Ppo Health Insurance Plans

When it comes to health insurance, choosing the right plan can be a daunting task. Among the various options available, Preferred Provider Organization (PPO) plans have gained significant popularity for their flexibility and extensive provider networks. PPO health insurance plans offer a unique blend of benefits, allowing individuals and families to access a wide range of healthcare services while enjoying the freedom to choose their preferred healthcare providers. In this comprehensive guide, we will delve into the world of PPO health insurance plans, exploring their features, advantages, and considerations to help you make an informed decision.

Understanding PPO Health Insurance Plans

PPO health insurance plans are a type of health coverage that provides policyholders with access to a network of preferred healthcare providers. Unlike other plans, such as Health Maintenance Organizations (HMOs), PPOs offer more flexibility in terms of provider choice and coverage options. Here's a closer look at how PPO plans operate:

Network of Providers

The cornerstone of PPO plans is their extensive network of healthcare providers, which includes doctors, specialists, hospitals, and other medical facilities. When you enroll in a PPO plan, you gain access to this network, allowing you to receive medical services from any provider within it. This network is carefully curated by the insurance company to ensure a high standard of care and competitive pricing.

One of the key advantages of PPO plans is the freedom to choose your healthcare providers. Unlike HMOs, which often require you to select a primary care physician and obtain referrals for specialist visits, PPOs allow you to directly consult specialists without prior authorization. This flexibility is particularly beneficial for individuals with specific healthcare needs or those who prefer to maintain relationships with trusted healthcare professionals.

Coverage and Cost

PPO health insurance plans typically offer comprehensive coverage for a wide range of medical services, including doctor visits, hospital stays, surgeries, prescriptions, and preventive care. The specific coverage and benefits can vary between plans and insurance companies, so it's essential to carefully review the plan's details to ensure it aligns with your healthcare needs.

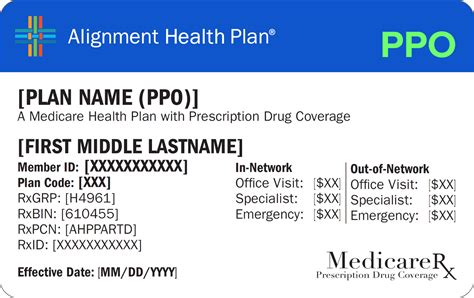

In terms of cost, PPO plans often require policyholders to pay a monthly premium, similar to other insurance plans. Additionally, there may be deductibles, copayments, and coinsurance amounts associated with various medical services. The cost structure can vary based on the plan's design and the insurance company's policies. It's crucial to assess these financial aspects to understand the overall affordability of the plan.

| PPO Plan Component | Description |

|---|---|

| Premium | Monthly payment for maintaining the insurance coverage. |

| Deductible | The amount you must pay out-of-pocket before the insurance coverage kicks in. |

| Copayment (Copay) | A fixed amount you pay for covered services, typically at the time of service. |

| Coinsurance | The percentage of the cost of a covered service you pay after meeting the deductible. |

Advantages of PPO Health Insurance Plans

PPO health insurance plans offer a range of advantages that make them an attractive option for many individuals and families. Let's explore some of the key benefits:

Flexibility and Provider Choice

One of the most significant advantages of PPO plans is the flexibility they provide in choosing healthcare providers. Unlike HMOs, which often restrict your options, PPOs allow you to visit any provider within their network without prior authorization. This freedom is especially beneficial for those who require specialized care or prefer to continue treatment with familiar healthcare professionals.

Wide Network Coverage

PPO plans are known for their extensive provider networks, which often cover a broad geographic area. This means that regardless of where you live or travel, you can typically find a provider who accepts your insurance. The wide network coverage is particularly advantageous for individuals who frequently travel or have specific healthcare needs that require specialized treatment.

Comprehensive Benefits

PPO health insurance plans typically offer a comprehensive range of benefits, covering a wide spectrum of medical services. From routine check-ups and preventive care to more complex procedures and specialty treatments, PPO plans aim to provide policyholders with the necessary coverage to address their healthcare needs. This comprehensive approach ensures that individuals have access to the care they require without compromising on quality.

Freedom from Referrals

Unlike HMOs, which often require referrals from primary care physicians for specialist visits, PPO plans grant policyholders the freedom to directly consult specialists. This eliminates the need for additional appointments and paperwork, streamlining the healthcare process and providing a more efficient experience. The ability to access specialists without referrals is particularly beneficial for individuals with chronic conditions or those who require specialized care.

Considerations and Limitations

While PPO health insurance plans offer numerous benefits, it's essential to consider certain factors and potential limitations to ensure the plan aligns with your specific needs and preferences.

