Pets Insurance Comparison

The pet insurance market is a rapidly growing industry, with an increasing number of pet owners seeking ways to provide comprehensive care for their beloved companions. As the demand for pet insurance rises, it's crucial for pet owners to make informed choices to ensure they get the best coverage for their furry friends. This comprehensive guide will delve into the key aspects of pet insurance, offering a detailed comparison of policies, benefits, and features to help you navigate this complex landscape.

Understanding the Basics of Pet Insurance

Pet insurance operates on a similar principle to human health insurance, offering financial protection for unexpected veterinary costs. These policies can cover a range of expenses, from routine check-ups and vaccinations to more serious medical conditions and accidents. However, it’s essential to understand that pet insurance typically works on a reimbursement basis, where you pay the veterinary fees upfront and then submit a claim to the insurance provider for reimbursement.

The market offers a variety of pet insurance policies, each with its unique features and coverage limits. These policies can be broadly categorized into three main types: accident-only, comprehensive, and lifetime policies. Accident-only policies, as the name suggests, cover accidents such as injuries sustained in a car accident or a fall. Comprehensive policies, on the other hand, provide a wider range of coverage, including illnesses, injuries, and sometimes even routine care. Lifetime policies are the most extensive, offering ongoing coverage for the life of the pet, with annual limits resetting each year.

Key Considerations When Choosing Pet Insurance

When selecting a pet insurance policy, there are several critical factors to consider. Firstly, the age and breed of your pet play a significant role. Some breeds are predisposed to certain conditions, and older pets may have a higher risk of developing health issues. Therefore, it’s essential to choose a policy that caters to these specific needs.

The level of coverage is another vital consideration. Different policies offer varying levels of coverage for different conditions. Some may have higher limits for certain illnesses or injuries, while others may have more comprehensive coverage for routine care. It's crucial to understand the specific terms and conditions of each policy to ensure you're getting the coverage you need.

Additionally, the reputation and financial stability of the insurance provider are crucial. You want to ensure the company is reliable and has a good track record of paying claims promptly. Checking customer reviews and financial ratings can provide valuable insights into the reliability of an insurance provider.

| Policy Type | Coverage | Premium |

|---|---|---|

| Accident-Only | Covers accidents and injuries | Generally lower premiums |

| Comprehensive | Includes accidents, illnesses, and routine care | Moderate to higher premiums |

| Lifetime | Ongoing coverage with annual limit resets | Highest premiums, but offers the most extensive coverage |

Comparing Popular Pet Insurance Providers

Let’s take a closer look at some of the leading pet insurance providers and compare their policies, benefits, and features.

Provider A: PetProtect

PetProtect is a well-known provider in the pet insurance industry, offering a range of policies to cater to different needs. Their policies are designed to provide comprehensive coverage, with options for accident-only, comprehensive, and lifetime plans.

Key Features:

- Accident-only plans start at $15 per month, making them an affordable option for pet owners.

- Comprehensive plans offer coverage for a wide range of illnesses and conditions, including cancer treatment and prescription medications.

- Lifetime plans provide ongoing coverage with annual limits that reset, ensuring continuous protection for the life of the pet.

- They have a quick and efficient claims process, with most claims being processed within 5-7 business days.

Pros:

- Affordable premiums, especially for accident-only plans.

- Comprehensive coverage options, including coverage for chronic conditions.

- Excellent customer service and prompt claim processing.

Cons:

- Some policies may have higher deductibles, which could increase out-of-pocket expenses.

- Waiting periods for certain conditions, such as 14 days for accidents and 180 days for illnesses.

Provider B: Healthy Paws

Healthy Paws is another prominent player in the pet insurance market, known for its comprehensive coverage and customer satisfaction.

Key Features:

- Offers a single comprehensive plan, providing coverage for accidents, illnesses, and even alternative therapies like acupuncture.

- No annual limits, which means your pet's coverage doesn't run out over time.

- Reimbursement is based on actual vet bills, with no benefit schedules or claim limits.

- They have an easy-to-use mobile app for managing policies and submitting claims.

Pros:

- No annual limits, ensuring continuous coverage without worrying about reaching a limit.

- Reimbursement based on actual vet bills, providing more flexibility.

- Covers a wide range of alternative therapies, giving pet owners more treatment options.

Cons:

- Only offers one type of plan, which may not suit all pet owners' needs.

- Premiums can be higher compared to other providers.

Provider C: Figo Pet Insurance

Figo is a relatively new player in the industry, but it has quickly gained popularity for its innovative approach to pet insurance.

Key Features:

- Offers comprehensive coverage for accidents, illnesses, and even hereditary conditions.

- Provides a unique pet profile, which includes your pet's medical history, vaccination records, and other important information.

- Has a 24/7 vet helpline, providing access to veterinary advice anytime, anywhere.

- Uses advanced technology, such as a mobile app for claim submissions and GPS tracking for lost pets.

Pros:

- Covers a wide range of conditions, including hereditary and congenital disorders.

- Innovative technology and features, such as the pet profile and GPS tracking.

- 24/7 vet helpline provides immediate access to veterinary advice.

Cons:

- Premiums can be on the higher end, especially for comprehensive coverage.

- May not be the best option for pet owners seeking basic accident-only coverage.

