Quote Flood Insurance

Flood insurance is a crucial aspect of safeguarding your property and finances, especially in regions prone to flooding. Obtaining a quote for flood insurance is an important step towards ensuring your peace of mind and financial security. In this comprehensive guide, we will delve into the world of flood insurance, exploring the factors that influence quotes, the process of obtaining them, and the steps you can take to secure the best coverage for your needs.

Understanding Flood Insurance Quotes

Flood insurance quotes are personalized estimates that determine the cost of your flood insurance policy. These quotes are influenced by various factors, each playing a significant role in assessing the risk and determining the premium. Let’s break down the key elements that impact flood insurance quotes.

Risk Assessment

One of the primary factors in flood insurance quotes is the assessment of risk. Insurance providers evaluate the likelihood of your property being affected by flooding. This assessment takes into account various data points, including the location of your property, its proximity to bodies of water, historical flood data, and even the elevation of the land. Properties located in high-risk flood zones generally carry a higher insurance premium.

For instance, consider the case of a coastal town frequently affected by hurricanes. Properties along the shoreline would likely face higher insurance premiums due to the increased risk of storm surges and coastal flooding.

Coverage Limits

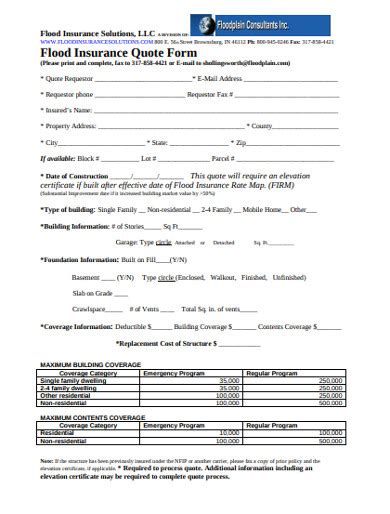

The coverage limits you select for your flood insurance policy directly impact the quote. Flood insurance typically offers two types of coverage: structural and contents. Structural coverage protects the physical building, while contents coverage safeguards your personal belongings. The higher the coverage limits you choose, the more protection you’ll have, but this also influences the cost of your insurance.

| Coverage Type | Limit |

|---|---|

| Structural Coverage | $250,000 |

| Contents Coverage | $100,000 |

In the above example, the policy provides ample coverage for both the building and its contents, but it's essential to tailor these limits to your specific needs to avoid overpaying.

Deductibles and Policy Terms

Deductibles and policy terms are additional considerations that affect your flood insurance quote. Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can reduce your premium, but it’s crucial to strike a balance that ensures you can afford the deductible in the event of a claim.

Policy terms refer to the duration of your insurance coverage. Most flood insurance policies are issued annually, but the cost may vary depending on whether you choose a shorter or longer term. Longer policy terms can sometimes result in discounted rates.

Obtaining a Flood Insurance Quote

Now that we’ve explored the factors influencing flood insurance quotes, let’s dive into the process of obtaining a quote. The process can vary slightly depending on the insurance provider, but here’s a general overview of what you can expect.

Gathering Information

Before initiating the quote process, it’s essential to gather the necessary information. This includes details about your property, such as its location, square footage, construction type, and any recent renovations or improvements. Having this information readily available will streamline the quoting process.

Contacting Insurance Providers

You have a few options when it comes to obtaining flood insurance quotes. You can directly contact insurance providers that offer flood insurance policies, either through their websites or by reaching out to their customer service representatives. Many providers offer online quote tools, allowing you to input your property details and receive an instant estimate.

Alternatively, you can work with an insurance broker or agent who can provide quotes from multiple providers. This can be advantageous as brokers have access to a wider range of insurance options and can offer personalized advice based on your specific needs.

Comparing Quotes

Once you’ve obtained multiple quotes, it’s crucial to compare them thoroughly. Consider not only the premium but also the coverage limits, deductibles, and any additional perks or benefits included in the policy. Some insurance providers may offer discounts or incentives that can make their policies more attractive.

Additionally, pay attention to the reputation and financial stability of the insurance provider. You want to ensure that the company you choose is reputable and has a strong financial standing to honor your claims in the event of a flood.

Tips for Securing the Best Flood Insurance Quote

Obtaining the best flood insurance quote requires a strategic approach. Here are some tips to help you navigate the process and secure a policy that offers both comprehensive coverage and a competitive premium.

Shop Around

Don’t settle for the first quote you receive. Shopping around and comparing quotes from multiple providers is essential. Different insurance companies may have varying risk assessments and pricing structures, so exploring your options can lead to significant savings.

Consider Coverage Options

Tailor your coverage limits to your specific needs. Overinsuring your property can result in unnecessary expenses, while underinsuring may leave you vulnerable in the event of a significant flood. Assess the value of your property and its contents, and choose coverage limits that provide adequate protection without being excessive.

Explore Discounts and Perks

Insurance providers often offer discounts and additional perks to attract customers. These can include discounts for having multiple policies with the same provider, loyalty discounts for long-term customers, or discounts for properties with certain flood-mitigation measures in place, such as elevated electrical systems or flood barriers.

Understand Exclusions

Flood insurance policies typically have exclusions, which are situations or events that are not covered by the policy. It’s crucial to understand these exclusions to ensure you’re not left unprotected. Common exclusions include damage caused by sewer backups, mudslides, or certain types of water damage that are not directly related to flooding.

The Importance of Flood Insurance

Flood insurance is not just a financial safeguard; it’s a critical component of disaster preparedness. Floods can occur unexpectedly and cause devastating damage to your property and belongings. Without flood insurance, you may be left with significant financial losses and the arduous task of rebuilding without adequate support.

Consider the case of a community hit by a sudden flash flood. Those with flood insurance can focus on their recovery and rebuilding efforts, knowing that their insurance will cover the costs of repairs and replacements. In contrast, those without insurance may face overwhelming financial burdens and a prolonged recovery process.

Frequently Asked Questions

How often should I review my flood insurance policy and quote?

+It is recommended to review your flood insurance policy and quote annually, especially if your circumstances or the flood risk in your area has changed. Regular reviews ensure that your coverage remains adequate and that you are not overpaying for unnecessary coverage.

Can I bundle my flood insurance with other policies to save money?

+Yes, bundling your flood insurance with other policies, such as homeowners or renters insurance, can often result in discounted rates. Many insurance providers offer multi-policy discounts, so it’s worth exploring this option to save on your overall insurance costs.

What are some common misconceptions about flood insurance quotes?

+One common misconception is that flood insurance quotes are based solely on the location of your property. While location is a significant factor, other elements, such as the construction of your building, the presence of flood-mitigation measures, and your chosen coverage limits, also play a role in determining the quote.

In conclusion, obtaining a flood insurance quote is a vital step towards protecting your property and finances from the devastating impacts of flooding. By understanding the factors that influence quotes and following the tips provided, you can secure a policy that offers comprehensive coverage at a competitive price. Remember, flood insurance is an investment in your peace of mind and financial security, ensuring that you’re prepared for whatever Mother Nature may bring.