Quote For Insurance Car

Finding the right car insurance coverage is crucial to ensure your vehicle and finances are protected. The process of obtaining a quote for car insurance can seem daunting, but with the right information and understanding of the factors involved, it becomes a straightforward task. This comprehensive guide will walk you through the steps to get an accurate quote for your insurance needs, helping you make informed decisions about your car insurance.

Understanding Car Insurance Quotes

A car insurance quote is an estimate of the cost of your insurance policy. It is based on several factors unique to your situation, such as your vehicle, driving record, and personal details. Insurance companies use these factors to assess the risk of insuring you and determine the premium you will pay.

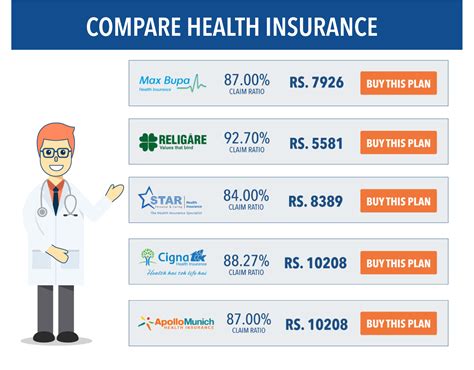

Obtaining multiple quotes is essential to compare prices and coverage options. Each insurance provider has its own formula for calculating premiums, so quotes can vary significantly. By shopping around, you can find the best value for your specific needs.

Factors Affecting Your Quote

Numerous factors influence the quote you receive for car insurance. Understanding these factors can help you make informed choices and potentially lower your insurance costs.

- Vehicle Type and Usage: The make, model, and year of your vehicle play a significant role. High-performance cars or luxury vehicles generally attract higher premiums due to their cost to repair or replace. Additionally, the purpose for which you use your car (commuting, business, or pleasure) can impact your quote.

- Driver Information: Your age, gender, and driving history are crucial factors. Younger drivers, especially males, often face higher premiums due to their statistically higher risk of accidents. A clean driving record with no accidents or traffic violations can lead to lower quotes.

- Coverage Preferences: The level of coverage you choose affects your quote. Comprehensive and collision coverage, which protect against damage to your vehicle, can increase your premium. However, these coverages provide valuable protection in case of accidents or natural disasters.

- Location and Usage: Where you live and how you use your vehicle impact your quote. Urban areas with higher traffic and crime rates often result in higher premiums. Similarly, if you drive frequently or for long distances, your insurance costs may increase.

- Insurance Company and Policy: Different insurance companies offer various policies with different features and price points. Comparing quotes from multiple providers is essential to find the best deal for your specific needs.

| Factor | Impact on Quote |

|---|---|

| Vehicle Type | High-performance cars may cost more to insure. |

| Driver Age and Gender | Younger drivers often face higher premiums. |

| Coverage Level | Comprehensive and collision coverage can increase costs. |

| Location | Urban areas with higher crime rates may result in higher premiums. |

| Insurance Company | Quotes vary between providers; comparison is key. |

The Quote Process

Obtaining a quote for car insurance is a straightforward process, whether you choose to do it online or with the help of an insurance agent.

Online Quote Process

Many insurance companies offer online quote tools on their websites. Here’s a step-by-step guide to getting an online quote:

- Gather Information: Before starting, gather all the necessary details, including your vehicle's make, model, and year, your driving record, and personal information like your name, address, and date of birth.

- Visit the Insurance Provider's Website: Navigate to the website of the insurance company you're interested in. Look for a "Get a Quote" or "Quote Calculator" button or link.

- Enter Your Information: Fill in the required fields with your vehicle and personal details. Be as accurate as possible to ensure an accurate quote.

- Select Coverage Options: Choose the coverage limits and types you desire. Consider the minimum requirements in your state and your personal preferences for additional coverage.

- Review and Adjust: Once you receive your quote, review it carefully. If the coverage or price doesn't meet your expectations, you can adjust your selections and generate a new quote.

- Compare and Purchase: Compare quotes from multiple providers to find the best deal. Once you've made your decision, proceed with purchasing the policy and providing any necessary payment information.

Working with an Insurance Agent

If you prefer a more personalized approach, working with an insurance agent can be beneficial. Here’s how the process typically works:

- Contact an Agent: Reach out to a local insurance agent or broker who represents multiple insurance companies. You can find agents through referrals, online searches, or insurance company directories.

- Provide Information: Meet with the agent in person or over the phone to discuss your insurance needs. Provide them with your vehicle and personal details, and they will guide you through the quote process.

- Receive Quotes: The agent will obtain quotes from various insurance providers on your behalf. They will present you with the options, explaining the coverage and costs associated with each.

- Review and Compare: Take the time to review and compare the quotes presented by the agent. Ask questions and seek clarification on any coverage details or terms you don't understand.

- Select a Policy: Once you've made your decision, the agent will assist you in finalizing the policy and making the necessary payments.

