Pet Insurance

Pet insurance is a vital topic for any pet owner who wants to ensure the health and well-being of their furry companions. With the rising costs of veterinary care and the unpredictable nature of pet health, having a solid understanding of pet insurance options is essential. This comprehensive guide will delve into the world of pet insurance, covering everything from the basics to advanced strategies to help you make informed decisions.

Understanding Pet Insurance: The Fundamentals

Pet insurance is a type of policy designed to cover the medical expenses of your pets. Similar to human health insurance, it provides financial protection against unexpected veterinary bills. It can be a lifesaver, especially for pet owners who may not have the means to cover expensive treatments or surgeries.

There are several types of pet insurance plans available, each with its own set of features and coverage limits. The most common types include:

- Accident-Only Plans: These policies cover injuries resulting from accidents, such as broken bones or lacerations. They typically have lower premiums compared to comprehensive plans.

- Comprehensive Plans: Offering a broader range of coverage, these plans include treatment for illnesses, accidents, and sometimes even routine care like vaccinations and check-ups.

- Specific Condition Plans: Tailored to cover specific health conditions, these plans are ideal for pets with pre-existing or hereditary conditions. They can provide peace of mind for owners of breeds prone to certain illnesses.

When choosing a pet insurance plan, it's crucial to consider your pet's age, breed, and any pre-existing health conditions. Some insurers may offer customized plans based on these factors, ensuring you get the right coverage for your furry friend.

The Benefits of Pet Insurance

Pet insurance offers a multitude of benefits, ensuring that pet owners can provide the best possible care for their animals without financial strain.

- Financial Security: The primary benefit of pet insurance is financial protection. With coverage in place, pet owners can focus on their pet's health rather than the cost of treatment.

- Early Treatment: By removing the financial barrier, pet insurance encourages owners to seek veterinary care promptly, potentially improving the prognosis and reducing the severity of illnesses or injuries.

- Peace of Mind: Knowing that your pet is covered can alleviate stress and worry, especially for unexpected emergencies. It allows owners to make decisions based on what's best for their pet, not what's financially feasible.

Moreover, pet insurance can also provide access to advanced medical treatments and technologies that might otherwise be unaffordable. This includes specialized surgeries, advanced imaging, and innovative therapies, ensuring your pet receives the best care available.

Choosing the Right Pet Insurance Plan

Selecting the appropriate pet insurance plan involves careful consideration of various factors. Here’s a comprehensive guide to help you make an informed decision.

Assessing Your Pet’s Needs

Every pet is unique, and their insurance needs will vary accordingly. Begin by evaluating your pet’s age, breed, and health history. Older pets or those with pre-existing conditions may require more comprehensive coverage, while younger, healthier pets might benefit from more basic plans.

Consider your pet's lifestyle and the risks they face. Outdoor pets, for instance, may be at higher risk of accidents or injuries, making accident-only plans a viable option. On the other hand, indoor pets might benefit from broader coverage for illnesses.

