Private Healthcare Insurance

Private healthcare insurance is a crucial aspect of modern healthcare systems, offering individuals and families access to specialized medical services and treatments. With the rising costs of healthcare and varying levels of coverage provided by public healthcare systems, private insurance plans have become increasingly popular worldwide. In this comprehensive guide, we will delve into the world of private healthcare insurance, exploring its benefits, features, and the impact it has on individuals and the healthcare industry as a whole.

Understanding Private Healthcare Insurance

Private healthcare insurance, also known as medical insurance or health insurance, is a contract between an individual or a group and an insurance company. This contract ensures that the insured individuals receive financial coverage for medical expenses incurred during their treatment. Unlike public healthcare systems, which are funded by taxes and often have limited resources, private insurance operates on a subscription or premium-based model.

The primary goal of private healthcare insurance is to provide individuals with access to quality healthcare services without the burden of high out-of-pocket expenses. By spreading the risk across a large pool of policyholders, insurance companies can offer comprehensive coverage for various medical procedures, treatments, and even preventive care.

Key Features of Private Healthcare Insurance

- Comprehensive Coverage: Private insurance plans typically offer a wide range of coverage options, including hospitalization, surgery, specialist consultations, diagnostic tests, and sometimes even dental and vision care. Some plans may also cover alternative therapies and mental health services.

- Choice of Providers: One of the significant advantages of private insurance is the freedom to choose healthcare providers. Policyholders can select their preferred doctors, hospitals, and specialists, ensuring they receive treatment from trusted and reputable medical professionals.

- Rapid Access to Care: Private healthcare insurance often provides faster access to medical services compared to public healthcare systems. Policyholders can bypass long waiting lists and receive timely treatment, which is crucial in emergency situations or when dealing with chronic conditions.

- Personalized Plans: Insurance companies offer a variety of plans to cater to different needs and budgets. Individuals can choose plans based on their age, health status, and specific requirements, ensuring they get the coverage that suits them best.

- Flexibility: Many private insurance plans allow policyholders to customize their coverage, adding or removing certain benefits to fit their preferences. This flexibility ensures that individuals can tailor their insurance to their unique healthcare needs.

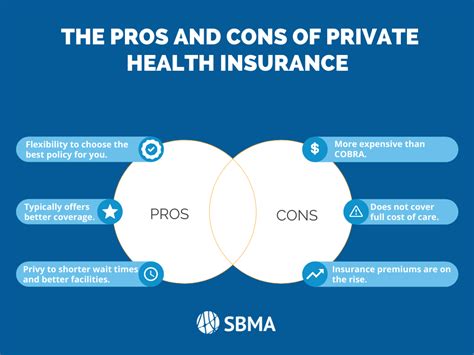

Benefits of Private Healthcare Insurance

Private healthcare insurance brings numerous advantages to individuals and families, revolutionizing the way they access and experience medical care. Here are some key benefits:

Financial Security

The most significant advantage of private healthcare insurance is financial protection. Medical expenses can be astronomical, and without insurance, individuals may face significant financial burdens. Private insurance plans cover a large portion of these costs, ensuring that individuals can afford necessary treatments without depleting their savings or incurring debt.

Quality Care

Private healthcare insurance often provides access to top-tier medical facilities and highly skilled specialists. Policyholders can choose from a network of renowned hospitals and doctors, ensuring they receive the best possible care. This aspect is especially beneficial for individuals with complex medical conditions or those seeking advanced treatments.

Preventive Care and Wellness

Many private insurance plans emphasize preventive care and wellness initiatives. These plans cover regular check-ups, vaccinations, and screenings, encouraging individuals to take a proactive approach to their health. By detecting and addressing health issues early on, private insurance promotes overall well-being and reduces the likelihood of more severe and costly illnesses.

Peace of Mind

Knowing that one has access to quality healthcare without financial constraints provides a sense of security and peace of mind. Private insurance allows individuals to focus on their health and well-being without worrying about the financial implications of medical treatments. This peace of mind can be particularly valuable for those with pre-existing conditions or families with young children.