Tips for Getting the Best Quote

Getting a car insurance quote is just the first step. To ensure you get the best deal, consider the following tips:

- Compare Multiple Quotes: As mentioned earlier, comparing quotes from different insurance providers is crucial. Don't settle for the first quote you receive; explore your options to find the most competitive price and coverage.

- Understand Coverage Options: Take the time to understand the different types of coverage available, such as liability, collision, comprehensive, and additional add-ons. Tailor your coverage to your specific needs and budget.

- Increase Your Deductible: Opting for a higher deductible can lower your premium. However, be sure you can afford the deductible in case of an accident or claim.

- Take Advantage of Discounts: Insurance companies offer various discounts, such as safe driver discounts, multi-policy discounts, and good student discounts. Ask about the discounts available and ensure you're eligible for any that apply to you.

- Maintain a Clean Driving Record: A clean driving record with no accidents or violations can lead to lower insurance premiums. Focus on safe driving practices to keep your record clean and potentially save on your insurance costs.

- Consider Bundle Policies: If you have multiple insurance needs, such as home and auto insurance, bundling your policies with the same provider can result in significant savings.

Understanding Your Policy

Once you’ve obtained your car insurance quote and decided on a policy, it’s essential to understand the details of your coverage. Your insurance policy document will outline the specific terms, conditions, and limits of your coverage.

Key Components of Your Policy

Every car insurance policy includes several key components. Familiarizing yourself with these components will help you understand your coverage and make informed decisions:

- Declarations Page: This page summarizes the most important details of your policy, including your name, address, vehicle information, coverage limits, and premium amount.

- Coverages and Limits: Your policy will outline the specific coverages you've chosen, such as liability, collision, comprehensive, and any additional add-ons. It will also detail the limits of each coverage, indicating the maximum amount the insurance company will pay for a covered loss.

- Exclusions and Limitations: It's important to understand what is not covered by your policy. Exclusions and limitations outline specific situations or types of damage that are not covered by your insurance.

- Policy Period and Renewal: Your policy will have a specific period of coverage, typically lasting one year. It will also include information on how and when to renew your policy to ensure continuous coverage.

- Deductibles and Out-of-Pocket Costs: Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. Understanding your deductible amounts is crucial when making a claim.

Reviewing and Adjusting Your Policy

As your circumstances and needs change, it’s essential to review and adjust your car insurance policy accordingly. Here are some situations that may warrant a policy review:

- Life Changes: Significant life events, such as getting married, having children, or buying a new home, can impact your insurance needs. Review your policy to ensure it aligns with your current situation.

- Vehicle Changes: If you purchase a new vehicle or make significant modifications to your existing one, your insurance needs may change. Ensure your policy reflects the accurate value and details of your new vehicle.

- Coverage Updates: As you gain more experience or your driving record improves, you may qualify for better coverage options or discounts. Review your policy periodically to explore these possibilities.

- Moving to a New Location: Changing your residence can impact your insurance rates. Different areas have varying risk factors, so be sure to update your policy when you move.

Making an Insurance Claim

In the event of an accident or other covered loss, it’s important to know how to navigate the insurance claim process. Here’s a step-by-step guide to help you through the process:

- Contact Your Insurance Provider: As soon as possible after an accident or loss, contact your insurance company to report the incident. Have your policy number and relevant details ready.

- Provide Necessary Information: Your insurance provider will ask for details about the incident, including the date, time, location, and any involved parties. Be as accurate and thorough as possible.

- Cooperate with the Claims Process: Your insurance company will guide you through the claims process, which may involve providing additional documentation, such as police reports or repair estimates. Cooperate fully to ensure a smooth and timely resolution.

- Understand Your Deductible: Before making a claim, review your policy to understand your deductible amount. This is the amount you must pay out of pocket before your insurance coverage takes effect.

- Choose Repairs and Settlement: Depending on the extent of the damage, you may have the option to choose your preferred repair shop or accept a settlement offer from the insurance company. Consider your options carefully and choose what's best for you.

Conclusion

Obtaining a quote for car insurance is a vital step in ensuring you have adequate coverage for your vehicle and finances. By understanding the factors that influence your quote, following the proper quote process, and implementing the tips provided, you can find the best car insurance policy to suit your needs. Remember to regularly review and adjust your policy to maintain optimal coverage and take advantage of any available discounts. With the right car insurance, you can drive with confidence, knowing you’re protected in the event of an accident or other unforeseen circumstances.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy annually or whenever you experience significant life changes, such as a new vehicle purchase, marriage, or relocation. Regular reviews ensure your coverage remains adequate and up-to-date with your evolving needs.

Can I get car insurance quotes without providing my personal information?

+While some online quote tools allow you to obtain rough estimates without providing personal details, accurate quotes require specific information about your vehicle and driving record. Providing accurate information ensures you receive precise quotes tailored to your needs.

What should I do if I’m unsure about the coverage options presented in my quote?

+If you’re uncertain about the coverage options in your quote, it’s best to consult with an insurance professional or agent. They can explain the nuances of different coverages and help you choose the options that align with your specific needs and budget.