Short Term Dental Insurance

Short-term dental insurance is an increasingly popular option for individuals and families seeking flexible and affordable dental coverage. This type of insurance plan offers a temporary solution for those who may be between jobs, transitioning to new health plans, or simply looking for a cost-effective way to maintain their oral health. In this comprehensive guide, we will delve into the world of short-term dental insurance, exploring its benefits, coverage options, and how it can provide essential dental care without breaking the bank.

Understanding Short-Term Dental Insurance

Short-term dental insurance, as the name suggests, is a temporary dental coverage solution designed to bridge gaps in long-term dental plans or provide coverage for a specific period. These plans typically offer a more flexible and cost-effective alternative to traditional dental insurance, making them an attractive option for many individuals and families.

One of the key advantages of short-term dental insurance is its flexibility. Unlike long-term plans that often require a year-long commitment, short-term plans can be tailored to fit specific needs and timelines. Whether you need coverage for a few months or a year, these plans can be customized to align with your requirements.

Coverage and Benefits

Short-term dental insurance plans typically cover a range of essential dental services, including:

- Preventive Care: This often includes regular dental check-ups, cleanings, and X-rays, which are crucial for maintaining good oral health.

- Restorative Procedures: Coverage may extend to fillings, root canals, and extractions, ensuring that you can address any dental issues promptly.

- Oral Surgery: Some plans may also cover more complex procedures like wisdom tooth removal or dental implants.

- Emergency Dental Care: Short-term plans often provide coverage for unexpected dental emergencies, offering peace of mind when unforeseen situations arise.

It's important to note that the specific coverage and benefits can vary between providers and plans. Some plans may offer more comprehensive coverage, while others may have limitations or exclusions. Understanding the fine print and choosing a plan that aligns with your dental needs is crucial.

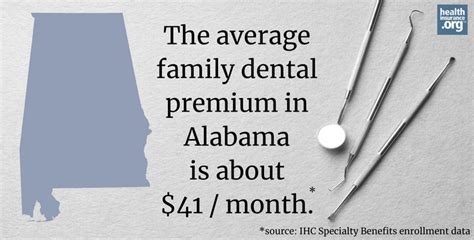

Affordability and Cost Structure

One of the primary appeals of short-term dental insurance is its affordability. These plans are often more cost-effective than long-term insurance options, making them accessible to a wider range of individuals. The cost structure typically involves a one-time enrollment fee and monthly premiums, which can be adjusted based on the coverage chosen.

Additionally, short-term plans may offer discounts for families or groups, making them an even more attractive option for those seeking coverage for multiple individuals. The affordability of these plans ensures that individuals can access essential dental care without straining their finances.

| Plan Type | Average Monthly Premium |

|---|---|

| Individual | $20 - $50 |

| Family | $40 - $100 |

Choosing the Right Short-Term Dental Plan

Selecting the appropriate short-term dental insurance plan involves careful consideration of your unique needs and circumstances. Here are some key factors to keep in mind when making your choice:

Assessing Your Dental Needs

Start by evaluating your current and potential future dental needs. Consider factors such as your age, the age of your dependents, and any existing dental conditions or treatments you may require. For instance, if you have young children, you’ll want to prioritize plans that offer extensive preventive care coverage.

Additionally, if you have any known dental issues or require ongoing treatment, ensure that the plan you choose covers these specific procedures. Some plans may have limitations or waiting periods for certain treatments, so it's essential to read the fine print.

Provider Network and In-Network Benefits

Many short-term dental insurance plans operate with a network of preferred dental providers. When choosing a plan, consider the convenience and potential cost savings of using in-network dentists. In-network providers often offer discounted rates, ensuring that your out-of-pocket expenses are minimized.

Research the plan's provider network to ensure that it includes dentists and specialists in your area. This can be particularly important if you have a preferred dentist or specialist you wish to continue seeing.

Coverage Limitations and Exclusions

Every dental insurance plan, including short-term ones, has its limitations and exclusions. It’s crucial to review these carefully to ensure that the plan aligns with your needs. Some common exclusions may include cosmetic dentistry, orthodontics, or certain specialized treatments.

