State By State Car Insurance Rates

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers across the United States. However, insurance rates can vary significantly from state to state, influenced by a multitude of factors. Understanding these variations is crucial for drivers seeking the best coverage options and for those interested in the economics of automotive insurance. This article delves into the intricacies of state-by-state car insurance rates, exploring the factors that contribute to these differences and offering insights into the cost of automotive insurance coverage across the nation.

Unraveling the State-by-State Variations in Car Insurance Rates

The landscape of car insurance rates in the United States is diverse and complex, with a myriad of factors influencing the cost of coverage from state to state. These factors range from demographic characteristics and driving behavior to the unique regulatory environments of each state. Understanding these variations is not just a matter of curiosity; it has practical implications for both individual drivers and the insurance industry as a whole.

The Role of Demographics and Driving Behavior

One of the primary drivers of state-by-state car insurance rate variations is the demographic makeup and driving behavior of a state's population. States with higher population densities, particularly those with large urban centers, often experience higher insurance rates. This is due in part to the increased risk of accidents and claims in more densely populated areas. Additionally, the age distribution of a state's population can play a role. States with a higher proportion of younger drivers, who are statistically more likely to be involved in accidents, tend to have higher insurance rates.

Driving behavior also significantly influences insurance rates. States with a higher incidence of traffic violations, such as speeding tickets and DUI offenses, often have higher insurance rates. This is because insurance companies use these metrics to assess the risk profile of drivers and adjust rates accordingly. Furthermore, the rate of car theft and vandalism can also impact insurance rates, as these incidents lead to higher claim payouts.

Regulatory Environments and Legal Requirements

Each state in the U.S. has its own set of regulations and laws governing the automotive insurance industry. These regulations can significantly impact insurance rates. For instance, states with no-fault insurance systems, where each driver's insurance company pays for their injuries and damages regardless of fault, often have higher insurance rates than states with traditional tort-based systems. This is because no-fault systems tend to lead to more frequent and costly claims.

Additionally, states with stricter legal requirements for insurance coverage often have higher insurance rates. For example, states that mandate higher minimum liability limits or require additional coverage types, such as personal injury protection (PIP) or uninsured/underinsured motorist coverage, will generally have higher average insurance rates.

Cost of Living and Economic Factors

The cost of living in a state, including the cost of labor and auto repair services, also plays a role in insurance rates. States with a higher cost of living often have higher insurance rates, as the cost to repair or replace a vehicle is higher in these areas. Similarly, states with a higher average income level may also have higher insurance rates, as insurance companies often use income as an indicator of potential risk and adjust rates accordingly.

Historical Claim Data and Regional Differences

Insurance rates are also influenced by historical claim data. States with a history of higher claim frequencies or severity, such as those with a higher incidence of natural disasters like hurricanes or earthquakes, often have higher insurance rates. This is because insurance companies use this data to assess the risk profile of a particular region and adjust rates to reflect that risk.

Furthermore, regional differences in driving conditions and road infrastructure can impact insurance rates. States with harsher winters, for example, may have higher insurance rates due to the increased risk of accidents during winter months. Similarly, states with a higher proportion of rural roads may have lower insurance rates, as rural driving is often considered less risky than urban driving.

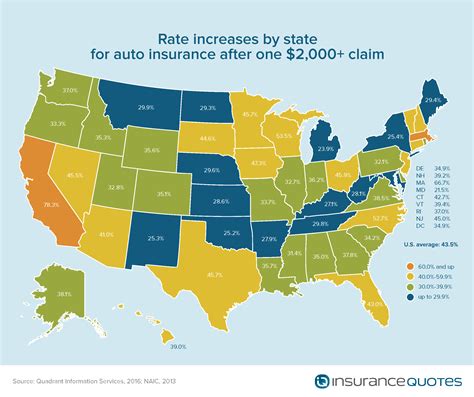

Comparative Analysis: State-by-State Insurance Rate Breakdown

To gain a clearer understanding of the variations in car insurance rates across the U.S., let's examine a comparative analysis of insurance rates in several states. This analysis will provide a snapshot of the diverse landscape of automotive insurance costs and the factors that contribute to these differences.

| State | Average Annual Insurance Rate | Key Factors Influencing Rates |

|---|---|---|

| California | $1,466 | High population density, stringent insurance regulations, and a history of natural disasters like earthquakes. |

| Texas | $1,191 | Large urban centers, high rate of traffic violations, and a unique no-fault insurance system for personal injury protection. |

| New York | $1,823 | Dense urban areas, strict insurance laws including high mandatory liability limits, and a high cost of living. |

| Florida | $1,619 | High incidence of hurricanes and other natural disasters, no-fault insurance system, and a large population of elderly drivers. |

| Illinois | $1,049 | Moderate population density, a mix of urban and rural areas, and relatively low rates of traffic violations. |

| Ohio | $893 | Rural-urban mix, low cost of living, and a lower rate of severe weather events. |

| Montana | $734 | Low population density, rural areas, and a low rate of traffic violations and car accidents. |

The Impact of State-Specific Factors

The comparative analysis above highlights the significant role that state-specific factors play in determining insurance rates. For instance, California's high insurance rates are influenced by its dense population, strict insurance regulations, and the risk posed by natural disasters like earthquakes. Similarly, Texas's rates are impacted by its large urban centers, high rate of traffic violations, and its unique no-fault insurance system for personal injury protection.

In contrast, states like Ohio and Montana benefit from lower insurance rates due to their more rural landscapes, lower rates of traffic violations, and a lower cost of living. These states also tend to have fewer severe weather events, which further reduces the risk profile and keeps insurance rates down.

