Progressive Car Insurance Quotes

In the dynamic world of car insurance, Progressive Insurance has solidified its position as a leading provider, offering a wide range of policies tailored to meet the diverse needs of vehicle owners. Understanding the intricacies of Progressive's car insurance quotes is essential for anyone seeking comprehensive coverage and competitive rates. This article delves into the factors that influence Progressive's quotes, explores their innovative insurance products, and provides practical tips for securing the best rates. Through a detailed analysis, we aim to empower readers with the knowledge to make informed decisions about their car insurance, ensuring they get the protection they need at a price that suits their budget.

Understanding Progressive Car Insurance Quotes

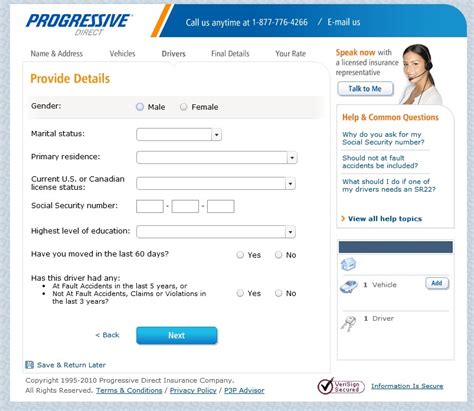

Progressive’s car insurance quotes are renowned for their accuracy and competitive pricing. The company employs a sophisticated risk assessment system that takes into account a multitude of factors to provide personalized quotes. These factors include the driver’s age, gender, driving record, location, and the type of vehicle being insured. By considering these variables, Progressive can offer tailored coverage options that cater to the unique needs of each policyholder.

Key Factors Influencing Progressive’s Quotes

One of the primary factors influencing Progressive’s car insurance quotes is the driver’s profile. Progressive evaluates drivers based on their age, with younger drivers often facing higher premiums due to their perceived higher risk. Additionally, the company considers the driver’s gender, with statistical data indicating that male drivers may be charged slightly higher premiums on average.

Progressive also conducts a thorough analysis of the driving record of potential policyholders. A clean driving record with no accidents or traffic violations can lead to more favorable quotes. Conversely, drivers with a history of accidents or violations may be considered higher risk and, consequently, face higher premiums.

The location of the driver also plays a significant role in Progressive's quote calculation. Areas with a higher incidence of accidents, thefts, or natural disasters may result in higher insurance rates. Additionally, the population density and traffic volume of an area can impact insurance costs.

The type of vehicle being insured is another crucial factor. Progressive considers the make, model, and age of the vehicle, as well as its safety features and repair costs. Vehicles with advanced safety technologies and those that are less expensive to repair may qualify for lower insurance rates.

| Factor | Impact on Quote |

|---|---|

| Driver's Profile | Age, gender, and driving record influence rates. |

| Location | Areas with higher accident rates or natural disasters may have higher insurance costs. |

| Vehicle Type | Make, model, age, and safety features impact insurance rates. |

Progressive’s Innovative Insurance Products

Progressive is known for its innovative approach to car insurance, offering a range of unique products that cater to the evolving needs of modern drivers. One such product is their Usage-Based Insurance (UBI) program, which allows drivers to save on insurance costs by monitoring their driving behavior. With UBI, drivers can opt to have their vehicles equipped with a small device that tracks driving habits, such as speeding, hard braking, and mileage. Those who demonstrate safe driving habits can qualify for substantial discounts on their insurance premiums.

Another innovative offering from Progressive is their Snapshot program. This program provides a personalized quote based on the driver's actual behavior behind the wheel. By installing a small device in the vehicle, Snapshot collects data on driving habits, such as the time of day the vehicle is used and the miles driven. This information is then used to generate a customized quote, often resulting in significant savings for safe drivers.

Progressive also offers a gap insurance product, which is particularly beneficial for drivers who have leased or financed their vehicles. Gap insurance covers the difference between the actual cash value of the vehicle and the amount still owed on the lease or loan in the event of a total loss or theft. This product provides peace of mind for drivers who may otherwise be liable for a significant financial gap.

