Planning Life Insurance

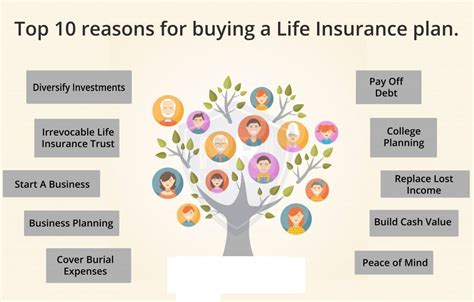

Life insurance is a fundamental aspect of financial planning, offering peace of mind and security to individuals and their loved ones. It provides a financial safety net during uncertain times, ensuring that families can maintain their standard of living and meet their financial obligations even in the absence of the policyholder. With various types and options available, planning life insurance involves a thoughtful consideration of personal circumstances, future goals, and the desired level of protection.

Understanding Life Insurance: Types and Benefits

Life insurance policies can be broadly categorized into two main types: term life insurance and permanent life insurance, each serving distinct purposes.

Term Life Insurance

Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years. It provides a death benefit to the beneficiaries in the event of the policyholder’s demise during the term. The premiums for term life insurance are generally more affordable compared to permanent life insurance, making it an attractive option for those seeking short-term protection or those with budget constraints.

Term life insurance is particularly beneficial for individuals with temporary financial responsibilities, such as covering mortgage payments or providing for children’s education. It ensures that, should the unexpected occur, the policyholder’s family is not left with a financial burden.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides lifelong coverage, ensuring protection for the policyholder’s entire life. This type of insurance offers a death benefit to the beneficiaries and also accumulates cash value over time. The cash value can be borrowed against or withdrawn, providing financial flexibility during retirement or in case of emergencies.

Permanent life insurance is often chosen by individuals seeking long-term financial security and peace of mind. It can be especially beneficial for those with significant financial responsibilities, such as business owners or individuals with extensive debt obligations.

| Life Insurance Type | Key Features |

|---|---|

| Term Life Insurance | Affordable premiums, coverage for a specified term, ideal for temporary financial responsibilities. |

| Permanent Life Insurance | Lifetime coverage, builds cash value, provides long-term financial security. |

Factors to Consider When Planning Life Insurance

When planning life insurance, several critical factors come into play. These considerations ensure that the chosen policy aligns with your unique circumstances and financial goals.

Assessing Your Financial Responsibilities

The first step in planning life insurance is to evaluate your current and future financial responsibilities. This includes assessing your debts, such as mortgages, loans, or credit card balances, and considering the financial needs of your dependents, such as children or elderly parents.

For instance, if you have a mortgage, you may want to consider a life insurance policy that covers the remaining balance, ensuring your family can stay in their home should you pass away. Similarly, if you have young children, you might opt for a policy that provides sufficient funds for their education and overall well-being.

Determining the Right Coverage Amount

The coverage amount of your life insurance policy is a critical consideration. It should be sufficient to meet your financial goals and provide for your loved ones’ needs. Factors to consider when determining coverage include:

- Income Replacement: Calculate the amount of income your dependents would need to maintain their current standard of living.

- Debt Obligations: Consider the total amount of debt you have, including mortgages, loans, and credit card balances.

- Funeral and Burial Costs: Account for the expenses associated with end-of-life services.

- Other Financial Goals: Determine if you have specific financial goals, such as providing for your children’s education or funding a business venture.

Choosing the Right Type of Policy

As mentioned earlier, the two primary types of life insurance are term and permanent. The choice between these depends on your financial situation, goals, and the level of coverage you require.

Term life insurance is ideal for those seeking short-term protection or those with limited financial resources. It provides a cost-effective solution for covering specific financial responsibilities, such as mortgage payments or children’s education expenses.

On the other hand, permanent life insurance is a more comprehensive solution, offering lifelong coverage and the potential for cash value accumulation. This type of insurance is well-suited for individuals with long-term financial responsibilities or those seeking a legacy-building financial tool.

Evaluating Add-Ons and Riders

Many life insurance policies offer add-ons or riders that can enhance your coverage. These optional features can provide additional benefits, such as:

- Waiver of Premium: This rider waives your premium payments if you become disabled, ensuring your coverage remains active.

- Accidental Death Benefit: This add-on provides an additional death benefit if the policyholder’s death is due to an accident.

- Critical Illness Rider: This rider pays a benefit if the policyholder is diagnosed with a critical illness, such as cancer or a heart attack.

