Policy Number Health Insurance

Welcome to an in-depth exploration of the world of health insurance, a topic that affects millions of individuals and families worldwide. In this comprehensive article, we will delve into the intricacies of health insurance policies, specifically focusing on the significance of policy numbers and their role in the healthcare ecosystem. Understanding these concepts is crucial for anyone navigating the complex landscape of medical coverage.

Unraveling the Significance of Policy Numbers in Health Insurance

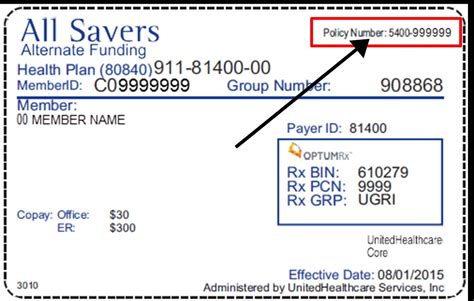

A policy number in health insurance is a unique identifier assigned to an individual’s or group’s insurance plan. This seemingly simple alphanumeric code holds immense importance, acting as a gateway to accessing medical services and benefits. In this section, we will uncover the various facets of policy numbers, their purpose, and their impact on the healthcare journey.

The Role of Policy Numbers in Identifying Insurance Coverage

Policy numbers serve as the primary means of identifying an insurance policy. Each insurance provider assigns a distinct number to every policy they issue. This number is used to differentiate between various policies, ensuring accurate record-keeping and administration. When individuals interact with healthcare providers, pharmacies, or insurance companies, presenting their policy number is often the first step in verifying their coverage.

For instance, consider Mr. Johnson, who recently purchased a health insurance plan from a reputable provider. His policy number, HPI-234567890, is his unique identifier, ensuring that his medical claims are processed accurately and efficiently. When Mr. Johnson visits his physician, the policy number is referenced to confirm his coverage and determine the applicable benefits.

Streamlining the Claims Process with Policy Numbers

One of the critical functions of policy numbers is streamlining the claims process. When individuals receive medical services or purchase prescribed medications, they are often required to provide their policy number to the healthcare provider or pharmacist. This information is then used to submit claims to the insurance company, allowing for the reimbursement of eligible expenses.

Imagine Ms. Garcia, who has recently undergone a surgical procedure. To claim her insurance benefits, she must provide her policy number, HPM-123456789, to her healthcare provider. The provider then utilizes this number to create and submit a detailed claim, including all the relevant information, to Ms. Garcia's insurance company. The policy number acts as a vital link between the healthcare provider and the insurance company, facilitating the smooth processing of claims.

| Policy Number | Policy Type | Claim Amount |

|---|---|---|

| HPI-234567890 | Individual | $1,500 |

| HPM-123456789 | Family | $3,000 |

| HPG-987654321 | Group | $2,200 |

Navigating Policy Details: Understanding the Policy Number Structure

Policy numbers are typically composed of a combination of letters and numbers, and their structure can vary between insurance providers. However, despite the variations, policy numbers generally follow a standardized format, ensuring consistency and ease of use.

Let's take a closer look at the policy number HPI-234567890 from earlier. In this example, HPI represents the insurance company's unique identifier, while 234567890 is a series of numbers that further differentiates the policy. This structure allows for quick identification of the insurance provider and the specific policy, making it easier to access policy details and benefits.

Maintaining Privacy and Security with Policy Numbers

While policy numbers are essential for identifying insurance coverage and processing claims, it is crucial to maintain privacy and security surrounding these sensitive details. Insurance companies employ robust data protection measures to safeguard policyholders’ information, ensuring that their personal and medical data remains confidential.

Additionally, individuals are advised to keep their policy numbers secure and refrain from sharing them with unauthorized parties. This practice helps prevent potential fraud and ensures that only authorized individuals can access and utilize their insurance benefits.

The Future of Health Insurance: Policy Numbers in a Digital Age

As technology continues to advance and digital transformation reshapes industries, the world of health insurance is also experiencing significant changes. In this section, we will explore how policy numbers are evolving to adapt to the digital age and the implications for healthcare accessibility and efficiency.

Digital Platforms: Enhancing Policy Number Accessibility

With the rise of digital platforms and mobile applications, insurance companies are now offering more convenient ways for policyholders to access their policy numbers and related information. Online portals and mobile apps provide individuals with quick and secure access to their policy details, allowing them to view coverage summaries, check claim statuses, and manage their insurance plans.

For example, Mr. Lee, a busy professional, can now easily access his policy number and policy details through his insurance provider's mobile app. With just a few taps on his smartphone, he can retrieve his policy number, HPL-345678901, and review his coverage limits, deductibles, and co-pays. This digital convenience empowers individuals to take a more active role in managing their healthcare and insurance needs.

Blockchain Technology: Revolutionizing Policy Number Security

Blockchain technology, known for its robust security features, is increasingly being explored by the insurance industry to enhance the security of policy numbers and other sensitive data. By utilizing blockchain, insurance companies can create secure and tamper-proof records of policy details, ensuring that policy numbers and related information remain intact and reliable.

Ms. Anderson, a technology enthusiast, is particularly interested in the potential of blockchain in health insurance. Her insurance provider has adopted blockchain technology to secure her policy number, HPA-456789012, and other critical policy details. This innovative approach provides Ms. Anderson with added peace of mind, knowing that her insurance information is stored securely and cannot be altered without authorization.

Artificial Intelligence: Optimizing Policy Number Management

Artificial Intelligence (AI) is another transformative technology that is revolutionizing the health insurance industry. AI-powered systems can analyze vast amounts of data, including policy numbers and related information, to identify patterns, detect anomalies, and optimize claim processing. This technology enhances efficiency, reduces administrative burdens, and improves the overall customer experience.

Consider Mr. Chen, who recently submitted a claim for a medical procedure. His insurance provider, utilizing AI algorithms, quickly processes his claim, verifying his policy number, HPB-567890123, and determining his eligibility for reimbursement. The AI system's efficiency ensures a faster turnaround time, benefiting both Mr. Chen and the insurance company.

Conclusion: Navigating the Health Insurance Landscape

In conclusion, policy numbers play a vital role in the health insurance ecosystem, serving as unique identifiers that facilitate access to medical services and benefits. From streamlining the claims process to ensuring privacy and security, policy numbers are integral to the efficient functioning of the healthcare system.

As we move forward into a digital age, the evolution of policy numbers and their integration with emerging technologies promises to enhance accessibility, security, and efficiency in health insurance. By staying informed and actively engaging with digital platforms, blockchain technology, and AI innovations, individuals can navigate the health insurance landscape with greater ease and confidence.

How do I find my policy number if I have lost it?

+If you have misplaced your policy number, you can easily retrieve it by contacting your insurance provider. Most insurance companies offer online portals or customer service representatives who can assist you in locating your policy number. Additionally, checking your insurance card or policy documents may reveal the number.

Can policy numbers change over time?

+Policy numbers generally remain consistent throughout the duration of your insurance policy. However, in certain circumstances, such as policy renewals or changes in coverage, your insurance provider may assign a new policy number. It is essential to keep track of any updates to your policy number to ensure accurate claim submissions.

Are policy numbers shared with healthcare providers?

+Policy numbers are typically shared with healthcare providers to verify your insurance coverage and process claims. When you receive medical services, your healthcare provider may request your policy number to confirm your eligibility for coverage and to submit claims to your insurance company. It is important to provide accurate policy number information to ensure timely claim processing.