Small Business Insurance Cost

Navigating the world of insurance for small businesses can be a complex task, especially when it comes to understanding the associated costs. In this comprehensive guide, we will delve into the various factors that influence small business insurance expenses, providing you with a detailed analysis to help you make informed decisions.

Understanding Small Business Insurance Costs

Small business insurance serves as a crucial safeguard against financial risks, ensuring that your venture remains protected and resilient. The cost of this protection varies widely and is influenced by several key factors. By examining these aspects, we can gain a deeper understanding of the financial commitments involved in securing your business.

Risk Assessment and Coverage Types

The foundation of insurance cost calculation lies in risk assessment. Insurers meticulously evaluate the unique risks associated with your business to determine the appropriate level of coverage. This assessment considers factors such as your industry, location, size, and the specific operations of your business.

Small businesses often require a range of insurance policies to address different risks. Common coverage types include general liability, property insurance, professional liability (or errors and omissions), workers’ compensation, and commercial auto insurance. Each of these policies caters to specific risks, and the cost of these coverages varies significantly based on your business’s needs.

The Impact of Business Size and Operations

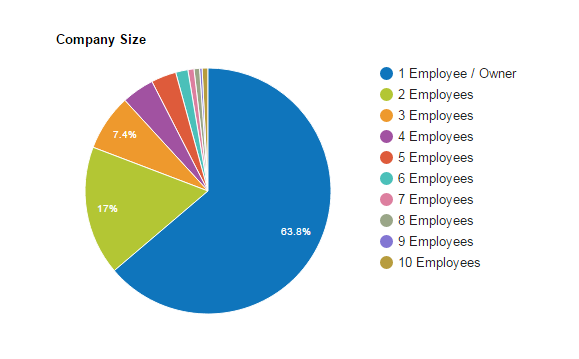

The size of your small business plays a pivotal role in determining insurance costs. Larger businesses with more employees, higher revenue, or a broader scope of operations typically face higher insurance premiums. This is because the potential for losses and claims increases with scale.

Additionally, the nature of your business operations can significantly impact insurance costs. High-risk industries, such as construction or manufacturing, often require more extensive coverage and may face higher premiums. Conversely, low-risk businesses, like consulting or graphic design, might enjoy more affordable insurance options.

| Business Type | Average Annual Premium |

|---|---|

| Construction | $3,500 - $10,000 |

| Retail | $1,500 - $3,000 |

| Healthcare | $2,000 - $5,000 |

| Professional Services | $1,000 - $2,500 |

This table provides a general overview of average annual premiums for different business types, showcasing the range of insurance costs across industries.

Location and Regional Factors

The geographic location of your business is another critical factor influencing insurance costs. Regions with higher crime rates, natural disaster risks, or dense populations often experience increased insurance premiums. This is because the potential for losses and claims is higher in these areas.

Additionally, regional regulations and legal requirements can impact insurance costs. Some states or localities may have specific insurance mandates or minimum coverage levels, which can affect the overall cost of insurance for small businesses operating in those areas.

The Role of Deductibles and Policy Limits

When selecting insurance policies, small business owners have the flexibility to choose deductibles and policy limits. Deductibles represent the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, as you’re assuming more financial responsibility in the event of a claim.

Policy limits, on the other hand, define the maximum amount an insurer will pay for a covered loss. Setting higher policy limits can provide more extensive coverage but may also increase your premiums. Finding the right balance between deductibles and policy limits is crucial to ensure your business is adequately protected without incurring excessive costs.

Comparative Analysis: Premium Variations

To illustrate the variations in small business insurance costs, let’s examine a comparative analysis of different business types and their respective insurance premiums. This analysis will provide a more granular understanding of the financial commitments involved.

Retail Business Example

A retail business, such as a boutique clothing store, faces unique risks. These may include property damage from theft or vandalism, liability claims from customer injuries, and product liability risks. The cost of insurance for a retail business can vary based on factors like store size, location, and the value of inventory.

| Retail Business | Coverage Type | Annual Premium |

|---|---|---|

| Clothing Boutique | General Liability | $1,200 |

| Electronics Store | Property Insurance | $1,800 |

| Grocery Store | Workers' Compensation | $3,000 |

| Online Retailer | Cyber Liability | $800 |

In this example, we can see that the insurance costs for a retail business can range from $1,200 to $3,000 annually, depending on the specific coverage needed. This highlights the importance of tailoring insurance policies to the unique needs of each business.

Professional Services Business Example

Professional services businesses, such as accounting firms or marketing agencies, face different risks. These may include professional liability claims, data breaches, or cyber attacks. The insurance costs for these businesses can vary based on factors like the number of employees, client diversity, and the sensitivity of the information they handle.

| Professional Services | Coverage Type | Annual Premium |

|---|---|---|

| Accounting Firm | Professional Liability | $1,500 |

| Marketing Agency | Cyber Liability | $900 |

| Law Firm | Errors & Omissions | $2,200 |

| Consulting Firm | General Liability | $1,000 |

The insurance costs for professional services businesses can range from $900 to $2,200 annually, emphasizing the need for comprehensive coverage to protect against potential risks in these industries.