| Pet Type | Recommended Coverage |

|---|---|

| Outdoor Pets | Accident-only or Comprehensive Plans |

| Indoor Pets | Comprehensive Plans with Illness Coverage |

| Senior Pets | Comprehensive Plans with Pre-existing Condition Coverage |

Comparing Insurance Providers

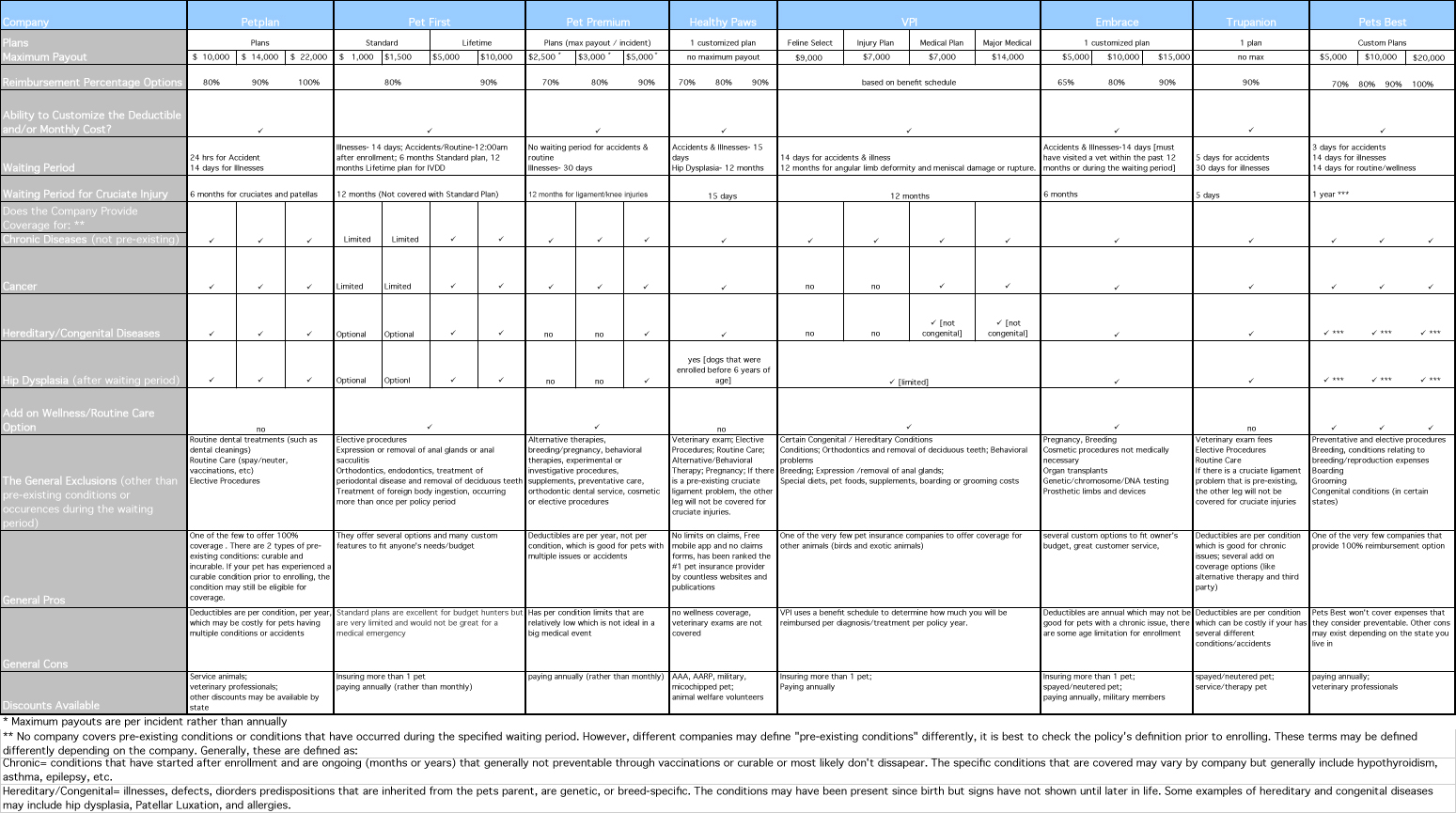

Once you have a clear idea of your pet’s needs, it’s time to explore the market and compare insurance providers. Different companies offer varying levels of coverage, deductibles, and premiums.

- Coverage Options: Review the coverage limits and exclusions. Ensure the plan covers the specific treatments or conditions that your pet might require.

- Deductibles and Co-Pays: Understand how deductibles and co-pays work. Higher deductibles can result in lower premiums, so choose a plan that aligns with your financial comfort.

- Premiums: Compare premiums for similar coverage levels. Remember, the cheapest plan might not always be the best value if it lacks the necessary coverage.

- Reputation and Customer Service: Research the insurer's reputation and customer service. Read reviews and testimonials to gauge their reliability and responsiveness.

Additional Considerations

Beyond the basics, there are several other factors to consider when choosing a pet insurance plan.

- Wellness and Routine Care Coverage: Some plans offer coverage for routine care like vaccinations, spaying/neutering, and dental procedures. Consider if this is a valuable addition to your plan.

- Alternative Therapies: If your pet responds well to alternative treatments like acupuncture or chiropractic care, ensure the plan covers these therapies.

- Travel and Emergency Coverage: If you frequently travel with your pet, look for plans that provide coverage for emergencies away from home.

- Pre-existing Condition Coverage: If your pet has a pre-existing condition, find a plan that offers coverage or has a waiting period that works for you.

Maximizing Your Pet Insurance Benefits

Now that you’ve chosen a pet insurance plan, it’s essential to understand how to maximize its benefits and make the most of your coverage.

Understanding Your Policy

Take the time to thoroughly read and understand your pet insurance policy. Familiarize yourself with the coverage limits, deductibles, and any exclusions. This knowledge will help you make informed decisions when seeking veterinary care.

Pay attention to the waiting periods for different types of coverage. For instance, some plans may have a waiting period for illnesses but not for accidents. Understanding these periods can help you plan your pet's care effectively.

Choosing the Right Veterinarian

Select a veterinarian who is experienced and knowledgeable about your pet’s breed and specific health needs. A good veterinarian will not only provide excellent care but also work with you to ensure your pet’s insurance coverage is utilized effectively.

Many pet insurance providers have preferred veterinarian networks. Choosing a vet from this network can often result in smoother claims processes and potentially lower out-of-pocket costs.

