Progressive Insurance Auto Quote

The auto insurance industry is a highly competitive sector, with companies vying for customers' attention and loyalty. Among the plethora of options, Progressive Insurance stands out as a prominent player, offering a range of insurance services and a unique approach to quoting and policy management. This article delves into the intricacies of Progressive Insurance's auto quote process, exploring its features, benefits, and impact on the industry.

Understanding Progressive Insurance’s Auto Quote System

Progressive Insurance, a leading name in the insurance market, has revolutionized the way customers obtain auto insurance quotes. Their innovative approach centers around an online platform that provides users with a seamless and personalized experience. Here’s an in-depth look at how Progressive’s auto quote system works and why it has gained traction among car owners.

The Online Quoting Process

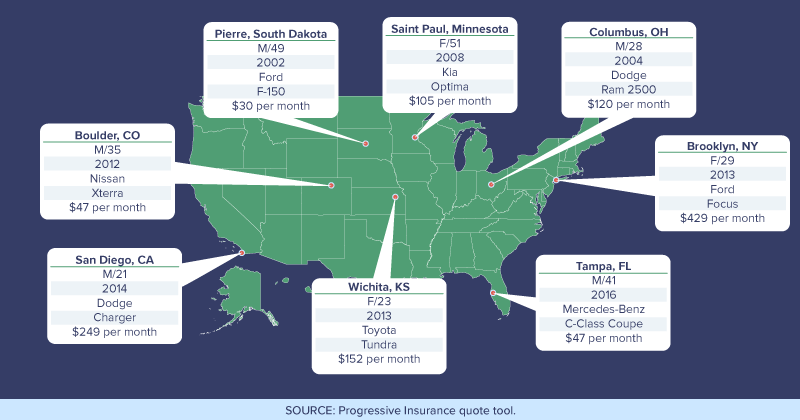

Progressive Insurance’s auto quote journey begins with a user-friendly online interface. Customers are guided through a straightforward process that collects essential information to generate a customized quote. This data includes personal details, vehicle specifications, driving history, and desired coverage options.

One notable feature of Progressive’s online quoting platform is its interactive nature. Users can adjust their coverage preferences and instantly see the impact on their potential premium. This real-time feedback empowers individuals to make informed decisions about their insurance needs.

Moreover, Progressive’s system leverages advanced algorithms to analyze user data and offer tailored recommendations. These suggestions take into account factors such as the customer’s risk profile, local market conditions, and available discounts, ensuring a quote that is both competitive and comprehensive.

Personalized Rates and Discounts

Progressive Insurance is renowned for its commitment to providing competitive rates and a variety of discounts. The auto quote process takes into account a range of factors to determine the most suitable premium for each individual. Here’s a glimpse at some of the key considerations:

- Vehicle Type and Usage: Progressive understands that different vehicles serve different purposes. Whether it’s a daily commute, occasional travel, or business use, the quote system factors in these nuances to offer accurate pricing.

- Driving History: A clean driving record can lead to significant savings. Progressive rewards safe drivers with discounts, acknowledging their responsible behavior on the road.

- Multi-Policy Discounts: Customers who bundle their insurance needs with Progressive often enjoy substantial savings. This strategy not only simplifies policy management but also reduces costs.

- Discounts for Safety Features: Vehicles equipped with advanced safety technologies may be eligible for discounts. Progressive recognizes the role of these features in preventing accidents and lowering insurance claims.

Instant Comparison and Choice

Progressive Insurance understands the importance of providing customers with options. Their auto quote platform allows users to compare multiple quotes side by side, ensuring they make an informed decision. This feature not only showcases Progressive’s own offerings but also includes quotes from other reputable insurers.

By presenting a comprehensive view of the market, Progressive empowers customers to choose the insurance plan that best suits their needs and budget. This transparency builds trust and ensures that individuals are not locked into a single provider without exploring all their options.

| Feature | Description |

|---|---|

| Real-Time Quotes | Progressive's system generates quotes instantly, allowing users to quickly assess their insurance options. |

| Customizable Coverage | Customers can tailor their coverage, adjusting deductibles and adding optional features to create a personalized policy. |

| Discount Eligibility | The quote platform identifies potential discounts based on individual circumstances, ensuring customers receive all applicable savings. |

The Impact on the Insurance Industry

Progressive Insurance’s innovative auto quote system has had a significant influence on the broader insurance landscape. Its success has spurred competitors to enhance their own quoting processes, leading to a more customer-centric approach across the industry.

Streamlined Customer Experience

Progressive’s online quoting platform has set a new standard for convenience and accessibility. By digitizing the quote process, they have eliminated the need for lengthy in-person meetings or complex paperwork. This streamlined approach has not only benefited customers but has also allowed insurance providers to focus on delivering superior service.

The ease of obtaining an auto quote online has encouraged more individuals to explore their insurance options, leading to increased market participation and a more competitive environment.

Data-Driven Decisions

The use of advanced algorithms and data analytics in Progressive’s quote system has revolutionized how insurance providers assess risk. By leveraging vast amounts of data, Progressive can offer more accurate and fair premiums, reducing the likelihood of overcharging or undercharging customers.

This data-driven approach has also enabled Progressive to identify new opportunities for cost savings and risk mitigation, benefiting both the company and its policyholders.

Enhanced Competition and Innovation

Progressive Insurance’s success in the auto quote space has inspired other insurers to innovate and differentiate their offerings. The resulting increase in competition has led to a wide range of benefits for consumers, including improved customer service, expanded coverage options, and more competitive pricing.

The industry-wide focus on digital transformation and customer-centricity can be traced back to Progressive’s pioneering efforts, shaping the future of insurance for the better.

Conclusion: A Revolution in Auto Insurance Quoting

Progressive Insurance’s auto quote system represents a paradigm shift in the insurance industry. By embracing digital technology and a customer-first mindset, Progressive has elevated the quoting process from a tedious task to a seamless, personalized experience. The impact of their innovation extends beyond their own customer base, influencing the entire insurance sector to adopt more efficient and consumer-friendly practices.

As the insurance landscape continues to evolve, Progressive’s auto quote system serves as a shining example of how technology can drive positive change, benefiting both insurers and policyholders alike.

Can I get a quote without providing personal information?

+While Progressive values your privacy, certain personal details are necessary to generate an accurate auto insurance quote. However, rest assured that your information is secure and used solely for the purpose of providing you with a personalized quote.

How does Progressive determine my premium?

+Progressive uses a combination of factors, including your driving record, vehicle type, and coverage preferences, to calculate your premium. Their advanced algorithms ensure a fair and competitive rate tailored to your specific needs.

Are there any additional fees or charges I should be aware of?

+Progressive strives for transparency in its pricing. The quote you receive includes all applicable fees and charges. However, it’s always a good idea to review the policy documents thoroughly to understand any potential additional costs associated with your coverage.