Sr22 Car Insurance

SR22 car insurance, often referred to as a "certificate of financial responsibility," is a specific type of insurance policy that is required for drivers who have had their licenses suspended or revoked due to serious traffic violations or accidents. It serves as proof to the state that the driver now carries adequate liability insurance coverage, meeting the minimum requirements set by the state.

This insurance is crucial for drivers who need to regain their driving privileges and is a mandatory step in the process of getting their licenses reinstated. SR22 insurance demonstrates to the state that the driver is financially responsible and capable of covering potential damages in the event of an accident.

In this comprehensive guide, we will delve into the intricacies of SR22 car insurance, exploring its purpose, how it works, the costs involved, and the steps to obtaining it. We will also provide insights into the impact of SR22 insurance on driving records and offer expert advice on how to navigate this often complex process.

Understanding SR22 Insurance

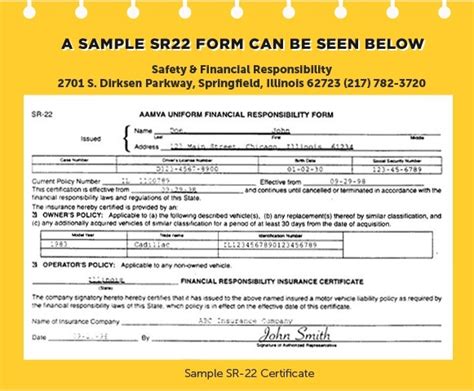

SR22 insurance is a specialized form of liability coverage that is required in specific situations, primarily when a driver has a history of serious traffic violations or has been involved in an accident without adequate insurance coverage. It is a legal document that the insurance company files with the state, guaranteeing that the driver maintains the required level of insurance for a set period, typically three years.

The primary purpose of SR22 insurance is to protect the public by ensuring that drivers who have demonstrated high-risk behavior have the means to cover potential damages. It is a crucial tool for states to regulate and manage high-risk drivers, ensuring they are adequately insured and reducing the risk of uninsured drivers on the roads.

Key Features of SR22 Insurance

- Mandatory Requirement: SR22 insurance is typically mandated by the state after a driver has had their license suspended or revoked due to serious traffic offenses, such as DUI (Driving Under the Influence), excessive speeding, reckless driving, or multiple accidents without insurance.

- Proof of Financial Responsibility: The SR22 form serves as a guarantee to the state that the driver carries liability insurance meeting the state’s minimum requirements. This ensures that the driver can cover potential damages in the event of an accident, providing financial protection to other parties involved.

- Duration and Renewal: SR22 insurance policies are typically in effect for a period of three years. During this time, the insurance company is required to notify the state if the policy is canceled or lapses. Once the required period has passed and the driver maintains a clean driving record, the SR22 requirement can be lifted.

- Cost and Coverage: SR22 insurance tends to be more expensive than standard liability insurance due to the high-risk nature of the policyholder. The cost can vary significantly based on the driver’s record and the state’s requirements. Coverage typically includes bodily injury liability, property damage liability, and, in some cases, uninsured motorist coverage.

Obtaining SR22 Insurance

Obtaining SR22 insurance involves a specific process, which can vary slightly depending on the state and the driver’s individual circumstances. Here is a general overview of the steps involved:

Step 1: Check Eligibility and Requirements

Not all drivers will be eligible for SR22 insurance. Eligibility typically depends on the severity of the traffic violations or accidents on the driver’s record. It is essential to understand the specific requirements and eligibility criteria set by your state.

Step 2: Choose an Insurance Provider

Not all insurance companies offer SR22 insurance. It is crucial to find an insurer that specializes in high-risk policies and has experience with SR22 requirements. Research and compare different providers to find the best coverage and rates for your situation.

Step 3: Apply for the Policy

Once you have selected an insurance provider, you will need to complete an application for the SR22 policy. This will involve providing personal and vehicle information, as well as details about your driving record and any past insurance coverage.

Step 4: Filing the SR22 Form

After your application is approved, the insurance company will file the SR22 form with the state. This process varies by state, but typically involves electronic submission or physical delivery of the form to the state’s Department of Motor Vehicles (DMV) or a similar agency.

Step 5: Maintain the Policy

Once the SR22 form is filed, it is essential to maintain the policy for the required period. This means keeping your insurance active and up-to-date throughout the duration of the SR22 requirement. Any lapses in coverage could result in the suspension of your license and additional fees.

Cost and Coverage Considerations

SR22 insurance is known for its higher premiums compared to standard liability insurance. The cost can vary significantly based on several factors, including the driver’s age, driving record, vehicle type, and state requirements.

Here are some key considerations regarding the cost and coverage of SR22 insurance:

Cost Factors

- Driving Record: The severity and frequency of past traffic violations or accidents play a significant role in determining the cost of SR22 insurance. Drivers with multiple serious offenses will likely face higher premiums.

- State Requirements: Each state has its own minimum insurance requirements, which can impact the cost of SR22 insurance. States with higher minimum coverage limits will generally result in higher premiums.

- Vehicle Type: The make, model, and age of your vehicle can influence the cost of insurance. Sports cars or high-performance vehicles, for example, may be more expensive to insure.

- Discounts: Despite the high-risk nature of SR22 insurance, there may still be opportunities to save on premiums. Some insurance companies offer discounts for safe driving, bundling policies, or paying premiums annually rather than monthly.

Coverage Options

SR22 insurance primarily focuses on liability coverage, which protects you financially if you are found at fault in an accident. However, it is important to understand the specific coverage limits and exclusions of your policy.

