Quote For Progressive Car Insurance

When it comes to car insurance, having a reliable and comprehensive policy is essential to protect yourself and your vehicle. Progressive Car Insurance is a well-known provider in the industry, offering a range of coverage options and innovative features. In this article, we will delve into the world of Progressive Car Insurance, exploring its offerings, benefits, and how you can obtain a quote tailored to your needs.

Understanding Progressive Car Insurance

Progressive Car Insurance, a subsidiary of the Progressive Corporation, has been a prominent player in the insurance market for over 80 years. With a commitment to providing customers with personalized and flexible insurance solutions, Progressive has grown to become one of the largest auto insurance providers in the United States.

The company's success lies in its ability to offer a wide array of coverage options, catering to diverse customer needs. Whether you're a new driver, a seasoned motorist, or someone seeking specialized coverage, Progressive has a policy to suit your requirements.

Key Coverage Options

Progressive Car Insurance offers a comprehensive range of coverage options, ensuring you can tailor your policy to your specific needs. Here are some of the key coverage types available:

- Liability Coverage: This provides protection in case you cause an accident that results in bodily injury or property damage to others. It covers medical expenses, repair costs, and legal fees.

- Collision Coverage: If your vehicle collides with another vehicle or object, this coverage pays for the repairs, regardless of who is at fault. It is essential for protecting your vehicle from costly repairs.

- Comprehensive Coverage: This coverage extends beyond collisions, protecting your vehicle from damage caused by non-collision events such as theft, vandalism, natural disasters, or hitting an animal.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses incurred by you or your passengers due to an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

In addition to these standard coverage options, Progressive also offers specialized coverages such as rental car reimbursement, gap insurance, and roadside assistance. These add-ons can provide additional peace of mind and convenience in case of emergencies.

Progressive’s Innovative Features

Progressive Car Insurance is known for its innovative approach to insurance, offering unique features that enhance the customer experience and provide added value.

- Snapshot: Progressive's Snapshot program allows drivers to potentially save on their insurance premiums by installing a small device that tracks their driving habits. This program uses telematics technology to monitor driving behavior, including miles driven, hard braking, and acceleration. Based on this data, Progressive can offer personalized discounts to safe drivers.

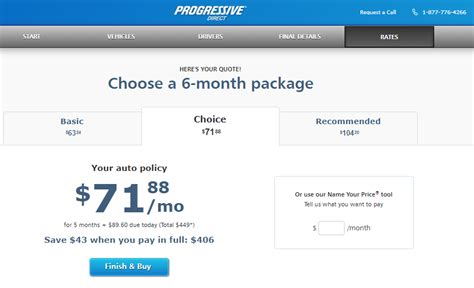

- Name Your Price: With Progressive's Name Your Price tool, customers can enter their desired monthly premium amount and receive quotes for coverage options that fit their budget. This feature empowers customers to take control of their insurance costs and find a policy that aligns with their financial goals.

- Online Claims: Progressive offers a user-friendly online claims process, allowing customers to file claims quickly and efficiently. Policyholders can submit claims, track their progress, and receive updates directly through the Progressive website or mobile app.

- Bundle Discounts: Progressive encourages customers to bundle their insurance policies, such as auto and home insurance, to receive significant discounts. Bundling not only saves money but also simplifies the insurance process by consolidating policies with a single provider.

Obtaining a Quote for Progressive Car Insurance

Getting a quote for Progressive Car Insurance is a straightforward process, designed to be efficient and tailored to your needs. Here’s a step-by-step guide to obtaining your personalized quote:

Step 1: Gather Information

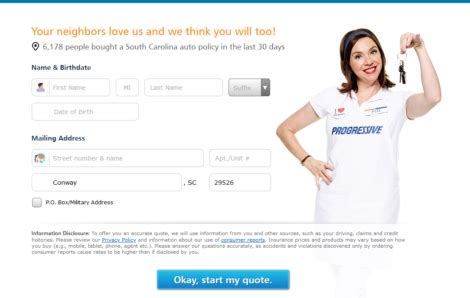

Before requesting a quote, it’s beneficial to have some key information readily available. This includes your personal details (name, date of birth, address), vehicle information (make, model, year, VIN), driving history (including any accidents or violations), and current insurance coverage details (if applicable). Having this information prepared will streamline the quote process.

