Quote For Car Insurance Progressive

The Cost of Car Insurance: Understanding Progressive’s Rates and Coverage

In the realm of car insurance, choosing the right provider is crucial to ensure you get the best value for your money while also securing adequate coverage. Progressive, a well-known name in the industry, offers a range of insurance plans tailored to meet various needs. This article aims to provide an in-depth analysis of Progressive’s car insurance quotes, exploring the factors that influence rates and the coverage options available. By the end, you should have a clear understanding of what to expect when seeking a quote from Progressive and be better equipped to make an informed decision about your car insurance.

Understanding Progressive’s Car Insurance Rates

Progressive’s car insurance rates are determined by a variety of factors, much like with any other insurer. These factors include your personal details, driving history, the make and model of your vehicle, and the coverage limits you choose. Let’s delve into these factors to gain a clearer picture:

Personal Details: Your age, gender, and marital status can impact your insurance rates. Typically, younger drivers, especially those under 25, tend to pay higher premiums due to their lack of driving experience. Progressive offers programs like the Snapshot program, which uses telematics to monitor driving behavior and can lead to discounts for safe driving habits.

Driving History: Your driving record plays a significant role in determining your insurance rates. A clean driving record with no accidents or violations can lead to lower premiums, while a history of accidents or traffic violations may result in higher rates. Progressive offers accident forgiveness programs for eligible drivers, which can help mitigate the impact of an at-fault accident on your rates.

Vehicle Details: The make, model, and year of your vehicle can affect your insurance rates. Generally, newer and more expensive vehicles tend to have higher insurance costs due to their higher replacement value and potential for more costly repairs. Additionally, vehicles with advanced safety features may qualify for discounts.

Coverage Limits: The level of coverage you choose directly impacts your insurance rates. Comprehensive and collision coverage, which protect against damage to your vehicle, can be more expensive than liability-only coverage, which only covers damage to other vehicles and property. Progressive offers a range of coverage options to suit different needs and budgets.

Progressive’s Coverage Options

Progressive offers a comprehensive range of car insurance coverage options to meet the diverse needs of its customers. Here’s an overview of the key coverage types:

Liability Coverage: This is the most basic type of car insurance and is mandatory in most states. It covers bodily injury and property damage liability, protecting you against claims made by others for injuries or property damage caused by you in an accident.

Collision Coverage: This coverage pays for the repair or replacement of your vehicle if it’s damaged in a collision, regardless of fault. It’s an optional coverage but is often required by lenders if you’re financing or leasing your vehicle.

Comprehensive Coverage: This coverage protects against damage to your vehicle caused by events other than collisions, such as theft, vandalism, weather-related incidents, or collisions with animals. It’s also an optional coverage but is recommended for comprehensive protection.

Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers after an accident, regardless of fault. It can cover a wide range of medical services, including hospital stays, doctor visits, and rehabilitation.

Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who either has no insurance or has insufficient insurance to cover the damages. It covers bodily injury and property damage, ensuring you’re not left financially vulnerable in such situations.

Rental Car Reimbursement: This coverage provides rental car expenses if your vehicle is in the shop for repairs due to a covered loss. It ensures you have a temporary vehicle to use while your car is being fixed.

Roadside Assistance: Progressive offers 24⁄7 roadside assistance, which can include services like towing, flat tire changes, jump-starts, and fuel delivery. This coverage provides peace of mind in case of unexpected vehicle breakdowns.

Progressive’s Additional Benefits and Discounts

In addition to its standard coverage options, Progressive offers a range of additional benefits and discounts to enhance its customers’ experience and provide cost savings:

Snapshot Program: This innovative program uses a small device plugged into your vehicle’s diagnostic port or a smartphone app to track your driving habits. Based on your driving behavior, such as hard braking, acceleration, and time of day, Progressive can offer personalized discounts. The program rewards safe driving and provides feedback to help improve your driving skills.

Multi-Policy Discounts: Progressive offers discounts when you bundle multiple insurance policies, such as car insurance with home or renters insurance. This can lead to significant savings and simplify your insurance management.

Multi-Car Discounts: If you insure multiple vehicles with Progressive, you may be eligible for a discount. This can be particularly beneficial for families with multiple drivers.

Good Student Discount: Progressive offers a discount for full-time students under 25 who maintain a B average or higher. This encourages academic excellence and provides a financial incentive for young drivers.

Loyalty Discounts: Progressive rewards its long-term customers with loyalty discounts, providing an incentive to stay with the company over the long term.

