Pet Health Insurance Plans

Pet health insurance has become an increasingly popular way for pet owners to ensure their furry companions receive the best possible veterinary care without breaking the bank. As the pet care industry continues to evolve, offering more advanced treatments and specialized services, the demand for comprehensive pet insurance plans has grown exponentially. This article will delve into the intricacies of pet health insurance, exploring the various options available, the benefits they provide, and the considerations pet owners should make when selecting a plan.

Understanding Pet Health Insurance Plans

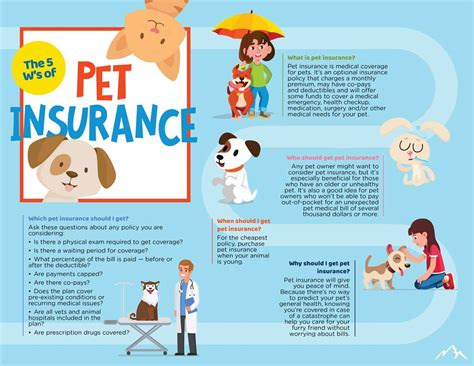

Pet health insurance operates similarly to human health insurance, offering coverage for various veterinary expenses. These plans are designed to provide financial support for unexpected illnesses, accidents, or even routine medical procedures. With the rising costs of veterinary care, especially for specialized treatments and surgeries, pet insurance can be a lifesaver, both literally and financially.

There are primarily three types of pet health insurance plans:

- Accident-Only Plans: As the name suggests, these plans cover injuries resulting from accidents, such as fractures, sprains, or wounds. They typically offer a more limited scope of coverage compared to other plans.

- Accident and Illness Plans: These plans provide coverage for both accidents and illnesses, including chronic conditions and long-term treatments. They are the most comprehensive option and offer the highest level of financial protection.

- Wellness Plans: Wellness plans focus on preventive care and routine procedures, such as vaccinations, annual check-ups, and dental cleanings. They are often combined with accident or illness plans to create a more holistic coverage package.

Each type of plan has its own set of benefits and limitations, and the choice depends on the pet's age, breed, and the owner's financial capabilities and preferences.

Key Features and Benefits of Pet Health Insurance

Reimbursement for Veterinary Costs

One of the primary benefits of pet health insurance is the reimbursement of veterinary expenses. Whether it’s an emergency visit, a routine surgery, or ongoing treatment for a chronic condition, pet insurance plans can provide significant financial relief. The reimbursement amount and process vary depending on the plan and the insurance provider, but it generally covers a percentage of the total cost.

| Plan Type | Reimbursement Coverage |

|---|---|

| Accident-Only | Up to 80% of accident-related expenses |

| Accident and Illness | 70-90% coverage for accidents and illnesses |

| Wellness | Varies, typically covers preventive care procedures |

Coverage for Chronic Conditions

Many pet health insurance plans now offer coverage for chronic conditions, which is a significant advantage for pet owners. Conditions like diabetes, arthritis, or kidney disease can require ongoing treatment and medication, leading to substantial expenses over time. Having insurance coverage for these conditions can ensure that pets receive the necessary care without straining their owners’ finances.

Specialized Treatment Coverage

With advancements in veterinary medicine, specialized treatments such as chemotherapy, radiation therapy, and even advanced surgeries are becoming more accessible. However, these treatments can be extremely costly. Pet insurance plans that cover specialized treatments provide peace of mind, knowing that if your pet requires such care, the financial burden will be significantly reduced.

Additional Benefits and Perks

Some pet insurance providers offer additional benefits and services to enhance the overall pet ownership experience. These may include access to 24⁄7 veterinary helplines, discounts on pet supplies and grooming services, and even coverage for alternative therapies like acupuncture or hydrotherapy. These extra perks can make a pet insurance plan even more appealing and comprehensive.

Factors to Consider When Choosing a Plan

Age and Breed of Your Pet

The age and breed of your pet play a crucial role in determining the right insurance plan. Younger pets are generally healthier and may require less extensive coverage, while older pets are more prone to health issues and may benefit from more comprehensive plans. Additionally, certain breeds are predisposed to specific health conditions, so it’s essential to consider these factors when selecting a plan.

