Retirement Insurance Companies

Retirement planning is a crucial aspect of financial management, and it often involves making informed decisions about insurance coverage. As individuals approach their retirement years, ensuring adequate financial protection becomes paramount. This comprehensive guide delves into the world of retirement insurance companies, exploring their role, the products they offer, and the factors to consider when choosing the right provider for your retirement needs.

The Role of Retirement Insurance Companies

Retirement insurance companies play a vital role in safeguarding individuals’ financial well-being during their golden years. These specialized entities offer a range of insurance products tailored to meet the unique needs of retirees and those approaching retirement age. By understanding the role of these companies and the products they provide, individuals can make more informed choices to secure their financial future.

Retirement insurance companies primarily focus on offering financial protection and risk management solutions for retirees and pre-retirees. They provide a safety net against unforeseen circumstances, such as medical emergencies, long-term care needs, or unexpected expenses, which can significantly impact an individual's retirement plans.

Key Products Offered by Retirement Insurance Companies

Retirement insurance companies offer a diverse range of products to cater to the varying needs of their clients. Here are some of the key insurance offerings:

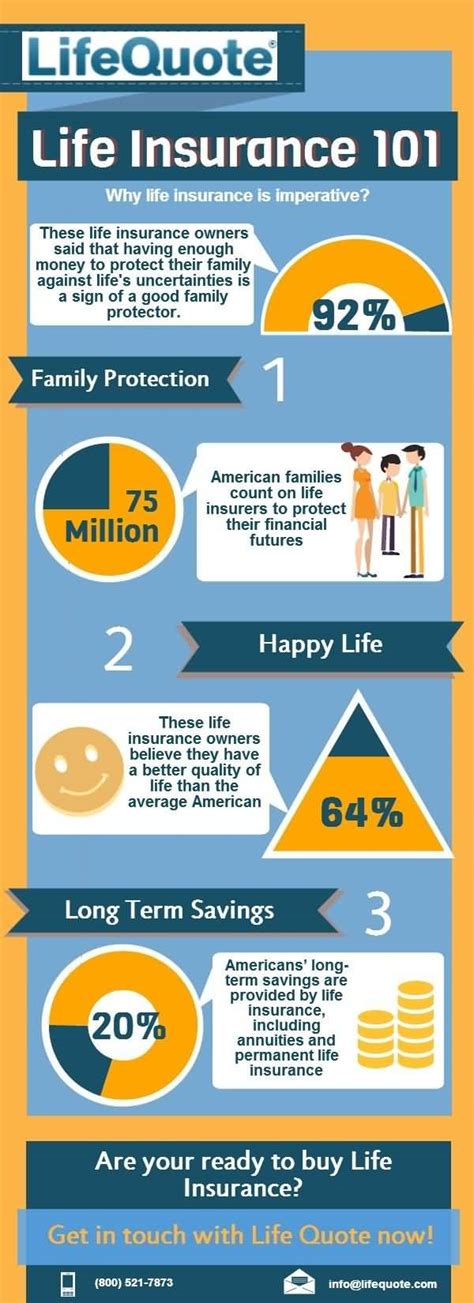

- Annuities: Annuities are a popular retirement planning tool that provides a guaranteed income stream for life or a specified period. They offer stability and peace of mind by ensuring a regular income, making them an attractive option for retirees seeking financial security.

- Life Insurance for Retirees: Life insurance policies designed specifically for retirees offer financial protection to beneficiaries in the event of the policyholder's passing. These policies often provide flexibility, allowing retirees to tailor coverage to their unique needs and budgets.

- Long-Term Care Insurance: As individuals age, the need for long-term care becomes a significant concern. Long-term care insurance policies cover the costs associated with assisted living, nursing home care, or in-home care, ensuring that retirees can access the necessary care without depleting their savings.

