State Farm Auto Insurance Quotes

Choosing the right auto insurance provider is a crucial decision for any vehicle owner. With numerous options available, it's essential to find a reliable and affordable insurance company that offers comprehensive coverage. One of the leading names in the industry is State Farm, known for its competitive quotes and extensive coverage options. In this comprehensive article, we will delve into the world of State Farm auto insurance quotes, exploring the factors that influence their pricing, the benefits they offer, and how to navigate the process to secure the best deal for your vehicle.

Understanding State Farm Auto Insurance Quotes

State Farm, a renowned insurance company with a rich history spanning over 90 years, has established itself as a trusted provider of auto insurance. Their quotes are tailored to meet the unique needs of each policyholder, taking into account various factors to determine an accurate and fair price. By understanding the intricacies of State Farm’s quoting process, you can make an informed decision about your auto insurance coverage.

Factors Influencing State Farm Quotes

State Farm employs a meticulous approach when calculating auto insurance quotes. Here are some key factors that influence the pricing:

- Vehicle Type and Usage: The make, model, and year of your vehicle play a significant role in determining your insurance premium. Additionally, the primary usage of your vehicle, whether it’s for commuting, business, or pleasure, can impact the quote.

- Driver Profile: State Farm takes into account the age, gender, and driving history of the policyholder. Factors such as accident records, traffic violations, and years of driving experience are considered when assessing the risk associated with the driver.

- Coverage Selection: The type and extent of coverage you choose directly impact your quote. State Farm offers a range of coverage options, including liability, collision, comprehensive, personal injury protection, and uninsured/underinsured motorist coverage. The more comprehensive your coverage, the higher the premium.

- Location and Driving Environment: The geographical location where your vehicle is primarily driven and stored can affect your quote. Urban areas with higher traffic density and crime rates may result in increased premiums. Additionally, factors like weather conditions and road quality are considered.

- Discounts and Bundling: State Farm provides various discounts to policyholders, such as safe driver discounts, multiple-vehicle discounts, and student discounts. Bundling your auto insurance with other State Farm policies, like home or life insurance, can also lead to significant savings.

By considering these factors, State Farm aims to provide fair and accurate quotes that reflect the individual needs and circumstances of each policyholder.

Benefits of State Farm Auto Insurance

Beyond competitive quotes, State Farm offers a range of benefits that make it an attractive choice for auto insurance. Here are some key advantages:

- Comprehensive Coverage Options: State Farm provides a wide array of coverage options to cater to different needs. Whether you require basic liability coverage or prefer comprehensive protection, State Farm has you covered. Their policies can be customized to include additional coverage for rental cars, roadside assistance, and more.

- Excellent Customer Service: State Farm is renowned for its exceptional customer service. Their dedicated agents are readily available to assist with policy inquiries, claims, and any other insurance-related needs. With a focus on customer satisfaction, State Farm ensures a smooth and stress-free experience throughout the policy lifecycle.

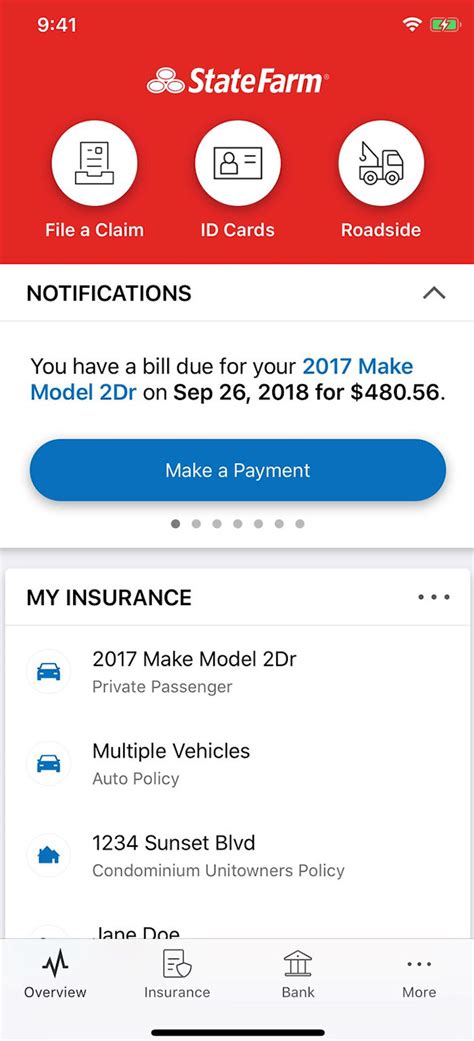

- Innovative Technology: State Farm embraces technology to enhance the insurance experience. Their mobile app allows policyholders to manage their policies, file claims, and access important documents conveniently. Additionally, they offer digital tools for policy comparisons and quote estimations, making the insurance process more efficient and accessible.