Step 2: Visit the Progressive Website

Head over to the official Progressive Car Insurance website. The homepage often features a prominent “Get a Quote” button, making it easy to navigate to the quote page. Alternatively, you can search for “Progressive Car Insurance Quote” on your preferred search engine to access the quote page directly.

Step 3: Enter Your Information

On the quote page, you’ll be prompted to provide the personal and vehicle information you gathered in Step 1. Progressive’s online quote form is designed to be user-friendly and intuitive, guiding you through the process step by step. You’ll have the opportunity to select the coverage options that best suit your needs and preferences.

Step 4: Review and Customize Your Quote

Once you’ve provided all the necessary information, Progressive’s system will generate a quote based on your input. This quote will include the estimated cost of your chosen coverage options. Review the quote carefully, ensuring that it aligns with your expectations and requirements. If needed, you can make adjustments to your coverage choices or explore additional add-ons to create a policy that fits your needs perfectly.

Step 5: Complete the Quote Process

After reviewing and customizing your quote, you’ll have the option to proceed with purchasing your Progressive Car Insurance policy. Progressive offers a seamless online purchasing process, allowing you to complete the transaction securely and efficiently. You’ll receive confirmation of your policy details and any necessary documentation.

Comparing Progressive to Other Insurers

When considering Progressive Car Insurance, it’s beneficial to compare it with other leading insurance providers to ensure you’re making an informed decision. Here’s a brief comparison of Progressive’s offerings against some of its competitors:

| Insurance Provider | Coverage Options | Discounts | Innovative Features |

|---|---|---|---|

| Progressive | Comprehensive coverage, including specialized options | Snapshot, Name Your Price, Multi-Policy Discounts | Snapshot program, Name Your Price tool, Online Claims |

| State Farm | Standard auto insurance coverage | Safe Driver Discount, Multi-Policy Discount | Drive Safe & Save Program |

| Geico | Standard and specialized coverage options | Military Discount, Good Student Discount | Mobile App for policy management |

| Allstate | Comprehensive coverage, including specialized add-ons | Safe Driving Bonus Check, Multi-Policy Discount | Drivewise Program, Digital Lockbox for policy documents |

While each insurance provider offers its unique advantages, Progressive stands out with its innovative features and customizable coverage options. The Snapshot program and Name Your Price tool provide a level of flexibility and personalization that can be appealing to many drivers.

Conclusion: Progressive Car Insurance - A Comprehensive Choice

Progressive Car Insurance offers a comprehensive and flexible approach to auto insurance, catering to a wide range of customer needs. With its extensive coverage options, innovative features, and personalized quote process, Progressive provides an excellent option for those seeking reliable and tailored insurance solutions. By exploring Progressive’s offerings and comparing them with other providers, you can make an informed decision to protect your vehicle and yourself on the road.

Can I get a quote for Progressive Car Insurance without providing personal information?

+While Progressive does offer preliminary quotes without requiring extensive personal information, obtaining an accurate and personalized quote will require providing some basic details about yourself and your vehicle. This information helps Progressive tailor the quote to your specific needs and circumstances.

How long does it take to receive a quote from Progressive Car Insurance?

+The time it takes to receive a quote from Progressive can vary depending on several factors, including the complexity of your insurance needs and the demand on their system. However, Progressive strives to provide quotes promptly, often within minutes, especially if you have all the necessary information readily available.

Are there any additional fees or hidden costs associated with Progressive Car Insurance quotes?

+Progressive Car Insurance is transparent about its pricing and does not typically include hidden fees or costs in its quotes. However, it’s important to carefully review the policy details and any add-ons you select, as these may have associated fees. Progressive’s quote process provides a clear breakdown of costs to help you understand your potential insurance expenses.