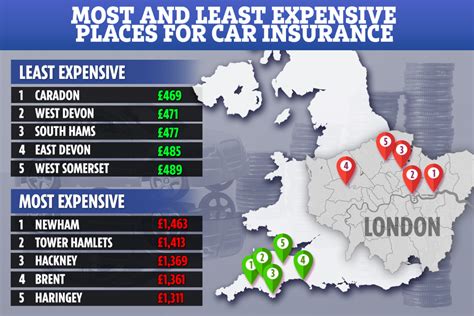

Places For Car Insurance

Car insurance is a vital aspect of vehicle ownership, providing financial protection and peace of mind to drivers. With numerous options available, finding the right insurance policy can be a daunting task. In this comprehensive guide, we will explore the best places to secure car insurance, considering various factors such as coverage, cost, and customer satisfaction. By the end of this article, you'll have the knowledge to make an informed decision and ensure you're getting the best value for your automotive insurance needs.

Understanding the Importance of Car Insurance

Before diving into the top places for car insurance, let’s first grasp the significance of having adequate coverage. Car insurance serves as a financial safety net, protecting you and your vehicle in the event of accidents, theft, or other unforeseen circumstances. It not only ensures your own protection but also covers any potential liabilities you may incur while on the road.

Furthermore, car insurance is a legal requirement in most countries and regions. Failing to maintain valid insurance coverage can result in hefty fines, license suspension, or even legal repercussions. It is therefore crucial to prioritize obtaining the right car insurance policy to stay compliant with the law and protect your interests.

Key Factors to Consider When Choosing Car Insurance

When searching for the best car insurance, several key factors should be taken into account. These include coverage options, cost, reputation, and customer service. Let’s delve deeper into each of these aspects to help you make an informed decision.

Coverage Options

Car insurance policies offer a range of coverage options, each designed to address specific risks. Understanding the different types of coverage available is essential to ensure you select a policy that aligns with your needs.

- Liability Coverage: This is the most basic form of car insurance, providing coverage for bodily injury and property damage caused to others in an accident for which you are at fault. Liability coverage is mandatory in most states and is a crucial aspect of any car insurance policy.

- Collision Coverage: Collision coverage protects your vehicle in the event of a collision with another vehicle or object. It covers the cost of repairs or replacement of your vehicle, regardless of who is at fault.

- Comprehensive Coverage: Comprehensive insurance provides protection against damage caused by non-collision events, such as theft, vandalism, natural disasters, or collisions with animals. This coverage is highly recommended to ensure your vehicle is fully protected.

- Personal Injury Protection (PIP): PIP coverage provides medical and rehabilitation expenses for you and your passengers, regardless of who is at fault in an accident. It is a vital component of car insurance, ensuring that you and your loved ones receive the necessary medical care without bearing the full financial burden.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in the event of an accident with a driver who has no insurance or insufficient insurance coverage. It ensures that you are not left financially vulnerable in such situations.

When evaluating car insurance providers, it's important to assess the range of coverage options they offer and choose a policy that provides the right balance of protection for your specific needs.

Cost and Affordability

The cost of car insurance is a significant consideration for many drivers. While it’s essential to find comprehensive coverage, it’s equally important to ensure that the policy is affordable and fits within your budget.

Insurance premiums can vary greatly depending on various factors, including your driving history, the make and model of your vehicle, your age and gender, and the coverage options you choose. Obtaining quotes from multiple providers is crucial to compare prices and find the most cost-effective option.

Additionally, consider exploring discounts and savings opportunities. Many insurance companies offer discounts for safe driving records, multiple policy bundles, or vehicle safety features. By taking advantage of these discounts, you can further reduce your insurance costs without compromising on coverage.

Reputation and Customer Service

When it comes to car insurance, the reputation and reliability of the provider are crucial factors. You want to ensure that your insurance company has a solid track record of paying claims promptly and fairly. Researching customer reviews and ratings can provide valuable insights into the satisfaction levels of existing policyholders.

Excellent customer service is another critical aspect. Look for insurance providers that offer easy-to-reach customer support, whether through phone, email, or online platforms. A responsive and knowledgeable customer service team can make a significant difference in resolving any issues or concerns you may have during your policy term.

The Top Places for Car Insurance

Now that we’ve covered the key factors to consider, let’s explore some of the top places to secure car insurance, based on comprehensive research and customer feedback.

1. State Farm

State Farm is a well-established and trusted insurance provider with a strong reputation for customer satisfaction. They offer a wide range of coverage options, including liability, collision, comprehensive, and additional perks like rental car coverage and roadside assistance. State Farm’s extensive network of agents provides personalized service, ensuring that you receive the support and guidance you need throughout your policy term.

