Private Insurance Plans Texas

Texas, the second most populous state in the United States, boasts a diverse healthcare landscape with a significant presence of private insurance plans. These plans offer a range of coverage options, catering to the varying needs of Texans. From major metropolitan areas like Houston and Dallas to the sprawling rural regions, understanding the intricacies of private insurance plans in Texas is crucial for residents seeking quality healthcare.

Understanding Private Insurance in Texas

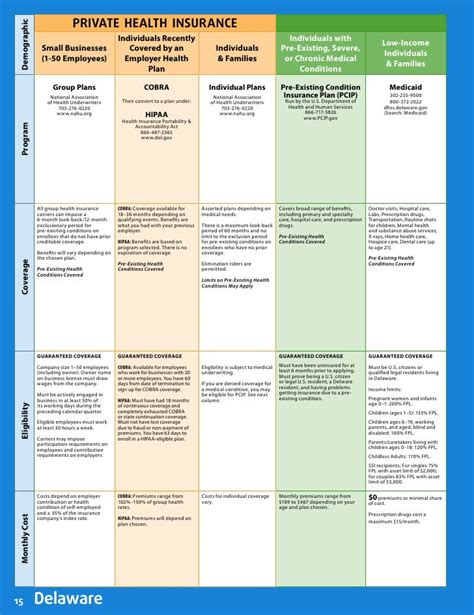

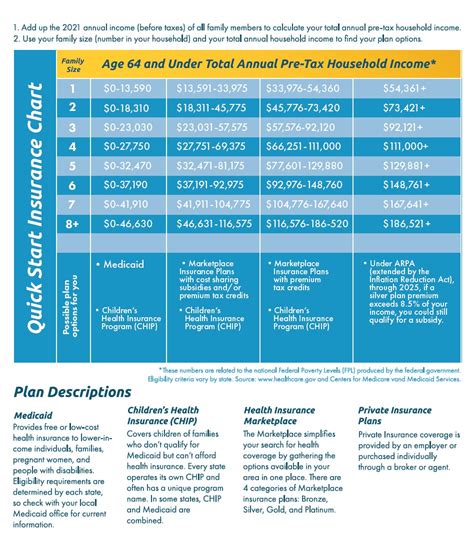

Private health insurance in Texas operates within a regulatory framework that allows for a wide array of plans and coverage options. These plans are primarily offered by private insurance companies, providing an alternative to government-sponsored programs like Medicare and Medicaid.

In Texas, the insurance market is characterized by a mix of national carriers and regional providers, offering policies that range from comprehensive plans covering a broad spectrum of medical services to more specialized plans with narrower networks and focused coverage.

Key Features of Texas Private Insurance Plans

-

Network Providers: Private insurance plans in Texas often have preferred provider organizations (PPOs) or health maintenance organizations (HMOs). PPOs allow members to choose any healthcare provider, with or without a referral, while HMOs typically require members to select a primary care physician and obtain referrals for specialist care.

-

Premiums and Deductibles: The cost of private insurance plans can vary significantly based on the coverage level, network size, and other factors. Premiums are typically paid monthly, and deductibles must be met before the insurance coverage kicks in fully.

-

Coverage Options: Texas private insurance plans offer a variety of coverage options, including individual and family plans, as well as plans tailored for specific age groups or health conditions. These plans may cover essential health benefits, such as doctor visits, hospital stays, prescription drugs, and preventive care.

-

Pre-Existing Condition Coverage: Texas law and the federal Affordable Care Act (ACA) mandate that private insurance plans cannot deny coverage or charge higher premiums based on pre-existing health conditions.

Enrolling in Private Insurance Plans

Texans can enroll in private insurance plans during the annual open enrollment period, which typically runs from November to December. However, individuals may also qualify for a Special Enrollment Period if they experience certain life events, such as marriage, divorce, birth or adoption of a child, or loss of other health coverage.

The enrollment process often involves comparing plans based on cost, coverage, and provider networks, as well as understanding any potential tax credits or subsidies that may be available to help offset the cost of premiums.

Navigating the Healthcare Landscape in Texas

Texas has a unique healthcare landscape, with a mix of private and public healthcare providers. Private insurance plans play a significant role in this ecosystem, offering Texans a range of coverage options to suit their individual needs.

For instance, in the Houston area, known for its world-class medical facilities, private insurance plans often provide access to renowned hospitals and specialized care. Similarly, in the Dallas-Fort Worth metroplex, private insurance plans may offer coverage for a wide range of services, including innovative treatments and technologies.

In rural Texas, where healthcare access can be more limited, private insurance plans may play a crucial role in providing coverage for essential services and ensuring continuity of care.

| Texas Private Insurance Plan | Key Features |

|---|---|

| Blue Cross Blue Shield of Texas | Wide network of providers, flexible plans, and robust digital tools for members. |

| UnitedHealthcare | Comprehensive coverage, including dental and vision plans, with a focus on preventive care. |

| Aetna | Customizable plans with various coverage options, including prescription drug benefits. |

| Humana | Specialized plans for seniors, including Medicare Advantage plans, with a focus on chronic condition management. |

| Cigna | Innovative wellness programs and digital health tools, with a broad network of providers. |

Private Insurance Plans: A Comparison

Understanding the differences between private insurance plans can help Texans make informed decisions about their healthcare coverage. Let’s delve into a comparative analysis of some prominent private insurance plans in Texas.