Mitigating Costs: Tips for Small Businesses

While insurance costs are influenced by various factors, there are strategies small business owners can employ to mitigate these expenses. Here are some tips to help you manage insurance costs effectively:

- Conduct a comprehensive risk assessment: Identify potential risks specific to your business and take proactive measures to mitigate them. This can include implementing safety protocols, training employees, and adopting best practices in your industry.

- Bundle policies: Many insurance providers offer discounts when you bundle multiple policies together. By combining general liability, property insurance, and professional liability under one insurer, you may be able to reduce your overall premiums.

- Review and adjust coverage regularly: As your business evolves, so do your insurance needs. Regularly review your policies to ensure they align with your current operations and risk profile. Adjust coverage limits and deductibles as necessary to maintain adequate protection without overpaying.

- Shop around for the best rates: Don't settle for the first insurance quote you receive. Compare rates from multiple providers to find the most competitive prices for your business. Online insurance marketplaces can be a valuable resource for comparing quotes and finding the best deals.

- Consider business insurance alternatives: Explore alternative insurance options, such as captive insurance or risk retention groups, which can provide more flexibility and potentially lower costs for small businesses. These alternatives may offer customized coverage and more control over your insurance program.

The Future of Small Business Insurance

As the business landscape continues to evolve, so does the insurance industry. Technological advancements and changing consumer expectations are shaping the future of small business insurance. Here’s a glimpse into some of the emerging trends and developments:

Digitalization and Insurance Tech

The insurance industry is embracing digital transformation, with a growing number of online platforms and mobile apps dedicated to streamlining the insurance process. These digital tools enable small business owners to compare policies, purchase coverage, and manage their insurance needs efficiently.

Additionally, insurance tech startups are leveraging advanced technologies like artificial intelligence and machine learning to offer more accurate risk assessments and personalized insurance solutions. These innovations can help small businesses secure tailored coverage at competitive prices.

Data-Driven Risk Assessment

With the vast amount of data available today, insurers are increasingly utilizing data analytics to assess risks more accurately. By analyzing historical data, claim patterns, and industry trends, insurers can better understand the specific risks faced by small businesses and price policies accordingly.

This data-driven approach can lead to more precise risk assessments, resulting in fairer premiums for small businesses. It also enables insurers to offer more targeted coverage options, ensuring that businesses receive the protection they need without unnecessary expenses.

Emerging Risks and Coverage Innovations

As new technologies and business models emerge, so do new risks. Insurers are continually adapting their coverage offerings to address these evolving risks. For example, with the rise of remote work and digital transformations, insurers are introducing cyber liability policies tailored to the unique risks faced by small businesses in the digital age.

Additionally, insurers are developing innovative coverage solutions to address specific industry needs. From drone insurance for construction businesses to professional liability coverage for emerging tech startups, insurers are expanding their offerings to meet the diverse risk profiles of small businesses.

Collaborative Insurance Models

Collaborative insurance models, such as peer-to-peer insurance and risk pooling, are gaining traction in the small business insurance space. These models leverage the power of community and shared resources to provide affordable coverage options.

Peer-to-peer insurance platforms, for instance, allow small businesses to pool their resources and share risks collectively. This can lead to lower premiums and more flexible coverage options, as businesses collaborate to manage their insurance needs together.

Conclusion: Navigating Small Business Insurance Costs

Understanding the factors that influence small business insurance costs is crucial for making informed decisions about your business’s financial protection. By conducting a thorough risk assessment, comparing quotes, and exploring alternative insurance options, you can find the right coverage at a competitive price.

As the insurance industry continues to evolve, small business owners can expect more innovative coverage solutions and streamlined processes. Embracing digital tools, leveraging data analytics, and staying informed about emerging risks will be key to navigating the complex world of small business insurance.

Remember, insurance is an essential investment in the longevity and success of your small business. By staying proactive and adapting to changing market dynamics, you can ensure your business remains protected and resilient for years to come.

How much does small business insurance typically cost per month or year?

+

The cost of small business insurance varies widely based on factors such as industry, location, size, and coverage needs. On average, small businesses can expect to pay between 500 and 2,000 per year for general liability insurance, which is a common baseline coverage. However, the total cost can exceed $10,000 annually for businesses with higher risks or more extensive coverage requirements.

What factors determine the cost of small business insurance?

+

Several factors influence the cost of small business insurance, including the type of business, location, number of employees, revenue, and the specific coverage needs. High-risk industries or businesses operating in areas with higher crime rates or natural disaster risks may face higher premiums. Additionally, the coverage limits and deductibles chosen by the business owner also impact the overall cost.

Are there ways to reduce the cost of small business insurance?

+

Yes, small business owners can take several steps to mitigate insurance costs. This includes conducting a comprehensive risk assessment to identify and mitigate potential risks, bundling policies with the same insurer to access discounts, and regularly reviewing coverage to ensure it aligns with the business’s current needs. Shopping around for competitive quotes and considering alternative insurance options, such as captive insurance or risk retention groups, can also help reduce costs.