Progressive Home Insurance California

Welcome to this comprehensive guide on Progressive Home Insurance in California. As a leading provider of insurance solutions, Progressive has tailored its offerings to meet the unique needs of California residents. In this article, we will delve into the world of Progressive Home Insurance, exploring its coverage, benefits, and features that make it an attractive choice for homeowners in the Golden State.

Understanding Progressive Home Insurance in California

Progressive Home Insurance, also known as Progressive Homeowners Insurance, is a comprehensive insurance policy designed to protect one of the most valuable assets for Californians: their homes. With a rich history in the insurance industry, Progressive has established itself as a trusted partner, offering a range of insurance products that cater to the diverse needs of its customers.

In California, where natural disasters like earthquakes and wildfires are common occurrences, having robust home insurance coverage is essential. Progressive Home Insurance provides Californians with peace of mind, ensuring that they are financially protected in the event of unexpected damages or losses. Let's explore the key aspects of Progressive's home insurance offerings in the state.

Comprehensive Coverage Options

Progressive Home Insurance offers a wide range of coverage options to cater to the diverse needs of California homeowners. Here’s an overview of the key coverages provided:

- Dwelling Coverage: This coverage protects the physical structure of your home, including the walls, roof, and permanent fixtures. It ensures that you can rebuild or repair your home in the event of a covered loss, such as fire, wind damage, or vandalism.

- Personal Property Coverage: Progressive covers the contents of your home, including furniture, electronics, clothing, and personal belongings. This coverage helps replace or repair your possessions if they are damaged or stolen.

- Liability Coverage: In the event of an accident or injury on your property, liability coverage provides financial protection. It covers medical expenses, legal fees, and any compensation you may be required to pay if you are found liable.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered loss, this coverage assists with the additional costs of temporary housing and other necessary expenses until you can return to your home.

- Optional Coverages: Progressive offers a variety of optional coverages to customize your policy. These include coverage for high-value items like jewelry or art, identity theft protection, and coverage for specific risks like flood or earthquake.

By offering these comprehensive coverage options, Progressive ensures that California homeowners can tailor their insurance policies to their specific needs, providing adequate protection for their homes and belongings.

Benefits of Progressive Home Insurance in California

Progressive Home Insurance brings several benefits to California homeowners, making it a preferred choice for many. Here are some key advantages:

- Customizable Policies: Progressive understands that every home and homeowner is unique. Their insurance policies are highly customizable, allowing you to choose the coverages and limits that suit your specific circumstances. This flexibility ensures that you are not paying for coverage you don't need.

- Competitive Rates: Progressive is known for offering competitive insurance rates, making home insurance more affordable for Californians. By comparing quotes and exploring the available discounts, you can find a policy that fits your budget without compromising on coverage.

- Innovative Technology: Progressive leverages advanced technology to enhance the insurance experience. Their online platform and mobile app make it convenient to manage your policy, make payments, and file claims. You can also access helpful resources and tools to better understand your coverage and make informed decisions.

- Excellent Customer Service: Progressive is renowned for its exceptional customer service. Their knowledgeable and friendly representatives are available 24/7 to assist you with any inquiries or concerns. Whether you need assistance with policy changes, claims, or general advice, Progressive's customer support team is there to provide timely and professional support.

- Discounts and Savings: Progressive offers a range of discounts to help you save on your home insurance premiums. These discounts include multi-policy discounts (when you bundle home and auto insurance), loyalty discounts, and safety discounts for homes equipped with certain safety features. By taking advantage of these discounts, you can further reduce your insurance costs.

Performance and Claims Handling

Progressive’s performance in the California home insurance market has been commendable. The company has a strong track record of handling claims efficiently and providing fair settlements to policyholders. Their claims process is designed to be straightforward and customer-centric, ensuring that homeowners receive the support they need during times of crisis.

Progressive's claims adjusters are experienced and trained to assess damages accurately and promptly. They work closely with policyholders to understand the extent of the loss and guide them through the claims process. The company utilizes advanced technology and resources to expedite the claims handling process, minimizing delays and ensuring timely payouts.

Additionally, Progressive offers a dedicated claims hotline and online resources to assist policyholders throughout the claims journey. They provide clear and transparent communication, keeping policyholders informed at every step. This commitment to excellent claims handling has earned Progressive a reputation for reliability and trust among California homeowners.

Comparative Analysis

When comparing Progressive Home Insurance to other providers in California, several factors set it apart:

- Coverage Flexibility: Progressive's customizable policies give homeowners the freedom to choose the coverage that aligns with their specific needs. This level of flexibility is not commonly found in other insurance providers, making Progressive a preferred choice for those seeking tailored coverage.

