Price Of Insurance For A Car

Determining the price of insurance for a car is a multifaceted process that depends on a myriad of factors, each influencing the overall cost. These factors encompass not only the vehicle's make, model, and age but also extend to the driver's personal profile, including their age, driving history, and location. Additionally, the type of coverage desired plays a pivotal role in shaping the insurance premium.

In this comprehensive exploration, we delve into the intricate world of car insurance pricing, offering an expert's insight into the key elements that contribute to the cost of coverage. By breaking down these factors and providing real-world examples, we aim to empower you with the knowledge needed to understand and potentially influence the price of insurance for your vehicle.

Vehicle Characteristics and Their Impact on Insurance Costs

The characteristics of your vehicle are fundamental in shaping the insurance premium. Make and Model are key determinants, as certain brands and models are statistically more prone to accidents or theft, leading to higher insurance costs. For instance, a luxury sports car with a high-performance engine and a history of frequent accidents will generally attract a higher premium compared to a standard family sedan.

The Age of the Vehicle also plays a role. Older cars often come with lower insurance costs, primarily due to their lower market value and the reduced risk of a costly accident. Conversely, newer models, especially those with advanced safety features, can lead to lower insurance premiums due to their enhanced safety ratings.

Additionally, the Vehicle's Usage influences insurance pricing. Cars primarily used for business or commercial purposes, or those driven frequently, will typically attract higher premiums due to the increased exposure to potential risks. On the other hand, vehicles that are only driven occasionally or for leisure purposes might benefit from lower insurance rates.

| Vehicle Category | Typical Insurance Premium |

|---|---|

| Luxury Sports Cars | $1,500 - $3,000 per year |

| Standard Family Sedans | $800 - $1,200 per year |

| Older, Low-Value Vehicles | $500 - $800 per year |

The Role of Driver Profile in Insurance Pricing

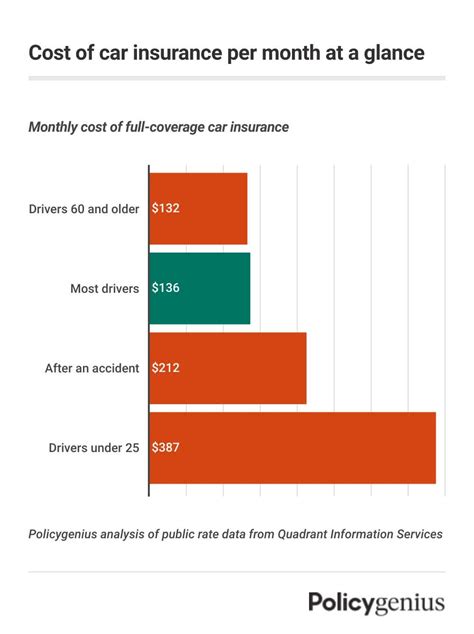

Beyond vehicle characteristics, the driver’s personal profile is a significant factor in insurance pricing. Age, for instance, plays a crucial role. Younger drivers, particularly those under 25, often face higher insurance premiums due to their lack of driving experience and higher statistical risk of accidents. In contrast, mature drivers aged 25 and above typically enjoy lower insurance rates, with the lowest premiums often seen for those aged 30 and over.

The Driving History is another critical factor. A clean driving record with no accidents or traffic violations can lead to significant discounts on insurance premiums. Conversely, a history of accidents or traffic citations can substantially increase insurance costs. For example, a driver with multiple speeding tickets or at-fault accidents might see their insurance premium double or even triple compared to a driver with a clean record.

Furthermore, Location is a key determinant. Insurance rates can vary significantly based on the geographic area in which the driver resides. Urban areas, with their higher population density and increased risk of accidents, often come with higher insurance premiums compared to rural or suburban areas. Similarly, regions with a higher rate of car theft or natural disasters might see elevated insurance costs.

| Driver Profile | Typical Insurance Premium |

|---|---|

| Young Driver (under 25) | $1,200 - $2,500 per year |

| Mature Driver (30+) | $800 - $1,500 per year |

| Driver with Clean Record | $500 - $1,000 per year |

| Driver with Accident History | $1,500 - $3,000 per year |

Understanding Coverage Types and Their Costs

The type and extent of coverage you choose for your vehicle is a significant factor in determining the insurance premium. Different coverage options offer varying levels of protection, and each comes with its own cost implications.

Liability Coverage

Liability Coverage is a fundamental component of car insurance. It protects you financially if you’re found at fault in an accident, covering the costs of damage or injuries you cause to others. The cost of liability coverage can vary widely based on factors such as the state’s minimum requirements, your driving history, and the limits of coverage you choose.

Comprehensive and Collision Coverage

Comprehensive Coverage provides protection for damage to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or hitting an animal. Collision Coverage, on the other hand, covers damage to your vehicle resulting from an accident, regardless of fault. These coverages typically come with higher premiums compared to liability coverage, as they offer more extensive protection.

