Pet Insurance Compare

Welcome to the comprehensive guide on pet insurance, a topic that has gained significant attention in recent years as pet owners seek to provide the best care for their beloved companions. With the rising costs of veterinary treatments and the desire to ensure our furry friends receive the highest quality of healthcare, pet insurance has become an essential consideration for many. In this expert-reviewed article, we will delve into the world of pet insurance, exploring its benefits, how it works, and why it might be the right choice for you and your pet.

Understanding Pet Insurance: A Comprehensive Overview

Pet insurance is a specialized form of health insurance designed specifically for our four-legged companions. It provides financial protection to pet owners by covering a range of veterinary expenses, ensuring that you can focus on your pet’s well-being without worrying about the associated costs.

Much like human health insurance, pet insurance policies vary widely in terms of coverage, benefits, and costs. Understanding the different types of pet insurance and how they work is crucial to making an informed decision for your pet's healthcare needs.

Types of Pet Insurance Policies

There are primarily three types of pet insurance policies available in the market: Accident-Only Insurance, Accident and Illness Insurance, and Wellness Plans. Each type offers distinct benefits and caters to different pet healthcare requirements.

Accident-Only Insurance covers your pet for any injuries sustained due to accidents, such as fractures, lacerations, or poisoning. This type of insurance is often more affordable than comprehensive plans but provides limited coverage.

Accident and Illness Insurance is the most comprehensive option, offering coverage for both accidental injuries and illnesses, including common ailments like ear infections, gastrointestinal issues, and even chronic conditions like diabetes. This type of insurance provides the broadest range of protection for your pet's health.

Wellness Plans, on the other hand, focus on preventive care and routine procedures. These plans typically cover annual check-ups, vaccinations, spaying/neutering, and other preventive measures to keep your pet healthy. Wellness plans are an excellent option for pet owners who want to ensure their pets receive regular, essential healthcare but may not require extensive medical treatment.

| Type of Insurance | Coverage |

|---|---|

| Accident-Only | Accidental injuries only |

| Accident and Illness | Accidental injuries and illnesses |

| Wellness Plans | Preventive care and routine procedures |

How Pet Insurance Works: The Claims Process

The claims process for pet insurance is relatively straightforward. When your pet requires veterinary treatment, you will need to pay the full amount upfront at the veterinary clinic. Afterward, you can submit a claim to your insurance provider, typically through an online portal or by mail. The claim form will require detailed information about the treatment, including the date, the veterinary clinic’s details, and a description of the treatment received.

The insurance provider will then review the claim and, if approved, reimburse you for the covered portion of the treatment cost. The reimbursement process can vary depending on the insurance company and the policy terms, but most providers aim to process claims within a few weeks.

It's important to note that some insurance companies may require you to submit the original itemized bill from the veterinary clinic, while others may accept a copy. Additionally, certain policies may have a deductible or a co-pay amount, which is the portion of the claim you must pay out of pocket before the insurance coverage kicks in.

The Benefits of Pet Insurance: Why It’s a Smart Choice

Pet insurance offers a multitude of benefits that can significantly enhance your pet’s quality of life and provide peace of mind for pet owners. Here are some key advantages to consider:

Financial Protection and Peace of Mind

The primary benefit of pet insurance is financial protection. Veterinary treatments, especially for illnesses or accidents, can be extremely costly. Pet insurance helps cover these expenses, ensuring that you can provide the best possible care for your pet without worrying about the financial burden.

With pet insurance, you can make informed decisions about your pet's healthcare without being limited by financial constraints. This peace of mind is invaluable, especially in emergency situations when prompt treatment is crucial.

Comprehensive Coverage for Unexpected Illnesses and Injuries

Accidents and illnesses can happen unexpectedly, and pets are no exception. From broken bones to gastrointestinal issues, the range of potential health problems is vast. Pet insurance, particularly accident and illness coverage, provides comprehensive protection for these unforeseen events.

By having pet insurance, you can ensure that your pet receives the necessary treatment without delay. Whether it's an emergency surgery or a course of medication for a chronic condition, the coverage provided by pet insurance gives you the flexibility to choose the best treatment options without worrying about the cost.

Preventive Care and Routine Procedures

Wellness plans and accident and illness policies often include coverage for preventive care and routine procedures. This includes annual check-ups, vaccinations, parasite control, and even dental care. By covering these essential procedures, pet insurance helps maintain your pet’s overall health and well-being.

Regular check-ups and preventive measures are crucial for early detection of potential health issues. With pet insurance, you can ensure that your pet receives the necessary care to stay healthy and catch any problems before they become more serious and costly to treat.

Choosing the Right Pet Insurance: Factors to Consider

Selecting the appropriate pet insurance policy involves careful consideration of various factors. Here are some key aspects to evaluate when making your decision:

Coverage Options and Policy Limits

Different pet insurance policies offer varying levels of coverage. Some policies may have specific limits on certain types of treatments or conditions, while others provide more comprehensive coverage. It’s essential to review the policy’s coverage options and limits to ensure they align with your pet’s healthcare needs.