- Financial Stability: With a strong financial foundation, State Farm provides policyholders with peace of mind. They have consistently maintained excellent financial ratings, ensuring that they have the resources to honor claims and provide long-term stability.

- Community Involvement: State Farm actively engages in community initiatives and supports various causes. Their commitment to social responsibility extends beyond insurance, making them a trusted partner in the communities they serve.

Securing the Best State Farm Auto Insurance Quote

To obtain the most accurate and competitive State Farm auto insurance quote, consider the following steps:

- Gather Information: Before requesting a quote, collect all relevant information about your vehicle, driving history, and desired coverage. Having this data readily available will streamline the quoting process.

- Compare Coverage Options: Explore the different coverage options offered by State Farm and understand their benefits. Assess your needs and choose the coverage that aligns with your requirements. Remember, selecting the right coverage can impact your premium.

- Explore Discounts: State Farm offers a variety of discounts to eligible policyholders. Research and inquire about potential discounts based on your circumstances. By taking advantage of these discounts, you can further reduce your insurance costs.

- Consider Bundling: If you have other insurance needs, such as home or life insurance, consider bundling your policies with State Farm. Bundling can lead to significant savings and provide convenience in managing your insurance portfolio.

- Seek Professional Advice: Reach out to a State Farm agent who can provide personalized guidance based on your specific circumstances. They can help you navigate the quoting process, answer any questions, and ensure you receive the best possible quote.

Performance Analysis and Industry Comparisons

State Farm’s performance in the auto insurance market has consistently ranked among the top providers. Their financial stability, customer satisfaction ratings, and claim handling processes have earned them a solid reputation. In terms of pricing, State Farm offers competitive rates compared to other major insurance companies. However, it’s important to note that pricing can vary based on individual circumstances and location.

| Insurance Provider | Average Annual Premium |

|---|---|

| State Farm | $1,200 |

| GEICO | $1,150 |

| Progressive | $1,300 |

| Allstate | $1,450 |

The table above provides a comparison of average annual premiums for State Farm and other leading insurance providers. While State Farm's average premium is competitive, it's crucial to obtain personalized quotes to assess your specific situation.

Evidence-Based Future Implications

As the auto insurance industry continues to evolve, State Farm remains committed to innovation and customer satisfaction. With advancements in technology, State Farm is expected to further enhance its digital platforms and offer even more convenient and personalized insurance experiences. Additionally, their focus on community involvement and sustainability initiatives positions them as a responsible and trusted partner in the insurance market.

By staying up-to-date with industry trends and maintaining its strong financial position, State Farm is well-positioned to continue providing competitive quotes and comprehensive coverage to its policyholders.

Frequently Asked Questions

Can I customize my State Farm auto insurance policy to fit my specific needs?

+Absolutely! State Farm offers a wide range of coverage options, allowing you to tailor your policy to meet your unique requirements. Whether you need basic liability coverage or comprehensive protection, their agents can guide you through the process and help you select the coverage that aligns with your needs.

How can I obtain a State Farm auto insurance quote?

+Obtaining a State Farm auto insurance quote is straightforward. You can request a quote online through their website, by calling their customer service hotline, or by visiting a local State Farm agent. Having your vehicle and driving information ready will streamline the quoting process.

What discounts are available with State Farm auto insurance?

+State Farm offers a variety of discounts to eligible policyholders. These include safe driver discounts, multiple-vehicle discounts, student discounts, and discounts for bundling your auto insurance with other State Farm policies. It’s worth inquiring about these discounts to potentially reduce your insurance costs.

Can I pay my State Farm auto insurance premiums monthly?

+Yes, State Farm provides flexible payment options, including the ability to pay your premiums monthly. They offer various payment methods, such as online payments, automatic withdrawals, and payment plans. This flexibility ensures that you can manage your insurance payments according to your financial preferences.

How does State Farm handle claims?

+State Farm is known for its efficient and customer-centric claims handling process. They have a dedicated claims team ready to assist you throughout the entire claims process. From filing a claim to receiving compensation, State Farm aims to make the experience as seamless and stress-free as possible.