Additional Coverages

There are several other coverages you can add to your policy to enhance protection, such as Uninsured/Underinsured Motorist Coverage, which protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages. Personal Injury Protection (PIP) or Medical Payments Coverage can also be added to cover medical expenses for you and your passengers, regardless of fault.

| Coverage Type | Typical Premium Range |

|---|---|

| Liability Only | $400 - $1,000 per year |

| Liability with Comprehensive and Collision | $800 - $2,500 per year |

| Additional Coverages (Uninsured Motorist, PIP, etc.) | $100 - $500 per year |

Strategies to Lower Your Car Insurance Costs

While the cost of car insurance is influenced by various factors that may be beyond your control, there are still several strategies you can employ to potentially lower your insurance premiums. These strategies involve a combination of behavioral changes, leveraging discounts, and shopping around for the best rates.

Maintaining a Clean Driving Record

One of the most effective ways to reduce your insurance costs is to maintain a clean driving record. This means avoiding accidents, traffic violations, and any other actions that might lead to points on your license. A clean driving record not only keeps your insurance premiums low but can also lead to substantial discounts from your insurance provider.

Utilizing Discounts

Insurance companies offer a variety of discounts that can significantly reduce your insurance premiums. These discounts can be based on a range of factors, including your age, occupation, educational background, vehicle safety features, and even your membership in certain organizations. For example, many insurers offer discounts to mature drivers (typically over 50), homeowners, and members of certain professional associations.

Additionally, installing approved safety devices in your vehicle, such as an anti-theft system or a tracking device, can lead to substantial discounts. These devices not only enhance your vehicle's security but also reduce the risk of theft or loss, making you a less risky investment for the insurance company.

Bundling Policies and Shopping Around

Bundling your car insurance with other policies, such as home or renters insurance, can often lead to significant savings. Many insurance providers offer multi-policy discounts, which can lower your overall insurance costs. Additionally, shopping around and comparing quotes from different insurance providers is a powerful strategy to find the best rates. Online comparison tools can be particularly useful for this purpose.

| Discount Type | Potential Savings |

|---|---|

| Clean Driving Record | Up to 20% off |

| Multi-Policy Discounts | 5% - 25% off |

| Safety Device Installations | Up to 15% off |

| Educational Discounts (e.g., good student discount) | 5% - 10% off |

The Future of Car Insurance: Emerging Trends and Technologies

The world of car insurance is evolving rapidly, driven by advancements in technology and changing consumer behaviors. These developments are set to revolutionize the way insurance is priced and delivered, offering both challenges and opportunities for insurers and consumers alike.

The Rise of Telematics and Usage-Based Insurance

Telematics, the technology that allows the transmission of vehicle data, is set to play a significant role in the future of car insurance. Usage-Based Insurance (UBI), which leverages telematics to price insurance policies based on actual driving behavior, is gaining traction. UBI policies offer drivers the opportunity to reduce their insurance costs by demonstrating safe and responsible driving habits.

With UBI, insurers can gather real-time data on factors such as mileage, time of day driven, and driving style (speed, acceleration, and braking). This data-driven approach to insurance pricing provides a more accurate assessment of individual risk, allowing insurers to offer personalized premiums based on an individual's actual driving behavior rather than broad demographic profiles.

The Impact of Autonomous Vehicles

The advent of autonomous vehicles is poised to have a profound impact on the car insurance industry. As these vehicles become more prevalent, they are expected to significantly reduce the number of accidents, which in turn could lead to lower insurance premiums. However, the transition period as autonomous vehicles are integrated into the market may present unique challenges for insurers, including the need to adapt policies to cover new types of risks.

The Role of Data Analytics and AI

Data analytics and artificial intelligence (AI) are already being utilized by insurers to improve pricing accuracy and efficiency. These technologies enable insurers to analyze vast amounts of data, from traditional demographic and vehicle-related information to more nuanced data points such as driving behavior and even weather patterns. By leveraging these insights, insurers can more accurately assess risk and price policies accordingly.

The Potential of Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, has the potential to revolutionize various industries, including insurance. Blockchain’s ability to provide a secure, decentralized digital ledger system could enhance data security and transparency in the insurance industry. This could lead to more efficient claim processes, improved fraud detection, and potentially lower insurance costs for consumers.

Conclusion: Navigating the Complex World of Car Insurance Pricing

Understanding the factors that influence the price of car insurance is essential for any vehicle owner. From the characteristics of your vehicle and your driving profile to the type of coverage you choose, each element plays a role in shaping your insurance premium. By staying informed and proactive, you can make strategic decisions to potentially lower your insurance costs while still maintaining adequate coverage.

Furthermore, as the car insurance industry continues to evolve with technological advancements and changing consumer behaviors, staying abreast of these developments can provide additional opportunities to optimize your insurance coverage and costs. With a comprehensive understanding of the factors at play and a proactive approach, you can navigate the complex world of car insurance pricing with confidence.

How often should I review my car insurance policy and premium?

+It’s a good practice to review your car insurance policy and premium annually, or whenever you experience a significant life change (e.g., marriage, divorce, buying a new home, changing jobs) that could impact your insurance needs or eligibility for discounts.

Can I negotiate my car insurance premium with my insurer?

+While insurance premiums are largely determined by standardized formulas and regulations, you can discuss your policy and premium with your insurer to ensure you’re receiving all applicable discounts and that your coverage levels are appropriate for your needs.

What are some common mistakes people make when purchasing car insurance that can lead to higher premiums or inadequate coverage?

+Common mistakes include not shopping around for the best rates, not bundling policies to take advantage of multi-policy discounts, selecting inadequate coverage levels, and failing to maintain a clean driving record.