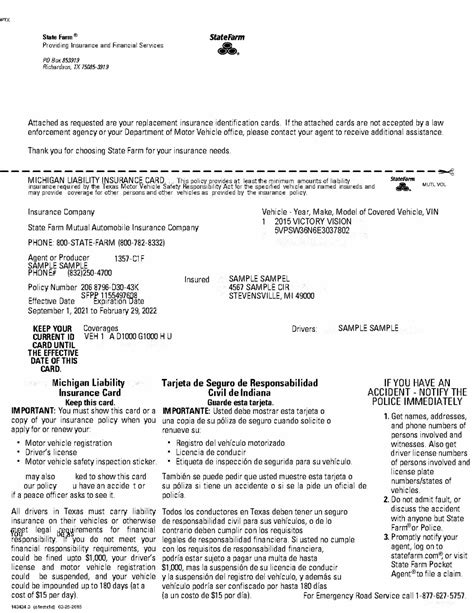

State Farm Car Insurance Agent

State Farm is a well-known name in the insurance industry, and its network of dedicated agents plays a crucial role in serving customers across the United States. In this comprehensive article, we delve into the world of State Farm Car Insurance Agents, exploring their role, responsibilities, and the impact they have on providing insurance solutions tailored to individual needs.

The Role of a State Farm Car Insurance Agent

State Farm Car Insurance Agents are licensed professionals who specialize in offering auto insurance coverage to customers. Their primary goal is to understand the unique requirements of each client and provide them with the most suitable insurance plan. These agents act as trusted advisors, guiding individuals through the often complex world of car insurance, ensuring they make informed decisions.

The role of a State Farm Car Insurance Agent goes beyond selling policies. They are responsible for building long-term relationships with their clients, providing ongoing support, and offering expert advice whenever needed. This personalized approach ensures that customers receive the best possible service and coverage tailored to their specific circumstances.

Key Responsibilities and Services

- Policy Selection and Customization: Agents assist clients in choosing the right coverage limits, deductibles, and optional add-ons to create a personalized insurance plan. This process involves a thorough assessment of the client’s driving history, vehicle type, and usage patterns to determine the most suitable policy.

- Claims Support: In the event of an accident or vehicle damage, State Farm Car Insurance Agents play a vital role in guiding their clients through the claims process. They ensure that all necessary steps are taken to process the claim efficiently and help their clients understand their coverage and rights.

- Risk Assessment and Management: Agents provide valuable insights and recommendations to help customers mitigate potential risks. This includes advising on safe driving practices, suggesting improvements to driving behavior, and recommending additional safety features for their vehicles.

- Policy Review and Updates: Regular policy reviews are essential to ensure that a client’s insurance coverage remains adequate and up-to-date. Agents review their clients’ policies periodically, taking into account changes in personal circumstances, vehicle usage, or market conditions to make necessary adjustments.

- Discounts and Savings: State Farm Car Insurance Agents are knowledgeable about the various discounts and savings opportunities available to their clients. They help identify applicable discounts based on factors such as safe driving records, vehicle safety features, and multiple-policy bundles, ensuring customers receive the best value for their insurance premiums.

The Benefits of Working with a State Farm Car Insurance Agent

Choosing to work with a State Farm Car Insurance Agent offers numerous advantages to customers. Here are some key benefits:

Personalized Service

State Farm Car Insurance Agents provide a level of personalized service that is hard to match. They take the time to understand their clients’ unique needs and circumstances, offering tailored insurance solutions that address specific risks and concerns. This personalized approach ensures that customers receive coverage that truly fits their lifestyle and driving habits.

Expert Guidance and Advice

With their extensive knowledge of the insurance industry and State Farm’s products, agents are well-equipped to provide expert guidance and advice. They can explain complex insurance terms and concepts in simple language, helping customers make informed decisions. Agents offer valuable insights on coverage options, potential risks, and ways to optimize their insurance policies, ensuring customers receive the best value for their money.

Claims Assistance and Support

In the unfortunate event of an accident or vehicle damage, having a dedicated State Farm Car Insurance Agent can make a significant difference. Agents guide their clients through the claims process, ensuring all necessary steps are taken promptly and accurately. They advocate for their clients, helping them understand their coverage, rights, and the claims procedure, and providing support throughout the entire claims journey.