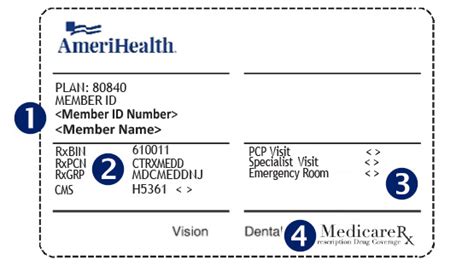

- Medicare Supplement Insurance (Medigap): For retirees enrolled in Medicare, Medigap policies fill the gaps left by original Medicare coverage. They cover additional expenses, such as copayments, deductibles, and other out-of-pocket costs, providing comprehensive healthcare coverage during retirement.

- Retirement Health Insurance: Retirement health insurance plans offer comprehensive medical coverage tailored to the needs of retirees. These plans often include prescription drug coverage, preventive care, and access to a network of healthcare providers, ensuring retirees can maintain their health and well-being.

Factors to Consider When Choosing a Retirement Insurance Company

Selecting the right retirement insurance company is a critical decision that can impact your financial security during retirement. Here are some key factors to evaluate when choosing a provider:

Financial Strength and Stability

The financial stability of the insurance company is paramount. Assess the company’s financial health by evaluating its credit ratings, solvency ratios, and overall financial performance. Opt for companies with strong financial ratings, ensuring they can honor their commitments and provide long-term stability.

Product Offerings and Customization

Evaluate the range of products offered by the insurance company. Look for providers that offer a comprehensive suite of retirement-focused insurance solutions, including annuities, life insurance, long-term care insurance, and health insurance. Customization options are also essential, allowing you to tailor the coverage to your specific needs and preferences.

Customer Service and Reputation

The quality of customer service is a critical aspect of your retirement insurance experience. Assess the company’s reputation by reading reviews, seeking recommendations, and researching their track record. Opt for companies known for their excellent customer service, prompt claim processing, and transparent communication.

Cost and Value

While cost is an important consideration, it’s crucial to evaluate the value offered by the insurance company. Compare premiums, benefits, and coverage limits across different providers. Look for companies that provide competitive pricing without compromising on the quality of coverage. Consider the long-term value and potential returns on your investment.

Flexibility and Adaptability

Retirement plans and needs can evolve over time. Choose an insurance company that offers flexible policies and the ability to adjust coverage as your circumstances change. This adaptability ensures that your insurance remains relevant and aligned with your retirement goals throughout your golden years.

Company History and Expertise

The longevity and expertise of the retirement insurance company are valuable indicators of their reliability. Assess the company’s history, focusing on their experience in the retirement insurance market. Choose providers with a proven track record of success and a deep understanding of the unique challenges and opportunities faced by retirees.

| Metric | Evaluation Criteria |

|---|---|

| Financial Strength | Assess credit ratings, solvency ratios, and financial stability. |

| Product Offerings | Evaluate the range of retirement-focused insurance solutions. |

| Customer Service | Research reputation, reviews, and claim processing efficiency. |

| Cost and Value | Compare premiums, benefits, and long-term value. |

| Flexibility | Look for adaptable policies that can evolve with your needs. |

| Company History | Consider longevity and expertise in the retirement insurance market. |

The Future of Retirement Insurance

The retirement insurance landscape is evolving, driven by changing demographics, advancements in healthcare, and shifting economic conditions. Here’s a glimpse into the future of retirement insurance and the trends shaping the industry:

Personalized Retirement Planning

The future of retirement insurance lies in personalized planning. Insurance companies are increasingly leveraging technology and data analytics to offer tailored solutions. By analyzing individual risk profiles, financial goals, and lifestyle factors, providers can create customized insurance packages that meet the unique needs of each retiree.

Digital Transformation

The digital revolution is transforming the retirement insurance industry. Insurtech companies are disrupting traditional models by offering innovative digital solutions. From online policy management and claim submission to AI-powered risk assessment, digital platforms enhance convenience, efficiency, and accessibility for retirees.

