Safty Insurance

Welcome to this in-depth exploration of the world of safety insurance, a critical yet often overlooked aspect of modern life. In today's fast-paced and ever-changing world, safety is a paramount concern for individuals, businesses, and communities alike. From safeguarding our personal health and well-being to protecting our assets and livelihoods, the importance of safety insurance cannot be overstated. This article aims to delve into the intricacies of safety insurance, shedding light on its various forms, benefits, and real-world applications.

Safety insurance is a broad term encompassing a range of policies and coverages designed to mitigate risks and provide financial protection against potential losses. Whether it's ensuring the security of your home, safeguarding your business operations, or protecting your health and that of your loved ones, safety insurance plays a crucial role in our lives. By understanding the different types of safety insurance and their specific benefits, we can make informed decisions to secure our future and minimize the impact of unforeseen events.

The Foundation of Safety Insurance

At its core, safety insurance is a contractual agreement between an insurance provider and a policyholder. In exchange for regular premium payments, the insurance company agrees to compensate the policyholder for specific losses or damages outlined in the policy. This compensation is designed to help the policyholder recover financially from unexpected events, providing a safety net to mitigate the impact of potential disasters.

The concept of safety insurance is deeply rooted in the principles of risk management and shared responsibility. By pooling resources from a large number of policyholders, insurance companies can effectively spread the financial burden of losses across a diverse group. This collective approach ensures that policyholders can access the necessary funds to rebuild, repair, or replace their assets in the event of a covered loss, promoting stability and resilience in the face of adversity.

The Diverse Landscape of Safety Insurance

Safety insurance is an expansive field, offering a myriad of coverage options to meet the unique needs of individuals and businesses. Here, we explore some of the most common types of safety insurance and their specific applications:

1. Property Insurance

Property insurance is a cornerstone of safety insurance, providing coverage for various types of property, including homes, apartments, and commercial buildings. This insurance protects policyholders against losses resulting from perils such as fire, theft, vandalism, and natural disasters. Property insurance typically includes coverage for the structure itself, as well as its contents, offering financial protection for policyholders in the event of damage or destruction.

| Property Type | Covered Perils |

|---|---|

| Residential Property | Fire, Flood, Theft, Vandalism |

| Commercial Property | Fire, Storm, Theft, Vandalism, Business Interruption |

2. Health Insurance

Health insurance is a vital component of safety insurance, ensuring access to essential healthcare services and financial protection against the high costs of medical treatment. With rising healthcare expenses, health insurance provides peace of mind, allowing individuals and families to focus on their well-being without the burden of overwhelming medical bills.

Health insurance policies vary widely, offering different levels of coverage and benefits. From comprehensive plans that cover a broad range of medical services to more specialized policies targeting specific health needs, policyholders can choose the coverage that best suits their unique circumstances.

3. Life Insurance

Life insurance is a critical aspect of safety insurance, providing financial security and peace of mind to policyholders and their loved ones. In the event of the policyholder’s untimely death, life insurance pays out a predetermined sum, known as the death benefit, to the designated beneficiaries. This financial support can help beneficiaries cover immediate expenses, such as funeral costs, and provide long-term financial stability.

Life insurance policies come in various forms, including term life insurance, which offers coverage for a specified period, and permanent life insurance, which provides lifelong coverage. The choice between these options depends on individual needs and financial goals, with term life insurance often being more affordable for short-term protection, while permanent life insurance offers long-term coverage and additional benefits such as cash value accumulation.

4. Auto Insurance

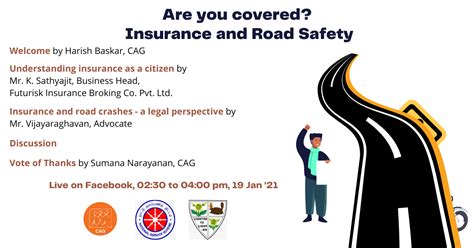

Auto insurance is a mandatory safety measure for vehicle owners, providing financial protection against accidents, theft, and other vehicular-related incidents. With a wide range of coverage options, auto insurance policies can be tailored to meet the specific needs of drivers, ensuring peace of mind and financial security on the road.

