Progressive Auto Insurance Office Near Me

In today's fast-paced world, having convenient access to essential services is a priority for many. When it comes to auto insurance, having a reliable and easily accessible provider is crucial. Progressive Auto Insurance, a leading name in the industry, understands the importance of customer convenience and has established a network of offices across the country to cater to its customers' needs. In this comprehensive guide, we will delve into the world of Progressive Auto Insurance, exploring its services, office locations, and how you can find the nearest office to meet your insurance requirements.

Progressive Auto Insurance: An Overview

Progressive Auto Insurance is a prominent player in the insurance industry, offering a comprehensive range of coverage options to cater to various customer needs. With a rich history spanning over [number of years], Progressive has established itself as a trusted provider, known for its innovative approaches and customer-centric services.

One of the key strengths of Progressive is its commitment to accessibility. Recognizing that insurance is a vital aspect of our daily lives, Progressive has strategically located its offices to ensure that customers can easily access their services. Whether you're looking for a new insurance policy, need to make changes to your existing coverage, or have a claim to file, having a Progressive office nearby can make the process more convenient and efficient.

The Benefits of Having a Progressive Auto Insurance Office Nearby

Having a Progressive Auto Insurance office conveniently located near your residence or workplace offers several advantages. Here’s why having easy access to their services can be beneficial:

- Personalized Service: Visiting a local Progressive office allows you to interact with knowledgeable insurance professionals who can provide personalized advice and guidance tailored to your specific needs. They can help you understand the intricacies of different coverage options and ensure you have the right protection for your vehicle.

- Quick Claim Resolution: In the unfortunate event of an accident or vehicle damage, having a nearby Progressive office can expedite the claims process. You can visit the office to report the incident, discuss the details, and receive guidance on the next steps, making the entire process more efficient and less stressful.

- Convenient Policy Management: Managing your auto insurance policy becomes easier when you have a local office to rely on. You can make policy changes, add or remove vehicles, or update your personal information without the hassle of long-distance communication. This convenience saves time and ensures your policy remains up-to-date.

- Face-to-Face Interaction: Sometimes, discussing insurance matters over the phone or online may not provide the level of clarity and comfort you desire. By visiting a Progressive office, you can have face-to-face conversations with insurance experts, ask questions, and receive immediate feedback, enhancing your overall understanding of the insurance process.

Finding the Nearest Progressive Auto Insurance Office

Locating the closest Progressive Auto Insurance office is a straightforward process thanks to the company’s user-friendly online tools and resources. Here’s a step-by-step guide to help you find the nearest office:

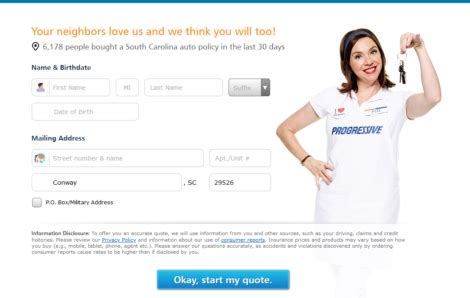

- Visit the Progressive Website: Start by accessing the official Progressive Auto Insurance website. You can type https://www.progressive.com into your web browser to reach their homepage.

- Locate the "Find an Office" Section: On the homepage, look for a dedicated section or menu option that says "Find an Office" or "Office Locator." This section will provide you with tools to search for nearby offices.

- Enter Your Location: Once you've found the "Find an Office" section, you'll be prompted to enter your current location. You can do this by typing in your city, state, or zip code, or even allowing the website to detect your location automatically using your device's GPS.

- Review Office Listings: After entering your location, the website will display a list of Progressive offices closest to your specified area. The list will typically include the office's name, address, contact information, and potentially opening hours.

- Filter and Refine Your Search: If you're looking for a specific type of office or need additional services, Progressive's search tool often allows you to filter the results. You can choose to view only certain office types, such as those offering commercial insurance or specialized services.

- Check Office Details: Before visiting an office, it's a good idea to review the details provided on the website. This includes checking the office's hours of operation, services offered, and any special notes or updates. Some offices may have specific hours for certain services, so it's beneficial to plan your visit accordingly.

- Use Interactive Maps: Progressive's website often includes interactive maps that show the location of each office. This visual representation can help you better understand the proximity of the offices to your location and plan your route accordingly.

- Contact the Office (if Needed): If you have specific questions or require further assistance, you can contact the office directly using the phone number or email address provided on the website. This allows you to clarify any doubts or make appointments if necessary.

Progressive Auto Insurance Office Services

Progressive Auto Insurance offices offer a wide range of services to cater to their customers’ diverse needs. Understanding the array of services available can help you maximize the benefits of having a local office nearby. Here’s an overview of the key services you can expect:

- New Policy Quotations: If you're in the market for a new auto insurance policy, visiting a Progressive office allows you to discuss your coverage needs with insurance professionals. They can provide personalized quotations based on your vehicle type, driving history, and other relevant factors, ensuring you get the best value for your insurance.

- Policy Management and Updates: Existing Progressive customers can easily manage their policies at local offices. This includes making changes to coverage limits, adding or removing vehicles, updating personal information, and discussing any policy-related questions or concerns. The office staff can guide you through the process, ensuring your policy remains up-to-date and tailored to your needs.

- Claims Processing and Support: In the event of an accident or vehicle damage, having a nearby Progressive office can streamline the claims process. You can report the incident, provide details, and receive guidance on the necessary steps to ensure a smooth and efficient claims experience. The office staff can assist with documenting the claim, assessing the damage, and coordinating repairs or replacements.

- Specialized Services: Progressive offices often offer specialized services to cater to unique insurance needs. This may include commercial auto insurance for business owners, motorcycle insurance, RV insurance, and even coverage for classic or collector cars. By visiting a local office, you can discuss these specialized options and ensure your valuable assets are adequately protected.

