Residential Insurance Quotes

Securing comprehensive residential insurance is a crucial aspect of safeguarding your home and possessions. Understanding the factors that influence insurance quotes is essential for homeowners seeking adequate coverage at an affordable rate. This comprehensive guide will delve into the intricacies of residential insurance quotes, shedding light on the key considerations and strategies to obtain the best coverage for your specific needs.

Understanding Residential Insurance Quotes

Residential insurance quotes are tailored estimates provided by insurance companies to protect homeowners from various risks. These quotes are influenced by a multitude of factors, each playing a pivotal role in determining the overall cost of coverage. From the location of your home to its construction and the specific risks it faces, every detail is taken into account when calculating insurance quotes.

Location and Its Impact

The geographic location of your home is a significant determinant in insurance quotes. Areas prone to natural disasters like hurricanes, earthquakes, or floods typically incur higher insurance costs. For instance, homes in regions frequently affected by wildfires or tornadoes may face steeper premiums to account for the increased risk.

| Region | Average Annual Premium |

|---|---|

| Hurricane-prone Coastal Areas | $1,500 - $3,000 |

| Tornado-prone Midwest | $1,200 - $2,500 |

| Flood-prone Low-lying Areas | $1,000 - $2,800 |

Additionally, crime rates and the proximity to fire stations can also influence insurance costs. Homes in safer neighborhoods with quicker emergency response times may enjoy more competitive rates.

Home Construction and Age

The construction and age of your home are other critical factors in insurance quotes. Older homes, especially those with outdated electrical or plumbing systems, may pose a higher risk of fire or water damage, leading to increased insurance costs.

| Home Age | Average Annual Premium |

|---|---|

| New Construction (0-5 years) | $800 - $1,200 |

| Moderately Aged (10-20 years) | $1,000 - $1,500 |

| Aged Homes (30+ years) | $1,200 - $2,000 |

The materials used in construction also play a role. Homes built with brick or concrete may offer better resistance to fire and wind damage, potentially resulting in lower insurance premiums.

Coverage Options and Deductibles

The coverage options you choose and the deductibles you select significantly impact your insurance quotes. Opting for higher coverage limits and lower deductibles can provide more comprehensive protection but may result in higher premiums.

| Coverage Type | Average Premium Increase |

|---|---|

| Increased Dwelling Coverage | +5% - +15% |

| Personal Property Coverage | +3% - +8% |

| Liability Coverage | +2% - +10% |

Additionally, certain optional coverages like flood or earthquake insurance can dramatically increase your premium. It's crucial to carefully consider your specific needs and the risks you want to mitigate when selecting coverage options.

Claims History and Credit Score

Your insurance claims history and credit score can also influence your insurance quotes. A history of frequent claims, even if they’re small, may raise red flags for insurance companies, potentially leading to higher premiums or even non-renewal of your policy.

Similarly, a poor credit score can be a red flag for insurance providers, as it may indicate a higher risk of filing claims. Improving your credit score can, therefore, be a strategic move to potentially reduce your insurance costs.

Tips for Securing the Best Residential Insurance Quotes

Obtaining the most favorable residential insurance quotes requires a strategic approach. Here are some expert tips to guide you in the process:

Shop Around and Compare Quotes

Residential insurance quotes can vary significantly between providers. Take the time to request quotes from multiple insurance companies to ensure you’re getting the most competitive rates for your specific circumstances.

Bundle Your Policies

Bundling your home and auto insurance policies with the same provider can often result in substantial savings. Many insurance companies offer multi-policy discounts, making it a financially wise decision to explore this option.

Improve Your Home’s Safety Features

Investing in safety features like smoke detectors, fire sprinklers, burglar alarms, or even storm shutters can make your home a safer environment and potentially reduce your insurance premiums. These features demonstrate a reduced risk of incidents, which can be appealing to insurance providers.

Review and Adjust Your Coverage Regularly

Your insurance needs may change over time. Regularly review your coverage to ensure it aligns with your current circumstances. Consider increasing your coverage limits or adding new coverages as your assets or risks change. Conversely, if your home’s value decreases or you’ve made significant upgrades to its safety features, you may be able to reduce your coverage and save on premiums.