Coverage Options and Limits

Review the coverage options and limits offered by different insurance providers. Look for plans that align with your pet’s potential health needs. Consider the maximum payout per condition, the annual limit, and whether the plan covers pre-existing conditions (some plans offer limited coverage for these conditions after a waiting period).

Deductibles and Co-Payments

Understand the deductibles and co-payment structures of the plans. Deductibles are the amount you must pay out of pocket before the insurance coverage kicks in, while co-payments are the percentage of the veterinary bill you pay after the deductible. Choose a plan with a deductible and co-payment structure that suits your financial situation and expectations.

Reputation and Customer Service

Research the reputation and customer service of the insurance provider. Look for reviews and testimonials from other pet owners to gauge the provider’s responsiveness, claim processing efficiency, and overall customer satisfaction. A reliable insurance provider with excellent customer service can make a significant difference in the claims process and overall experience.

Real-World Examples and Success Stories

To illustrate the impact of pet health insurance, let's consider a few real-life scenarios:

- Mr. Smith's Story: Mr. Smith adopted a 3-year-old mixed-breed dog, Max. Max was healthy but developed a severe allergic reaction to certain foods, requiring specialized dietary management and regular veterinary visits. With his pet insurance plan, Mr. Smith was able to cover the costs of Max's dietary needs and frequent check-ups, ensuring his furry friend's well-being without financial strain.

- Ms. Johnson's Experience: Ms. Johnson's 8-year-old cat, Luna, was diagnosed with diabetes. Managing Luna's condition involved regular insulin injections and frequent glucose monitoring. Ms. Johnson's pet insurance plan covered a significant portion of these expenses, making it possible for her to provide Luna with the necessary care and maintain her quality of life.

- The Jones Family's Rescue: The Jones family adopted a 6-month-old puppy, Bella, from a local shelter. Unfortunately, Bella was involved in an accident and required emergency surgery to repair a broken leg. Their pet insurance plan covered the majority of the surgical costs, providing much-needed financial relief during a stressful time.

Future Trends and Innovations in Pet Health Insurance

The pet health insurance industry is constantly evolving, driven by technological advancements and changing consumer demands. Here are some trends to watch out for:

- Telemedicine Integration: The rise of telemedicine in human healthcare is now making its way into the pet care industry. Some insurance providers are offering telemedicine services as part of their plans, allowing pet owners to consult with veterinarians remotely for minor health concerns.

- Wearable Technology: Wearable devices for pets, such as activity trackers and health monitors, are becoming more popular. Insurance providers may start offering incentives or discounts for pet owners who use these devices to track their pet's health and activity levels.

- AI-Powered Diagnostics: Artificial intelligence is being leveraged to develop advanced diagnostic tools for pets. These tools can assist in early detection of diseases and conditions, potentially leading to more efficient and cost-effective treatments. Insurance providers may offer coverage for these innovative diagnostics in the future.

- Genetic Testing and Personalized Medicine: With advancements in genetic testing, it's becoming possible to identify genetic predispositions to certain diseases in pets. Insurance providers may begin offering coverage for genetic testing and personalized treatment plans based on an individual pet's genetic profile.

Conclusion

Pet health insurance is an invaluable tool for pet owners, offering financial protection and peace of mind. With a wide range of plan options and benefits, pet owners can tailor their insurance coverage to their pets' specific needs. As the industry continues to innovate, pet insurance plans are becoming more comprehensive and tailored, ensuring that our furry companions receive the best care possible.

Can I get insurance for my pet if they have a pre-existing condition?

+Most pet insurance plans have waiting periods and exclusions for pre-existing conditions. However, some providers offer limited coverage for these conditions after a certain period. It’s important to review the plan’s policy regarding pre-existing conditions before purchasing.

How much does pet insurance cost?

+The cost of pet insurance varies depending on the plan, the age and breed of the pet, and the level of coverage. Generally, accident-only plans are more affordable, while accident and illness plans offer more comprehensive coverage at a higher cost. Wellness plans often have a fixed monthly premium.

What is the claim process like for pet insurance?

+The claim process typically involves submitting a claim form along with the veterinary invoice and any relevant medical records. Some insurance providers offer online claim submission for convenience. The reimbursement process can vary, but most providers aim to process claims within a few weeks.