Performance Analysis and Real-World Examples

To further illustrate the differences between these providers, let's look at some real-world scenarios and how each provider's policies would perform.

Scenario: Emergency Surgery for a Dog

Imagine your dog, a 5-year-old Labrador Retriever, requires emergency surgery due to a ruptured cruciate ligament. The surgery and post-operative care amount to $5,000.

PetProtect: With their comprehensive plan, you would have a deductible of $250 and a 90% reimbursement rate. This means you'd be reimbursed $4,750, leaving you with a $250 out-of-pocket expense.

Healthy Paws: Their policy would cover the full amount of $5,000, as they don't have any annual limits or claim limits. You'd only need to pay the deductible, which could range from $100 to $500, depending on your chosen plan.

Figo: Figo's policy would also cover the full amount, with a deductible ranging from $50 to $500, depending on your chosen plan. They offer a 90% reimbursement rate, so you'd be reimbursed $4,500, with an out-of-pocket expense of the chosen deductible.

Scenario: Routine Care for a Cat

Consider a 3-year-old cat that requires annual vaccinations and routine check-ups, amounting to $300 per year.

PetProtect: Their accident-only plan would not cover this scenario, as it's considered routine care. You'd need to opt for their comprehensive plan, which would provide coverage for routine care with a 70% reimbursement rate.

Healthy Paws: Healthy Paws covers routine care with a 70% reimbursement rate. So, for this scenario, you'd be reimbursed $210, leaving you with an out-of-pocket expense of $90.

Figo: Figo also covers routine care, with a 70% reimbursement rate. Similar to Healthy Paws, you'd be reimbursed $210, with an out-of-pocket expense of $90.

Evidence-Based Future Implications

As the pet insurance market continues to evolve, several trends and developments are shaping the future of this industry.

Technological Advancements

The integration of technology is becoming increasingly common in pet insurance. Providers are utilizing advanced tools like mobile apps, GPS tracking, and digital health records to enhance the overall experience for pet owners. This not only improves convenience but also allows for better management of policies and more efficient claim submissions.

Focus on Preventative Care

There’s a growing emphasis on preventative care in the pet insurance industry. Many providers are now offering coverage for routine care and wellness visits, recognizing the importance of early detection and prevention of health issues. This shift towards preventative care is expected to continue, ensuring better overall health for pets and potentially reducing the need for more extensive and costly treatments in the future.

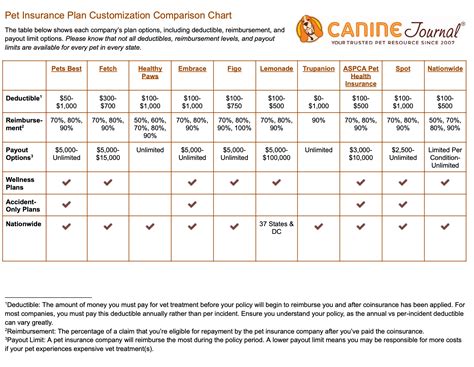

Customization and Flexibility

Pet insurance providers are increasingly offering customizable plans, allowing pet owners to choose the level of coverage that best suits their needs and budget. This flexibility ensures that pet owners can find a policy that provides adequate coverage without paying for unnecessary benefits. Customization is expected to become even more prevalent, providing more options for pet owners to tailor their insurance plans.

FAQs

What is the average cost of pet insurance?

+

The cost of pet insurance can vary significantly depending on the provider, the type of coverage, and the age and breed of your pet. On average, accident-only plans can start as low as 10-20 per month, while comprehensive plans can range from 30 to 70 per month. Lifetime plans typically have the highest premiums, often exceeding $100 per month.

Do all pet insurance policies cover pre-existing conditions?

+

No, most pet insurance policies exclude coverage for pre-existing conditions. A pre-existing condition is an illness or injury that your pet had before the policy was purchased or during a waiting period. However, some providers offer limited coverage for pre-existing conditions after a certain period of continuous coverage.

Can I switch pet insurance providers if I’m not satisfied with my current policy?

+

Yes, you can switch pet insurance providers at any time. However, it’s important to note that pre-existing conditions may not be covered by the new provider, and you may have to wait through a new waiting period for certain conditions. It’s advisable to thoroughly research and compare policies before making a switch.

Are there any discounts available for pet insurance policies?

+

Yes, many pet insurance providers offer discounts. Common discounts include multi-pet discounts (if you insure multiple pets with the same provider), early enrollment discounts (for enrolling your pet at a younger age), and breed-specific discounts (for certain breeds that are less prone to health issues). Additionally, some providers may offer loyalty discounts for long-term customers.

How do I make a claim with my pet insurance provider?

+

The process for making a claim can vary slightly between providers, but generally, you’ll need to submit a claim form along with supporting documentation, such as veterinary invoices and treatment records. Some providers offer online or mobile claim submissions, while others may require you to mail in the necessary documents. It’s important to review your policy’s claim process and keep all relevant documents organized.

In conclusion, choosing the right pet insurance policy is a critical decision for pet owners. By understanding the different types of policies, key considerations, and real-world performance, you can make an informed choice that provides the best care for your furry companion. As the industry continues to evolve, staying updated with the latest trends and developments will ensure you make the most suitable choice for your pet’s unique needs.