- Long-Term Care Rider: This add-on covers long-term care expenses, providing financial support for extended care needs.

The Process of Obtaining Life Insurance

Obtaining life insurance involves several steps, each designed to ensure the policy aligns with your needs and is underwritten appropriately.

Step 1: Research and Compare

Start by researching different life insurance providers and policies. Compare premiums, coverage options, and the financial strength of the insurance companies. Look for companies with a solid reputation and a track record of paying claims promptly.

Consider seeking recommendations from trusted sources, such as financial advisors or insurance brokers, who can provide insights into the best policies for your specific circumstances.

Step 2: Determine Your Needs and Budget

Assess your financial responsibilities and determine the coverage amount you require. Consider your budget and decide whether you can afford term life insurance or if permanent life insurance is a more suitable long-term solution.

It’s essential to strike a balance between the level of coverage you need and what you can comfortably afford. A financial advisor can help you navigate this process and ensure you make an informed decision.

Step 3: Apply for Coverage

Once you’ve chosen a suitable policy, you’ll need to complete an application. This typically involves providing personal information, such as your name, date of birth, and contact details, as well as answering questions about your health and lifestyle.

Depending on the policy and the insurance company, you may also be required to undergo a medical examination. This examination helps the insurance company assess your risk and determine your premium.

Step 4: Underwriting and Approval

After submitting your application, the insurance company will review your information and conduct an underwriting process. This process evaluates your health, lifestyle, and other factors to determine your risk level and the appropriate premium.

If you’re approved for coverage, you’ll receive a policy document outlining the terms and conditions, including the coverage amount, premium, and any riders or add-ons you’ve chosen.

Maximizing the Benefits of Life Insurance

Life insurance is more than just a financial tool; it’s a commitment to your loved ones’ future. To maximize the benefits of your life insurance policy, consider the following strategies:

Review and Update Regularly

Life circumstances change, and so should your life insurance policy. Review your policy annually or whenever significant life events occur, such as marriage, the birth of a child, or a major career change. Adjust your coverage and beneficiaries as needed to ensure your policy remains aligned with your current needs.

Consider Tax Advantages

Some life insurance policies, particularly permanent life insurance, offer tax advantages. The cash value within these policies grows tax-deferred, and death benefits are typically tax-free. Consult with a tax professional to understand the potential tax benefits and how they can enhance your financial strategy.

Incorporate Estate Planning

Life insurance can be a valuable component of your estate plan. It can provide liquidity to your estate, ensuring your heirs can pay estate taxes and other financial obligations without having to sell assets prematurely. Work with an estate planning attorney to integrate your life insurance policy into your overall estate strategy.

Conclusion: A Secure Future with Life Insurance

Planning life insurance is a crucial step in securing your family’s financial future. By understanding the types of life insurance, assessing your needs, and choosing the right policy, you can provide a safety net for your loved ones during uncertain times.

Remember, life insurance is a long-term commitment, and it’s essential to review and update your policy regularly to ensure it continues to meet your changing needs. With the right coverage in place, you can have peace of mind knowing your family is protected and supported, no matter what life may bring.

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your financial responsibilities and goals. A general rule of thumb is to have coverage that is 10-15 times your annual income. However, this can vary based on your specific circumstances. Consider your mortgage, debts, children’s education expenses, and other financial obligations to determine the appropriate coverage amount.

What is the difference between term and permanent life insurance?

+Term life insurance provides coverage for a specified term, typically 10-30 years, and is more affordable. It is ideal for covering short-term financial responsibilities. Permanent life insurance, on the other hand, offers lifelong coverage and builds cash value over time. It is a more comprehensive solution suitable for long-term financial security.

Do I need to undergo a medical exam to get life insurance?

+The requirement for a medical exam depends on the insurance company and the policy. Some policies, especially term life insurance, may require a medical exam to assess your health and determine your risk level. Permanent life insurance policies often have more comprehensive underwriting processes, which may include a medical exam.

Can I change my life insurance policy once it’s in place?

+Yes, you can typically make changes to your life insurance policy, such as increasing or decreasing coverage, adding or removing beneficiaries, or adjusting riders and add-ons. However, any changes may impact your premiums and may require a new application and underwriting process.

How often should I review my life insurance policy?

+It’s recommended to review your life insurance policy annually or whenever significant life events occur. Regular reviews ensure your coverage remains adequate and aligned with your changing needs and circumstances.