Comparing Private and Public Healthcare

While private healthcare insurance offers numerous benefits, it is essential to understand how it differs from public healthcare systems. Here’s a comparative analysis:

| Aspect | Private Healthcare | Public Healthcare |

|---|---|---|

| Cost | Premium-based, varies with plan and provider | Tax-funded, generally free or low-cost |

| Coverage | Comprehensive, customizable plans | Varies by country and region, often limited |

| Waiting Times | Generally shorter, rapid access | Longer waiting lists for certain procedures |

| Choice of Providers | Wide range of options, policyholder's choice | Limited options, often assigned by the system |

| Specialist Care | Easy access to specialists | May require referrals, limited access |

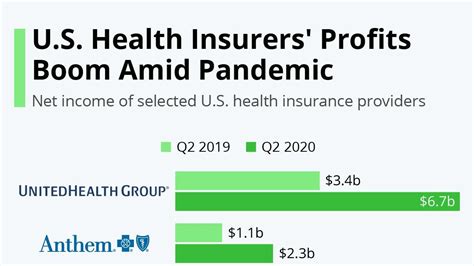

Impact on Healthcare Systems

The rise of private healthcare insurance has had a significant impact on the overall healthcare landscape. It has introduced competition and innovation, driving improvements in public healthcare systems as well. Additionally, private insurance provides an alternative for those who may not be satisfied with the coverage or accessibility of public healthcare.

However, the increasing popularity of private insurance has also raised concerns about potential inequalities in healthcare access. Some argue that it creates a two-tier system, where those with higher incomes can afford better healthcare, while those with limited means may struggle to access adequate care. Addressing these concerns and ensuring equitable access to healthcare remains a critical challenge.

The Future of Private Healthcare Insurance

The private healthcare insurance industry is continually evolving to meet the changing needs and expectations of policyholders. Here are some key trends and potential developments to watch out for:

Digital Transformation

The digital age has transformed the way insurance companies operate. Many insurers are now leveraging technology to enhance customer experience, streamline processes, and improve efficiency. Digital platforms and mobile apps allow policyholders to manage their insurance, file claims, and access healthcare services more conveniently.

Personalized Medicine

With advancements in medical technology and genomics, the concept of personalized medicine is gaining traction. Private insurance companies are exploring ways to incorporate genetic testing and precision medicine into their coverage, offering tailored treatment plans based on an individual’s unique genetic profile.

Wellness and Prevention

The focus on preventive care and wellness is likely to continue, with insurance companies incentivizing policyholders to maintain healthy lifestyles. This may include discounts or rewards for participating in wellness programs, regular exercise, and healthy dietary choices.

Artificial Intelligence and Data Analytics

AI and data analytics are revolutionizing the healthcare industry, and insurance companies are no exception. These technologies can help insurers better understand risk factors, predict health trends, and offer more accurate and personalized coverage. Additionally, AI-powered chatbots and virtual assistants can enhance customer service and support.

Global Expansion

Private healthcare insurance is expanding globally, with many countries adopting or strengthening their private insurance sectors. This trend is particularly evident in emerging markets, where the demand for quality healthcare is growing rapidly.

Conclusion

Private healthcare insurance plays a vital role in modern healthcare systems, providing individuals with access to specialized medical care and financial protection. While it offers numerous benefits, it is essential to consider the broader implications and ensure equitable access to healthcare for all. As the industry continues to evolve, it will be fascinating to see how private insurance adapts to emerging technologies and changing healthcare needs.

How does private healthcare insurance work?

+Private healthcare insurance operates on a premium-based model, where individuals pay regular fees (premiums) to an insurance company. In return, the insurer provides coverage for various medical expenses, ensuring that policyholders can access quality healthcare without incurring significant financial burdens.

What are the key differences between private and public healthcare systems?

+Private healthcare systems are funded by premiums paid by policyholders, offering comprehensive and customizable coverage. Public healthcare systems, on the other hand, are tax-funded and often provide limited coverage, with longer waiting times and restricted access to specialists. Private insurance provides faster access to care and more choices in providers.

Is private healthcare insurance affordable for everyone?

+The affordability of private healthcare insurance can vary depending on factors such as age, health status, and the chosen plan. While it may be more costly for certain individuals, many insurance companies offer a range of plans to cater to different budgets. Additionally, some governments provide subsidies or tax benefits to make private insurance more accessible.