Perm Life Insurance Quotes

Permanent life insurance, also known as whole life insurance, is a valuable financial tool that provides long-term protection and a range of benefits for policyholders. This type of insurance policy offers coverage throughout the insured individual's lifetime, ensuring peace of mind and financial security for themselves and their loved ones. In this comprehensive guide, we will delve into the world of permanent life insurance quotes, exploring the factors that influence rates, the advantages it offers, and how to navigate the process of obtaining accurate quotes.

Understanding Permanent Life Insurance Quotes

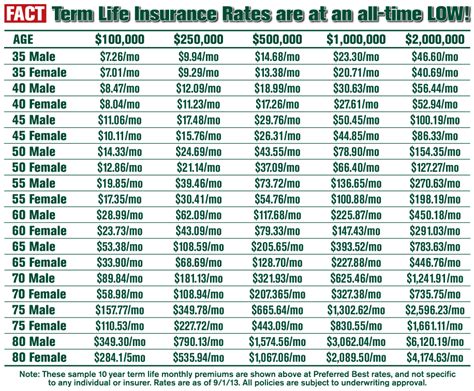

Permanent life insurance quotes are estimates of the premium costs associated with a whole life insurance policy. These quotes are tailored to the individual’s specific circumstances, including their age, health status, lifestyle factors, and the desired coverage amount. The quote provides an indication of the ongoing financial commitment required to secure the benefits of permanent life insurance.

Key Factors Influencing Quotes

Several critical factors play a significant role in determining permanent life insurance quotes. These factors include:

- Age: Generally, younger individuals are offered more favorable rates due to their lower risk profile. As you age, the cost of coverage tends to increase.

- Health and Lifestyle: The overall health and lifestyle choices of the applicant are carefully considered. Pre-existing medical conditions, smoking habits, and other risk factors can impact the quote.

- Coverage Amount: The desired coverage amount is a crucial factor. Higher coverage amounts typically result in higher premiums.

- Gender: In some regions, gender can influence quotes, with men often facing slightly higher rates due to historical actuarial data.

- Occupation: Certain occupations with higher risk profiles may lead to higher premiums.

- Family History: Genetic factors and family medical history can also be taken into account during the quoting process.

The Benefits of Permanent Life Insurance

Permanent life insurance offers a range of advantages that make it an attractive option for individuals seeking long-term financial protection and security.

Lifetime Coverage

One of the primary benefits is the guarantee of lifetime coverage. Unlike term life insurance, which provides coverage for a specific period, permanent life insurance remains in force as long as the premiums are paid. This ensures that the policyholder and their beneficiaries have protection throughout their lives, regardless of changing circumstances.

Cash Value Accumulation

Permanent life insurance policies accumulate cash value over time. This cash value acts as a savings component, allowing policyholders to build a financial asset. The cash value can be borrowed against, providing flexibility and potential tax advantages. It can also be used to pay premiums or provide additional funds during retirement.

Guaranteed Death Benefit

The death benefit of a permanent life insurance policy is guaranteed, meaning that the beneficiary receives the full amount upon the insured individual’s passing. This provides a valuable financial safety net for loved ones, ensuring they can maintain their standard of living and cover expenses such as funeral costs, outstanding debts, and ongoing living expenses.

Flexibility and Customization

Permanent life insurance policies offer a high degree of flexibility. Policyholders can choose the coverage amount, adjust premiums, and even customize riders to meet their specific needs. This customization ensures that the policy aligns with the individual’s financial goals and circumstances.

Navigating the Quote Process

Obtaining accurate permanent life insurance quotes requires a thorough understanding of the process and the factors involved. Here are some steps to guide you through the quote process:

Assess Your Needs

Start by evaluating your financial goals and the specific needs you want the insurance policy to address. Consider factors such as your income, assets, debts, and the financial well-being of your dependents. This assessment will help you determine the appropriate coverage amount and the type of permanent life insurance policy that suits your requirements.

Research Insurance Providers

Not all insurance companies offer the same rates or levels of service. Research and compare multiple providers to find those with a strong reputation for financial stability and customer satisfaction. Look for companies that specialize in permanent life insurance and have a track record of providing competitive rates.