Longevity and Health Management

With increasing life expectancies, retirement insurance companies are focusing on longevity and health management. This includes offering incentives for healthy lifestyle choices, providing access to wellness programs, and integrating telemedicine services. By promoting healthy aging, insurance providers can mitigate risks and improve overall well-being during retirement.

Social and Environmental Considerations

The future of retirement insurance is also influenced by social and environmental factors. Companies are increasingly recognizing the importance of sustainable practices and social responsibility. This includes offering eco-friendly insurance options, supporting community initiatives, and promoting financial literacy to empower retirees to make informed choices.

Emerging Technologies

Emerging technologies, such as blockchain and artificial intelligence, are poised to revolutionize the retirement insurance industry. Blockchain technology can enhance security, transparency, and data management, while AI-powered analytics can improve risk assessment and personalized recommendations. These technologies promise greater efficiency, accuracy, and customization in retirement planning.

Collaboration and Partnerships

Collaboration between retirement insurance companies, financial institutions, and healthcare providers is becoming more common. These partnerships aim to create holistic retirement solutions that address financial, medical, and lifestyle needs. By working together, these entities can offer comprehensive coverage and seamless integration of services, benefiting retirees.

Regulatory Changes and Consumer Protection

The retirement insurance industry is subject to regulatory oversight to protect consumers. As the industry evolves, regulators are focusing on enhancing consumer protection measures. This includes stricter guidelines for product disclosure, improved dispute resolution mechanisms, and enhanced oversight of insurance companies’ practices.

Global Retirement Trends

The retirement landscape is diverse across different regions and countries. Global retirement trends, such as increasing retirement ages, changing pension systems, and varying healthcare models, influence the retirement insurance industry. Insurance companies must adapt their offerings to cater to the unique needs of retirees in different markets.

Education and Financial Literacy

Financial literacy plays a crucial role in retirement planning. Insurance companies are recognizing the importance of empowering retirees with financial knowledge. Educational initiatives, workshops, and online resources are being developed to help retirees understand their insurance options, make informed decisions, and navigate the complexities of retirement planning.

What is the difference between a retirement insurance company and a regular insurance company?

+Retirement insurance companies specialize in offering insurance products tailored to the unique needs of retirees and pre-retirees. They focus on providing financial protection and risk management solutions specifically for retirement planning. Regular insurance companies, on the other hand, offer a broader range of insurance products catering to various life stages and needs, including auto, home, and life insurance.

How do I choose the right retirement insurance company for my needs?

+When selecting a retirement insurance company, consider factors such as financial stability, product offerings, customer service reputation, cost, and flexibility. Assess their financial health, evaluate their range of retirement-focused insurance solutions, and ensure they provide personalized guidance and support. Seek recommendations, compare options, and consult with financial advisors to make an informed decision.

Are retirement insurance products affordable for everyone?

+Retirement insurance products can vary in affordability depending on the coverage and benefits offered. While some policies may have higher premiums, it’s essential to evaluate the long-term value and potential returns. Consider your financial goals, budget, and the level of protection you require. Consulting with an insurance professional can help you find options that align with your financial capabilities.

Can I switch retirement insurance companies if I’m not satisfied with my current provider?

+Yes, you have the option to switch retirement insurance companies if you’re not satisfied with your current provider. Assess your reasons for dissatisfaction, such as inadequate coverage, poor customer service, or financial instability. Research and compare alternative providers, considering factors like financial strength, product offerings, and customer reviews. Consult with a financial advisor to ensure a smooth transition and avoid any potential pitfalls.

What should I look for in a retirement insurance policy to ensure comprehensive coverage?

+When evaluating retirement insurance policies, look for comprehensive coverage that addresses your specific needs. Consider factors such as annuity options for guaranteed income, life insurance for financial protection, long-term care insurance for healthcare costs, and retirement health insurance for comprehensive medical coverage. Assess the policy’s flexibility, customization options, and the potential for future adjustments to ensure it aligns with your changing retirement goals.