Renters Insurance Prices Per Month

Renters insurance is a vital yet often overlooked aspect of financial planning for tenants across the globe. It provides essential protection for individuals and families who rent their homes, safeguarding them from unexpected financial burdens arising from various risks and perils. The cost of this insurance can vary significantly depending on several factors, and understanding these can help renters make informed decisions about their coverage.

In this comprehensive guide, we delve into the intricacies of renters insurance prices per month, exploring the key determinants, offering insights into average costs, and providing strategies to secure the best value for your money. Whether you're a seasoned renter or new to the world of insurance, this article aims to equip you with the knowledge to navigate the market effectively and ensure you're adequately protected.

Understanding the Factors Influencing Renters Insurance Costs

The price of renters insurance is influenced by a myriad of factors, each playing a role in determining the final cost. These factors are unique to every renter and can significantly impact the insurance premium.

Coverage Amount and Deductible

The coverage amount you choose directly affects your premium. Higher coverage limits for personal property, liability, and additional living expenses will generally result in a higher monthly premium. Conversely, opting for a higher deductible (the amount you pay out of pocket before your insurance kicks in) can lower your monthly payments.

For instance, if you decide to insure your personal belongings for $50,000 with a $500 deductible, your monthly premium will likely be higher than if you insured the same belongings for $30,000 with a $1,000 deductible. It's a delicate balance between the coverage you need and the cost you can afford.

Location and Risk Factors

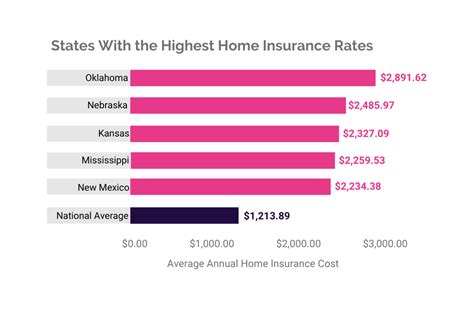

Where you live can significantly impact your renters insurance premium. Insurance companies assess the potential risks associated with different locations, including crime rates, weather conditions, and the proximity to fire stations and hydrants. Areas with higher crime rates or frequent natural disasters are generally more expensive to insure.

Consider a renter living in a coastal area prone to hurricanes. Their insurance premium would likely be higher compared to someone in a landlocked state due to the increased risk of property damage from natural disasters.

Type of Building and Security Features

The type of building you rent can also influence your insurance cost. For example, a single-family home may offer more privacy and security than an apartment building, potentially leading to a lower premium. Additionally, the presence of security features such as smoke detectors, fire sprinklers, and security systems can reduce the risk of loss and therefore lower your insurance costs.

Credit History and Claims History

Insurance companies often consider your credit score when determining your premium. A good credit history can lead to lower insurance rates, as it indicates a level of financial responsibility. Similarly, a history of frequent claims can signal higher risk to the insurer, potentially resulting in increased premiums.

Policy Discounts and Bundles

Insurance companies often offer discounts and bundles to attract customers. For instance, you might receive a discount for purchasing your renters insurance policy from the same company that insures your car. Additionally, discounts are often available for senior citizens, military personnel, and members of certain professional organizations.

Average Monthly Renters Insurance Costs

The average monthly cost of renters insurance varies significantly based on geographic location and the level of coverage chosen. According to a recent survey, the national average monthly premium for renters insurance is around 15 to 30. However, it’s essential to note that this average can be quite misleading, as the cost of renters insurance can range from as low as 5 to over 50 per month.

| Coverage Level | Average Monthly Premium |

|---|---|

| Basic Coverage | $10 - $20 |

| Standard Coverage | $20 - $30 |

| Comprehensive Coverage | $30 - $50 |

It's crucial to remember that these averages are just a guide. Your specific premium will depend on the factors discussed earlier, as well as the insurance company you choose and any additional coverage options you select.

Regional Variations

Renters insurance costs can vary significantly across different regions. For example, renters in high-cost-of-living areas may pay more for insurance due to the higher value of their possessions and the increased risk of theft or damage. On the other hand, renters in rural areas may enjoy lower premiums due to reduced risk factors.

Coverage Level Variations

The level of coverage you choose will also impact your monthly premium. Basic coverage, which typically includes personal property and liability protection, will generally be the most affordable option. Standard coverage, which might include additional living expenses and higher liability limits, will cost more. Comprehensive coverage, offering the highest level of protection including replacement cost coverage for personal belongings, will be the most expensive option.

Strategies to Get the Best Renters Insurance Deal

Finding the best renters insurance deal requires a combination of research, understanding your needs, and negotiating with insurance providers. Here are some strategies to help you get the best value for your money.

Compare Multiple Quotes

Obtaining multiple quotes is essential to finding the best deal. Compare prices and coverage options from at least three different insurance companies to ensure you’re getting a competitive rate. Online comparison tools can be a great starting point, but don’t forget to also get quotes from local insurers who may offer better rates for your specific location.

Bundle Your Policies

Bundling your renters insurance with other policies, such as auto insurance, can often lead to significant savings. Many insurance companies offer multi-policy discounts, so it’s worth inquiring about these when you’re shopping around.

Understand Your Coverage Needs

Before you start shopping for renters insurance, take the time to understand your coverage needs. Consider the value of your personal belongings, the level of liability protection you require, and any additional coverages that might be beneficial (e.g., identity theft protection, water backup coverage, etc.). Knowing what you need will help you avoid overpaying for coverage you don’t require.

Choose a Higher Deductible

Opting for a higher deductible can lower your monthly premium. However, it’s important to choose a deductible amount that you can afford to pay out of pocket if needed. A higher deductible means you’ll pay more if you need to make a claim, but it can significantly reduce your monthly insurance costs.

