Search Car Insurance Policy

Navigating the world of car insurance can be a complex journey, filled with unique terms, coverage options, and a myriad of policy details. Understanding your car insurance policy is essential to ensure you're adequately protected and to avoid any surprises should an accident or unforeseen event occur. In this comprehensive guide, we'll delve into the key aspects of car insurance policies, helping you become an informed and savvy driver.

Unraveling the Coverage Puzzle

At the heart of every car insurance policy lies a comprehensive coverage plan, designed to protect you, your vehicle, and other road users. This coverage can be tailored to your specific needs and circumstances, ensuring you have the right level of protection. Here's a breakdown of the key coverage types you'll encounter:

Liability Coverage

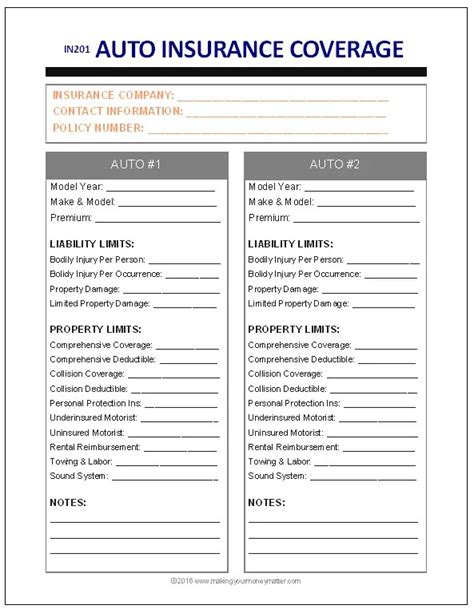

Liability coverage is a fundamental component of any car insurance policy. It protects you financially in the event you cause an accident, covering the costs of injuries and property damage to others. This coverage is typically split into two categories:

- Bodily Injury Liability: Covers medical expenses, pain and suffering, and lost wages for individuals injured in an accident you caused.

- Property Damage Liability: Pays for repairs or replacement of vehicles and other property damaged in an accident you caused.

It's crucial to ensure you have adequate liability coverage to protect your financial well-being in the event of a serious accident.

Comprehensive and Collision Coverage

While liability coverage protects you against claims made by others, comprehensive and collision coverage provides protection for your own vehicle. Here's a closer look:

- Comprehensive Coverage: Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or collisions with animals.

- Collision Coverage: Pays for repairs to your vehicle if you're involved in an accident, regardless of who's at fault. This coverage is particularly beneficial if you have a newer or more expensive vehicle.

Both comprehensive and collision coverage typically come with a deductible, which is the amount you'll pay out of pocket before your insurance kicks in. Choosing the right deductible can help balance your premiums and coverage needs.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is an essential coverage for many drivers, as it provides additional protection for you and your passengers in the event of an accident. PIP covers medical expenses, lost wages, and other related costs, regardless of who's at fault. It's a no-fault coverage, meaning it applies even if you're not responsible for the accident.

Uninsured/Underinsured Motorist Coverage

Unfortunately, not all drivers carry adequate insurance. Uninsured/Underinsured Motorist coverage steps in to protect you if you're involved in an accident with a driver who has little or no insurance. This coverage can help cover your medical expenses, vehicle repairs, and other related costs.

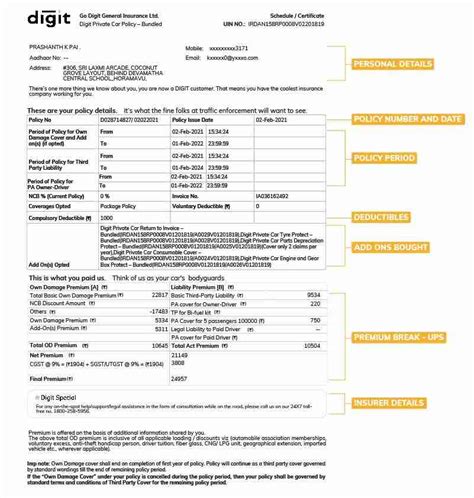

Policy Add-Ons and Endorsements

Beyond the core coverage types, car insurance policies often offer a range of add-ons and endorsements to enhance your protection. These additional coverages can be tailored to your specific needs and circumstances. Here are a few common options:

- Rental Car Reimbursement: Covers the cost of renting a vehicle while your own car is being repaired after an insured event.

