Retired Military Insurance

For those who have proudly served in the military, planning for retirement involves unique considerations, especially when it comes to insurance. Understanding the intricacies of retired military insurance is crucial to ensuring a secure and comfortable future. This comprehensive guide aims to unravel the complexities, providing you with expert insights and practical steps to navigate the insurance landscape post-military service.

Understanding the Basics

Retired military insurance encompasses a range of coverage options tailored to meet the specific needs of veterans and their families. These policies are designed to provide financial protection and peace of mind, covering various aspects of life after active duty. Let’s delve into the key components and considerations.

Life Insurance for Veterans

One of the primary concerns for retired military personnel is ensuring adequate life insurance coverage. This type of insurance serves as a safety net for your loved ones, providing financial support in the event of your passing. There are several options available, including:

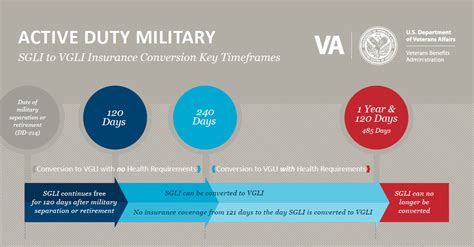

Service-Related Life Insurance: Offered through the Department of Veterans Affairs (VA), this insurance is specifically designed for veterans and their families. It provides a death benefit to eligible beneficiaries and can be a cost-effective option for those with service-related needs.

Term Life Insurance: A popular choice for many, term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years. It is ideal for those seeking temporary protection, such as covering mortgage payments or providing for dependents during their formative years.

Permanent Life Insurance: Unlike term insurance, permanent life insurance offers lifelong coverage, often with an added cash value component. This option is suitable for those seeking long-term financial protection and potential tax advantages.

Health Insurance Coverage

Maintaining comprehensive health insurance is essential for retired military personnel. The VA offers various healthcare programs tailored to veterans’ needs, including:

VA Healthcare: Eligible veterans can access a range of medical services through the VA healthcare system, which includes primary care, specialty care, mental health services, and more. Understanding your eligibility and the benefits offered is crucial for optimal healthcare coverage.

TRICARE for Life (TFL): TFL is a valuable health insurance option for Medicare-eligible retirees and their families. It complements Medicare coverage, ensuring that retirees have access to a comprehensive healthcare plan.

Supplemental Health Insurance: Depending on your specific needs, considering supplemental health insurance can provide additional coverage for services not covered by traditional plans. This may include dental, vision, or long-term care insurance.

Navigating the Process

Understanding the available insurance options is the first step; the next is navigating the process of securing the right coverage. Here are some key steps to guide you:

Step 1: Assess Your Needs

Begin by evaluating your unique circumstances and insurance requirements. Consider factors such as your age, health status, financial goals, and the needs of your dependents. This assessment will help you determine the type and level of coverage you require.

Step 2: Research Available Options

Explore the various insurance providers and policies available to retired military personnel. Compare benefits, premiums, and coverage limits to find the best fit for your needs. Don’t hesitate to seek advice from financial advisors or insurance brokers with expertise in military insurance.

Step 3: Utilize VA Benefits

Take advantage of the benefits offered by the VA. Understand your eligibility for VA healthcare and explore the different programs available. The VA provides valuable resources and support to help veterans navigate the healthcare system and access the care they need.

Step 4: Consider Group Plans

Retired military personnel often have access to group insurance plans, which can offer cost-effective coverage. These plans are typically provided through veteran service organizations or military-affiliated associations. Research and compare these options to find the most suitable plan for your situation.

Real-Life Examples and Success Stories

Understanding the impact of retired military insurance can be best illustrated through real-life stories. Let’s explore a few examples:

Story 1: John’s Service-Related Coverage

John, a retired veteran, utilized his service-related life insurance to provide financial stability for his family. After his passing, his wife received the death benefit, which allowed her to pay off their mortgage and cover the costs of their children’s education. John’s insurance ensured his family’s future was secure, even in his absence.