Pay attention to any waiting periods for specific procedures. While short-term plans offer immediate coverage for preventive care, some restorative or major procedures may have waiting periods before they become eligible for coverage.

Comparing Premiums and Deductibles

Premiums and deductibles are essential components of any insurance plan. When comparing short-term dental insurance options, consider the balance between premiums and deductibles. Higher premiums may result in lower deductibles, making it more cost-effective for those who anticipate frequent dental visits.

Additionally, some plans may offer a choice between different premium levels, allowing you to customize your coverage and costs based on your preferences.

Enrolling and Utilizing Short-Term Dental Insurance

Once you’ve selected the ideal short-term dental insurance plan, the enrollment process is straightforward. Most providers offer online applications, making it convenient to sign up and get covered quickly.

The Enrollment Process

During the enrollment process, you’ll be asked to provide basic personal information and choose your coverage options. This is also an opportunity to review the plan’s terms and conditions, ensuring that you fully understand the coverage and any potential exclusions.

After enrollment, you'll receive your insurance card and a welcome kit, which typically includes a summary of benefits and a guide to using your insurance.

Maximizing Your Coverage

To make the most of your short-term dental insurance, it’s essential to understand how to utilize it effectively. Here are some tips:

- Schedule regular dental check-ups and cleanings to maintain optimal oral health and catch any potential issues early on.

- If you have any ongoing dental treatments, ensure that you schedule appointments within the coverage period to maximize your benefits.

- Familiarize yourself with the plan’s network of providers and choose in-network dentists to take advantage of discounted rates.

- Keep track of your deductible and out-of-pocket expenses to ensure you stay within your budget.

The Future of Short-Term Dental Insurance

Short-term dental insurance has gained popularity as an accessible and flexible alternative to traditional long-term plans. As the healthcare landscape continues to evolve, we can expect to see further innovations and improvements in this type of coverage.

Expanding Coverage Options

Insurance providers are increasingly recognizing the value of short-term plans and are working to expand coverage options. This may include introducing more comprehensive plans that cover a wider range of dental procedures, including orthodontics and cosmetic dentistry.

Additionally, there may be a shift towards more customizable plans, allowing individuals to choose the level of coverage they require based on their unique needs.

Technological Advancements

The integration of technology into the healthcare industry is inevitable, and dental insurance is no exception. We can anticipate the development of digital platforms and mobile apps that streamline the enrollment process and make it easier for policyholders to access their benefits and manage their coverage.

These technological advancements may also enhance the efficiency of claims processing, reducing wait times and improving the overall user experience.

Addressing Industry Challenges

While short-term dental insurance offers numerous benefits, it’s not without its challenges. One of the primary concerns is the potential for individuals to view these plans as a substitute for long-term coverage, leading to gaps in care and potentially more significant health issues down the line.

To address this, insurance providers may focus on educating consumers about the importance of continuous dental care and the value of long-term insurance plans. This could involve implementing incentives or discounts for those who transition seamlessly from short-term to long-term coverage.

Frequently Asked Questions

Can I use short-term dental insurance to cover existing dental conditions?

+Short-term dental insurance typically has waiting periods for certain procedures, including those related to pre-existing conditions. However, preventive care such as check-ups and cleanings are often covered immediately. It’s important to review the plan’s terms and conditions to understand the coverage for existing conditions.

Are there any age restrictions for short-term dental insurance plans?

+Most short-term dental insurance plans have age restrictions, typically ranging from 18 to 64 years old. However, some providers may offer plans specifically designed for older individuals or have flexible age requirements. It’s best to check with the provider to confirm their age eligibility criteria.

Can I extend my short-term dental insurance plan if I need coverage for a longer period?

+Yes, many short-term dental insurance plans offer the option to extend your coverage for an additional term. The extension period and any associated fees or requirements may vary between providers. It’s advisable to contact your insurance company to inquire about the extension process and any potential limitations.

Short-term dental insurance provides a valuable and flexible solution for individuals seeking temporary coverage or those who want to bridge gaps in their long-term plans. With its affordability, customizable coverage, and expanding options, it offers a practical way to maintain good oral health. As the industry continues to evolve, we can anticipate further improvements, ensuring that short-term dental insurance remains a viable and accessible option for individuals and families.