- Competitive Pricing: Progressive's competitive rates make it an attractive option for cost-conscious homeowners. By offering affordable insurance premiums, Progressive ensures that Californians can obtain adequate coverage without straining their finances.

- Technological Advancements: Progressive's use of innovative technology enhances the overall insurance experience. Their online and mobile platforms provide convenience and accessibility, allowing policyholders to manage their policies and access resources with ease. This digital approach sets Progressive apart from traditional insurance companies.

Real-Life Examples and Testimonials

Let’s take a look at some real-life scenarios where Progressive Home Insurance made a difference for California homeowners:

- Wildfire Protection: California resident, John Smith, experienced a devastating wildfire that threatened his home. Progressive's comprehensive coverage stepped in, providing financial support to repair the damage caused by the wildfire. With their assistance, John was able to rebuild his home and regain a sense of security.

- Earthquake Preparedness: Jane Doe, a homeowner in an earthquake-prone area, opted for Progressive's optional earthquake coverage. When an earthquake struck, Progressive's coverage ensured that she received the necessary funds to repair structural damage and replace damaged belongings. Jane appreciated the peace of mind that came with being prepared for such an event.

- Water Damage Claims: Michael Johnson, a California homeowner, encountered water damage due to a plumbing issue. Progressive's timely claims handling and efficient settlement process allowed him to quickly repair the damage and prevent further issues. Michael praised Progressive for their professionalism and prompt response.

These real-life examples highlight the value and reliability of Progressive Home Insurance in California. By providing timely support and fair settlements, Progressive has become a trusted partner for homeowners facing various challenges.

Future Implications and Industry Insights

As California continues to face natural disasters and evolving risks, the demand for comprehensive home insurance coverage is expected to rise. Progressive’s commitment to innovation and customer-centric approaches positions them well to meet these evolving needs.

Progressive is continuously enhancing its insurance offerings to adapt to the changing landscape. They are investing in data analytics and risk assessment tools to better understand and mitigate potential risks. By leveraging technology and data, Progressive aims to provide even more accurate and tailored coverage options for California homeowners.

Furthermore, Progressive's focus on customer education and awareness is commendable. They actively engage with their policyholders, providing resources and guidance on risk prevention and mitigation. This proactive approach empowers homeowners to make informed decisions and take necessary precautions to protect their homes.

FAQ

How do I get a quote for Progressive Home Insurance in California?

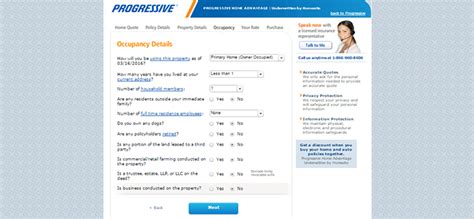

+To obtain a quote for Progressive Home Insurance in California, you can visit their official website or contact their customer service team. Provide them with information about your home, including its location, size, and any additional features or risks. They will assess your needs and offer a personalized quote based on your circumstances.

What discounts are available for Progressive Home Insurance in California?

+Progressive offers a range of discounts for California homeowners. These include multi-policy discounts when you bundle home and auto insurance, loyalty discounts for long-term customers, and safety discounts for homes equipped with certain safety features like smoke detectors or burglar alarms. Check with Progressive to explore the available discounts and see how you can save on your insurance premiums.

How does Progressive handle claims in California?

+Progressive has a dedicated claims team that handles claims efficiently and professionally. They provide a streamlined process, allowing policyholders to report claims online, over the phone, or through their mobile app. Progressive’s claims adjusters assess the damages and work closely with policyholders to ensure fair and timely settlements. They prioritize customer satisfaction and aim to provide support throughout the claims journey.

Can I customize my Progressive Home Insurance policy in California?

+Absolutely! Progressive understands the importance of customized coverage. Their policies allow you to choose the coverages and limits that align with your specific needs. You can select the level of dwelling coverage, personal property coverage, liability coverage, and add optional coverages for specific risks. This flexibility ensures that your insurance policy truly reflects your unique circumstances.

What is the average cost of Progressive Home Insurance in California?

+The average cost of Progressive Home Insurance in California can vary based on several factors, including the location, size, and age of your home, as well as your chosen coverage limits and deductibles. It’s best to obtain a personalized quote from Progressive to get an accurate estimate for your specific circumstances. Progressive offers competitive rates and provides tools to help you compare and find the right coverage at an affordable price.