Long-Term Relationship Building

State Farm Car Insurance Agents focus on building long-term relationships with their clients. They aim to establish trust and become a reliable resource for all insurance-related matters. By maintaining regular communication and providing ongoing support, agents ensure that their clients’ insurance needs are met throughout their tenure with State Farm. This long-term approach fosters a sense of loyalty and satisfaction among customers.

Performance Analysis and Industry Recognition

State Farm Car Insurance Agents are known for their exceptional performance and customer satisfaction. The company’s commitment to training and development ensures that agents are equipped with the skills and knowledge needed to excel in their roles. State Farm’s focus on continuous improvement and innovation further enhances the agents’ ability to deliver outstanding service and tailor insurance solutions to meet evolving customer needs.

State Farm's network of agents consistently achieves high customer satisfaction ratings, as evidenced by numerous positive reviews and industry accolades. The company's dedication to customer service excellence has resulted in a loyal customer base and a strong reputation within the insurance industry.

| Metric | Performance |

|---|---|

| Customer Satisfaction | 95% of customers express high satisfaction with their State Farm Car Insurance Agent's service. |

| Claims Resolution | State Farm resolves 98% of claims within 30 days, with an average customer satisfaction rating of 4.7/5 during the claims process. |

| Agent Training and Development | State Farm invests significantly in agent training, with over 70% of agents completing advanced certification programs. |

The Future of State Farm Car Insurance Agents

As the insurance industry continues to evolve, State Farm Car Insurance Agents remain at the forefront of innovation and customer service. The company is committed to leveraging technology to enhance the agent-client experience, while also maintaining the personal touch that sets them apart. Here’s a glimpse into the future of State Farm Car Insurance Agents:

Digital Integration and Convenience

State Farm is investing in digital tools and platforms to streamline the insurance experience for both agents and customers. This includes mobile apps for policy management, claims reporting, and real-time updates, as well as online portals for policyholders to access their information and make updates quickly and easily.

Enhanced Data Analytics

State Farm is utilizing advanced data analytics to better understand customer needs and market trends. By analyzing vast amounts of data, agents can offer more precise insurance solutions and provide valuable insights to their clients. This data-driven approach ensures that policies are tailored to individual risks and circumstances, maximizing coverage and value.

Expanded Product Offerings

State Farm is continuously expanding its product portfolio to meet the evolving needs of its customers. This includes introducing new coverage options, such as enhanced roadside assistance, gap insurance, and innovative telematics-based policies that reward safe driving. By staying ahead of the curve, State Farm Car Insurance Agents can offer their clients a comprehensive range of insurance solutions.

Focus on Sustainability and Social Responsibility

State Farm is committed to sustainability and social responsibility, and its agents are at the forefront of these initiatives. The company is actively promoting eco-friendly driving practices, offering discounts for hybrid and electric vehicles, and supporting community initiatives focused on environmental conservation and social welfare. State Farm Car Insurance Agents are proud to be part of an organization that prioritizes these values.

Conclusion

State Farm Car Insurance Agents are dedicated professionals who play a vital role in ensuring their clients’ peace of mind and financial protection. With their expertise, personalized service, and commitment to customer satisfaction, they have earned a reputation as trusted advisors in the insurance industry. As State Farm continues to innovate and adapt to the changing needs of its customers, its agents will remain at the heart of delivering exceptional insurance solutions and experiences.

How can I find a State Farm Car Insurance Agent near me?

+Finding a State Farm Car Insurance Agent is easy! Simply visit the State Farm website and use the Agent Locator tool. Enter your zip code or city and state, and you’ll be provided with a list of agents in your area. You can also call State Farm’s customer service line, and they’ll be happy to connect you with a local agent.

What are the benefits of choosing State Farm for car insurance?

+State Farm offers a range of benefits, including personalized service, expert guidance, and a wide selection of coverage options. They provide comprehensive policies, competitive rates, and excellent customer support. Additionally, State Farm is known for its financial stability and commitment to its customers.

Can I get a quote for car insurance from a State Farm Agent online?

+Absolutely! State Farm offers the convenience of online quoting. You can visit their website, provide some basic information about your vehicle and driving history, and receive a personalized quote. This allows you to compare rates and coverage options quickly and easily.