Auto insurance typically includes liability coverage, which protects the policyholder against claims arising from accidents they cause, as well as collision and comprehensive coverage, which cover damages to the policyholder's vehicle. Additionally, personal injury protection (PIP) and uninsured/underinsured motorist coverage are often included to provide further financial protection in the event of an accident.

5. Business Insurance

Business insurance is a crucial component of safety insurance for entrepreneurs and business owners. It provides protection against a wide range of risks, ensuring the financial stability and continuity of operations in the face of unforeseen events. From property damage and liability claims to business interruption and cyber risks, business insurance policies are tailored to meet the unique needs of different industries and business structures.

Some common types of business insurance include general liability insurance, which covers third-party claims and lawsuits, commercial property insurance, which protects against property damage and loss, and professional liability insurance, also known as errors and omissions (E&O) insurance, which safeguards professionals against claims of negligence or mistakes in their work.

The Benefits of Safety Insurance

Safety insurance offers a multitude of benefits that extend far beyond financial protection. Here, we delve into some of the key advantages of having comprehensive safety insurance coverage:

1. Peace of Mind

Perhaps the most significant benefit of safety insurance is the peace of mind it provides. By having the right insurance coverage in place, policyholders can rest assured knowing they are financially prepared to face unforeseen circumstances. Whether it’s a natural disaster, a medical emergency, or a business disruption, safety insurance offers the security and confidence to navigate these challenges with resilience.

2. Financial Protection

Safety insurance is designed to provide financial protection against a wide range of risks. From covering the costs of medical treatment and property repairs to compensating for lost income and business interruptions, insurance policies ensure that policyholders can access the necessary funds to recover from adverse events. This financial protection allows individuals and businesses to focus on their recovery without the added burden of financial strain.

3. Risk Mitigation

Safety insurance not only provides financial protection but also plays a crucial role in risk mitigation. By identifying potential risks and taking proactive measures to mitigate them, insurance companies help policyholders avoid or minimize losses. This can include implementing safety protocols, conducting regular inspections, and providing educational resources to prevent accidents and minimize the impact of unforeseen events.

4. Legal Protection

Certain types of safety insurance, such as liability insurance, provide legal protection in the event of claims or lawsuits. This is particularly crucial for businesses, as it helps protect against costly legal battles and potential damages awarded by courts. With liability insurance in place, policyholders can focus on their operations with confidence, knowing they have the necessary coverage to handle legal disputes effectively.

5. Access to Expertise

Insurance companies bring a wealth of expertise and resources to the table, providing valuable support and guidance to policyholders. From assisting with claim processes and offering risk management advice to connecting policyholders with specialized services, insurance providers ensure that their clients have access to the knowledge and assistance they need to navigate complex situations effectively.

Real-World Applications and Success Stories

Safety insurance is not just a theoretical concept; it has tangible, real-world applications that have made a significant impact on the lives of individuals and communities. Here, we explore a few success stories that highlight the transformative power of safety insurance:

1. Natural Disaster Recovery

When Hurricane Katrina struck the Gulf Coast in 2005, it caused unprecedented devastation. Many homeowners who had invested in comprehensive property insurance were able to rebuild their homes and communities with the financial support provided by their insurance policies. This real-world example demonstrates the critical role of safety insurance in helping individuals and communities recover from catastrophic events.

2. Medical Emergency Assistance

Health insurance has proven to be a lifeline for countless individuals facing unexpected medical emergencies. Take the case of John, a young professional who suffered a severe accident, requiring extensive medical treatment. With his health insurance coverage, John was able to access the necessary care without worrying about the financial burden. His insurance policy provided the financial support needed to cover his medical expenses, allowing him to focus on his recovery and return to a healthy, productive life.

3. Business Continuity

Business insurance is a critical tool for ensuring the continuity of operations in the face of unexpected disruptions. For instance, consider a small business owner whose shop was damaged in a fire. With the right business insurance coverage, they were able to quickly rebuild and reopen their doors, minimizing the financial impact and maintaining their customer base. This real-world application of safety insurance highlights its importance in sustaining businesses and local economies.

