Selecting Car Insurance

Choosing the right car insurance is a crucial decision that can significantly impact your financial well-being and peace of mind. With numerous options and factors to consider, it's essential to approach this process with careful research and an understanding of your specific needs. In this comprehensive guide, we'll delve into the world of car insurance, exploring key aspects, industry insights, and practical tips to help you make an informed choice.

Understanding Your Coverage Needs

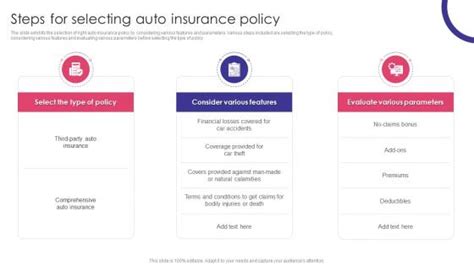

The first step in selecting car insurance is to assess your unique requirements. Consider the following factors to determine the level of coverage you need:

- Vehicle Value: The worth of your car plays a vital role in determining the appropriate level of insurance. For instance, if you own a classic or high-end vehicle, comprehensive coverage becomes essential to protect against theft, damage, and potential depreciation.

- Usage: Evaluate how often and for what purpose you use your vehicle. If you have a long daily commute or frequently drive in high-risk areas, you may require more extensive coverage.

- Legal Requirements: Familiarize yourself with the minimum insurance requirements in your region. While these may vary, most jurisdictions mandate liability coverage to protect others in the event of an accident you cause.

- Personal Preferences: Think about your comfort level with risk and potential out-of-pocket expenses. If you prefer more financial protection, you might opt for higher coverage limits and additional endorsements.

Exploring Coverage Options

Car insurance offers a range of coverage types to address different needs. Here’s a breakdown of the primary options:

Liability Coverage

Liability insurance is a fundamental component, providing protection in the event you cause bodily injury or property damage to others. This coverage typically includes:

- Bodily Injury Liability: Covers medical expenses and lost wages for injured parties.

- Property Damage Liability: Pays for repairs or replacement of damaged property, such as another vehicle or structures.

Collision and Comprehensive Coverage

These coverages are optional but highly recommended, especially for newer or financed vehicles. Collision insurance covers damages to your car resulting from collisions with other vehicles or objects, while comprehensive coverage protects against non-collision incidents like theft, vandalism, and natural disasters.

Personal Injury Protection (PIP) and Medical Payments Coverage

PIP and medical payments coverage provide medical expense coverage for you and your passengers, regardless of fault. These coverages can be especially beneficial in states with no-fault insurance laws.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage. It ensures you’re financially protected even if the other driver is at fault.

Additional Endorsements and Riders

Car insurance providers offer various endorsements and riders to customize your policy. These may include coverage for rental cars, roadside assistance, gap insurance, and more.

Comparing Insurance Providers

Once you have a clear understanding of your coverage needs, it’s time to research and compare insurance providers. Here are some key factors to consider:

Reputation and Financial Stability

Choose reputable insurance companies with a strong financial standing. Check ratings from independent agencies like AM Best or Standard & Poor’s to ensure the provider is financially stable and can fulfill their obligations.

Coverage Options and Customization

Look for providers that offer a comprehensive range of coverage options and allow you to customize your policy to fit your specific needs. Flexibility in coverage limits and endorsements is essential.

Pricing and Discounts

Compare quotes from multiple providers to find the most competitive rates. Many insurers offer discounts for safe driving records, loyalty, multi-policy bundles, and other factors. Be sure to inquire about available discounts to lower your premiums.

Customer Service and Claims Handling

Consider the provider’s reputation for customer service and claims handling. Look for companies with a history of prompt and fair claims processing. Read reviews and seek recommendations from trusted sources to gauge their customer satisfaction.

Digital Services and Convenience

In today’s digital age, many insurance companies offer online and mobile services for policy management, claims filing, and other tasks. Assess the provider’s digital offerings to ensure they align with your preferences for convenience and accessibility.

