services accessed impact OOP costs. Individuals with chronic conditions or frequent medical needs may face higher expenses.

- Network Providers: Utilizing in-network healthcare providers often results in lower OOP costs compared to out-of-network services.

- Plan Maximums: Insurance plans typically have annual or lifetime maximums for OOP expenses. Once these limits are reached, the insurance company covers the remaining costs.

Managing Out-of-Pocket Costs

Navigating out-of-pocket expenses effectively is crucial for financial well-being. Here are some strategies to consider:

- Choose the Right Plan: Assess your healthcare needs and financial situation to select a plan with OOP costs that align with your circumstances.

- Understand Your Plan: Familiarize yourself with the specific OOP costs, deductibles, and coinsurance rates to anticipate potential expenses.

- Utilize In-Network Providers: Opt for in-network healthcare services to minimize unexpected costs.

- Consider Health Savings Accounts (HSAs): HSAs allow you to save pre-tax dollars for medical expenses, providing a tax-efficient way to manage OOP costs.

- Negotiate Bills: In certain cases, healthcare providers may offer discounts or payment plans for uninsured or high OOP expenses.

Out-of-Pocket Maximums: A Safety Net

Insurance plans often include out-of-pocket maximums, which act as a financial safeguard. Once an individual’s OOP expenses reach this maximum, the insurance company covers 100% of the remaining costs for covered services. For example, if your plan has a 5,000 OOP maximum, you will only pay up to 5,000 in OOP expenses annually, regardless of the actual cost of your medical care.

Out-of-pocket maximums vary between insurance plans and may apply to an individual or a family as a whole. These maximums provide peace of mind, ensuring that catastrophic illnesses or injuries do not lead to financial ruin.

The Role of OOP Maximums in Plan Selection

When choosing an insurance plan, evaluating the OOP maximum is essential. Plans with lower maximums may offer more financial protection but often come with higher premiums. On the other hand, plans with higher maximums may be more cost-effective for individuals with low healthcare utilization.

Out-of-Pocket Costs and Healthcare Reform

The Affordable Care Act (ACA) has implemented regulations to control and limit out-of-pocket expenses. These reforms aim to make healthcare more affordable and accessible, particularly for individuals with pre-existing conditions or chronic illnesses.

Under the ACA, insurance plans are required to have an annual out-of-pocket maximum, ensuring that individuals do not face unlimited financial liability for their healthcare. Additionally, the ACA introduced essential health benefits, which include a set of covered services that must be provided by insurance plans without any additional cost sharing, such as deductibles or coinsurance.

The Future of Out-of-Pocket Costs

As the healthcare industry evolves, the management of out-of-pocket expenses remains a critical focus. With rising healthcare costs, finding a balance between insurance coverage and individual financial responsibility is essential.

Innovations in healthcare financing, such as value-based care models, aim to shift the focus from volume-based care to outcomes-based care. These models may lead to more predictable and controlled out-of-pocket expenses for individuals.

Key Considerations for the Future

- Consumer-Directed Health Plans: These plans, often paired with HSAs, give individuals more control over their healthcare decisions and costs.

- Telehealth Services: The increased use of telehealth may reduce OOP costs by eliminating travel and in-person visit expenses.

- Price Transparency: Efforts to enhance price transparency in healthcare could empower individuals to make more informed decisions about their healthcare choices and expenses.

Conclusion

Understanding out-of-pocket insurance costs is vital for individuals to navigate the complex world of healthcare finance. By comprehending the different components of OOP expenses and the factors influencing them, individuals can make informed decisions about their insurance coverage and healthcare utilization.

As the healthcare landscape continues to evolve, staying informed about insurance plans, OOP costs, and emerging trends is essential. This knowledge empowers individuals to take charge of their healthcare decisions and financial well-being.

What is the difference between out-of-pocket costs and premiums?

+Out-of-pocket costs refer to the expenses an individual pays directly for healthcare services, including deductibles, copayments, and coinsurance. Premiums, on the other hand, are the regular payments made to the insurance company to maintain coverage. Premiums do not cover specific healthcare services but ensure access to insurance benefits.

Are there any exceptions to out-of-pocket maximums?

+Out-of-pocket maximums generally apply to covered services under the insurance plan. However, certain services or treatments, like cosmetic procedures, may not be covered and therefore not subject to the OOP maximum.

How can I reduce my out-of-pocket expenses?

+To minimize OOP costs, consider choosing an insurance plan with a lower deductible and coinsurance rate. Additionally, staying within the plan’s network of providers and utilizing preventive care services can help reduce unexpected expenses.