Small Business Vehicle Insurance

For small business owners, understanding the nuances of vehicle insurance is crucial. Whether you're a sole proprietor making deliveries or a small business owner with a fleet of vehicles, the right insurance coverage is essential to protect your assets, manage risks, and ensure compliance with regulations. This comprehensive guide will delve into the world of small business vehicle insurance, offering insights, strategies, and expert advice to help you make informed decisions.

Navigating the Landscape of Small Business Vehicle Insurance

Small business vehicle insurance is a complex topic, but it’s an indispensable aspect of running a successful enterprise. From single-vehicle operations to larger fleets, the right insurance coverage can mean the difference between smooth operations and significant financial setbacks. This section will provide an overview of the key considerations and options available to small business owners.

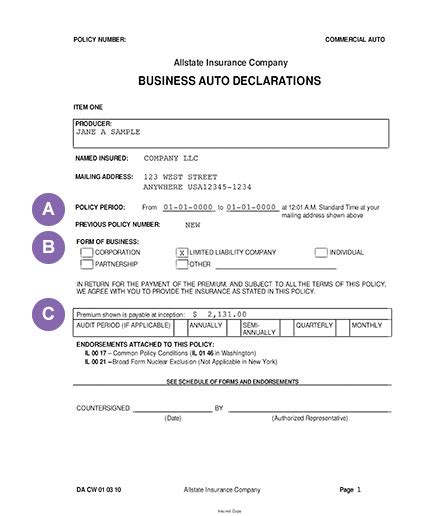

Understanding the Basics: Commercial Auto Insurance

Commercial auto insurance is a type of policy specifically designed for businesses that use vehicles. It provides coverage for a range of risks, including accidents, theft, and damage to the insured vehicles. This type of insurance is distinct from personal auto insurance, as it covers business-related use and often includes additional protections tailored to the unique needs of businesses.

Some key features of commercial auto insurance include:

- Liability Coverage: This protects the business against claims arising from accidents caused by the insured vehicles. It covers medical expenses, property damage, and legal fees.

- Physical Damage Coverage: This covers the cost of repairing or replacing insured vehicles that have been damaged in an accident, stolen, or vandalized.

- Uninsured/Underinsured Motorist Coverage: Provides protection if an accident involves a driver who either has no insurance or insufficient insurance to cover the damages.

- Medical Payments Coverage: Covers the medical expenses of the business's employees or other authorized individuals who are injured in a work-related accident.

- Comprehensive Coverage: Offers protection against non-collision incidents, such as fire, vandalism, or natural disasters.

When selecting a commercial auto insurance policy, it's essential to consider the specific needs and risks of your business. Factors such as the type of vehicles used, the nature of their use (e.g., delivery, transportation of goods or people), and the number of drivers can all influence the type of coverage required.

The Importance of Adequate Coverage

Insufficient insurance coverage can leave small businesses vulnerable to significant financial losses. For instance, if a business vehicle is involved in an accident and the driver is found at fault, the business could face costly legal fees, medical bills, and property damage claims. Without adequate liability coverage, these expenses could quickly exceed the business’s financial resources, potentially leading to bankruptcy.

Similarly, if a business vehicle is damaged or stolen and the business does not have physical damage coverage, the cost of repairs or replacement could be prohibitive, disrupting operations and potentially impacting the business's ability to serve its customers.

It's also important to note that commercial auto insurance is often a legal requirement for businesses that use vehicles. Failure to comply with these regulations can result in fines, penalties, and even the suspension of the business's operations.

Customizing Coverage: Tailoring Policies to Your Business

One of the key benefits of commercial auto insurance is the ability to customize coverage to fit the specific needs of your business. This customization ensures that your insurance policy is not only cost-effective but also provides the right level of protection for your unique circumstances.

For instance, a business that primarily transports goods might focus on physical damage coverage and cargo protection, while a business that provides transportation services for clients might prioritize liability coverage and medical payments protection for passengers.

Some common types of coverage that can be tailored include:

- Garagekeepers Coverage: Provides protection for customers' vehicles in your care, custody, or control. This is particularly relevant for businesses that offer vehicle storage, repair, or servicing.

- Hired and Non-Owned Auto Coverage: Covers vehicles that are not owned by the business but are used for business purposes, such as rental cars or vehicles borrowed from employees.

- Business Auto Policy (BAP): A comprehensive policy that can be tailored to include various types of coverage, including liability, physical damage, and additional protections like rental reimbursement or towing and labor coverage.