Story 2: Sarah’s Comprehensive Healthcare

Sarah, a retired military nurse, relied on VA healthcare for her medical needs. Through the VA system, she accessed specialized care for her service-related injuries and received ongoing support for her mental health. The comprehensive coverage and personalized care ensured Sarah’s well-being post-retirement.

Story 3: David’s Group Insurance Plan

David, a retired air force officer, opted for a group insurance plan offered by a veteran service organization. This plan provided him with affordable life and health insurance coverage, ensuring he could maintain his desired lifestyle without financial strain. The group plan’s collective buying power made it an attractive option.

Expert Insights and Recommendations

As an industry expert with extensive knowledge of retired military insurance, here are some key insights and recommendations:

Prioritize Comprehensive Coverage: Ensure you have adequate life and health insurance coverage to protect your family and maintain your quality of life. Consider your specific needs and tailor your insurance plans accordingly.

Utilize VA Resources: Take full advantage of the benefits and resources offered by the VA. From healthcare to disability compensation, the VA provides a comprehensive support system for veterans. Stay informed about your eligibility and explore all available options.

Regularly Review and Update: Insurance needs can change over time. Regularly review your coverage and make adjustments as necessary. Life events such as marriage, the birth of children, or changes in health status may require updates to your insurance plans.

Seek Professional Guidance: Consult with financial advisors or insurance brokers who specialize in military insurance. Their expertise can help you navigate the complex insurance landscape and make informed decisions tailored to your unique circumstances.

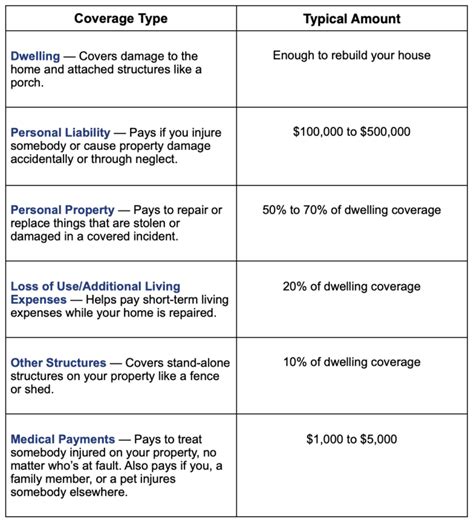

Table: A Comparison of Insurance Options

| Insurance Type | Key Features | Coverage Period | Cost |

|---|---|---|---|

| Service-Related Life Insurance | Designed for veterans and their families | N/A | Varies |

| Term Life Insurance | Temporary coverage, ideal for specific needs | 10-30 years | Affordable |

| Permanent Life Insurance | Lifelong coverage with potential cash value | Lifelong | Higher cost |

| VA Healthcare | Comprehensive medical services for eligible veterans | Lifelong | Varies based on eligibility |

| TRICARE for Life (TFL) | Complements Medicare for retirees | Lifelong | Varies based on plan |

| Supplemental Health Insurance | Covers additional services not included in main plans | Varies | Additional cost |

Frequently Asked Questions (FAQs)

How do I determine my eligibility for VA healthcare benefits?

+Determining your eligibility for VA healthcare benefits involves assessing various factors, including your military service history, disability status, and income level. The VA has specific guidelines and criteria to determine eligibility. It's recommended to visit the VA's official website or consult with a VA benefits counselor for a comprehensive evaluation of your eligibility.

Can I purchase life insurance through the VA?

+Yes, the VA offers life insurance specifically designed for veterans and their families. This insurance, known as Service-Related Life Insurance, provides death benefits to eligible beneficiaries. It is a valuable option for veterans seeking affordable and tailored coverage.

What are the advantages of group insurance plans for retired military personnel?

+Group insurance plans offer several advantages, including collective buying power, which often results in more affordable premiums. These plans are typically offered through veteran service organizations or military-affiliated associations, providing retired military personnel with access to comprehensive coverage at a lower cost.

As you plan for your retirement, remember that insurance is a vital component of financial security. By understanding the available options and taking proactive steps, you can ensure a bright and secure future for yourself and your loved ones. Stay informed, seek expert advice, and make informed decisions to navigate the retired military insurance landscape with confidence.