Maintain a Clean Claims History

Avoiding unnecessary claims can help keep your insurance costs down. While it’s important to file claims for significant losses, smaller incidents may be better handled out of pocket to avoid potential premium increases or non-renewal of your policy.

The Future of Residential Insurance Quotes

The residential insurance industry is continuously evolving, driven by advancements in technology and changing consumer expectations. Here’s a glimpse into the future of residential insurance quotes and what homeowners can expect in the coming years.

Data-Driven Insurance

Insurance companies are increasingly leveraging data analytics to refine their risk assessment processes. This shift towards data-driven insurance allows providers to offer more accurate and personalized quotes based on real-time data and analytics. As a result, homeowners can expect more precise and competitive quotes tailored to their specific circumstances.

Digital Transformation

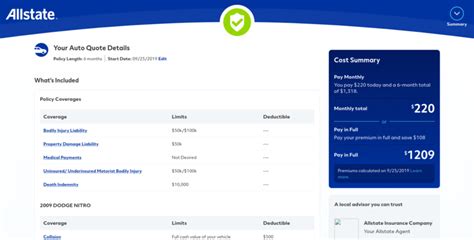

The digital revolution has transformed the insurance industry, with online platforms and mobile apps offering streamlined quote comparisons and policy management. Homeowners can now obtain multiple quotes in a matter of minutes, compare coverage options side-by-side, and make informed decisions from the comfort of their homes.

Telematics and Usage-Based Insurance

Telematics technology, which tracks and analyzes driving behavior, is already being used in auto insurance. This technology is now being explored for residential insurance, particularly in the context of home security. By installing smart sensors and devices, insurance companies can monitor home safety and security in real-time, offering discounts to homeowners who maintain a high level of security.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are set to revolutionize the insurance industry. These technologies can analyze vast amounts of data, identify patterns, and make predictions with remarkable accuracy. In the context of residential insurance, AI and ML can enhance risk assessment, fraud detection, and claims processing, leading to more efficient and accurate quote generation.

Personalized Insurance

The future of residential insurance quotes lies in personalization. Insurance companies are increasingly recognizing the importance of catering to individual customer needs. By leveraging data analytics and advanced technologies, providers can offer tailored coverage options and competitive quotes that align perfectly with each homeowner’s unique circumstances and preferences.

Conclusion

Obtaining the right residential insurance coverage at an affordable rate is a complex but essential process. By understanding the factors that influence insurance quotes and adopting a strategic approach, homeowners can navigate the market with confidence. The future of residential insurance quotes is promising, with advancements in technology and data analytics poised to revolutionize the industry, offering more accurate, personalized, and competitive quotes to homeowners.

What is the average cost of residential insurance?

+The average cost of residential insurance can vary significantly depending on various factors such as location, home value, coverage options, and deductibles. As a rough estimate, the average annual premium for homeowners’ insurance in the United States is around $1,200. However, it’s crucial to obtain personalized quotes to understand the exact cost for your specific circumstances.

How often should I review my residential insurance policy?

+It’s recommended to review your residential insurance policy at least once a year. This allows you to ensure that your coverage is still adequate and that you’re not paying for unnecessary coverages. Additionally, reviewing your policy annually gives you the opportunity to take advantage of any discounts or promotions that your insurance provider may be offering.

Can I negotiate my residential insurance premium?

+While insurance premiums are primarily determined by factors such as location, home value, and coverage options, there are some instances where you may be able to negotiate your premium. For example, if you have a long history with the insurance company and a clean claims record, you may have some leverage to negotiate a lower rate. It’s always worth inquiring about potential discounts or asking for a review of your policy to see if any adjustments can be made.

What are some common discounts available for residential insurance?

+Insurance companies often offer a variety of discounts to attract and retain customers. Some common discounts for residential insurance include multi-policy discounts (bundling home and auto insurance), safety feature discounts (for homes with smoke detectors, burglar alarms, etc.), loyalty discounts (for long-term customers), and claim-free discounts (for homeowners with no recent claims). It’s worth inquiring with your insurance provider about the specific discounts they offer.