Cost and Financial Implications

PPO plans can sometimes be more expensive than other insurance options, such as HMOs. The cost structure, including premiums, deductibles, copayments, and coinsurance, should be carefully evaluated to ensure the plan fits within your budget. It's crucial to assess not only the monthly premium but also the potential out-of-pocket expenses that may arise during the course of the year.

Additionally, it's important to consider the plan's coverage limits and any potential gaps in coverage. Some PPO plans may have limitations on certain services or treatments, so it's essential to review the plan's benefits summary to understand what is and isn't covered.

Network Restrictions

While PPO plans boast extensive provider networks, it's possible that certain specialists or medical facilities may not be included. It's advisable to check the network directory provided by the insurance company to ensure that your preferred providers are part of the network. If a particular provider is not in-network, you may still have the option to use them, but at a higher out-of-pocket cost.

Administrative Complexity

PPO plans, with their flexibility and wide network coverage, can sometimes involve more administrative tasks compared to other insurance options. Policyholders may need to keep track of various providers, submit claims, and manage their own healthcare records. While this level of involvement can be empowering for some, it may be a consideration for those who prefer a more streamlined and hands-off approach to healthcare management.

Choosing the Right PPO Plan

Selecting the right PPO health insurance plan requires careful consideration of your specific needs and preferences. Here are some key factors to keep in mind when evaluating and comparing PPO plans:

Network and Provider Coverage

Start by assessing the provider network of each plan. Ensure that your preferred healthcare providers, including specialists and facilities, are included in the network. Consider the geographic coverage of the network to ensure it aligns with your travel and residence patterns.

Coverage Benefits and Limits

Review the plan's benefits summary to understand the scope of coverage. Pay close attention to the services and treatments that are included and excluded. Consider your current and potential future healthcare needs to ensure the plan provides adequate coverage. Additionally, review the plan's limits on certain services to avoid unexpected out-of-pocket expenses.

Cost and Affordability

Evaluate the plan's cost structure, including premiums, deductibles, copayments, and coinsurance. Consider your budget and financial situation to determine whether the plan is affordable in the long term. Remember that while a lower premium may be attractive, it could be offset by higher out-of-pocket expenses if you require extensive medical care.

Plan Reputation and Reviews

Research the reputation and reviews of the insurance company offering the PPO plan. Look for feedback from current and past policyholders to gain insights into their experiences with the plan. Consider factors such as customer service, claim processing, and overall satisfaction to ensure you choose a reputable and reliable insurance provider.

Customizable Options

Explore whether the PPO plan offers customizable options to tailor the coverage to your specific needs. Some plans may allow you to choose different levels of coverage, add additional benefits, or select a plan with a higher premium but lower out-of-pocket costs. Customizable options can help you create a plan that aligns perfectly with your healthcare requirements.

Frequently Asked Questions

How do PPO plans differ from HMOs?

+PPO plans offer more flexibility in provider choice and typically have a wider network of providers compared to HMOs. PPOs allow direct access to specialists without referrals, while HMOs often require a primary care physician's referral. Additionally, PPO plans often have higher premiums but lower out-of-pocket costs, whereas HMOs tend to have lower premiums but higher out-of-pocket expenses.

Can I use out-of-network providers with a PPO plan?

+Yes, PPO plans generally allow you to use out-of-network providers, although at a higher cost. Out-of-network providers are typically reimbursed at a lower rate, resulting in higher out-of-pocket expenses for the policyholder. It's important to check the plan's coverage and network directory to understand the specific terms for out-of-network care.

What is the typical cost structure of a PPO plan?

+The cost structure of a PPO plan typically includes a monthly premium, deductibles, copayments, and coinsurance. The specific amounts can vary based on the plan's design and the insurance company's policies. It's important to carefully review the plan's cost structure to understand the overall affordability and potential out-of-pocket expenses.

Are PPO plans suitable for individuals with chronic conditions?

+PPO plans can be a suitable option for individuals with chronic conditions due to their flexibility and comprehensive benefits. The ability to choose specialists without referrals and access a wide network of providers can be beneficial for managing ongoing healthcare needs. However, it's crucial to carefully review the plan's coverage and potential limitations to ensure it meets the specific requirements of chronic conditions.

How can I find the right PPO plan for my needs?

+To find the right PPO plan, consider your healthcare needs, preferred providers, and budget. Assess the provider network, coverage benefits, and cost structure of each plan. Research the reputation of the insurance company and read reviews from current and past policyholders. Compare multiple PPO plans to find the one that aligns best with your specific requirements.

Choosing the right health insurance plan is a crucial decision that can significantly impact your healthcare experience and financial well-being. PPO health insurance plans offer a unique combination of flexibility, provider choice, and comprehensive benefits, making them an attractive option for many individuals and families. By understanding the advantages, considerations, and key factors involved in selecting a PPO plan, you can make an informed decision that aligns with your healthcare needs and preferences.