Quick Life Insurance Quote

In the ever-evolving landscape of financial planning and risk management, life insurance stands as a cornerstone, offering individuals and families a crucial safety net. This article delves into the intricate world of life insurance, providing an expert-level guide to understanding quotes, policies, and the overall process of securing financial protection for your loved ones.

Unraveling the Complexity of Life Insurance Quotes

Life insurance quotes serve as the initial step in the process of securing financial protection for your beneficiaries. These quotes are tailored estimates, providing a glimpse into the potential cost and coverage of a life insurance policy. The quote-generation process is intricate, factoring in various elements that collectively influence the overall cost and terms of the policy.

Key Factors Influencing Life Insurance Quotes

Several critical factors come into play when determining life insurance quotes. These include:

- Age and Health: Younger individuals, typically in better health, often secure more affordable rates. As one ages or experiences health complications, the costs may increase significantly.

- Lifestyle and Habits: Factors such as smoking, extreme sports participation, or high-risk occupations can influence quotes. Carriers often assess these lifestyle choices when determining policy costs.

- Family History: Genetic predispositions to certain diseases or conditions can impact quotes. Carriers may delve into your family’s medical history to assess potential risks.

- Occupation: Certain occupations, especially those involving physical labor or high-risk environments, can result in higher premiums.

- Policy Type and Coverage: The type of policy (term or permanent) and the level of coverage desired significantly affect the quote. Higher coverage amounts naturally result in higher premiums.

It's crucial to understand that life insurance quotes are just estimates and can vary significantly based on individual circumstances and the carrier's assessment of risk. Therefore, it's advisable to obtain quotes from multiple carriers to ensure a comprehensive understanding of the market and to identify the best fit for your needs.

The Quote-to-Policy Process

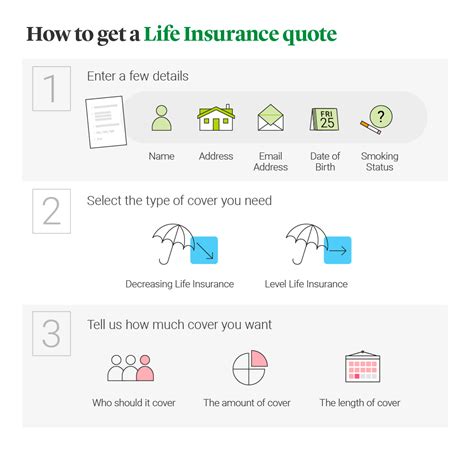

Securing a life insurance policy typically involves several steps beyond the initial quote. Here’s a simplified breakdown of the process:

- Quote Request: Potential policyholders initiate the process by requesting quotes from carriers, often through online forms or agent consultations.

- Assessment and Quote Generation: Carriers assess the provided information and generate quotes, factoring in the aforementioned key factors.

- Application and Medical Exam: If the quote is acceptable, the potential policyholder proceeds with the application process, which may include a medical exam to assess health status.

- Underwriting: Carriers evaluate the application and medical exam results, determining the final policy terms and premiums. This process can involve additional medical tests or inquiries.

- Policy Issuance: Once the underwriting process is complete and the policy is approved, the carrier issues the policy, providing the policyholder with the necessary documents and details.

It's important to note that the entire process can vary in complexity and duration, depending on individual circumstances and the carrier's specific requirements.

Maximizing Value and Savings

Securing the best value for your life insurance policy involves more than just obtaining the lowest premium. It’s about finding a balance between cost and coverage that aligns with your specific needs and financial situation. Here are some strategies to consider:

- Compare Multiple Carriers: Shop around and compare quotes from various carriers. This not only provides a broader perspective on pricing but also highlights the unique features and benefits offered by each carrier.

- Assess Your Needs: Understand your specific needs and goals. Determine the coverage amount and type that best aligns with your financial responsibilities and objectives. Overestimating your needs can lead to unnecessary expenses, while underestimating may leave you underprotected.

- Bundle Policies: Consider bundling your life insurance policy with other financial products, such as disability or long-term care insurance. Carriers often offer discounts for multiple policies.

- Review Regularly: Life insurance needs can evolve over time. Regularly review your policy to ensure it remains aligned with your current circumstances and goals. Life events such as marriage, childbirth, or career changes may warrant policy adjustments.

By implementing these strategies and staying informed about your options, you can navigate the complex world of life insurance quotes and policies with confidence, securing the financial protection your loved ones deserve.

Case Study: A Real-Life Example

Let’s illustrate the life insurance quote process with a real-life scenario. Imagine a 35-year-old professional, John, who is married with two young children. John, recognizing the importance of financial security, decides to explore life insurance options.

John’s Journey to Financial Protection

John begins his quest by requesting quotes from several reputable carriers. He provides detailed information about his age, health status, and occupation. The quotes he receives vary, with some carriers offering more competitive rates based on his healthy lifestyle and low-risk occupation.

| Carrier | Quote |

|---|---|

| Carrier A | $500 annually for a 20-year term policy with $1 million coverage |

| Carrier B | $650 annually for a 20-year term policy with $1 million coverage |

| Carrier C | $480 annually for a 20-year term policy with $1 million coverage |

Intrigued by Carrier C's competitive quote, John decides to proceed with their application process. He completes the application, including a detailed medical history, and schedules a medical exam to assess his current health status. The underwriting process reveals no significant health concerns, and Carrier C offers John a policy with the quoted terms and premiums.

Satisfied with the coverage and cost, John secures the policy, providing his family with the financial protection they need in the event of an unforeseen tragedy. This real-life example underscores the importance of a thorough and informed approach to life insurance, ensuring individuals like John can make well-informed decisions about their financial future.

FAQ

What is the difference between term and permanent life insurance?

+Term life insurance provides coverage for a specific period, often 10, 20, or 30 years, while permanent life insurance, such as whole life or universal life, provides coverage for the policyholder’s entire life. Term life insurance tends to be more affordable, while permanent life insurance often includes a cash value component that can be accessed by the policyholder.

How often should I review my life insurance policy?

+It’s recommended to review your policy at least annually to ensure it aligns with your current needs and circumstances. Major life events like marriage, childbirth, or career changes may warrant policy adjustments.

Can I convert my term life insurance to permanent life insurance?

+Yes, many term life insurance policies offer a conversion option, allowing policyholders to convert their term policy to a permanent life insurance policy without undergoing additional medical underwriting. This can be a valuable option for those who wish to extend their coverage beyond the term period.