Common coverage options include:

- Bodily Injury Liability: This covers medical expenses and lost wages for injuries sustained by others in an accident for which you are responsible.

- Property Damage Liability: Covers the cost of repairing or replacing property damaged in an accident for which you are at fault.

- Uninsured Motorist Coverage: Provides protection if you are involved in an accident with an uninsured or underinsured driver.

- Personal Injury Protection (PIP): Offers coverage for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault.

- Comprehensive and Collision Coverage: While not typically included in SR22 policies, these coverages can be added to protect your own vehicle in the event of an accident, theft, or other covered incidents.

Impact on Driving Record and Future Insurance

Obtaining an SR22 insurance policy is a significant step towards repairing your driving record and regaining your driving privileges. However, it is important to understand the long-term impact of SR22 insurance on your driving record and future insurance options.

Driving Record

The SR22 requirement is a consequence of serious traffic violations or accidents. While it demonstrates your commitment to maintaining adequate insurance coverage, it does not erase the underlying violations from your driving record. These violations will remain on your record for a set period, typically 3-7 years, depending on the state and the severity of the offense.

During the SR22 requirement period, it is crucial to maintain a clean driving record. Any additional violations or accidents could result in further penalties, including an extension of the SR22 requirement or even the permanent revocation of your license.

Future Insurance Options

Once you have successfully completed the SR22 requirement period and maintained a clean driving record, you may be eligible to transition back to standard liability insurance. However, the impact of your high-risk driving history will continue to affect your insurance rates for several years.

Here are some considerations for future insurance options:

- Premium Increases: Even after the SR22 requirement is lifted, you can expect your insurance premiums to remain higher than they were before the violations. Insurance companies use your driving record to assess your risk level, and past violations will continue to impact your rates.

- Shopping for Insurance: It is advisable to shop around for insurance quotes regularly, as rates can vary significantly between providers. Compare quotes from multiple insurers to find the best coverage and rates for your situation.

- Bundling Policies: Consider bundling your auto insurance with other policies, such as homeowners or renters insurance, to potentially save on premiums. Many insurance companies offer discounts for bundling multiple policies.

- Safe Driving Discounts: Focus on maintaining a clean driving record to qualify for safe driving discounts. These discounts can help offset the increased premiums associated with a high-risk driving history.

Expert Advice and Tips

Navigating the process of obtaining and maintaining SR22 insurance can be challenging, but there are strategies and expert tips that can help make the process smoother.

Tips for Obtaining SR22 Insurance

- Research Insurance Providers: Take the time to research and compare different insurance providers that offer SR22 policies. Look for companies with a good reputation and experience in handling high-risk policies.

- Understand State Requirements: Familiarize yourself with the specific requirements and eligibility criteria set by your state. This knowledge will help you navigate the process more efficiently and ensure you meet all the necessary criteria.

- Be Transparent: When applying for SR22 insurance, be honest and transparent about your driving record and any past insurance coverage. Insurance companies will verify this information, and any discrepancies could lead to policy denial or cancellation.

- Explore Payment Options: Many insurance companies offer flexible payment plans for SR22 policies. Consider paying your premiums annually or semi-annually to potentially save on administrative fees associated with monthly payments.

Maintaining SR22 Insurance

- Keep Coverage Active: It is crucial to maintain your SR22 insurance coverage throughout the required period. Any lapses in coverage could result in the suspension of your license and additional fees. Set up automatic payments or reminders to ensure timely premium payments.

- Review Coverage Regularly: Periodically review your SR22 policy to ensure it meets your current needs and circumstances. As your driving record improves, you may be eligible for additional coverage options or lower premiums.

- Drive Safely: The most effective way to improve your driving record and reduce future insurance costs is to drive safely and avoid additional violations or accidents. Focus on defensive driving techniques and be mindful of your driving behavior.

Conclusion

SR22 car insurance is a specialized form of liability coverage that plays a crucial role in managing high-risk drivers and ensuring their financial responsibility on the roads. Obtaining and maintaining SR22 insurance is a complex process, but with the right knowledge and strategies, drivers can navigate this requirement successfully.

By understanding the purpose, cost, and impact of SR22 insurance, drivers can make informed decisions about their coverage and work towards repairing their driving records. It is essential to choose an experienced insurance provider, maintain a clean driving record, and explore opportunities to save on premiums while meeting the SR22 requirement.

Remember, SR22 insurance is a second chance for drivers to demonstrate their commitment to safe and responsible driving. With dedication and a focus on improving driving behavior, drivers can not only regain their driving privileges but also work towards more affordable insurance options in the future.

How long does an SR22 insurance policy typically last?

+SR22 insurance policies are typically in effect for a period of three years. However, this duration can vary based on state regulations and individual circumstances. It is essential to maintain the policy for the entire required period to avoid license suspension.

Can I switch insurance companies while having an SR22 requirement?

+Yes, you can switch insurance companies while having an SR22 requirement. However, it is crucial to ensure that your new insurance provider is willing to file the SR22 form on your behalf and that you maintain continuous coverage throughout the switch. Any lapses in coverage could result in the suspension of your license.

What happens if I move to a different state while having an SR22 requirement?

+If you move to a different state while having an SR22 requirement, you will need to notify both your current and new state’s DMV. The process for transferring your SR22 requirement may vary, so it is essential to understand the specific regulations of both states. In most cases, you will need to obtain a new SR22 form from your new state’s DMV and ensure your insurance provider files it accordingly.