Real-Life Examples and Customer Experiences

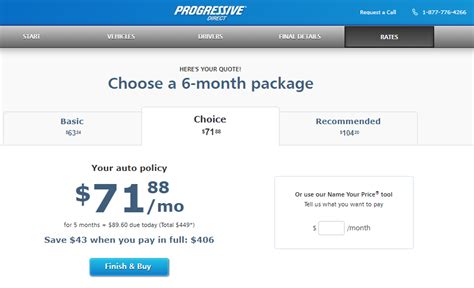

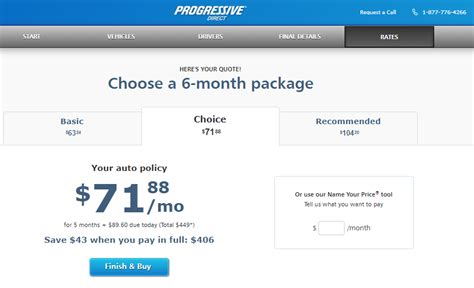

To provide a more tangible understanding of Progressive’s car insurance quotes, let’s look at some real-life examples and customer experiences:

John, a 35-year-old male with a clean driving record, recently purchased a new Toyota Camry. He chose Progressive for his car insurance and opted for comprehensive coverage with a 500 deductible. His annual premium came out to be 1,200, which he found to be a competitive rate given his vehicle’s value and his driving history.

Sarah, a 22-year-old female, recently graduated from college and purchased her first car, a used Honda Civic. She chose Progressive and enrolled in the Snapshot program. Based on her safe driving habits, she received a 15% discount on her premiums, bringing her annual cost down to $850.

Mike, a 45-year-old with a history of accidents and traffic violations, was concerned about the cost of his car insurance. Progressive offered him liability-only coverage with a high deductible, which suited his budget and provided the necessary protection. His annual premium was $750, which he found to be a reasonable rate given his driving history.

Comparative Analysis

To provide a comprehensive understanding, let’s compare Progressive’s car insurance rates and coverage with those of a few other major insurers:

| Insurer | Average Annual Premium | Coverage Options | Key Features |

|---|---|---|---|

| Progressive | $1,200 | Comprehensive range, including liability, collision, comprehensive, medical payments, uninsured/underinsured motorist, rental car reimbursement, and roadside assistance | Snapshot program, multi-policy and car discounts, good student discount, loyalty rewards |

| GEICO | $1,100 | Similar to Progressive, offering a wide range of coverage options | Military discounts, accident forgiveness, 24⁄7 customer service |

| State Farm | $1,300 | Comprehensive coverage, including liability, collision, comprehensive, medical payments, uninsured/underinsured motorist, rental car reimbursement, and roadside assistance | Steer Clear safe driving program, Drive Safe & Save program, good student discount |

| Allstate | $1,400 | Comprehensive coverage similar to Progressive | Drivewise program for personalized rates, accident forgiveness, vanishing deductible option |

Conclusion

Progressive offers a comprehensive range of car insurance coverage options, providing flexibility to meet the diverse needs of its customers. Its rates are competitive, and its various discounts and benefits, such as the Snapshot program and multi-policy discounts, can lead to significant savings. However, it’s important to note that insurance rates can vary widely based on individual circumstances and state regulations. Therefore, it’s always recommended to obtain quotes from multiple insurers to ensure you’re getting the best value for your specific needs.

FAQ

How do I get a quote from Progressive for car insurance?

+You can get a quote from Progressive by visiting their website or by calling their customer service hotline. They’ll ask you for details about your vehicle, driving history, and coverage preferences to provide an accurate quote.

What factors influence Progressive’s car insurance rates?

+Progressive’s rates are influenced by factors such as your age, gender, marital status, driving history, the make and model of your vehicle, and the coverage limits you choose. Personal details and driving history are key factors in determining rates.

What types of coverage does Progressive offer for car insurance?

+Progressive offers a comprehensive range of coverage options, including liability, collision, comprehensive, medical payments, uninsured/underinsured motorist, rental car reimbursement, and roadside assistance. You can choose the coverage that best suits your needs and budget.

Does Progressive offer any discounts on car insurance?

+Yes, Progressive offers a variety of discounts, including the Snapshot program for safe drivers, multi-policy and multi-car discounts, a good student discount, and loyalty rewards for long-term customers. These discounts can significantly reduce your insurance premiums.

How does Progressive’s car insurance compare to other major insurers?

+Progressive offers competitive rates and a comprehensive range of coverage options, similar to other major insurers like GEICO, State Farm, and Allstate. However, rates can vary based on individual circumstances and state regulations. It’s recommended to obtain quotes from multiple insurers for comparison.