Pet Insurance Coverage Comparison

In the realm of pet ownership, ensuring the well-being of our furry companions is a top priority. Pet insurance has emerged as a vital tool to safeguard pets' health and alleviate the financial burden of unexpected veterinary expenses. With a plethora of options available, choosing the right pet insurance coverage can be a complex decision. This comprehensive guide aims to demystify the process, offering an in-depth comparison of various pet insurance plans to empower pet owners in making informed choices.

Understanding Pet Insurance Basics

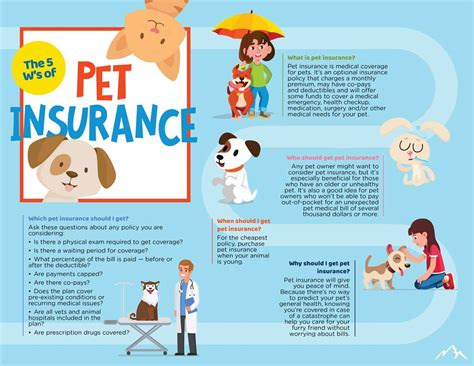

Pet insurance operates similarly to human health insurance, offering financial protection against unexpected veterinary costs. It covers a range of medical treatments, from routine check-ups and vaccinations to specialized surgeries and emergency care. Understanding the different types of pet insurance plans and their coverage options is essential for selecting the right policy.

Types of Pet Insurance Plans

There are three primary types of pet insurance plans: Accident-Only, Accident and Illness, and Wellness Plans. Accident-Only plans provide coverage for injuries sustained by pets, such as fractures or bites. Accident and Illness plans offer a more comprehensive coverage, including treatment for illnesses like cancer or diabetes. Wellness Plans, on the other hand, focus on preventative care, covering routine check-ups, vaccinations, and dental procedures.

Each type of plan comes with its own set of advantages and limitations. Accident-Only plans are generally the most affordable, making them a popular choice for budget-conscious pet owners. However, they provide limited coverage and may not be suitable for pets with pre-existing conditions or those prone to illnesses.

Accident and Illness plans offer a more comprehensive solution, covering a wide range of medical conditions. These plans are ideal for pet owners seeking peace of mind and extensive coverage. However, they typically come with a higher premium.

Wellness Plans are a relatively new addition to the pet insurance market, designed to encourage regular preventative care. These plans cover a variety of routine procedures, helping pet owners stay on top of their pet's health. While they may not cover major illnesses or accidents, they can significantly reduce the cost of essential preventative care.

| Plan Type | Coverage | Advantages | Limitations |

|---|---|---|---|

| Accident-Only | Injuries from accidents | Affordable, suitable for healthy pets | Limited coverage, excludes illnesses |

| Accident and Illness | Accidents and medical conditions | Comprehensive coverage, ideal for peace of mind | Higher premiums |

| Wellness | Routine check-ups, vaccinations, dental care | Encourages preventative care, reduces cost of essential procedures | Does not cover major illnesses or accidents |

Key Factors to Consider

When comparing pet insurance plans, several factors should be taken into account. These include the pet’s age, breed, and pre-existing conditions. Older pets or those with a history of medical issues may face higher premiums or be subject to coverage exclusions.

The level of coverage and the reimbursement process are also crucial considerations. Some plans offer a set reimbursement amount, while others reimburse a percentage of the total veterinary bill. Understanding these details can help pet owners manage their financial expectations.

Additionally, the insurance provider's reputation and financial stability are essential. It is advisable to choose a reputable insurer with a strong financial standing to ensure the policy remains viable over the long term.

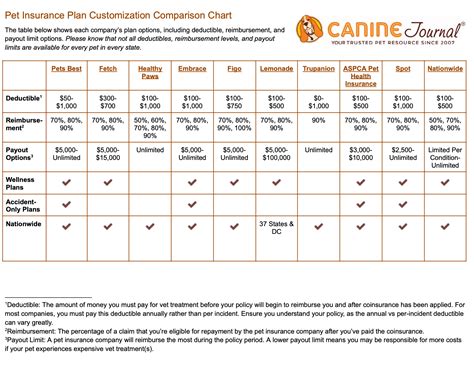

Comparing Pet Insurance Providers

The pet insurance market is diverse, with numerous providers offering a range of plans. A thorough comparison of these providers can help pet owners identify the best fit for their needs.

Embrace Pet Insurance

Embrace Pet Insurance is a leading provider in the industry, known for its comprehensive coverage and innovative features. Their plans offer flexible reimbursement options, allowing pet owners to choose the level of coverage that suits their budget.

One of the standout features of Embrace's plans is their Wellness Rewards program. This unique offering provides an annual wellness reward, which can be used towards routine care procedures, encouraging pet owners to prioritize their pet's health.

