Save Car Insurance

The rising cost of car insurance is a concern for many drivers, especially with the increasing number of accidents and claims. In an effort to keep their premiums affordable, drivers are exploring various strategies to save on car insurance. This comprehensive guide aims to provide expert insights and practical tips to help you navigate the world of car insurance and find ways to reduce your expenses.

Understanding the Factors that Impact Car Insurance Costs

Before delving into strategies to save on car insurance, it’s essential to grasp the factors that influence insurance premiums. These include your driving history, the type of vehicle you own, the area you live in, and your personal details such as age and occupation.

Insurance companies use these factors to assess the risk associated with insuring your vehicle. For instance, a driver with a history of accidents or traffic violations is considered a higher risk and will likely pay higher premiums. Similarly, certain makes and models of vehicles are more expensive to insure due to their repair costs or theft rates.

Driving History and Safety Measures

Your driving record plays a crucial role in determining your insurance premium. A clean driving record with no accidents or traffic violations can lead to significant savings. On the other hand, a single traffic offense or an at-fault accident can cause your rates to increase dramatically.

To mitigate this, consider taking defensive driving courses. Many insurance companies offer discounts to drivers who complete these courses, as they demonstrate a commitment to safe driving practices. Additionally, installing safety features like anti-theft devices or advanced driver-assistance systems can reduce your insurance costs by lowering the risk of accidents and theft.

Vehicle Choice and Maintenance

The type of vehicle you drive also affects your insurance premium. High-performance sports cars or luxury vehicles often come with higher insurance costs due to their value and the potential for costly repairs. On the other hand, smaller, economical cars tend to be more affordable to insure.

Regular vehicle maintenance is another factor that can influence your insurance costs. Well-maintained vehicles are less likely to experience breakdowns or require extensive repairs, which can lead to lower insurance claims. Keep a record of your vehicle's maintenance history and share it with your insurance provider to potentially negotiate a lower premium.

| Vehicle Type | Average Insurance Premium |

|---|---|

| Sports Car | $2,200 |

| SUV | $1,500 |

| Sedan | $1,200 |

| Hatchback | $1,100 |

Location and Usage

Your geographic location and how you use your vehicle also impact your insurance costs. Drivers in urban areas often pay more due to higher risks of accidents and theft. Conversely, rural areas tend to have lower insurance rates.

Additionally, the purpose for which you use your vehicle matters. If you primarily use your car for commuting to work, your insurance costs may be higher compared to someone who uses their vehicle for occasional leisure trips. This is because commute drivers are on the road more frequently, increasing the likelihood of accidents.

Shopping Around and Negotiating for Better Rates

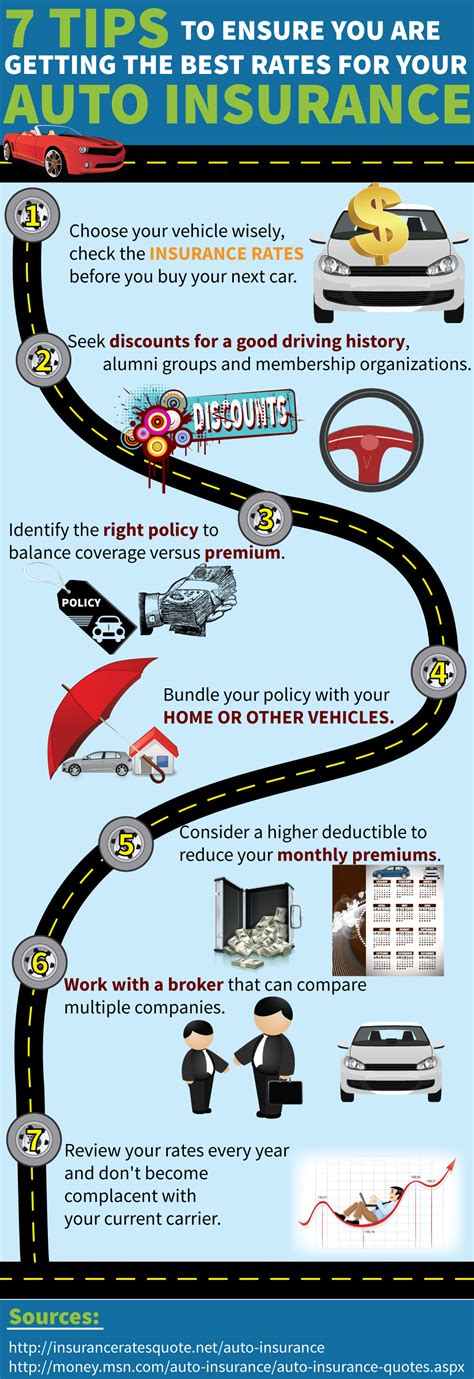

One of the most effective ways to save on car insurance is to compare quotes from multiple providers. Insurance companies use different methodologies to calculate premiums, so the rates offered can vary significantly.