The Influence of Regulatory and Legal Environments

The regulatory and legal environments of each state also significantly impact insurance rates. For example, New York's high insurance rates are partly due to its strict insurance laws, which include high mandatory liability limits and additional coverage requirements. Florida's rates are influenced by its no-fault insurance system, which mandates personal injury protection coverage for all drivers.

On the other hand, states like Illinois and Ohio have more moderate insurance rates due to their less stringent insurance regulations. These states often have lower mandatory liability limits and fewer additional coverage requirements, which can help keep insurance rates more affordable.

Understanding Regional Variations

Regional variations in insurance rates also provide insights into the diverse landscape of automotive insurance in the U.S. For instance, states in the Northeast, such as New York and Massachusetts, often have higher insurance rates due to their dense urban areas and strict insurance laws. In contrast, states in the Midwest and South, such as Ohio and Alabama, tend to have lower insurance rates, influenced by their more rural landscapes and less stringent insurance regulations.

Furthermore, states with a high incidence of natural disasters, such as hurricanes in Florida or earthquakes in California, often have higher insurance rates due to the increased risk of claims in these regions. These regional variations highlight the complex interplay of various factors that influence insurance rates across the country.

Future Implications and Industry Insights

As we navigate the evolving landscape of automotive insurance, several key trends and insights emerge that are shaping the future of this industry. These insights offer a glimpse into how insurance rates may evolve and the strategies that insurance providers and consumers can adopt to navigate these changes effectively.

The Impact of Technological Advancements

Technological advancements are revolutionizing the automotive insurance industry, offering new tools for risk assessment and policy customization. Telematics and usage-based insurance (UBI) programs, which track driving behavior and offer real-time feedback to drivers, are becoming increasingly popular. These programs provide insurance companies with more accurate data on individual driving habits, allowing for more precise risk assessments and potentially lower insurance rates for safe drivers.

Additionally, the integration of artificial intelligence and machine learning algorithms is enhancing the accuracy of claims processing and fraud detection, leading to more efficient and cost-effective operations for insurance providers. These technological advancements are expected to drive down insurance rates over time as they improve the overall efficiency and accuracy of the insurance process.

The Role of Data Analytics and Personalization

Data analytics is playing an increasingly significant role in the automotive insurance industry. Insurance companies are leveraging advanced analytics tools to gain deeper insights into risk factors and tailor insurance policies to individual drivers. By analyzing vast amounts of data, insurance providers can identify patterns and correlations that were previously hidden, enabling them to offer more personalized insurance products and potentially lower rates for specific demographics or driving behaviors.

Personalization in insurance is expected to become even more prevalent in the future. Insurance providers will continue to refine their algorithms and data models to offer policies that are tailored to the unique needs and risk profiles of individual drivers. This shift towards personalized insurance products is likely to result in more equitable insurance rates, as rates will be based on individual driving behavior and risk factors rather than broad demographic categories.

The Rise of Insurtech and Digital Insurance Platforms

The rise of Insurtech, or insurance technology startups, is disrupting the traditional insurance landscape. These innovative companies are leveraging technology to offer more efficient, transparent, and customer-centric insurance products. Digital insurance platforms, for instance, are making it easier for consumers to compare insurance rates and coverage options, empowering them to make more informed decisions about their automotive insurance.

Insurtech companies are also challenging traditional insurance models by offering unique insurance products, such as pay-as-you-drive or per-mile insurance, which can be more affordable for certain types of drivers. As these companies continue to innovate and gain market share, they are expected to drive competition and potentially lower insurance rates across the industry.

The Importance of Consumer Education and Awareness

In an era of increasing insurance complexity and diversity of insurance products, consumer education and awareness are more important than ever. Consumers need to be well-informed about the factors that influence insurance rates and the coverage options available to them. This knowledge empowers consumers to make more strategic decisions about their insurance coverage, potentially saving them money and ensuring they have the right coverage for their needs.

Insurance providers and regulatory bodies also play a crucial role in consumer education. By providing clear and accessible information about insurance products, rates, and coverage options, they can help consumers make more informed choices. Additionally, initiatives to improve financial literacy around insurance can help consumers understand the value of insurance and the importance of maintaining adequate coverage.

FAQ

What are the main factors that influence car insurance rates across different states?

+A multitude of factors influence car insurance rates across states, including demographic characteristics, driving behavior, regulatory environments, cost of living, historical claim data, and regional differences. These factors collectively shape the insurance landscape and determine the cost of automotive insurance coverage.

How do regulatory environments impact car insurance rates in different states?

+Regulatory environments significantly impact car insurance rates. States with more stringent insurance laws, such as higher mandatory liability limits or additional coverage requirements, often have higher insurance rates. Conversely, states with less stringent regulations may have more affordable insurance rates.

What role does the cost of living play in state-by-state car insurance rates?

+The cost of living in a state can influence car insurance rates. States with a higher cost of living often have higher insurance rates, as the cost to repair or replace a vehicle is typically higher in these areas. This is due to the higher cost of labor and auto repair services in these regions.

How do technological advancements impact car insurance rates and the industry as a whole?

+Technological advancements, such as telematics and usage-based insurance programs, are revolutionizing the automotive insurance industry. These advancements provide insurance companies with more accurate data on individual driving habits, allowing for more precise risk assessments. Over time, this is expected to drive down insurance rates for safe drivers.

What is the role of data analytics in shaping the future of car insurance rates and coverage options?

+Data analytics is playing an increasingly significant role in the automotive insurance industry. By analyzing vast amounts of data, insurance providers can gain deeper insights into risk factors and tailor insurance policies to individual drivers. This shift towards personalized insurance products is expected to result in more equitable insurance rates and better coverage options for consumers.