Price Comparison Auto Insurance

Finding the best deal on auto insurance is a crucial financial decision for many individuals and households. With numerous insurance providers offering a wide range of policies and coverage options, the task of comparing prices and finding the most suitable coverage can be daunting. This comprehensive guide aims to delve into the world of auto insurance, providing an in-depth analysis of price comparison strategies and offering valuable insights to help you make an informed decision.

Understanding Auto Insurance Coverage and Pricing

Auto insurance is a contract between you and the insurance provider, designed to protect you financially in the event of an accident, theft, or other vehicle-related incidents. The coverage and pricing of auto insurance policies can vary significantly, depending on several factors such as your driving history, the type of vehicle you own, and the level of coverage you choose.

The main components of an auto insurance policy include:

- Liability Coverage: This covers the costs of injuries and damages you cause to others in an accident. It's typically divided into bodily injury liability and property damage liability.

- Comprehensive Coverage: Also known as "other than collision" coverage, this option covers damage to your vehicle caused by incidents other than collisions, such as theft, vandalism, natural disasters, or animal collisions.

- Collision Coverage: This coverage pays for repairs to your vehicle after an accident, regardless of fault. It's often paired with comprehensive coverage.

- Medical Payments or Personal Injury Protection (PIP): These cover the cost of medical treatment for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the damages.

The price of your auto insurance policy will depend on these coverage options, as well as other factors like your age, gender, marital status, location, and the make and model of your vehicle. Insurance companies use complex algorithms to calculate risk and set premiums, making it essential to understand these factors when comparing prices.

Factors Affecting Auto Insurance Prices

When comparing auto insurance prices, it’s crucial to understand the various factors that can influence the cost of your policy. Here are some of the key elements that play a role in determining insurance premiums:

Driving Record

Your driving history is one of the most significant factors in auto insurance pricing. Insurance companies closely examine your record for any violations, accidents, or claims. A clean driving record typically results in lower premiums, while a history of accidents or moving violations can lead to higher costs.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can also impact your insurance premiums. Sports cars and luxury vehicles often have higher insurance costs due to their value and potential for higher speeds. Additionally, the purpose of your vehicle usage (commuting, business, pleasure) can affect your rates.

Location and Demographic Factors

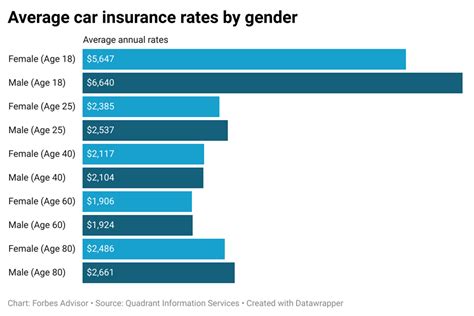

Where you live and your demographic details can also influence insurance prices. Insurance companies consider factors like crime rates, traffic density, and the likelihood of natural disasters in your area. Demographic details such as age, gender, and marital status can also play a role, as these factors are statistically linked to certain driving behaviors.

Coverage and Deductibles

The level of coverage you choose and the deductibles you opt for can significantly impact your insurance premiums. Higher coverage limits and lower deductibles generally result in higher premiums, while lower coverage and higher deductibles can lead to more affordable policies. It’s important to strike a balance between coverage and cost based on your personal needs and financial situation.

Strategies for Effective Price Comparison

Comparing auto insurance prices can be a complex process, but with the right strategies, you can make it more manageable and ensure you’re getting the best deal. Here are some effective methods to consider:

Use Online Comparison Tools

Numerous online platforms and websites offer auto insurance comparison tools. These tools allow you to input your details and preferences, and then provide a list of quotes from various insurance providers. While these tools can be a great starting point, it’s important to note that they may not include every insurance company or take into account all the unique factors that could impact your rates.

Get Quotes from Multiple Insurers

To get a more comprehensive view of the market, it’s beneficial to request quotes from multiple insurance companies directly. This allows you to compare rates and coverage options from a variety of providers. Many insurers offer online quote tools or customer service representatives who can provide quotes over the phone.

