Quote Boat Insurance

Boat insurance is a crucial aspect of boat ownership, offering protection and peace of mind to boat enthusiasts and professionals alike. As the saying goes, "A boat without insurance is like a ship sailing into a storm without a compass." In this comprehensive guide, we will delve into the world of boat insurance, exploring its importance, coverage options, and how to obtain the best quotes to safeguard your aquatic adventures.

Understanding the Significance of Boat Insurance

Boat insurance serves as a vital safeguard for boat owners, ensuring financial protection in the event of accidents, damage, or liability claims. With the vast diversity of waterways and potential risks, from rough seas to congested marinas, having adequate insurance is not just a prudent decision but a necessary one.

The specific needs of boat owners vary greatly, influenced by factors such as boat type, usage, and geographical location. Whether you own a sleek racing yacht, a tranquil fishing boat, or a versatile powerboat, understanding the unique risks and tailoring your insurance coverage accordingly is paramount.

Exploring Coverage Options: A Comprehensive Overview

Boat insurance offers a range of coverage options, each designed to address specific risks and provide tailored protection. Here’s a breakdown of some key components:

Liability Coverage

Liability insurance is a cornerstone of boat insurance, safeguarding boat owners against claims arising from accidents or injuries caused to others. This coverage is especially crucial when navigating crowded waterways or hosting passengers onboard.

| Policy Type | Coverage Limit |

|---|---|

| Basic Liability | $100,000 - $300,000 |

| Extended Liability | $500,000 - $1,000,000 |

| Umbrella Policy | Exceeds $1,000,000 |

Physical Damage Coverage

Physical damage coverage is designed to protect your boat against a variety of perils, including accidents, theft, vandalism, and natural disasters. This coverage can be further tailored to meet your specific needs, ensuring comprehensive protection.

| Coverage Type | Description |

|---|---|

| Collision Coverage | Covers damage to your boat resulting from collisions. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, fire, or weather-related damage. |

| Hull & Machinery Coverage | Covers the physical structure and machinery of your boat. |

Additional Coverages

Beyond the fundamental coverages, boat insurance policies often offer a range of additional protections to cater to diverse boating needs. These can include:

- Medical Payments Coverage: Covers medical expenses for passengers injured onboard, regardless of fault.

- Uninsured Boater Coverage: Provides protection in case of an accident with an uninsured or underinsured boater.

- Emergency Assistance Coverage: Offers assistance and coverage for emergency towing and other related services.

- Trailer & Towing Coverage: Extends protection to your boat trailer and the process of towing your boat.

Obtaining the Best Boat Insurance Quotes: A Step-by-Step Guide

Securing the most suitable and cost-effective boat insurance quote requires a strategic approach. Here’s a step-by-step guide to help you navigate the process:

Step 1: Assess Your Needs

Start by evaluating your specific boating needs and risks. Consider factors such as boat type, usage, and geographical location. Are you a recreational boater, a fisherman, or a racing enthusiast? Do you primarily cruise in coastal waters or inland lakes? Understanding these nuances will help tailor your insurance coverage effectively.

Step 2: Research Insurers

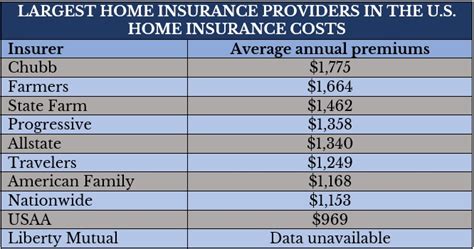

Research reputable boat insurance providers in your region. Look for insurers with a strong track record in marine insurance, positive customer reviews, and a comprehensive range of coverage options. Online resources, industry publications, and recommendations from fellow boaters can be invaluable in this process.

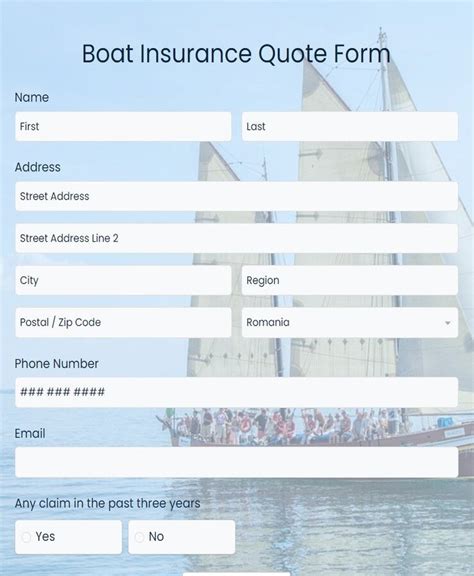

Step 3: Gather Documentation

To obtain accurate quotes, you’ll need to provide insurers with relevant documentation. This typically includes details about your boat (make, model, age, value), your boating experience, and any additional equipment or modifications. Ensure all information is up-to-date and accurate to avoid discrepancies later.

