Progressive Auto Insurance Quote

Obtaining a Progressive Auto Insurance quote is a straightforward process that allows you to assess your insurance needs and receive a personalized rate. Progressive, a leading provider in the auto insurance industry, offers a wide range of coverage options and innovative features to cater to various driver profiles. In this article, we will delve into the steps to get a Progressive auto insurance quote, explore the factors that influence your quote, and discuss the unique advantages of choosing Progressive as your insurance partner.

Step-by-Step Guide to Getting a Progressive Auto Insurance Quote

Securing a Progressive auto insurance quote is a convenient and transparent process. Here’s a detailed breakdown of the steps involved:

Step 1: Gather Necessary Information

Before initiating the quote process, it’s beneficial to have specific details readily available. These include your personal information (name, date of birth, driver’s license number), vehicle details (make, model, year, VIN), and driving history (including any accidents or violations). Having this information organized will streamline the quote process.

Step 2: Choose Your Coverage Options

Progressive offers a comprehensive suite of coverage options to tailor your policy to your unique needs. These may include liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), uninsured/underinsured motorist coverage, and more. Understanding your coverage preferences is essential before requesting a quote.

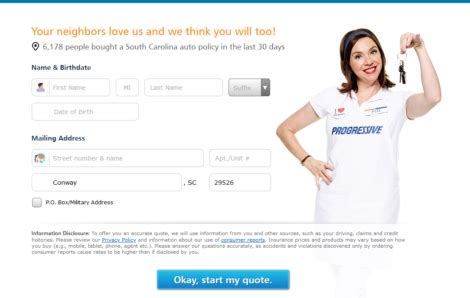

Step 3: Utilize Progressive’s Online Quote Tool

Progressive provides an intuitive online quote tool accessible via their website. This tool guides you through a series of questions to gather the necessary information for an accurate quote. You can input your vehicle and driver details, select your desired coverage options, and even compare quotes from multiple providers.

Step 4: Review and Personalize Your Quote

Once you’ve provided the required information, Progressive’s quote tool will generate a personalized rate based on your specific circumstances. Take the time to review the quote, ensuring that the coverage limits and deductibles align with your preferences. If needed, you can adjust these settings to find the optimal balance between cost and coverage.

Step 5: Complete the Application Process

If you’re satisfied with your Progressive auto insurance quote, you can proceed to complete the application process. This typically involves providing additional personal and vehicle information, as well as selecting a payment method. Progressive offers flexible payment options, including monthly, quarterly, or annual installments, to accommodate various financial situations.

Factors Influencing Your Progressive Auto Insurance Quote

Several factors contribute to the calculation of your Progressive auto insurance quote. Understanding these factors can help you anticipate your insurance costs and potentially identify areas for savings.

Driver Profile

Your driving history is a significant factor in determining your insurance rates. Progressive considers elements such as your age, gender, marital status, and driving record (including accidents and traffic violations) when calculating your quote. Younger drivers or those with a history of accidents may face higher premiums, while experienced, safe drivers often benefit from more competitive rates.

Vehicle Details

The make, model, and year of your vehicle play a role in your insurance quote. Factors such as the vehicle’s safety features, repair costs, and theft frequency can influence the cost of your insurance. Additionally, the primary use of your vehicle (commuting, pleasure driving, business use) and the average annual mileage can impact your rates.

Coverage Preferences

The coverage options you select will directly affect your insurance quote. Higher coverage limits and additional coverage types typically result in higher premiums. However, it’s crucial to strike a balance between cost and protection to ensure you have adequate coverage without overspending.

Location and Usage

Your geographical location and the primary use of your vehicle can impact your insurance rates. Areas with higher accident rates or instances of vandalism and theft may result in increased premiums. Similarly, if you primarily use your vehicle for commuting or business purposes, your rates may differ from those who use their vehicles solely for leisure.

The Advantages of Choosing Progressive Auto Insurance

Progressive stands out as a preferred auto insurance provider due to its comprehensive coverage options, innovative features, and customer-centric approach. Here are some key advantages of choosing Progressive for your auto insurance needs:

Comprehensive Coverage Options

Progressive offers a wide range of coverage options to cater to diverse driver profiles. From liability coverage to collision and comprehensive protection, you can tailor your policy to match your specific needs. Additionally, Progressive provides specialized coverage for unique situations, such as ridesharing or classic car ownership.