Submitting Claims Efficiently

Learn the ins and outs of submitting claims to your insurance provider. Most providers have online portals or apps that make the process easier. Ensure you have all the necessary documentation, such as veterinary invoices and treatment records.

Keep in mind that the timeliness of your claim submission can impact the speed of reimbursement. Some providers offer faster reimbursement for electronic claims, so consider this when choosing a provider.

Utilizing Additional Benefits

Beyond basic coverage, many pet insurance plans offer additional benefits and services. These can include:

- 24/7 Vet Hotlines: Access to a veterinary hotline can provide peace of mind and expert advice during emergencies or for non-urgent questions.

- Discounts on Pet Supplies: Some providers offer discounts on pet food, accessories, and even grooming services.

- Behavioral Therapy Coverage: If your pet has behavioral issues, certain plans may cover the cost of therapy or training.

- Loss and Theft Coverage: In the unfortunate event of your pet going missing or being stolen, some plans provide coverage for the costs associated with finding them.

Advanced Strategies for Pet Insurance

For those looking to delve deeper into the world of pet insurance, there are advanced strategies that can further optimize your coverage and benefits.

Combining Policies

Consider combining multiple policies to enhance your pet’s coverage. For instance, you could have a basic accident-only plan for your pet’s daily needs and a more comprehensive plan for emergencies or specific health concerns.

This strategy allows you to balance coverage and costs, ensuring your pet is protected without breaking the bank.

Tailoring Coverage to Your Pet’s Age

As your pet ages, their insurance needs may change. Younger pets are generally healthier and may require more basic coverage, while older pets may benefit from more comprehensive plans.

Review your pet's insurance plan annually, especially around their birthday or the policy's renewal date. This allows you to adjust coverage levels and deductibles as needed, ensuring your pet is always protected.

Exploring Discounts and Rewards

Many pet insurance providers offer discounts and rewards programs. These can include discounts for multiple pets, loyalty rewards, or even discounts for specific breeds or conditions.

Keep an eye out for these opportunities and take advantage of them to reduce your insurance costs. Additionally, some providers offer discounts for certain behaviors, such as microchipping or spaying/neutering your pet.

Future of Pet Insurance

The pet insurance industry is evolving rapidly, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of pet insurance.

Digital Transformation

The digital revolution is transforming the pet insurance landscape. Insurers are increasingly embracing digital technologies to streamline processes, enhance customer experiences, and improve claim management.

Expect to see more advanced online platforms and mobile apps, allowing for easier policy management, claim submissions, and access to veterinary advice. Telemedicine services are also becoming more prevalent, offering pet owners convenient and affordable options for minor health issues.

Personalized Insurance Plans

The future of pet insurance lies in personalized plans tailored to individual pet needs. With advancements in data analytics and artificial intelligence, insurers will be able to offer more precise and targeted coverage.

This could involve dynamic plans that adjust coverage levels based on your pet's age, health, and lifestyle. For instance, if your pet develops a specific condition, the plan could automatically increase coverage for related treatments, ensuring you're never caught off guard.

Integration with Veterinary Care

The integration of pet insurance with veterinary care is another exciting development. Insurers are partnering with veterinary practices to streamline the entire process, from diagnosis to treatment and insurance claims.

This integration can lead to more efficient and effective care, reducing the administrative burden on both pet owners and veterinarians. It may also result in more accurate diagnoses and better treatment outcomes, as insurers and veterinarians work together to optimize care plans.

Conclusion

Pet insurance is an essential tool for any pet owner, offering financial protection and peace of mind. By understanding the fundamentals, comparing plans, and maximizing your benefits, you can ensure your pet receives the best possible care. As the industry evolves, stay informed about the latest advancements to make the most of your pet insurance coverage.

What is the average cost of pet insurance per month?

+

The cost of pet insurance varies depending on several factors, including the age, breed, and health of your pet, as well as the type of coverage you choose. On average, pet insurance premiums can range from 20 to 80 per month. However, this can be significantly higher or lower depending on your specific circumstances.

Does pet insurance cover pre-existing conditions?

+

Most pet insurance policies have waiting periods or exclusions for pre-existing conditions. However, some providers offer specific plans or riders that can cover certain pre-existing conditions after a waiting period. It’s important to carefully review the policy’s terms and conditions to understand what’s covered.

Can I get pet insurance for an older pet?

+

Yes, many pet insurance providers offer coverage for older pets. However, the cost of insurance tends to increase with age due to the higher risk of health issues. Additionally, some providers may have upper age limits or restrict coverage for certain conditions in older pets.

What happens if I switch insurance providers?

+

When switching insurance providers, it’s important to understand the implications for your pet’s coverage. Most providers will honor the waiting periods and exclusions from your previous policy, but they may not cover claims that were already made. It’s advisable to carefully review the terms of your new policy and consider the potential gaps in coverage.