Use online comparison tools to gather quotes from various insurers. These tools allow you to input your details once and receive multiple quotes, making the process efficient and convenient. Ensure you're comparing apples to apples by considering factors like coverage limits, deductibles, and any additional benefits or discounts offered.

Bundling Policies and Loyalty Rewards

Many insurance companies offer discounts when you bundle multiple policies with them. For instance, you can save by combining your car insurance with home, life, or health insurance. This not only simplifies your insurance management but also often results in substantial savings.

Additionally, loyalty can pay off. Some insurance providers offer discounts to customers who have been with them for an extended period. If you've been a loyal customer for years, don't hesitate to ask about potential loyalty rewards or long-term customer discounts.

Negotiating with Your Current Provider

If you’re satisfied with your current insurance provider but want to lower your premiums, consider negotiating. Insurance companies want to retain their customers, so they may be open to discussing options to keep your business. Highlight any changes that might have reduced your risk profile, such as a spotless driving record over the past year or installing safety features in your vehicle.

You can also negotiate by requesting a review of your policy. Insurance providers regularly update their rates and policies, so asking for a review might uncover opportunities for savings. Be prepared to provide evidence of any changes that might justify a lower premium, such as a reduction in annual mileage or an improvement in your credit score.

Utilizing Discounts and Savings Programs

Insurance companies offer a variety of discounts and savings programs to attract and retain customers. Being aware of these opportunities can help you maximize your savings.

Common Discounts and How to Qualify

Some of the most common car insurance discounts include:

- Safe Driver Discount: This discount is offered to drivers with a clean driving record. To qualify, you must typically have no at-fault accidents or moving violations for a certain period, often 3 to 5 years.

- Multi-Policy Discount: As mentioned earlier, bundling multiple policies with the same insurer can lead to significant savings. This discount applies to customers who have multiple types of insurance, such as auto, home, and life, with the same provider.

- Good Student Discount: Many insurance companies offer discounts to students who maintain a certain GPA or are on the honor roll. This discount is often available to students under the age of 25.

- Loyalty Discount: As mentioned earlier, long-term customers may be eligible for loyalty discounts. The specific requirements vary by insurer, but typically, you must have been with the company for several years without any significant claims.

Safety Features and Discounts

Installing certain safety features in your vehicle can lead to substantial savings on your insurance premium. These features include:

- Anti-theft Devices: Vehicles equipped with anti-theft devices like GPS trackers, immobilizers, or alarm systems are less likely to be stolen, making them a lower risk for insurance companies. As a result, you may qualify for a lower premium.

- Advanced Driver-Assistance Systems (ADAS): ADAS technologies, such as lane departure warning, automatic emergency braking, and adaptive cruise control, can significantly reduce the risk of accidents. Many insurance companies offer discounts to vehicles equipped with these features.

- Telematics Devices: These devices monitor your driving behavior, such as speed, acceleration, and braking. By installing a telematics device and demonstrating safe driving habits, you may be eligible for a usage-based insurance discount.

Optimizing Your Coverage and Deductibles

Reviewing your car insurance coverage and deductibles regularly is crucial to ensure you’re not overpaying for coverage you don’t need or underpaying for essential protections.

Understanding Your Coverage Needs

The coverage you require will depend on various factors, including your vehicle’s value, your financial situation, and state-specific laws. Generally, it’s advisable to have at least the minimum coverage required by your state’s laws, which typically includes liability insurance to cover injuries and property damage you cause to others.

However, if your vehicle is financed or leased, the lender may require you to carry collision and comprehensive insurance to protect their interest in the vehicle. Additionally, if you have significant assets, you might want to consider higher liability limits to protect yourself from potential lawsuits.

Adjusting Your Deductibles

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can lower your insurance premium. This is because you’re taking on more financial responsibility, which reduces the risk for the insurance company.

However, it's essential to choose a deductible amount you can afford in the event of a claim. If you opt for a high deductible to save on premiums but then cannot afford to pay it when the time comes, you may be left with significant out-of-pocket expenses.

| Deductible Amount | Average Premium Savings |

|---|---|

| $500 | 10% |

| $1,000 | 20% |

| $1,500 | 30% |

Reviewing Coverage Annually

Your insurance needs can change over time. It’s essential to review your coverage annually to ensure it aligns with your current circumstances. For instance, if you’ve paid off your vehicle, you may no longer need collision and comprehensive coverage, as the vehicle’s value is now your own concern rather than the lender’s.