Step 4: Compare Quotes

Obtain quotes from multiple insurers to compare coverage and pricing. When comparing quotes, pay attention to the specifics of each policy, including coverage limits, deductibles, and any exclusions. Ensure that you’re comparing policies with similar coverage levels to make an apples-to-apples comparison.

Step 5: Negotiate and Tailor

Once you’ve narrowed down your options, consider negotiating with insurers to tailor your policy to your specific needs. Many insurers offer customizable coverage options, allowing you to add or remove certain protections. This customization can help you strike a balance between comprehensive coverage and affordability.

Step 6: Review and Finalize

Before finalizing your boat insurance policy, thoroughly review the terms and conditions. Pay close attention to coverage limits, deductibles, and any exclusions or limitations. Ensure that the policy aligns with your boating activities and provides the level of protection you require. If you have any questions or concerns, don’t hesitate to reach out to the insurer for clarification.

The Future of Boat Insurance: Innovations and Trends

The world of boat insurance is evolving, driven by technological advancements and changing consumer needs. Here are some key trends and innovations shaping the future of boat insurance:

Digital Transformation

Insurers are increasingly embracing digital technologies to enhance the customer experience and streamline processes. From online quote comparisons to digital policy management and claims reporting, the boat insurance landscape is becoming more accessible and efficient.

Data-Driven Underwriting

Advanced analytics and data-driven underwriting are transforming the way boat insurance policies are priced and tailored. Insurers are leveraging vast datasets and sophisticated algorithms to assess risk more accurately, offering personalized coverage and competitive pricing.

Connected Boat Technology

The integration of connected boat technology, such as GPS tracking and onboard sensors, is opening up new possibilities for risk assessment and claims management. This technology enables insurers to monitor boats remotely, providing real-time data on usage patterns, maintenance needs, and potential risks. As a result, insurers can offer more precise coverage and potentially reduce premiums for responsible boat owners.

Sustainable Practices

The marine industry is increasingly focused on sustainability, and boat insurance is following suit. Insurers are developing policies and incentives to encourage environmentally friendly boating practices, such as using eco-friendly fuels and adopting energy-efficient technologies. These initiatives not only promote sustainability but can also result in cost savings for boat owners.

Conclusion: Navigating the Seas of Boat Insurance with Confidence

Boat insurance is not just a legal requirement but a critical component of responsible boat ownership. By understanding your unique risks, exploring a range of coverage options, and obtaining the best quotes, you can safeguard your aquatic adventures and enjoy the open waters with peace of mind. Remember, the right boat insurance policy is one that provides comprehensive protection at a competitive price, tailored to your specific needs.

Frequently Asked Questions (FAQ)

How much does boat insurance typically cost?

+The cost of boat insurance varies widely depending on factors such as the type of boat, its value, the level of coverage, and your location. On average, boat owners can expect to pay anywhere from 200 to 2,000 annually for a basic policy. However, premiums can exceed $5,000 for high-value boats or those with extensive coverage needs.

What factors influence the cost of boat insurance?

+Several factors influence the cost of boat insurance, including the type and value of your boat, your boating experience and claims history, the level of coverage you require, and your geographical location. Insurers also consider the boat’s usage, such as whether it’s used for personal pleasure, fishing, or commercial purposes.

Are there any discounts available for boat insurance?

+Yes, many insurers offer discounts to boat owners who take proactive steps to reduce risk. These can include discounts for boat safety courses, installing anti-theft devices, maintaining a clean claims history, or bundling your boat insurance with other policies like homeowners or auto insurance.

What should I do if I need to make a boat insurance claim?

+If you need to make a boat insurance claim, it’s important to act promptly. Contact your insurer as soon as possible and provide them with all the relevant details, including photos or videos of the damage. Cooperate fully with the insurer’s claims process, and be prepared to provide additional documentation or information as needed.

Can I switch boat insurance providers if I’m not satisfied with my current policy?

+Absolutely! Boat insurance is a competitive market, and it’s in your best interest to shop around for the best coverage and pricing. If you’re not satisfied with your current policy or feel you’re paying too much, consider obtaining quotes from other reputable insurers. Remember to carefully review the terms and conditions of any new policy before making the switch.