When tailoring your coverage, it's beneficial to work with an insurance agent who understands your industry and can guide you in selecting the right combination of protections. They can help you navigate the various policy options and ensure that your business is adequately protected without unnecessary expense.

Real-World Examples: How Small Businesses Manage Vehicle Insurance

Let’s look at some real-world scenarios to understand how different small businesses approach vehicle insurance.

Scenario 1: Delivery Business

John runs a small delivery business, using a fleet of five vans to transport goods across the city. His business faces unique challenges, as his vehicles are on the road for extended periods and are at higher risk of accidents and theft. John chooses a commercial auto insurance policy that provides comprehensive coverage, including liability, physical damage, and uninsured motorist protection. He also opts for additional coverage for cargo, as his vans often carry valuable goods. By tailoring his policy to his specific needs, John ensures that his business is protected against a range of potential risks.

Scenario 2: Service Business

Sarah owns a small plumbing business, often using her personal vehicle to travel to job sites. Given the nature of her work, Sarah's vehicle is at risk of damage from tools or materials. She decides to purchase hired and non-owned auto coverage, which protects her personal vehicle when used for business purposes. This coverage ensures that if her vehicle is damaged while on a job, she won't have to pay out of pocket for repairs. Additionally, Sarah purchases medical payments coverage to protect her and her employees in case of an accident while on the job.

Scenario 3: Transportation Business

Michael operates a small transportation business, providing luxury car services for clients. His business relies on maintaining a high standard of service, which includes ensuring the safety and comfort of his clients. Michael chooses a commercial auto insurance policy with extensive liability coverage, as well as medical payments coverage for his clients. He also includes coverage for personal effects, as his clients often carry valuable items in his vehicles. By focusing on these specific coverages, Michael can provide his clients with peace of mind and maintain the reputation of his business.

Performance Analysis and Case Studies

To further illustrate the importance and impact of small business vehicle insurance, let’s delve into some real-world case studies and performance analyses.

Case Study: Impact of Adequate Insurance Coverage

Consider a small construction business that owns a fleet of trucks and heavy machinery. Without adequate insurance coverage, a single accident involving one of their trucks could have devastating financial consequences. For instance, if a driver is at fault in an accident that results in significant property damage and injuries, the business could face legal fees, medical bills, and compensation claims totaling hundreds of thousands of dollars.

However, with comprehensive commercial auto insurance, the business is protected. The liability coverage in their policy would cover the cost of these claims, protecting the business's financial stability. Furthermore, the physical damage coverage would ensure that the damaged truck is repaired or replaced, minimizing downtime and allowing the business to continue operations.

This case study highlights the critical role that adequate insurance coverage plays in protecting small businesses from potentially catastrophic financial losses.

Performance Analysis: The Financial Benefits of Tailored Coverage

Tailoring insurance coverage to the specific needs of a small business can result in significant financial benefits. Let’s analyze a hypothetical scenario to illustrate this point.

Imagine a small catering business that uses a fleet of vehicles to transport food and equipment to various event venues. This business has the option of choosing a standard commercial auto insurance policy or customizing its coverage to better fit its unique needs.

By opting for a standard policy, the business might pay for coverages it doesn't need, such as extensive liability protection for bodily injury, while lacking coverage for other critical risks. For instance, they might not have sufficient protection for food spoilage or equipment damage during transport.

However, by tailoring their coverage, they can focus on the risks that are most relevant to their business. This might include increased protection for food spoilage, as well as coverage for equipment damage and theft. By doing so, they can reduce their overall insurance costs while ensuring they are adequately protected against the risks that are most likely to impact their operations.

This performance analysis demonstrates how a tailored insurance approach can lead to significant cost savings and improved risk management for small businesses.

Future Implications and Industry Trends

Looking ahead, the landscape of small business vehicle insurance is likely to be shaped by several key trends and developments.

The Rise of Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is becoming increasingly popular in the insurance industry. This technology allows insurance providers to offer usage-based insurance policies, which tailor premiums based on actual driving behavior rather than historical data or demographics.

For small businesses, this could mean significant savings. By adopting safe driving practices and using vehicles efficiently, businesses can qualify for lower premiums. Additionally, telematics data can help businesses identify areas for improvement, such as reducing idling time or optimizing routes, which can further enhance operational efficiency.

The Impact of Autonomous Vehicles and Electric Fleets

The adoption of autonomous vehicles and the shift towards electric fleets are likely to have significant implications for small business vehicle insurance.

