Sr22 Insurence

SR22 insurance is a specialized type of auto insurance certificate required by certain states in the United States for drivers with a history of serious violations or high-risk behaviors behind the wheel. It serves as proof of financial responsibility and is often mandated by state authorities or courts after a driver has committed certain offenses, such as driving under the influence (DUI), reckless driving, or multiple traffic violations.

Understanding SR22 Insurance

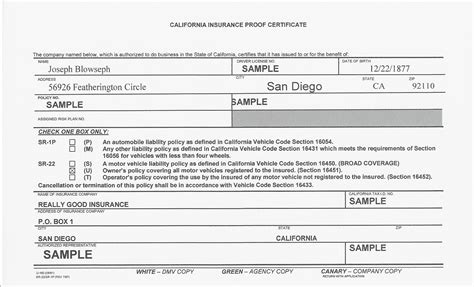

SR22 insurance is not a traditional insurance policy but rather a document filed with the state’s Department of Motor Vehicles (DMV) or the relevant regulatory body. This document verifies that the driver has purchased the minimum level of liability insurance coverage required by law. The SR22 form acts as a guarantee to the state that the driver carries the necessary insurance to operate a vehicle legally.

The primary purpose of SR22 insurance is to protect other drivers and pedestrians on the road. By ensuring that high-risk drivers have adequate liability coverage, the state aims to mitigate the financial burden that these drivers might impose on others in the event of an accident. SR22 insurance is typically required for a set period, often ranging from one to three years, depending on the nature of the offense and the state's regulations.

Who Needs SR22 Insurance?

Drivers who have been convicted of certain traffic offenses or who have had their driver’s license suspended or revoked may be ordered by the court or the DMV to obtain SR22 insurance. Common scenarios include:

- Driving under the influence (DUI) or driving while intoxicated (DWI)

- Refusing to submit to a chemical test for alcohol or drug impairment

- Hit-and-run accidents

- Reckless driving

- Multiple serious traffic violations

- Failing to maintain adequate insurance coverage

It's important to note that the specific requirements and regulations regarding SR22 insurance vary from state to state. Some states may have alternative forms or requirements, such as FR44 insurance in Florida and Virginia.

Obtaining SR22 Insurance

To obtain SR22 insurance, a driver typically needs to follow these general steps:

- Contact an Insurance Provider: Not all insurance companies offer SR22 insurance, so it’s essential to find a provider that specializes in high-risk auto insurance. You can reach out to multiple insurers to compare rates and coverage options.

- Provide Necessary Information: The insurance company will require details about your driving record, including any convictions or violations that led to the need for SR22 insurance. They may also ask for personal and vehicle information.

- File the SR22 Form: Once you have purchased the required insurance policy, the insurance company will file the SR22 form with the state’s DMV or the appropriate regulatory body. This form is usually valid for a specific period, as determined by the state’s regulations.

- Maintain Continuous Coverage: It’s crucial to maintain continuous insurance coverage throughout the period mandated by the state. Any lapse in coverage could result in the cancellation of your SR22 insurance and further legal consequences.

SR22 insurance can often be more expensive than standard auto insurance due to the high-risk nature of the policy. However, it is a necessary step for drivers to regain their driving privileges and comply with state laws.

Costs and Coverage

The cost of SR22 insurance can vary significantly based on several factors, including:

- State Requirements: Different states have varying minimum liability coverage limits, which directly impact the cost of SR22 insurance.

- Driver’s Record: The severity and frequency of past offenses can influence the insurance premium. Multiple violations or a recent DUI conviction may result in higher rates.

- Insurance Company: Different insurers may offer varying rates for SR22 insurance, so it’s beneficial to shop around and compare quotes.

- Vehicle Type: The make, model, and age of your vehicle can affect the cost of insurance.

In addition to the minimum liability coverage required by the SR22 form, drivers may also consider purchasing additional coverage, such as collision and comprehensive insurance, to protect their vehicles in the event of an accident or other damages.

Restoring Driving Privileges

Obtaining and maintaining SR22 insurance is a crucial step for drivers seeking to restore their driving privileges after a serious violation. The process typically involves the following steps:

- Complete Court-Mandated Penalties: Depending on the offense, you may need to serve jail time, pay fines, or complete a substance abuse treatment program. Ensuring that you fulfill all court-ordered obligations is essential before applying for SR22 insurance.

- Obtain SR22 Insurance: As mentioned earlier, you’ll need to purchase SR22 insurance from a specialized insurer. The insurance company will then file the SR22 form with the state, verifying your financial responsibility.

- Reapply for a Driver’s License: Once you have obtained SR22 insurance, you can typically reapply for a driver’s license. The process may involve passing a written or driving test, depending on the state’s requirements.

- Maintain Compliance: It’s crucial to maintain continuous SR22 insurance coverage for the entire period mandated by the state. Failure to do so could result in the suspension of your driver’s license and legal consequences.

The Impact of SR22 Insurance on Driving Privileges

SR22 insurance is a tool used by states to ensure that high-risk drivers maintain adequate insurance coverage. By requiring SR22 insurance, states aim to promote safer roads and protect the financial interests of all drivers. The presence of SR22 insurance can have the following impacts on a driver’s privileges:

- License Reinstatement: For drivers who have had their license suspended or revoked due to a serious violation, obtaining SR22 insurance is often a necessary step to regain driving privileges.

- Continuous Monitoring: The state may closely monitor drivers with SR22 insurance to ensure they maintain continuous coverage. Any lapse in insurance could lead to further penalties or the suspension of their driver’s license.

- Reduced Risks: By requiring high-risk drivers to carry SR22 insurance, states aim to reduce the likelihood of uninsured motorists causing accidents and financial burdens on others.

FAQs

Can I drive without SR22 insurance if I have a DUI conviction?

+No, if you have been convicted of a DUI or DWI and are required to carry SR22 insurance, driving without it can result in severe legal consequences, including license suspension and additional fines.

How long do I need to maintain SR22 insurance?

+The duration of SR22 insurance requirements varies by state and the nature of the offense. It can range from one to three years, but it’s essential to check with your state’s DMV for specific regulations.

Can I switch insurance providers while I have SR22 insurance?

+Yes, you can switch insurance providers as long as you maintain continuous coverage. Ensure that your new insurer is aware of your SR22 requirements and can provide the necessary coverage.

What happens if my SR22 insurance lapses?

+If your SR22 insurance lapses, the state may suspend your driver’s license and require you to start the process again, including paying additional fees and penalties. It’s crucial to maintain continuous coverage.

Are there any alternatives to SR22 insurance?

+Some states offer alternative forms, such as FR44 insurance in Florida and Virginia, which serve a similar purpose. It’s essential to check with your state’s regulations to understand the specific requirements.