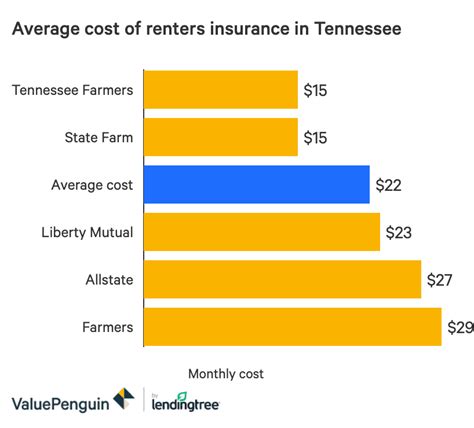

Renters Insurance Monthly Cost

Renters insurance is an essential yet often overlooked aspect of financial planning for individuals living in rented accommodations. The monthly cost of this insurance can vary significantly depending on a range of factors, including the location, coverage limits, and the insurer's policies. This comprehensive guide will delve into the factors influencing the monthly cost of renters insurance, offering a detailed analysis to help renters make informed decisions about their insurance coverage.

Understanding Renters Insurance

Renters insurance is a type of policy that provides coverage for personal belongings, liability, and additional living expenses in the event of a covered loss. Unlike homeowners insurance, which covers the structure of the home as well as its contents, renters insurance is primarily focused on the personal property and potential liabilities of the tenant.

This insurance policy is crucial for renters as it offers protection against unforeseen events like theft, fire, or natural disasters that could result in substantial financial losses. Additionally, renters insurance can provide liability coverage if a guest is injured in the rented property, offering a vital layer of protection for the tenant.

Factors Influencing Monthly Cost

Coverage Limits

The amount of coverage one chooses to purchase is a significant factor in determining the monthly cost of renters insurance. Generally, the higher the coverage limit, the more the insurance will cost. Coverage limits typically refer to the maximum amount the insurer will pay out for a covered loss. For instance, if a tenant has 20,000 worth of personal belongings and chooses a coverage limit of 15,000, they may pay a lower premium than if they opted for a $20,000 limit.

Location

The geographical location of the rented property plays a pivotal role in determining insurance costs. Areas prone to natural disasters like hurricanes, floods, or earthquakes often see higher insurance premiums. This is because insurers consider the risk of loss in these areas to be higher, thus increasing the cost of coverage. For example, renters in Florida may pay more for insurance due to the state’s susceptibility to hurricanes.

Insurer’s Policies

Each insurance company has its own policies and rates, which can significantly impact the monthly cost of renters insurance. Insurers consider a variety of factors, including the tenant’s credit score, claims history, and the type of building the tenant resides in. For instance, a tenant with a good credit score and no claims history may receive a lower premium than a tenant with a lower credit score and a history of claims.

Deductibles

The deductible is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible can lower the monthly premium, as the tenant assumes more financial responsibility in the event of a claim. Conversely, a lower deductible may result in a higher monthly premium, but it offers more financial protection in the event of a loss.

Additional Coverages

Renters insurance policies often come with optional additional coverages, such as personal liability insurance, medical payments coverage, or coverage for high-value items like jewelry or electronics. Selecting these additional coverages can increase the monthly premium, but they may provide crucial protection in specific situations.

| Coverage Type | Description | Cost Impact |

|---|---|---|

| Personal Liability | Covers legal costs and damages if you're sued for bodily injury or property damage | May increase premium |

| Medical Payments | Pays for medical expenses for injuries sustained by others on your property | May increase premium |

| High-Value Items | Provides additional coverage for expensive items like jewelry or electronics | May increase premium |

Discounts and Bundling

Insurance companies often offer discounts to renters who bundle their policies. For instance, a tenant who also has auto insurance with the same insurer may receive a discount on their renters insurance policy. Additionally, insurers may offer discounts for policyholders who have safety features like smoke detectors or security systems installed in their rented property.

Case Study: John’s Renters Insurance Experience

Let’s consider a hypothetical case study to illustrate the factors influencing renters insurance costs. John, a 30-year-old professional, recently moved into a new apartment in downtown Chicago. He decided to shop around for renters insurance to protect his belongings.

John started by obtaining quotes from three different insurers. He discovered that his coverage limits, the amount of personal property he wanted insured, significantly impacted the quotes he received. Insurer A offered a quote of $20 per month for a coverage limit of $10,000, while Insurer B quoted $25 per month for a limit of $15,000. John ultimately chose Insurer B's policy, as it provided a more comprehensive coverage limit for only a slightly higher premium.

Location also played a role in John's insurance costs. Chicago, being a large city with a history of certain types of crime, had an impact on his insurance rates. John's apartment, located in a relatively safe neighborhood, benefited from lower insurance rates compared to apartments in higher-crime areas.

John also took advantage of discounts offered by the insurers. He bundled his renters insurance with his auto insurance policy, resulting in a 10% discount on both policies. Additionally, John had installed a home security system in his apartment, which qualified him for a further 5% discount on his renters insurance.

By understanding the factors influencing renters insurance costs and shopping around for the best rates, John was able to secure comprehensive coverage at a reasonable monthly cost.

Tips for Choosing Renters Insurance

When selecting renters insurance, it’s important to consider the following tips to ensure you’re getting the best value for your money:

- Understand Your Coverage Needs: Assess the value of your personal belongings and choose a coverage limit that adequately protects your assets.

- Compare Multiple Quotes: Obtain quotes from different insurers to ensure you're getting a competitive rate.

- Consider Bundling: If you have other insurance policies, such as auto insurance, consider bundling them to potentially save on your renters insurance premium.

- Review Your Policy Regularly: Life circumstances and the value of your belongings can change over time. Regularly review your policy to ensure your coverage limits and deductibles are still appropriate.

- Shop Around for the Best Deductible: A higher deductible can lower your premium, but ensure it's an amount you're comfortable paying out of pocket in the event of a claim.

The Future of Renters Insurance

The renters insurance market is continually evolving, with insurers adopting new technologies and strategies to better serve their customers. One notable trend is the increasing availability of digital tools and platforms that allow renters to quickly and easily obtain quotes, manage their policies, and file claims.

Additionally, insurers are leveraging data analytics and machine learning to more accurately assess risk and set premiums. This can result in more personalized insurance rates for renters, taking into account factors such as the specific location and security features of their rented property.

As the housing market continues to evolve, with more people opting for rented accommodations, the demand for renters insurance is likely to increase. Insurers will need to adapt their offerings to meet the changing needs of this growing market, potentially leading to more comprehensive coverage options and innovative policy features.

Conclusion

Renters insurance is a vital financial protection for individuals living in rented accommodations. By understanding the factors that influence the monthly cost of this insurance, renters can make informed decisions about their coverage, ensuring they have adequate protection at a reasonable price. As the renters insurance market continues to evolve, it’s important for renters to stay informed about the latest trends and offerings to make the best choices for their insurance needs.

How much does renters insurance typically cost per month?

+The monthly cost of renters insurance can vary widely, but on average, it ranges from 15 to 30 per month. However, this can be influenced by various factors, including coverage limits, location, and additional coverages.

Are there any ways to lower the cost of renters insurance?

+Yes, there are several strategies to reduce the cost of renters insurance. These include choosing a higher deductible, bundling policies with the same insurer, and taking advantage of discounts for safety features like smoke detectors or security systems.

What is covered under a typical renters insurance policy?

+A standard renters insurance policy typically covers personal property (like furniture, clothing, and electronics), liability (if someone is injured on your property), and additional living expenses (if your rental becomes uninhabitable due to a covered loss). Additional coverages for high-value items or medical payments may be available for an extra cost.