2. Geico

Geico, known for its catchy slogans and competitive pricing, is a top choice for many car insurance seekers. They provide comprehensive coverage options, including liability, collision, and comprehensive insurance, as well as additional benefits such as emergency roadside service and mechanical breakdown insurance. Geico’s online platform offers convenience and ease of use, allowing you to manage your policy and make payments with just a few clicks.

3. Progressive

Progressive is another prominent player in the car insurance market, offering a wide array of coverage options and innovative features. Their policies include standard liability coverage, as well as optional collision and comprehensive insurance. Progressive is known for its Name Your Price tool, which allows you to set your desired monthly budget and receive quotes for policies that fit within that range. This unique feature empowers you to take control of your insurance costs.

4. Allstate

Allstate is a leading insurance provider with a focus on customer service and innovation. They offer a comprehensive range of coverage options, including liability, collision, and comprehensive insurance, as well as additional benefits such as rental car reimbursement and roadside assistance. Allstate’s Drivewise program utilizes telematics technology to monitor your driving habits, offering discounts for safe driving behaviors.

5. USAA

USAA is a highly regarded insurance provider exclusively serving military members, veterans, and their families. They are known for their exceptional customer service and affordable insurance rates. USAA offers a full suite of coverage options, including liability, collision, and comprehensive insurance, as well as unique benefits tailored to the needs of military personnel and their families.

Comparative Analysis: Top Car Insurance Providers

To provide a comprehensive comparison of the top car insurance providers, let’s examine their key features, coverage options, and customer satisfaction ratings in a table format.

| Provider | Key Features | Coverage Options | Customer Satisfaction Rating |

|---|---|---|---|

| State Farm | Personalized service, extensive agent network, comprehensive coverage options | Liability, Collision, Comprehensive, Rental Car Coverage, Roadside Assistance | 4.5/5 |

| Geico | Competitive pricing, convenient online platform, emergency roadside service | Liability, Collision, Comprehensive, Mechanical Breakdown Insurance | 4.3/5 |

| Progressive | Innovative features, Name Your Price tool, comprehensive coverage options | Liability, Collision, Comprehensive, Rental Car Reimbursement | 4.2/5 |

| Allstate | Excellent customer service, Drivewise program, comprehensive coverage | Liability, Collision, Comprehensive, Rental Car Reimbursement, Roadside Assistance | 4.1/5 |

| USAA | Exclusive to military personnel, exceptional customer service, affordable rates | Liability, Collision, Comprehensive, Unique Military Benefits | 4.8/5 |

This comparative analysis provides a snapshot of the top car insurance providers, highlighting their key features, coverage options, and customer satisfaction ratings. It serves as a valuable tool to help you make an informed decision when choosing the right insurance provider for your needs.

Future Trends in Car Insurance

The car insurance industry is constantly evolving, driven by technological advancements and changing consumer preferences. Here are some future trends to watch out for:

- Telematics and Usage-Based Insurance (UBI): Telematics technology, which tracks driving behavior and habits, is gaining popularity. UBI policies offer personalized premiums based on individual driving patterns, rewarding safe drivers with lower rates.

- Digitalization and Online Platforms: The rise of digital insurance platforms allows customers to easily compare policies, obtain quotes, and manage their insurance needs online. This trend enhances convenience and empowers consumers to make informed choices.

- Data Analytics and Personalization: Insurance providers are leveraging data analytics to offer personalized coverage options and tailored recommendations. By analyzing vast amounts of data, insurers can provide more accurate risk assessments and offer tailored policies to meet individual needs.

- Sustainable and Green Insurance: With growing environmental concerns, sustainable insurance options are gaining traction. These policies incentivize eco-friendly driving behaviors and offer discounts for electric or hybrid vehicles, promoting greener transportation choices.

FAQ

What are the key factors to consider when choosing car insurance?

+

When selecting car insurance, consider factors such as coverage options (liability, collision, comprehensive), cost and affordability, reputation of the provider, and customer service. Research and compare multiple providers to find the best fit for your needs.

How can I save money on car insurance premiums?

+

To save on car insurance premiums, explore discounts for safe driving records, multiple policy bundles, or vehicle safety features. Additionally, consider raising your deductible or opting for a higher excess to reduce your monthly payments.

What is the difference between liability and comprehensive coverage?

+

Liability coverage protects you against claims for bodily injury or property damage caused to others in an accident for which you are at fault. Comprehensive coverage, on the other hand, provides protection for your vehicle against non-collision events like theft, vandalism, or natural disasters.

As the car insurance landscape continues to evolve, staying informed about the latest trends and options is crucial. By considering the key factors outlined in this guide and keeping an eye on emerging trends, you can make well-informed decisions and secure the best car insurance coverage for your needs.