Progressive Auto Insurance Rates

Welcome to a comprehensive exploration of Progressive's auto insurance rates. As one of the largest and most well-known insurance providers in the United States, Progressive offers a range of policies designed to cater to diverse customer needs. Understanding their rates and the factors influencing them is essential for anyone seeking affordable and comprehensive car insurance.

Understanding Progressive’s Rating Factors

Progressive’s auto insurance rates are influenced by a myriad of factors, each playing a unique role in determining the overall cost of a policy. These factors include:

Vehicle Type and Usage

The type of vehicle you drive significantly impacts your insurance rates. Factors such as make, model, year, and even the vehicle’s safety features can influence the cost. Additionally, how you use your vehicle matters. Progressive considers whether you primarily use your car for commuting, business, or pleasure, as different usage types carry varying levels of risk.

Driver Profile and History

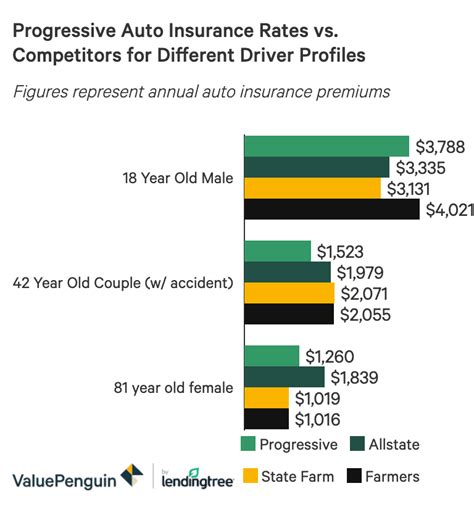

Your driving history and personal details are key considerations. Progressive assesses your age, gender, marital status, and driving record. A clean driving record with no recent accidents or violations can lead to more favorable rates. Conversely, younger drivers or those with a history of accidents may face higher premiums.

Coverage Selection

The level of coverage you choose directly affects your insurance rates. Progressive offers various coverage options, including liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. The more coverage you select, the higher your premium is likely to be.

| Coverage Type | Description |

|---|---|

| Liability | Covers bodily injury and property damage claims made against you in an accident. |

| Collision | Pays for repairs or replacement of your vehicle if it's damaged in an accident, regardless of fault. |

| Comprehensive | Covers damages from incidents other than collisions, such as theft, vandalism, or natural disasters. |

| Medical Payments | Covers medical expenses for you and your passengers, regardless of fault. |

| Uninsured/Underinsured Motorist | Protects you if you're involved in an accident with a driver who has no insurance or insufficient coverage. |

Deductible and Payment Options

Your deductible, which is the amount you pay out-of-pocket before your insurance kicks in, also impacts your rates. Typically, a higher deductible leads to lower premiums. Additionally, Progressive offers various payment plans, and the frequency of your payments can influence your overall rate.

Location and Risk Factors

Where you live and drive plays a crucial role in determining your insurance rates. Progressive considers factors like traffic congestion, crime rates, and the frequency of natural disasters in your area. Higher-risk locations generally result in higher insurance premiums.

Progressive’s Rate Comparison and Discounts

When comparing Progressive’s rates to those of other insurers, it’s essential to consider the value and benefits you receive. Progressive offers a range of discounts to help reduce your insurance costs, including:

- Multi-Policy Discount: Combining your auto insurance with other policies, such as home or renters insurance, can result in significant savings.

- Good Driver Discount: A clean driving record with no accidents or violations for a specified period can lead to reduced rates.

- Paperless Discount: Opting for paperless billing and policy documents can save you a few dollars each year.

- Snapshot Discount: Progressive's usage-based insurance program, Snapshot, allows you to save money by providing real-time feedback on your driving habits.

- Loyalty Discount: Progressive rewards long-term customers with discounts for maintaining continuous coverage.

Real-World Rate Examples

To illustrate Progressive’s rate structure, consider the following examples. These rates are estimates and may vary based on individual circumstances:

| Profile | Estimated Annual Premium |

|---|---|

| Single, 25-year-old male with a clean driving record | $1,200 - $1,500 |

| Married couple, both 35 years old with one teen driver | $1,800 - $2,200 |

| Senior citizen, 65 years old with a long-standing clean record | $900 - $1,200 |

Performance Analysis and Customer Satisfaction

Progressive’s performance and customer satisfaction ratings are generally positive. The company has consistently received high marks for its financial stability and claims-handling processes. J.D. Power, a leading consumer insights and analytics company, ranked Progressive highly in its 2022 U.S. Auto Insurance Study for overall customer satisfaction.

Claims Handling and Customer Service

Progressive is known for its efficient claims process, with many customers praising the company’s quick response times and fair settlements. The insurer offers multiple channels for filing claims, including online, over the phone, or through its mobile app.

Digital Tools and Convenience

Progressive has invested heavily in digital technologies to enhance the customer experience. Their mobile app allows users to manage their policies, file claims, and access their insurance cards easily. Additionally, the Snapshot program provides a convenient way to track driving habits and potentially save on insurance costs.

Future Implications and Industry Trends

As the auto insurance industry evolves, Progressive continues to adapt and innovate. The company is actively exploring new technologies, such as autonomous vehicles and telematics, to stay ahead of the curve. Progressive’s focus on data-driven decision-making and its commitment to customer satisfaction position it well for future growth and success.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles presents both challenges and opportunities for auto insurers. Progressive is actively engaged in research and development to understand the potential impact of this technology on insurance rates and coverage. As autonomous vehicles become more prevalent, Progressive aims to offer tailored insurance solutions to meet the unique needs of this emerging market.

Telematics and Usage-Based Insurance

Progressive’s Snapshot program is a prime example of how telematics is transforming the insurance industry. By collecting real-time data on driving habits, insurers can offer more personalized and accurate rates. As usage-based insurance gains traction, Progressive is likely to continue refining its programs to provide customers with the best possible value.

How often do Progressive’s rates change?

+Progressive’s rates can change periodically, typically once a year, to reflect updates in risk assessment, market trends, and regulatory changes. However, individual policyholders may see more frequent rate adjustments based on their personal circumstances, such as changes in their driving record or vehicle usage.

Can I negotiate my Progressive insurance rates?

+While Progressive’s rates are based on a complex algorithm and are not negotiable, you can take advantage of their various discounts to potentially lower your premium. It’s always a good idea to review your policy annually and discuss your options with your agent to ensure you’re getting the best rate available.

What happens if I need to make a claim with Progressive?

+Making a claim with Progressive is a straightforward process. You can start a claim online, over the phone, or through their mobile app. Progressive’s claims team will guide you through the process, assess the damage, and work to resolve your claim as quickly and fairly as possible.