Discounts and Savings Opportunities

Progressive is known for its commitment to helping customers save on their insurance premiums. They offer a variety of discounts, including multi-policy discounts (for bundling auto insurance with other policies), good student discounts, safe driver discounts, and loyalty rewards. By taking advantage of these savings opportunities, you can potentially reduce your insurance costs significantly.

Innovative Features and Tools

Progressive continuously innovates to enhance the customer experience. Their online quote tool is user-friendly and provides real-time quotes, allowing you to compare rates instantly. Additionally, Progressive offers the Snapshot program, which uses telematics technology to track your driving habits and potentially provide discounts based on safe driving behavior.

Exceptional Customer Service

Progressive prides itself on delivering exceptional customer service. Their dedicated claims teams are available 24⁄7 to assist with any insurance-related inquiries or claims. Progressive also offers a variety of digital tools and resources, such as the Progressive app, which provides policy management, claims tracking, and roadside assistance at your fingertips.

Flexibility and Customization

Progressive understands that every driver has unique needs. They offer flexible payment options, allowing you to choose the schedule that suits your financial situation. Additionally, Progressive’s customizable coverage options ensure that you can create a policy that aligns perfectly with your preferences and budget.

Real-Life Progressive Auto Insurance Success Stories

To further illustrate the benefits of choosing Progressive auto insurance, let’s explore a few real-life success stories:

Story 1: Safe Driver Discounts

Sarah, a 35-year-old professional, has been a loyal Progressive customer for over a decade. As a safe driver with no accidents or violations, Sarah has consistently received discounts for her driving record. Over the years, these discounts have added up, resulting in significant savings on her insurance premiums. Sarah’s loyalty and safe driving behavior have been rewarded with competitive rates and excellent customer service.

Story 2: Customized Coverage for Classic Car Owners

John, a car enthusiast, owns a classic 1967 Mustang that he uses for weekend drives and car shows. Progressive’s specialized classic car insurance coverage offered John the peace of mind he needed to protect his cherished vehicle. With tailored coverage limits and unique features like agreed value settlements, John can enjoy his classic car without worrying about inadequate protection.

Story 3: Exceptional Claims Experience

Emily, a recent college graduate, was involved in a minor accident while driving her car. She was impressed by Progressive’s efficient claims process. From the initial reporting to the final settlement, Emily received prompt assistance and regular updates. Progressive’s dedicated claims team ensured a smooth and stress-free experience, allowing Emily to focus on her recovery and getting back on the road.

Progressive Auto Insurance: A Comprehensive Solution

Progressive Auto Insurance stands out as a trusted and reliable partner for drivers seeking comprehensive coverage, innovative features, and exceptional customer service. By offering a wide range of coverage options, competitive rates, and a customer-centric approach, Progressive caters to diverse driver profiles and provides peace of mind on the road. Whether you’re a safe driver seeking discounts or a classic car enthusiast requiring specialized coverage, Progressive has the solutions to meet your needs.

| Coverage Options | Discounts and Savings |

|---|---|

| Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments, Rental Car Reimbursement, and more | Multi-Policy Discounts, Good Student Discounts, Safe Driver Discounts, Loyalty Rewards, Snapshot Discounts, and more |

How often should I review my Progressive auto insurance policy?

+

It’s recommended to review your insurance policy annually or whenever significant life changes occur. This ensures your coverage remains adequate and up-to-date.

Can I bundle my auto insurance with other policies to save money?

+

Yes, Progressive offers multi-policy discounts when you bundle your auto insurance with other policies, such as home or renters insurance.

What factors determine my insurance rates with Progressive?

+

Progressive considers factors like your driving history, vehicle details, coverage preferences, location, and usage when determining your insurance rates.

Can I customize my Progressive auto insurance policy to fit my specific needs?

+

Absolutely! Progressive offers a wide range of coverage options, allowing you to tailor your policy to match your unique requirements and budget.