Blue Cross Blue Shield of Texas

Blue Cross Blue Shield of Texas (BCBSTX) is a well-established insurer in the state, offering a wide range of health plans. Their plans often feature:

- Extensive Provider Network: BCBSTX boasts one of the largest provider networks in Texas, ensuring broad access to healthcare services.

- Flexible Plan Options: From PPOs to HMOs, BCBSTX offers a variety of plans to suit different preferences and needs.

- Digital Tools: The insurer provides robust digital platforms for members, including online portals and mobile apps, for convenient access to plan information and services.

UnitedHealthcare

UnitedHealthcare is a national insurer with a strong presence in Texas. Their key offerings include:

- Comprehensive Coverage: UnitedHealthcare plans often cover a broad range of services, including dental and vision care, providing a holistic approach to healthcare.

- Focus on Preventive Care: The insurer emphasizes preventive services, aiming to keep members healthy and reduce the need for more extensive medical interventions.

- Wellness Programs: UnitedHealthcare offers various wellness initiatives and incentives to encourage members to adopt healthy lifestyles.

Aetna

Aetna, another national insurer, provides a range of health plans in Texas with features such as:

- Customizable Plans: Aetna offers a variety of plan designs, allowing Texans to tailor their coverage to their specific healthcare needs.

- Prescription Drug Benefits: Many Aetna plans include robust prescription drug coverage, a crucial aspect for individuals managing chronic conditions.

- Online Tools: The insurer provides digital resources for members, including cost estimators and personalized health tools, to help manage healthcare expenses and maintain wellness.

Humana

Humana, a leading provider of Medicare plans, also offers private insurance plans in Texas, particularly targeted at seniors. Their plans often include:

- Senior-Focused Plans: Humana’s private insurance plans in Texas are designed to cater to the unique healthcare needs of seniors, offering specialized coverage for chronic conditions and senior-specific services.

- Medicare Advantage Plans: Humana is known for its comprehensive Medicare Advantage plans, which often include additional benefits beyond what traditional Medicare covers.

- Chronic Condition Management: The insurer provides resources and support for individuals managing chronic illnesses, helping them navigate their healthcare needs effectively.

Cigna

Cigna, a global health service company, offers innovative health plans in Texas with features such as:

- Broad Provider Network: Cigna has a strong network of healthcare providers in Texas, ensuring members have access to a wide range of medical services.

- Digital Health Tools: The insurer provides cutting-edge digital health platforms, offering members convenient access to their health information and services.

- Wellness Programs: Cigna offers various wellness initiatives, including programs focused on mental health and overall well-being, to help members stay healthy and manage stress.

The Future of Private Insurance in Texas

The landscape of private insurance in Texas is continually evolving, influenced by factors such as healthcare policy changes, advancements in medical technology, and shifts in consumer preferences. As the state’s population continues to grow and diversify, private insurance plans will need to adapt to meet the changing needs of Texans.

One notable trend is the increasing focus on value-based care, where insurers and healthcare providers collaborate to deliver high-quality, cost-effective healthcare services. This shift is expected to drive innovations in healthcare delivery, with a greater emphasis on preventive care, chronic disease management, and patient-centered approaches.

Additionally, the integration of digital health technologies is likely to play a pivotal role in the future of private insurance in Texas. From telemedicine services to digital health platforms, insurers are increasingly leveraging technology to enhance member engagement, improve access to care, and streamline healthcare administration.

Furthermore, as the state continues to address healthcare disparities and access issues, particularly in rural areas, private insurance plans may play a critical role in bridging these gaps. By expanding their networks and offering innovative coverage options, insurers can help ensure that all Texans have access to the healthcare services they need.

In conclusion, private insurance plans in Texas offer a vital pathway to quality healthcare for millions of residents. As the healthcare landscape evolves, these plans will need to adapt to meet the changing needs and expectations of Texans. By staying informed about their coverage options and seeking out the plans that best suit their individual needs, Texans can navigate the complex world of healthcare with confidence and assurance.

Can I enroll in a private insurance plan outside of the open enrollment period in Texas?

+Yes, Texans can enroll in a private insurance plan outside of the open enrollment period if they experience a qualifying life event, such as marriage, divorce, birth or adoption of a child, or loss of other health coverage. This is known as a Special Enrollment Period.

What happens if I have a pre-existing health condition when enrolling in a private insurance plan in Texas?

+Texas law and the federal Affordable Care Act (ACA) prohibit private insurance plans from denying coverage or charging higher premiums based on pre-existing health conditions. This means that regardless of your health status, you should be able to find a private insurance plan that provides comprehensive coverage.

How can I compare private insurance plans in Texas to find the best fit for my needs?

+Comparing private insurance plans in Texas involves evaluating factors such as cost (premiums, deductibles, and out-of-pocket expenses), coverage (including network providers and covered services), and additional benefits (such as wellness programs or digital health tools). It’s also beneficial to read reviews and seek recommendations from trusted sources.