Autonomous vehicles, with their advanced safety features and reduced risk of human error, could lead to a decrease in accidents and insurance claims. This could result in lower insurance premiums for businesses that adopt this technology. However, it may also present new challenges, such as the need for specialized coverage for potential software failures or cybersecurity risks.

Similarly, the shift to electric fleets could impact insurance needs. Electric vehicles often have lower maintenance costs and are generally safer to operate, which could result in reduced insurance premiums. However, they may also require additional coverage for unique risks, such as battery failure or charging station liability.

The Role of Technology in Risk Management

Advancements in technology are also expected to play a significant role in risk management for small businesses. From GPS tracking and telematics to predictive analytics and artificial intelligence, these technologies can help businesses better understand and manage their risks.

For instance, GPS tracking can help businesses monitor vehicle usage and location, ensuring that vehicles are being used for their intended purposes and in compliance with insurance policies. Predictive analytics can identify potential risks, such as areas with a high incidence of accidents or theft, allowing businesses to adjust their operations or insurance coverage accordingly.

Overall, the future of small business vehicle insurance is likely to be characterized by a continued focus on customization and risk management, with technology playing an increasingly prominent role.

Expert Insights and Recommendations

As an expert in the field of small business vehicle insurance, I’d like to offer some key recommendations and insights to help business owners navigate this complex landscape.

The Importance of Regular Policy Reviews

Small businesses should regularly review their insurance policies to ensure they remain adequately protected. This is particularly important as businesses grow and their needs change. For instance, a business that starts with a single vehicle may require different coverage as it expands its fleet or begins transporting valuable goods.

Regular policy reviews also allow businesses to take advantage of any new coverages or discounts that may become available. Insurance providers often update their policies to reflect changes in regulations, technology, and industry trends. By staying informed, businesses can ensure they are accessing the most up-to-date and cost-effective coverage options.

Building a Strong Relationship with Your Insurance Agent

Working closely with a trusted insurance agent can be immensely beneficial for small businesses. A good insurance agent will understand the unique needs and risks of your business and can guide you in selecting the right coverage. They can also provide valuable advice on risk management strategies and help you navigate any claims processes.

Building a strong relationship with your insurance agent can also lead to better rates and more flexible coverage options. Agents who are familiar with your business and its operations are often able to negotiate better terms with insurance providers, resulting in more cost-effective and comprehensive coverage.

The Value of Loss Control and Risk Management

Loss control and risk management strategies are essential for small businesses to mitigate potential losses and keep insurance costs down. This can include implementing safety measures, such as driver training programs, vehicle maintenance protocols, and the use of telematics technology to monitor driving behavior.

By proactively managing risks, small businesses can not only reduce the likelihood of accidents and claims but also demonstrate to insurance providers that they are responsible and proactive in their operations. This can lead to more favorable insurance rates and terms, as well as a better understanding of the business's specific needs and risks.

Staying Informed on Industry Trends and Regulations

The world of insurance is constantly evolving, with new regulations, technologies, and coverages emerging regularly. Staying informed on these developments is crucial for small business owners to ensure they are accessing the most relevant and beneficial insurance options.

This includes keeping up with changes in state and federal regulations that may impact insurance requirements, as well as emerging technologies and coverages that could benefit their business. For instance, understanding the implications of electric vehicles or autonomous driving technologies can help business owners make informed decisions about their fleet and insurance coverage.

Conclusion

Small business vehicle insurance is a critical aspect of running a successful enterprise, providing protection against a range of risks and ensuring compliance with regulations. By understanding the key considerations, customizing coverage to their unique needs, and staying informed on industry trends, small business owners can effectively manage their insurance needs and keep their operations running smoothly.

What is the difference between personal auto insurance and commercial auto insurance for small businesses?

+Personal auto insurance is designed for individual use, whereas commercial auto insurance is tailored to meet the specific needs of businesses that use vehicles. Commercial policies typically offer higher liability limits, cover a wider range of risks (such as damage to goods being transported), and may include additional coverages like hired and non-owned auto coverage.

How can small businesses reduce their insurance costs without compromising coverage?

+Small businesses can reduce insurance costs by implementing loss control and risk management strategies, such as driver training programs and vehicle maintenance protocols. They can also explore usage-based insurance policies, which offer premiums based on actual driving behavior, and shop around for the best rates and coverage options.

What are some common exclusions in small business vehicle insurance policies that businesses should be aware of?

+Common exclusions in small business vehicle insurance policies may include coverage for intentional acts, wear and tear, mechanical or electrical breakdown, and damage resulting from the use of alcohol or drugs. It’s crucial for businesses to carefully review their policies to understand what is and isn’t covered.