Examine Policy Details

When comparing quotes, it’s essential to look beyond just the price. Pay close attention to the coverage limits, deductibles, and any exclusions or limitations in the policy. Make sure the policies you’re comparing offer similar levels of coverage, as this can significantly impact the value you’re getting for your money.

Consider Bundling and Discounts

Many insurance companies offer discounts for bundling multiple policies (e.g., auto and home insurance) or for certain professions, affiliations, or life events. Ask about these discounts when requesting quotes to ensure you’re getting the most competitive rates.

Understand Your Options

Before starting your price comparison journey, take some time to understand the different types of auto insurance coverage available and the options that best suit your needs. This knowledge will help you ask the right questions and make informed decisions when comparing policies.

Making the Right Choice for Your Auto Insurance

Once you’ve thoroughly researched and compared auto insurance prices and policies, it’s time to make a decision. Here are some key considerations to help you choose the right auto insurance provider and policy:

Financial Stability and Reputation

Ensure the insurance company you choose has a strong financial rating and a good reputation for paying claims promptly. Look for reviews and ratings from independent sources to get an unbiased view of the company’s performance.

Customer Service and Claims Process

Consider the insurer’s customer service record and the ease of their claims process. You want a company that is responsive, helpful, and efficient when it comes to handling your insurance needs, especially in the event of an accident or claim.

Policy Flexibility and Customization

Look for an insurance provider that offers flexible policies and the ability to customize your coverage. This ensures you can tailor your policy to your specific needs and budget.

Renewal and Cancellation Policies

Understand the insurer’s policies regarding renewals and cancellations. Some companies offer discounts for long-term customers or have lenient cancellation policies, which can be beneficial if your circumstances change.

The Future of Auto Insurance Pricing

The auto insurance industry is constantly evolving, with new technologies and trends shaping the way insurance is priced and delivered. Here’s a glimpse into the future of auto insurance pricing:

Telematics and Usage-Based Insurance

Telematics technology allows insurance companies to monitor your driving behavior in real-time. This data can be used to offer personalized insurance rates based on how, when, and where you drive. Usage-based insurance, or pay-as-you-drive models, are becoming increasingly popular, providing more accurate pricing based on individual driving habits.

Data Analytics and Machine Learning

Insurance companies are leveraging advanced data analytics and machine learning algorithms to improve their risk assessment and pricing models. These technologies can identify patterns and trends in driving behavior, accident data, and other factors, leading to more accurate and efficient pricing.

Connected Cars and Vehicle Safety Features

The rise of connected cars and advanced vehicle safety features is also influencing auto insurance pricing. These technologies can reduce the risk of accidents and improve driver safety, leading to potential discounts and more affordable insurance rates.

Insurance-Tech Startups and Digital Innovation

The insurance industry is seeing a wave of innovation from tech startups and digital disruptors. These companies are leveraging technology to offer more efficient, personalized, and affordable insurance options, challenging traditional insurers to adapt and improve their offerings.

Conclusion

Comparing auto insurance prices is a critical step in finding the right coverage at the best value. By understanding the factors that influence insurance pricing, employing effective comparison strategies, and considering the future trends in the industry, you can make an informed decision that protects your financial interests and provides the coverage you need.

FAQ

How often should I compare auto insurance prices?

+It’s recommended to review and compare your auto insurance rates annually, or whenever your policy is up for renewal. This allows you to stay up-to-date with the market and take advantage of any changes in your personal circumstances or the insurance landscape that could impact your rates.

Can I negotiate my auto insurance rates?

+While auto insurance rates are largely determined by objective factors and algorithms, you can sometimes negotiate with your insurer, especially if you’ve been a loyal customer for many years. It’s worth discussing your options and any potential discounts with your insurance provider.

What are some common auto insurance discounts I should look for?

+Common auto insurance discounts include multi-policy discounts (for bundling multiple policies with the same insurer), good student discounts, safe driver discounts, loyalty discounts, and discounts for certain professions or affiliations. It’s always worth asking your insurer about potential discounts when comparing quotes.

How do insurance companies determine my risk level and set my premiums?

+Insurance companies use a combination of factors and algorithms to assess your risk level and set your premiums. These factors can include your driving record, the type of vehicle you drive, your location, demographic details, and the coverage options you choose. The higher the perceived risk, the higher your premiums are likely to be.