Gather Necessary Information

To obtain an accurate quote, you will need to provide detailed information about yourself and your health. This includes your age, gender, height, weight, smoking status, and any relevant medical conditions. Be prepared to answer questions about your family’s medical history and your occupation. Accurate and honest disclosure of this information is crucial for obtaining an accurate quote.

Request Quotes

Contact the insurance providers you have researched and request quotes. You can do this online, over the phone, or by visiting their offices. Provide the necessary information and ask for quotes for different coverage amounts and policy types. Compare the quotes received, considering not only the premium costs but also the overall value and reputation of the insurance company.

Consider Policy Riders

Policy riders are optional additions to your permanent life insurance policy that can enhance its benefits. Common riders include waiver of premium, accelerated death benefit, and long-term care coverage. Discuss these options with your insurance agent to determine if any riders align with your specific needs and budget.

Review and Analyze

Take the time to carefully review and analyze the quotes you receive. Compare the premiums, coverage amounts, and any additional benefits or riders offered. Consider the financial strength and customer service reputation of the insurance companies providing the quotes. Seek advice from financial advisors or insurance professionals if needed to make an informed decision.

Performance Analysis and Future Implications

The performance of permanent life insurance policies can vary based on several factors, including the financial stability of the insurance company, investment returns, and the policyholder’s choices. While permanent life insurance offers long-term protection, it is essential to regularly review and assess the policy’s performance to ensure it continues to meet your financial goals and objectives.

Performance Indicators

Several key performance indicators can help evaluate the effectiveness of a permanent life insurance policy. These include:

- Cash Value Growth: Monitor the growth of the policy’s cash value over time. A steady increase indicates effective investment management by the insurance company.

- Dividend Payments: If your policy is participating, meaning it pays dividends, track the dividend payments received. Dividends can be used to reduce premiums, purchase additional coverage, or receive cash payments.

- Mortality and Expense Charges: Understand the mortality and expense charges associated with your policy. These charges are deducted from the policy’s cash value and should be reasonable and competitive.

- Surrender Value: The surrender value represents the amount you would receive if you decided to terminate the policy. A higher surrender value indicates better performance and financial stability.

Future Considerations

As your financial situation and needs evolve, it is crucial to periodically reassess your permanent life insurance policy. Consider the following future implications and adjustments:

- Coverage Review: Regularly review your coverage amount to ensure it aligns with your current financial obligations and goals. As your income and assets grow, you may need to increase your coverage to maintain adequate protection.

- Policy Riders: Evaluate the riders attached to your policy and consider adding or removing them based on your changing needs. For example, if you no longer require long-term care coverage, you can remove that rider to reduce your premium costs.

- Investment Options: Some permanent life insurance policies offer investment options within the cash value component. Review these options periodically to ensure they align with your risk tolerance and financial goals. Consider consulting a financial advisor for expert guidance.

- Policy Loans: Understand the terms and conditions of policy loans. While policy loans can provide access to funds, they must be repaid with interest. Evaluate the impact of policy loans on your overall financial plan.

FAQs

Can I get a permanent life insurance policy if I have pre-existing medical conditions?

+

Yes, individuals with pre-existing medical conditions can still obtain permanent life insurance. However, the quotes may be higher, and the underwriting process may involve more comprehensive health assessments. It’s essential to disclose all relevant health information to ensure an accurate quote.

Are there any tax benefits associated with permanent life insurance?

+

Yes, permanent life insurance policies offer certain tax advantages. The cash value within the policy grows on a tax-deferred basis, and the death benefit received by beneficiaries is typically tax-free. Additionally, policy loans and withdrawals, when used properly, may have tax advantages.

Can I change my permanent life insurance policy later on?

+

Yes, permanent life insurance policies can be modified or adjusted over time. You can increase or decrease coverage amounts, add or remove riders, and even change the premium payment structure. However, these changes may impact the overall cost and terms of the policy.

What happens if I miss a premium payment for my permanent life insurance policy?

+

Missing a premium payment can have consequences. In most cases, a grace period of 30-60 days is provided to make the payment without penalty. If the premium remains unpaid beyond the grace period, the policy may enter a lapse status, and coverage may be terminated. It’s crucial to stay current with premium payments to maintain uninterrupted coverage.