Assessing Your Risk Profile

Your risk profile, including your driving record, age, and location, plays a significant role in determining your insurance rates. Here’s how these factors influence your premiums:

Driving Record

A clean driving record with no accidents or violations can lead to lower insurance rates. Conversely, multiple accidents or traffic violations may result in higher premiums or even policy cancellations.

Age and Experience

Younger drivers, particularly those under 25, often face higher insurance premiums due to their lack of driving experience. As you age and gain more years of safe driving, your rates may decrease.

Location and Usage

Your location and the usage of your vehicle also impact your insurance rates. Areas with higher crime rates or more frequent accidents may result in increased premiums. Similarly, using your vehicle for business purposes or long commutes can lead to higher rates.

Obtaining Quotes and Making the Decision

Now that you’ve assessed your coverage needs, compared providers, and evaluated your risk profile, it’s time to obtain quotes and make an informed decision. Here’s a step-by-step guide:

- Gather Information: Collect all relevant documents, including your driver’s license, vehicle registration, and any existing insurance policies. Have your vehicle’s make, model, and VIN ready for accurate quotes.

- Request Quotes: Contact multiple insurance providers or use online comparison tools to request quotes. Be sure to provide accurate and consistent information to ensure an accurate comparison.

- Review Coverage and Pricing: Carefully examine the coverage options and limits offered by each provider. Compare not only the premiums but also the quality and reputation of the insurance company.

- Consider Additional Benefits: Look beyond just the price. Assess the provider’s customer service, claims handling process, and any additional benefits or perks they offer.

- Make an Informed Decision: Choose the insurance provider that best aligns with your coverage needs, budget, and personal preferences. Ensure you understand the terms and conditions of your chosen policy.

Managing Your Policy and Making Adjustments

Once you’ve selected your car insurance provider, it’s important to periodically review and manage your policy. Here are some tips for ongoing policy management:

- Regular Policy Reviews: Periodically review your policy to ensure it still meets your needs. Life changes, such as getting married, having children, or purchasing a new vehicle, may require adjustments to your coverage.

- Safe Driving and Discounts: Maintain a safe driving record to potentially qualify for additional discounts. Many insurers offer safe driver discounts or accident-free incentives.

- Bundling Policies: Consider bundling your car insurance with other policies, such as home or renters insurance, to potentially save money through multi-policy discounts.

- Policy Adjustments: As your vehicle ages or your financial situation changes, you may want to adjust your coverage limits or deductibles to find the right balance between protection and affordability.

The Importance of Regular Reviews

Car insurance is not a one-time decision; it requires ongoing attention and adjustments. Regularly reviewing your policy ensures that your coverage remains up-to-date and aligned with your changing needs. Stay informed about industry trends, new coverage options, and any changes in your personal circumstances that may impact your insurance requirements.

How much car insurance do I need?

+The amount of car insurance you need depends on various factors, including the value of your vehicle, your driving record, and your personal preferences. As a starting point, consider the minimum liability limits required by your state, which typically cover bodily injury and property damage. However, for added protection, many experts recommend purchasing higher liability limits and considering comprehensive and collision coverage, especially for newer or financed vehicles.

What factors influence car insurance rates?

+Several factors influence car insurance rates, including your age, driving record, location, and the type of vehicle you drive. Younger drivers, those with a history of accidents or violations, and individuals living in areas with higher crime rates or accident frequencies often face higher premiums. Additionally, the make, model, and safety features of your vehicle can impact your rates.

How can I save money on car insurance?

+There are several strategies to save money on car insurance. First, maintain a clean driving record, as this can lead to lower premiums. Consider bundling your car insurance with other policies, such as home or renters insurance, to qualify for multi-policy discounts. Explore safe driver discounts, loyalty rewards, and other incentives offered by insurance providers. Additionally, regularly review your coverage and consider increasing your deductibles to lower your premiums.