The Future of Safety Insurance

As we look ahead, the future of safety insurance holds exciting possibilities and innovative solutions. With advancements in technology and a growing awareness of the importance of risk management, the insurance industry is poised for significant transformation. Here, we explore some of the key trends and developments shaping the future of safety insurance:

1. Digital Transformation

The insurance industry is undergoing a digital revolution, leveraging technology to enhance customer experiences and streamline operations. From online policy management and digital claim submissions to artificial intelligence-powered risk assessments, the digital transformation of safety insurance is making processes more efficient, convenient, and accessible for policyholders.

2. Data-Driven Risk Assessment

With the availability of vast amounts of data and advanced analytics, insurance companies are now able to conduct more accurate and comprehensive risk assessments. By leveraging data-driven insights, insurers can offer personalized coverage options, optimize pricing, and develop innovative products that better meet the unique needs of policyholders.

3. Sustainable and Resilient Practices

As environmental concerns continue to rise, the insurance industry is playing a pivotal role in promoting sustainable and resilient practices. From incentivizing energy-efficient buildings and vehicles to supporting renewable energy initiatives, safety insurance is increasingly becoming a tool for driving positive environmental change. Additionally, insurers are developing specialized policies to protect against emerging risks, such as climate change-related events, ensuring communities have the necessary coverage to recover from these challenges.

4. Enhanced Customer Engagement

Insurers are increasingly focused on building strong relationships with their policyholders, offering personalized experiences and proactive support. Through the use of customer relationship management (CRM) systems and advanced analytics, insurance companies can better understand their clients’ needs and provide tailored advice and guidance. This enhanced customer engagement not only improves satisfaction but also helps policyholders make more informed decisions about their safety insurance coverage.

5. Collaboration and Partnerships

The future of safety insurance lies in collaboration and partnerships between insurance companies, governments, and other stakeholders. By working together, these entities can develop comprehensive risk management strategies, share resources, and address emerging challenges more effectively. This collaborative approach ensures that safety insurance remains an adaptable and responsive tool, capable of meeting the evolving needs of individuals, businesses, and communities.

Conclusion

Safety insurance is a critical component of our modern lives, providing financial protection and peace of mind in an uncertain world. From safeguarding our homes and businesses to ensuring access to essential healthcare services, safety insurance plays a vital role in our well-being and financial security. By understanding the diverse landscape of safety insurance and its real-world applications, we can make informed decisions to protect ourselves, our loved ones, and our communities.

As we navigate the complexities of the future, the insurance industry will continue to innovate and adapt, offering cutting-edge solutions to address emerging risks. With a commitment to digital transformation, data-driven insights, and sustainable practices, safety insurance will remain a cornerstone of resilience and stability, empowering individuals and businesses to thrive in the face of adversity.

How does safety insurance work, and what are the key principles behind it?

+

Safety insurance operates on the principles of risk management and shared responsibility. Policyholders pay regular premiums to the insurance company, which then provides financial protection against specific losses or damages outlined in the policy. By pooling resources from a large number of policyholders, insurance companies can effectively spread the financial burden of losses, ensuring that policyholders have the necessary funds to recover from unforeseen events.

What are the different types of safety insurance, and how do they differ from each other?

+

Safety insurance encompasses a wide range of policies, including property insurance, health insurance, life insurance, auto insurance, and business insurance. Each type of insurance is designed to meet specific needs and provide financial protection against different types of risks. For instance, property insurance protects against losses resulting from fire, theft, or natural disasters, while health insurance ensures access to medical care and financial protection against high medical costs.

What are the key benefits of having safety insurance coverage?

+

Safety insurance offers numerous benefits, including peace of mind, financial protection, risk mitigation, legal protection, and access to expertise. By having the right insurance coverage in place, policyholders can navigate unforeseen circumstances with resilience, access the necessary funds to recover from losses, and take proactive measures to minimize risks. Insurance companies also provide valuable support and guidance, helping policyholders make informed decisions and navigate complex situations.