- Roadside Assistance: Provides emergency services like towing, battery jump-starts, and flat tire changes.

- Glass Coverage: Offers specialized coverage for windshields and other glass components of your vehicle, often with no deductible.

- Gap Insurance: Covers the difference between your vehicle's actual cash value and the remaining balance on your loan or lease if your car is totaled.

Adding these endorsements to your policy can provide additional peace of mind and financial protection in specific situations.

Understanding Your Policy Limits and Deductibles

When reviewing your car insurance policy, it's crucial to understand your policy limits and deductibles. These factors play a significant role in determining your coverage and out-of-pocket expenses.

Policy Limits

Policy limits refer to the maximum amount your insurance company will pay for a covered claim. These limits are typically set for each coverage type, such as liability, comprehensive, and collision. It's important to choose limits that align with your financial needs and the value of your vehicle. Higher limits provide greater protection but may result in higher premiums.

Deductibles

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Deductibles can vary depending on the coverage type. For instance, you may have a separate deductible for comprehensive and collision coverage. Choosing a higher deductible can lower your premiums, but it also means you'll pay more out of pocket if you need to make a claim.

It's essential to strike a balance between your deductible and your financial comfort level. Consider your ability to cover unexpected expenses and choose a deductible that aligns with your budget and risk tolerance.

The Importance of Regular Policy Reviews

Your car insurance policy should be a living document, evolving to meet your changing needs and circumstances. Regular policy reviews are crucial to ensure your coverage remains adequate and up-to-date. Here's why regular reviews matter:

- Life Changes: Major life events like getting married, having children, purchasing a new home, or changing jobs can impact your insurance needs. Regular reviews ensure your policy reflects these changes.

- Vehicle Changes: If you've purchased a new or used vehicle, or if your vehicle's value has significantly changed, your insurance coverage may need to be adjusted.

- Coverage Gaps: Over time, you may identify gaps in your coverage that could leave you financially vulnerable. Regular reviews can help you identify and address these gaps.

- Premium Savings: Insurance companies may offer new discounts or promotions that could lower your premiums. By reviewing your policy, you can take advantage of these opportunities.

Aim to review your car insurance policy at least once a year, or whenever significant life changes occur. This proactive approach ensures you're always adequately protected and helps you make the most of your insurance coverage.

Conclusion: Empowering Your Insurance Journey

Understanding your car insurance policy is a crucial step towards becoming a more informed and confident driver. By unraveling the coverage puzzle, exploring add-ons and endorsements, and staying on top of your policy limits and deductibles, you can ensure you have the right protection for your unique needs. Regular policy reviews are the key to staying ahead of the curve and making the most of your insurance coverage.

As you navigate the world of car insurance, remember that knowledge is power. The more you understand your policy, the better equipped you'll be to make informed decisions and protect yourself and your loved ones on the road. So, take the time to explore your policy, ask questions, and seek expert advice when needed. Your peace of mind and financial security are worth the effort.

How often should I review my car insurance policy?

+It’s recommended to review your policy annually or whenever significant life changes occur. Regular reviews ensure your coverage remains up-to-date and aligned with your needs.

What is the difference between comprehensive and collision coverage?

+Comprehensive coverage protects against non-collision incidents like theft, vandalism, and natural disasters. Collision coverage, on the other hand, covers damages resulting from collisions, regardless of fault.

Can I customize my car insurance policy?

+Absolutely! Car insurance policies are highly customizable. You can choose your coverage types, limits, deductibles, and add-ons to create a policy that fits your specific needs and budget.