Senior Life Insurance Quotes

Life insurance is an essential financial tool that provides security and peace of mind, especially for individuals in their senior years. As people age, the need for adequate coverage becomes more prominent, as it can help ensure their loved ones are protected and their legacy is preserved. Obtaining life insurance quotes tailored to seniors is a crucial step in this process, as it allows individuals to make informed decisions about their coverage and financial planning.

Understanding Senior Life Insurance Quotes

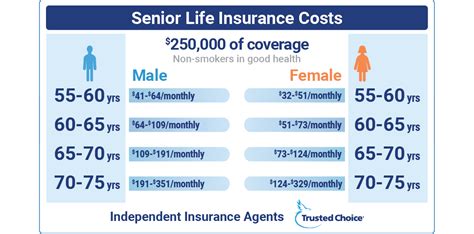

Senior life insurance quotes are specialized assessments that consider the unique needs and circumstances of older individuals. These quotes take into account factors such as age, health status, lifestyle, and desired coverage amounts to provide an accurate estimate of the insurance premium. By understanding these quotes, seniors can navigate the complex world of life insurance and make choices that align with their financial goals and family’s needs.

Key Factors Influencing Senior Life Insurance Rates

Several critical factors impact the cost of life insurance for seniors. Firstly, age plays a significant role, as premiums generally increase with age due to the higher risk associated with older individuals. Additionally, health conditions are a major consideration. Pre-existing medical conditions or a history of serious illnesses can impact the availability and cost of coverage. Other factors include lifestyle choices, such as smoking or participation in high-risk activities, which can also affect insurance rates.

| Factor | Impact on Senior Life Insurance Rates |

|---|---|

| Age | Increases with age, as the risk of claims rises. |

| Health Status | Pre-existing conditions or illnesses may result in higher premiums or limited coverage. |

| Lifestyle Choices | Smoking, hazardous hobbies, or occupations can increase premiums. |

| Coverage Amount | Larger coverage amounts often require higher premiums. |

| Term Length | Longer term lengths may result in more affordable monthly premiums. |

Types of Senior Life Insurance

There are various types of life insurance policies available to seniors, each designed to meet different needs and preferences. Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years. It is often more affordable than permanent life insurance and is suitable for seniors who seek coverage for a specific purpose, such as funeral expenses or debt repayment. In contrast, permanent life insurance, including whole life and universal life policies, provides lifelong coverage and builds cash value over time, making it a popular choice for seniors who want guaranteed coverage and the potential for investment growth.

The Benefits of Senior Life Insurance

Securing life insurance as a senior offers numerous advantages. Firstly, it provides a financial safety net for loved ones, ensuring they are protected and supported even after the policyholder’s passing. Life insurance can also help cover outstanding debts, such as mortgages or medical expenses, and can be used to fund end-of-life arrangements, including funerals and burial costs. Additionally, for those with estates or businesses, life insurance can be a vital tool for estate planning and business continuity.

How to Obtain Accurate Senior Life Insurance Quotes

Obtaining precise life insurance quotes as a senior involves a few key steps. Firstly, it’s essential to compare quotes from multiple insurers to find the most competitive rates. Online quote comparison tools can be particularly useful for this purpose. Additionally, seeking guidance from a qualified insurance agent or financial advisor can provide valuable insights and help seniors navigate the complexities of life insurance policies.

The Role of Medical Exams in Senior Life Insurance

Medical exams are a common requirement when applying for life insurance as a senior. These exams help insurers assess the health status and risk profile of the applicant. While the process may seem intimidating, it’s important to note that many insurers offer simplified issue policies that may not require a medical exam. Additionally, for seniors with pre-existing conditions, there are guaranteed issue policies available, although these typically come with higher premiums.

Maximizing Senior Life Insurance Coverage

To make the most of senior life insurance, it’s crucial to tailor the coverage to individual needs. This involves assessing the desired coverage amount, term length, and any additional riders or benefits that may be beneficial. For example, accelerated death benefits or long-term care riders can provide added protection for specific health-related needs. Regularly reviewing and updating the policy ensures that it remains relevant and aligned with changing circumstances and goals.

The Future of Senior Life Insurance

The life insurance industry is continually evolving, and seniors can expect to see innovations that make coverage more accessible and affordable. Advances in technology, such as the use of wearable health devices and artificial intelligence, may soon play a larger role in risk assessment and policy underwriting. Additionally, the growing popularity of hybrid policies that combine life insurance with long-term care coverage is expected to continue, offering seniors a more comprehensive solution for their future financial and healthcare needs.

Final Thoughts

Senior life insurance quotes are a vital step in securing the financial well-being of seniors and their loved ones. By understanding the factors that influence rates, the different types of policies available, and the benefits they offer, seniors can make informed decisions about their coverage. With the right life insurance policy, seniors can rest assured knowing they have taken the necessary steps to protect their legacy and provide for their family’s future.

Can I get life insurance if I have a pre-existing medical condition as a senior?

+

Absolutely! Many life insurance companies offer policies specifically designed for seniors with pre-existing conditions. These policies, known as guaranteed issue policies, may have higher premiums but provide coverage regardless of health status. It’s always best to consult with an insurance professional to find the most suitable option.

What is the difference between term and permanent life insurance for seniors?

+

Term life insurance provides coverage for a specified period, typically 10-30 years, and is often more affordable. Permanent life insurance, such as whole or universal life, offers lifelong coverage and builds cash value, making it a more comprehensive option. The choice between the two depends on individual needs and financial goals.

How can I get the most accurate senior life insurance quotes?

+

To get the most accurate quotes, compare rates from multiple insurers using online tools. Additionally, consulting with a qualified insurance agent or financial advisor can provide personalized guidance and ensure you understand all your options.