For instance, if your pet has a history of chronic conditions or is prone to certain illnesses, you may want to opt for a policy with higher coverage limits for those specific conditions. Similarly, if your pet is active and adventurous, an accident-only policy might not provide sufficient coverage.

Deductibles, Co-Pays, and Reimbursement Rates

Pet insurance policies typically have deductibles, co-pays, and reimbursement rates that impact the overall cost of the policy and the out-of-pocket expenses you may incur. Deductibles are the amount you must pay before the insurance coverage begins, while co-pays are the portion of the claim you must pay alongside the insurance provider.

Reimbursement rates refer to the percentage of the claim that the insurance provider covers. For example, a policy with an 80% reimbursement rate means the insurance company will cover 80% of the eligible expenses, and you will be responsible for the remaining 20%. Understanding these financial aspects is crucial for managing your pet's healthcare costs effectively.

Waiting Periods and Pre-Existing Conditions

Most pet insurance policies have waiting periods before certain conditions or treatments are covered. These waiting periods can range from a few days to several months and are designed to prevent pet owners from insuring their pets only when they are already ill or injured.

Additionally, pre-existing conditions are typically excluded from coverage. A pre-existing condition refers to any illness, injury, or symptom that your pet has shown signs of before the insurance policy starts. It's important to review the policy's terms regarding waiting periods and pre-existing conditions to ensure you understand the coverage limitations.

The Future of Pet Insurance: Emerging Trends and Innovations

The pet insurance industry is continuously evolving, with new trends and innovations shaping the future of pet healthcare. Here’s a glimpse into some of the developments that are transforming the way we insure and care for our pets:

Telemedicine and Digital Health Solutions

The integration of telemedicine and digital health solutions is revolutionizing the way veterinary care is delivered. Pet insurance providers are increasingly partnering with telemedicine platforms, allowing pet owners to access veterinary advice and consultations remotely.

These digital solutions offer convenience, especially for minor health concerns or follow-up appointments. Pet owners can schedule video calls with veterinarians, receive personalized advice, and even obtain prescriptions, all from the comfort of their homes. This trend not only enhances accessibility to veterinary care but also reduces the need for unnecessary clinic visits, potentially lowering insurance claims.

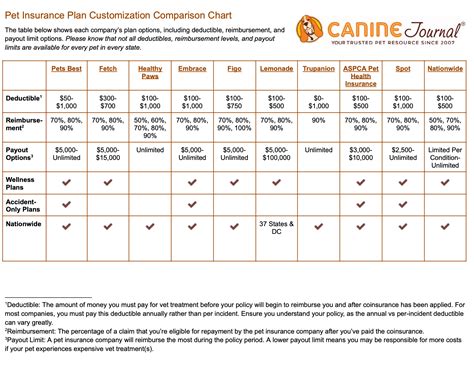

Personalized Insurance Plans and Customizable Coverage

One-size-fits-all insurance policies are becoming a thing of the past. Pet insurance providers are now offering more personalized plans that cater to the unique needs of individual pets. These plans allow pet owners to customize their coverage, selecting specific benefits and limits based on their pet’s breed, age, and health history.

By offering customizable coverage, pet insurance companies can provide more tailored solutions, ensuring that pet owners only pay for the coverage they truly need. This approach not only enhances affordability but also empowers pet owners to make informed choices about their pet's healthcare.

Advanced Diagnostics and Treatment Options

The field of veterinary medicine is rapidly advancing, with new diagnostics and treatment options becoming available. Pet insurance providers are recognizing the importance of covering these advanced procedures to ensure that pets receive the most effective and up-to-date care.

From MRI scans and advanced imaging technologies to cutting-edge surgical techniques, pet insurance policies are expanding their coverage to include these innovative treatments. This development not only improves the quality of care for pets but also gives pet owners the confidence to pursue the best possible treatment options without financial constraints.

Frequently Asked Questions (FAQ)

Can I get pet insurance for my older pet?

+

Yes, many pet insurance providers offer policies for older pets. However, it’s important to note that coverage for pre-existing conditions is typically excluded, and premiums may be higher due to the increased likelihood of health issues in older pets.

Does pet insurance cover routine procedures like vaccinations and spaying/neutering?

+

It depends on the type of pet insurance policy you choose. Wellness plans and some accident and illness policies include coverage for routine procedures like vaccinations, spaying/neutering, and parasite control. However, accident-only policies typically do not cover these procedures.

What is the average cost of pet insurance per month?

+

The cost of pet insurance can vary widely depending on factors such as your pet’s breed, age, location, and the type of coverage you select. On average, pet insurance policies range from 30 to 80 per month, but prices can be higher or lower based on individual circumstances.

In conclusion, pet insurance is a valuable tool for pet owners, providing financial protection and peace of mind when it comes to their pet’s healthcare. By understanding the different types of policies, their benefits, and the factors to consider, you can make an informed decision to ensure your pet receives the best possible care throughout their lifetime. The future of pet insurance looks bright, with innovations and trends that continue to enhance the overall experience for both pets and their owners.