- Roadside Assistance and Emergency Services: Progressive understands that vehicle emergencies can happen anytime, anywhere. Their offices often provide information and support for roadside assistance services, including towing, flat tire changes, fuel delivery, and more. Having this knowledge readily available can be a lifesaver in unexpected situations.

- Educational Resources: Progressive offices are not just about transacting insurance; they also serve as educational hubs. You can access resources and materials that help you better understand insurance concepts, coverage options, and safety practices. This empowers you to make informed decisions about your insurance needs and enhances your overall driving experience.

Comparing Progressive Auto Insurance to Other Providers

When it comes to choosing an auto insurance provider, it’s beneficial to compare Progressive with other leading companies in the industry. Here’s a brief comparison to help you evaluate Progressive’s services and offerings:

| Feature | Progressive | Competitor 1 | Competitor 2 |

|---|---|---|---|

| Policy Customization | Progressive offers a wide range of coverage options, allowing customers to tailor their policies to their specific needs. They provide flexible plans and add-ons to ensure comprehensive protection. | Competitor 1 also provides customizable policies but may have fewer add-on options. | Competitor 2 has a more limited selection of coverage options, focusing primarily on basic liability coverage. |

| Claims Handling | Progressive is known for its efficient and customer-centric claims process. They offer 24/7 claims reporting and provide prompt assistance, ensuring a smooth and stress-free experience for policyholders. | Competitor 1 has a similar claims process but may have slightly longer response times. | Competitor 2 has a more traditional claims process, with longer wait times and less personalized attention. |

| Customer Service | Progressive prioritizes customer satisfaction and provides multiple channels for support, including phone, email, and online chat. Their knowledgeable staff is readily available to assist with policy inquiries and claims. | Competitor 1 offers similar customer service channels but may have slightly longer wait times for phone support. | Competitor 2 primarily relies on phone support, which can sometimes lead to longer hold times and less personalized assistance. |

| Discounts and Rewards | Progressive offers a variety of discounts to help customers save on their insurance premiums. These include safe driver discounts, multi-policy discounts, and even discounts for bundling home and auto insurance. | Competitor 1 provides similar discounts but may have more limited options. | Competitor 2 has a smaller selection of discounts, primarily focusing on safe driving and multi-policy discounts. |

| Digital Services | Progressive has invested heavily in digital services, offering a user-friendly website and mobile app for policy management and claims reporting. They provide real-time updates and allow customers to track their claims progress. | Competitor 1 has a functional website and app but may have fewer features and less real-time updates. | Competitor 2 has a basic online presence but lacks the advanced digital services offered by Progressive and Competitor 1. |

Tips for a Smooth Progressive Office Visit

To ensure a productive and efficient visit to your local Progressive Auto Insurance office, consider the following tips:

- Prepare Your Documents: Before heading to the office, gather all relevant documents related to your insurance policy, such as your current policy documents, vehicle registration, and driver's license. Having these documents readily available can expedite the process and ensure a more accurate assessment of your needs.

- Make an Appointment (if Needed): While Progressive offices typically welcome walk-ins, it's always a good idea to call ahead and make an appointment, especially if you have a complex matter to discuss or require specialized services. This ensures that the office staff can dedicate adequate time to your needs.

- Have a Clear Objective: Before visiting the office, take some time to clarify your goals and the specific services you require. Whether it's discussing a new policy, filing a claim, or making policy changes, having a clear objective will help you make the most of your time at the office.

- Review Your Policy: If you're an existing Progressive customer, take a moment to review your current policy documents before your visit. This will help you identify any areas where you may want to make changes or discuss additional coverage options with the office staff.

- Explore Online Tools: Progressive's website offers a wealth of online tools and resources to assist with policy management and claims reporting. Familiarize yourself with these tools beforehand so that you can maximize their benefits during your office visit.

Progressive Auto Insurance: A Trusted Partner for Your Insurance Needs

Progressive Auto Insurance stands out as a reliable and customer-centric provider in the insurance industry. With a strong focus on accessibility and a commitment to offering a wide range of services, Progressive ensures that its customers can easily access the support and guidance they need. Whether you’re a new customer seeking comprehensive coverage or an existing policyholder looking to manage your policy, having a Progressive office nearby provides unparalleled convenience and peace of mind.

By following the steps outlined in this guide, you can effortlessly locate the nearest Progressive Auto Insurance office and take advantage of their expertise and services. Remember, when it comes to insurance, having a trusted partner like Progressive by your side can make all the difference in ensuring you have the protection you need, when and where you need it.

How can I find the address and contact information for a specific Progressive Auto Insurance office?

+You can easily find the address and contact details of a specific Progressive office by using the “Find an Office” feature on their website. Simply enter your location, and the website will provide a list of nearby offices along with their addresses, phone numbers, and other relevant information.

What should I bring when visiting a Progressive Auto Insurance office for the first time?

+When visiting a Progressive office for the first time, it’s a good idea to bring your driver’s license, vehicle registration, and any existing insurance documents you have. These documents will help the office staff understand your insurance needs and provide accurate quotations or assistance.

Can I purchase an auto insurance policy directly from a Progressive office, or do I need to do it online?

+Yes, you can purchase an auto insurance policy directly from a Progressive office. The office staff can guide you through the process, answer any questions you have, and help you choose the right coverage options. However, you can also purchase a policy online through their website if that’s more convenient for you.

Are there any additional fees or charges for visiting a Progressive Auto Insurance office?

+No, there are no additional fees or charges for visiting a Progressive office. Their offices are open to the public, and their staff is there to assist you with your insurance needs without any extra costs. However, it’s always a good idea to check their website or contact the office directly to confirm any specific policies or procedures.