Shop Around Regularly

Renters insurance rates can change over time, so it’s a good idea to shop around for new quotes annually or whenever your circumstances change significantly (e.g., moving to a new location, getting married, etc.). Regularly reviewing your insurance needs and comparing rates can help ensure you’re always getting the best deal.

Take Advantage of Discounts

Insurance companies often offer a variety of discounts, including those for seniors, military personnel, homeowners, and more. Be sure to inquire about all applicable discounts when you’re getting quotes. You might also consider taking advantage of loyalty discounts by staying with the same insurer for multiple years.

Common Misconceptions About Renters Insurance Costs

There are several common misconceptions about renters insurance costs that can lead to misinformation and poor decision-making. Understanding these misconceptions can help renters make more informed choices about their insurance coverage.

Renters Insurance is Always Expensive

One of the most common misconceptions is that renters insurance is always expensive. While it’s true that insurance can add to your monthly expenses, the cost of renters insurance is often much lower than people expect. As we’ve seen, the average monthly premium for renters insurance is around 15 to 30, and it can be even lower with the right coverage choices and discounts.

Renters Insurance is Unnecessary

Another misconception is that renters insurance is unnecessary. Some renters mistakenly believe that their landlord’s insurance policy will cover their personal belongings in the event of a loss. However, this is not the case. Landlord insurance typically covers the building and its structures, but not the personal belongings of tenants. Renters insurance is essential to protect your belongings and provide liability coverage in case of accidents.

All Renters Insurance Policies are the Same

There’s a misconception that all renters insurance policies offer the same coverage. In reality, renters insurance policies can vary significantly in terms of coverage, exclusions, and add-ons. It’s crucial to review the policy details and understand what’s included and what’s not to ensure you’re getting the coverage you need.

Renters Insurance is Only for High-Value Items

Some renters believe that renters insurance is only necessary if they have high-value items, such as expensive jewelry or artwork. While it’s true that renters insurance can provide valuable protection for high-value items, it’s also important to insure your everyday items. Even if you don’t have many high-value possessions, renters insurance can still provide crucial protection against unexpected events like theft, fire, or water damage.

The Future of Renters Insurance: Technological Advancements and Emerging Trends

The renters insurance landscape is evolving, driven by technological advancements and changing consumer preferences. Here are some key trends that are shaping the future of renters insurance.

Digital Transformation

The insurance industry is undergoing a digital transformation, with more insurers offering online and mobile tools for policy management and claims filing. This shift towards digital services is making it easier and more convenient for renters to manage their insurance, leading to increased accessibility and potentially lower costs.

Data Analytics and Risk Assessment

Advanced data analytics are allowing insurers to more accurately assess risk and price policies. By leveraging data on a variety of factors, including crime rates, weather patterns, and even social media activity, insurers can better understand the risks faced by renters and price policies accordingly. This can lead to more accurate pricing and potentially lower premiums for renters in lower-risk areas.

Personalized Coverage

With the availability of more data and advanced analytics, insurers are increasingly able to offer personalized coverage options. This means renters can choose coverage that fits their specific needs and circumstances, rather than opting for a one-size-fits-all policy. Personalized coverage can lead to more efficient use of insurance resources and potentially lower premiums for renters who don’t require extensive coverage.

Emerging Technologies and Risks

The rise of new technologies, such as smart home devices and autonomous vehicles, is creating new risks and opportunities for renters insurance. For example, smart home devices can help reduce the risk of certain types of losses, potentially leading to lower premiums. On the other hand, the increasing use of autonomous vehicles could lead to new liability risks for renters, potentially impacting insurance costs.

Sustainability and Environmental Risks

With growing awareness of environmental issues, insurers are beginning to consider the impact of climate change and natural disasters on renters insurance. This includes the potential for more frequent and severe weather events, as well as the risk of property damage from rising sea levels and other environmental factors. As insurers adapt to these changing risks, renters may see changes in coverage options and pricing.

Conclusion: The Importance of Renters Insurance

Renters insurance is an essential aspect of financial planning for tenants, providing protection against unexpected losses and liability risks. While the cost of renters insurance can vary widely based on a variety of factors, understanding these factors and taking advantage of available discounts and strategies can help renters secure the best value for their money.

As the insurance landscape continues to evolve, staying informed about emerging trends and technological advancements can help renters make more informed choices about their coverage. By understanding the latest developments and keeping up with changes in the market, renters can ensure they're getting the protection they need at a price they can afford.

In conclusion, renters insurance is a vital investment for tenants, offering peace of mind and financial protection. By being proactive and informed about their insurance options, renters can ensure they're adequately protected and prepared for whatever the future may bring.

What is the average monthly cost of renters insurance?

+The average monthly cost of renters insurance can vary widely depending on factors such as location, coverage level, and personal circumstances. However, the national average monthly premium for renters insurance is around 15 to 30. It’s important to note that this is just an average, and your specific premium may be higher or lower depending on your unique situation.

How can I reduce the cost of my renters insurance?

+There are several strategies you can use to reduce the cost of your renters insurance. These include comparing quotes from multiple insurers, bundling your renters insurance with other policies (such as auto insurance), choosing a higher deductible, and taking advantage of available discounts. Additionally, understanding your coverage needs and only purchasing the coverage you require can help keep costs down.

What factors influence the cost of renters insurance?

+The cost of renters insurance is influenced by a variety of factors, including the coverage amount and deductible you choose, your location and the associated risk factors, the type of building you rent, your credit history and claims history, and any policy discounts or bundles you’re eligible for. Each of these factors can impact your premium, so it’s important to understand how they apply to your specific situation.

Related Terms:

- Lemonade renters insurance

- State Farm renters insurance

- GEICO renters insurance