Additionally, changes in your personal life, such as getting married, having children, or purchasing a home, can impact your insurance needs. These changes might warrant adjustments to your coverage limits or the addition of new policies, such as life or homeowners insurance.

The Impact of Credit Score on Insurance Premiums

Your credit score can significantly influence your car insurance premiums. Insurance companies use credit-based insurance scores to assess the risk of insuring a driver. These scores are based on information in your credit report, such as payment history, outstanding debts, and length of credit history.

Improving Your Credit Score

Improving your credit score can lead to lower insurance premiums. Here are some strategies to boost your credit score:

- Pay your bills on time: Late payments can significantly damage your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

- Reduce your credit utilization: Try to keep your credit card balances below 30% of your credit limit. High credit utilization can negatively impact your score.

- Build a long credit history: The longer your credit history, the better. Avoid closing old credit accounts, as this can shorten your credit history.

- Check your credit report regularly: Review your credit report for errors or fraudulent activity. Disputing inaccuracies can help improve your credit score.

Shopping Around for Insurers Who Don’t Use Credit Scores

Not all insurance companies use credit scores to determine premiums. Some insurers offer policies that are based solely on driving-related factors, such as your driving record and the type of vehicle you own. Shopping around for these insurers can help you save if you have a low credit score.

Future Implications and Technological Advances

The car insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. These developments are likely to have a significant impact on insurance premiums and the strategies consumers can employ to save on their policies.

Telematics and Usage-Based Insurance

Telematics devices, which monitor driving behavior, are becoming increasingly common. These devices can provide insurance companies with detailed data on driving habits, allowing them to offer usage-based insurance policies. These policies can reward safe drivers with lower premiums, as their driving behavior demonstrates a lower risk profile.

However, the widespread adoption of telematics may also lead to increased surveillance and potential privacy concerns. It's essential for consumers to be aware of these implications and advocate for data privacy and security measures when considering usage-based insurance policies.

Autonomous Vehicles and the Future of Car Insurance

The rise of autonomous vehicles is expected to revolutionize the car insurance industry. As these vehicles become more prevalent, insurance premiums are likely to decrease as the risk of accidents and driver error is reduced. However, the transition to autonomous vehicles will be gradual, and the full impact on insurance premiums is not yet clear.

Additionally, the introduction of autonomous vehicles may lead to a shift in insurance liability. Currently, drivers are typically liable for accidents they cause. With autonomous vehicles, the liability may shift to the vehicle manufacturer or the software developer, potentially leading to new insurance products and liability frameworks.

The Role of Insurtech and Digital Innovations

Insurtech, or insurance technology, is driving significant innovation in the car insurance industry. Insurtech companies are leveraging digital technologies to offer more efficient, personalized, and data-driven insurance products. These innovations can lead to better risk assessment, more accurate pricing, and improved customer experiences.

For example, some Insurtech startups are developing AI-powered apps that can assess vehicle damage and provide repair estimates, streamlining the claims process. Others are using machine learning algorithms to predict and prevent fraud, which can reduce insurance costs for all consumers.

Conclusion: Saving on Car Insurance

Saving on car insurance requires a combination of strategies, from understanding the factors that impact your premiums to optimizing your coverage and leveraging discounts. By staying informed, comparing quotes, and negotiating with insurers, you can find the best deal for your needs.

Additionally, staying up-to-date with technological advancements and industry trends is crucial. The car insurance landscape is evolving rapidly, and being aware of these changes can help you make informed decisions and take advantage of new opportunities to save.

How often should I review my car insurance policy and coverage?

+It’s recommended to review your car insurance policy and coverage at least once a year, or whenever there’s a significant change in your circumstances (e.g., getting married, buying a new car, moving to a new location). Regular reviews ensure that your coverage remains adequate and aligned with your needs.

Can I save on car insurance by paying my premiums annually instead of monthly?

+Yes, many insurance companies offer a discount if you pay your premiums annually rather than monthly. This is because it reduces the administrative costs for the insurer and shows commitment from the policyholder. However, ensure you have the financial means to pay the annual premium upfront.

What are some tips for negotiating lower car insurance rates with my provider?

+When negotiating with your insurance provider, highlight any improvements in your risk profile, such as a clean driving record, installation of safety features, or a reduction in annual mileage. Also, be prepared to discuss any changes in your circumstances that might warrant a policy review or adjustment. Finally, don’t hesitate to shop around and use competing quotes as leverage.

How do I know if my credit score is impacting my car insurance rates?

+If your credit score has significantly changed (either positively or negatively) since you last purchased car insurance, it’s worth checking if your insurer uses credit-based insurance scores. If they do, your credit score may be impacting your rates. You can request a quote from other insurers who don’t use credit scores to see if you can get a better deal.