Tips for Securing the Best Progressive Car Insurance Quote

Securing the best car insurance quote from Progressive involves a combination of understanding the factors that influence rates and employing strategic approaches to mitigate costs. Here are some practical tips to help you get the most competitive quote:

Build a Strong Driving Record

Maintaining a clean driving record is paramount to securing favorable car insurance quotes. Avoid traffic violations and accidents, as these can significantly impact your insurance rates. If you’ve had a clean driving record for an extended period, you may qualify for discounts or more competitive rates.

Consider Usage-Based Insurance

Progressive’s Usage-Based Insurance program can be a great way to save on insurance costs. If you’re a safe driver, you can potentially qualify for substantial discounts by participating in this program. The Snapshot program, in particular, offers a personalized quote based on your actual driving behavior, often resulting in significant savings.

Bundle Your Policies

Bundling your car insurance with other types of insurance, such as home or renters insurance, can lead to substantial savings. Progressive offers multi-policy discounts, which can lower your overall insurance costs. By combining policies, you not only save money but also streamline your insurance management.

Explore Discounts

Progressive offers a range of discounts that can reduce your insurance premiums. These may include discounts for safe driving, good student status, loyalty, or even for belonging to certain professional organizations or alumni groups. Be sure to inquire about all the discounts you may be eligible for when obtaining your quote.

Opt for Higher Deductibles

Choosing a higher deductible can lower your insurance premiums. While this means you’ll have to pay more out of pocket if you file a claim, it can result in significant savings on your monthly insurance costs. However, it’s essential to choose a deductible amount that you’re comfortable with and can afford in the event of a claim.

The Future of Progressive Car Insurance

As the automotive and insurance industries continue to evolve, Progressive remains at the forefront of innovation. The company is actively exploring new technologies and approaches to enhance its car insurance offerings. One area of focus is the integration of autonomous vehicle technology, which has the potential to revolutionize the way car insurance is priced and delivered.

Progressive is also investing in data analytics to further refine its risk assessment processes. By leveraging advanced data analytics techniques, the company aims to more accurately predict risks and offer even more precise and competitive quotes. This data-driven approach ensures that Progressive's quotes remain fair and tailored to the unique needs of each policyholder.

Additionally, Progressive is exploring telematics as a means to gather real-time data on driving behavior. Telematics devices installed in vehicles can provide detailed information on driving habits, road conditions, and even vehicle health. This data can be used to offer more personalized insurance coverage and potentially reduce insurance costs for safe drivers.

Industry Impact and Benefits

Progressive’s innovative approach to car insurance has had a significant impact on the industry as a whole. The company’s focus on usage-based insurance and data analytics has influenced other insurers to adopt similar strategies, leading to a more competitive market. As a result, consumers benefit from a wider range of insurance options and potentially lower premiums.

Furthermore, Progressive's commitment to technological advancements has improved the overall customer experience. The company's digital platforms and mobile apps offer convenient and efficient ways to manage insurance policies, file claims, and access real-time information. This level of convenience and accessibility is highly valued by modern consumers who seek seamless interactions with their insurance providers.

How does Progressive determine car insurance rates?

+Progressive uses a comprehensive risk assessment system that considers factors such as the driver’s age, gender, driving record, location, and the type of vehicle being insured. This system allows them to offer personalized quotes based on individual circumstances.

What is Progressive’s Usage-Based Insurance (UBI) program?

+UBI is a program that allows drivers to save on insurance costs by monitoring their driving behavior. Progressive equips vehicles with a small device that tracks driving habits, and safe drivers can qualify for substantial discounts.

Can I bundle my Progressive car insurance with other policies?

+Yes, Progressive offers multi-policy discounts when you bundle your car insurance with other types of insurance, such as home or renters insurance. Bundling policies can lead to significant savings on your overall insurance costs.