Embrace's plans also include coverage for alternative therapies, such as acupuncture and chiropractic care, making them a top choice for pet owners seeking holistic treatment options.

| Feature | Embrace Pet Insurance |

|---|---|

| Reimbursement Options | Flexible, with a range of coverage levels |

| Wellness Rewards | Annual reward for routine care procedures |

| Alternative Therapies | Coverage for acupuncture, chiropractic care, and more |

Healthy Paws Pet Insurance

Healthy Paws Pet Insurance is another reputable provider, known for its simple and straightforward coverage. Their plans offer unlimited coverage for the life of the pet, providing peace of mind for pet owners.

Healthy Paws' plans cover a wide range of medical conditions, including hereditary and chronic illnesses. This makes them an excellent choice for pet owners with breeds prone to specific health issues.

Additionally, Healthy Paws offers a convenient mobile app, allowing pet owners to manage their policy, file claims, and access their pet's medical records on the go.

| Feature | Healthy Paws Pet Insurance |

|---|---|

| Coverage | Unlimited, lifelong coverage |

| Medical Conditions | Covers hereditary and chronic illnesses |

| Mobile App | Convenient policy management and claim filing |

Trupanion

Trupanion is a well-established pet insurance provider, offering comprehensive coverage and a unique 90% reimbursement rate. Their plans provide coverage for a wide range of medical conditions, including injuries and illnesses.

One of the key advantages of Trupanion's plans is their direct billing feature. This means that Trupanion pays the veterinary clinic directly, reducing the financial burden on pet owners during a time of need.

Trupanion also offers a 24/7 helpline, providing pet owners with access to veterinary experts for advice and support.

| Feature | Trupanion |

|---|---|

| Reimbursement | 90% reimbursement rate |

| Direct Billing | Pays veterinary clinics directly |

| 24/7 Helpline | Access to veterinary experts for advice and support |

Expert Insights and Recommendations

When selecting a pet insurance plan, it is crucial to consider your pet’s unique needs and your financial capabilities. While comprehensive plans offer extensive coverage, they may not be the most suitable option for all pet owners.

For instance, if your pet is generally healthy and has no history of medical issues, an Accident-Only plan with a Wellness add-on may be a cost-effective choice. This combination provides coverage for accidents and encourages regular preventative care.

Additionally, it is essential to read the fine print and understand the terms and conditions of the policy. Some policies may have waiting periods or exclusions for pre-existing conditions. Being aware of these details can help you manage your expectations and ensure you receive the coverage you need.

The Future of Pet Insurance

The pet insurance industry is evolving rapidly, with new providers and innovative plans entering the market. The rise of telemedicine and the integration of technology are shaping the future of pet healthcare.

Telemedicine services, such as video consultations with veterinary experts, are becoming increasingly popular. These services offer convenient and affordable access to veterinary care, especially for minor issues or follow-up appointments.

The integration of technology is also enhancing the pet insurance experience. Mobile apps and online portals allow pet owners to manage their policies, track claims, and access their pet's medical records with ease. This digital transformation is making pet insurance more accessible and user-friendly.

Looking ahead, the focus on preventative care and early detection is expected to continue. Wellness Plans and the inclusion of routine care procedures in insurance policies are likely to become more prevalent. This shift towards proactive healthcare will not only benefit pet owners but also contribute to the overall well-being of our furry companions.

Conclusion

Pet insurance is an essential tool for pet owners, providing financial protection and peace of mind. With a range of plans and providers to choose from, the process of selecting the right coverage can be daunting. However, by understanding the different types of plans, comparing providers, and considering expert insights, pet owners can make informed decisions to ensure the best care for their beloved pets.

As the pet insurance industry continues to evolve, we can expect to see more innovative offerings and a greater focus on preventative care. Ultimately, the goal is to provide the best possible healthcare for our pets, ensuring they live long, healthy, and happy lives.

How much does pet insurance typically cost?

+The cost of pet insurance can vary significantly depending on the type of plan, the pet’s age and breed, and the level of coverage. On average, Accident-Only plans range from 10 to 30 per month, Accident and Illness plans can be 30 to 70 per month, and Wellness Plans may cost around 20 to 40 per month. However, these are just estimates, and the actual cost can be higher or lower based on individual circumstances.

What are the key differences between Accident-Only and Accident and Illness plans?

+Accident-Only plans cover injuries sustained by pets, such as fractures or bites. They are generally affordable but provide limited coverage, excluding illnesses. Accident and Illness plans, on the other hand, offer comprehensive coverage, including treatment for both accidents and illnesses. These plans are ideal for pet owners seeking peace of mind and extensive coverage, but they typically come with a higher premium.

Can pet insurance cover pre-existing conditions?

+Pre-existing conditions are generally excluded from pet insurance coverage. However, some providers may offer coverage for certain conditions if they are not severe or have been stable for a specific period before the policy was taken out. It is essential to carefully review the policy’s terms and conditions to understand the coverage for pre-existing conditions.