Quote On Car Insurance

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers. In this comprehensive guide, we will delve into the world of car insurance, exploring its importance, the various coverage options, and the factors that influence policy costs. By understanding the intricacies of car insurance, you can make informed decisions to ensure your vehicle and your wallet are adequately protected.

Understanding Car Insurance

Car insurance is a contract between a policyholder and an insurance company, where the insurer agrees to provide financial coverage for specific risks associated with vehicle ownership. These risks can include accidents, theft, vandalism, and even natural disasters. The primary goal of car insurance is to protect drivers from potentially devastating financial consequences that may arise from such incidents.

There are several key components to car insurance policies that every driver should be aware of:

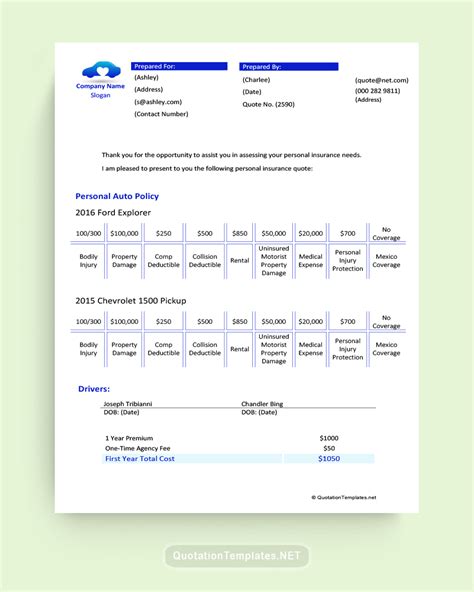

- Liability Coverage: This is the most basic form of car insurance, covering damages and injuries you cause to others in an accident. It includes both bodily injury liability and property damage liability.

- Collision Coverage: Collision insurance covers the cost of repairing or replacing your vehicle after an accident, regardless of fault. It is an optional coverage but is often recommended for newer or financed vehicles.

- Comprehensive Coverage: Comprehensive insurance provides protection against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or collisions with animals. It is also optional but highly beneficial for comprehensive protection.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for the medical expenses of you and your passengers, regardless of fault, after an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Car insurance policies can be customized to meet individual needs, and the specific coverage options available may vary depending on the insurer and the state's requirements. It is crucial to carefully review and understand the policy terms and conditions to ensure you have the appropriate level of protection.

Factors Influencing Car Insurance Costs

The cost of car insurance can vary significantly from one policy to another, and several factors contribute to these variations. Understanding these factors can help you make informed choices to potentially reduce your insurance premiums.

Vehicle Type and Usage

The type of vehicle you drive plays a significant role in determining your insurance costs. Generally, sports cars, luxury vehicles, and high-performance vehicles are more expensive to insure due to their higher repair costs and potential for accidents. Additionally, the primary use of your vehicle can impact premiums. For example, if you use your car for business purposes or commute long distances daily, your insurance rates may be higher.

Driving History and Experience

Your driving record is a critical factor in insurance pricing. A clean driving history with no accidents or violations indicates a lower risk to the insurer and can result in more affordable premiums. Conversely, a history of accidents, especially those at fault, or moving violations can significantly increase your insurance costs.

Furthermore, your age and experience as a driver are also considered. Younger drivers, especially those under 25, often pay higher premiums due to their lack of experience on the road. As you gain years of driving experience and maintain a clean record, your insurance rates may decrease.

Location and Mileage

The geographic location where you primarily drive and park your vehicle can impact your insurance rates. Areas with higher populations, congested traffic, and a higher incidence of accidents and thefts tend to have higher insurance premiums. Additionally, the number of miles you drive annually is a factor, as higher mileage may indicate a greater risk of being involved in an accident.

Coverage and Deductibles

The level of coverage you choose and the associated deductibles can significantly affect your insurance costs. Opting for higher coverage limits and lower deductibles typically results in more expensive premiums. However, it’s essential to strike a balance between your budget and the level of protection you desire.

Discounts and Bundling

Insurance companies often offer discounts to policyholders who meet certain criteria. These discounts can include safe driver discounts, multi-policy discounts (bundling car insurance with other policies like homeowners or renters insurance), and loyalty discounts for long-term customers. Additionally, some insurers provide discounts for specific safety features or driving habits, such as anti-theft devices or low-mileage usage.

Comparing Quotes and Choosing the Right Policy

When shopping for car insurance, it’s crucial to compare quotes from multiple insurers to find the best coverage at the most competitive price. Online quote comparison tools can be a convenient way to quickly gather multiple quotes and assess the market.

However, it's essential to remember that the cheapest quote may not always be the best option. Consider the insurer's reputation, financial stability, and customer service ratings. Look for a company with a track record of prompt claims handling and positive customer experiences.

Once you've gathered a few quotes, carefully review the policy details. Ensure that the coverage limits, deductibles, and any exclusions or limitations align with your needs and expectations. It's also a good idea to reach out to the insurer's customer service department to clarify any uncertainties and get a better understanding of their claim process.

The Future of Car Insurance

The car insurance industry is continuously evolving, and several trends and advancements are shaping its future. One notable development is the rise of usage-based insurance (UBI) programs, where insurance premiums are based on real-time driving data. These programs use telematics devices or smartphone apps to track driving habits, rewarding safe drivers with lower premiums.

Additionally, the increasing adoption of autonomous vehicle technologies is likely to impact car insurance in the coming years. As self-driving cars become more prevalent, the nature of accidents and liability may shift, potentially leading to new coverage options and pricing models.

The integration of advanced driver-assistance systems (ADAS) and connected car technologies is also expected to influence insurance rates. These technologies can enhance safety and reduce the likelihood of accidents, potentially leading to lower insurance costs for policyholders.

Conclusion

Car insurance is a vital aspect of responsible vehicle ownership, offering financial protection and peace of mind. By understanding the different coverage options, the factors influencing insurance costs, and the latest industry trends, you can make informed decisions to ensure you have the right coverage at a competitive price. Remember, comparing quotes, reviewing policy details, and choosing a reputable insurer are key steps in securing the best car insurance for your needs.

Frequently Asked Questions

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. varies by state and can range from 500 to 1,500 per year. However, this is just an average, and individual rates can be significantly higher or lower depending on various factors, including the driver’s age, driving record, and the type of vehicle insured.

Can I get car insurance without a driver’s license?

+Obtaining car insurance without a valid driver’s license can be challenging but not impossible. Some insurers may offer non-driver policies, which cover the vehicle for specific purposes like storage or transportation. However, these policies often have limited coverage and higher premiums.

What is the difference between comprehensive and collision coverage?

+Comprehensive coverage provides protection against non-collision incidents, such as theft, vandalism, natural disasters, and collisions with animals. On the other hand, collision coverage specifically covers damages to your vehicle resulting from a collision with another vehicle or object, regardless of fault.

Can I switch car insurance companies mid-policy term?

+Yes, you can switch car insurance companies at any time, even mid-policy term. However, you should carefully review the terms of your existing policy to understand any potential cancellation fees or penalties. It’s also essential to ensure that your new policy provides the desired coverage and goes into effect promptly to avoid any gaps in protection.