State Farm Insurance Print Insurance Card

In today's digital age, many insurance companies offer convenient online platforms and mobile apps, allowing policyholders to access and manage their insurance information easily. Despite this, the physical insurance card still holds significant value and importance, especially in the automotive and property insurance sectors. This article explores the significance of insurance cards, with a focus on State Farm's approach to providing print insurance cards, and delves into the process, benefits, and best practices associated with obtaining and utilizing these cards.

The Significance of Insurance Cards

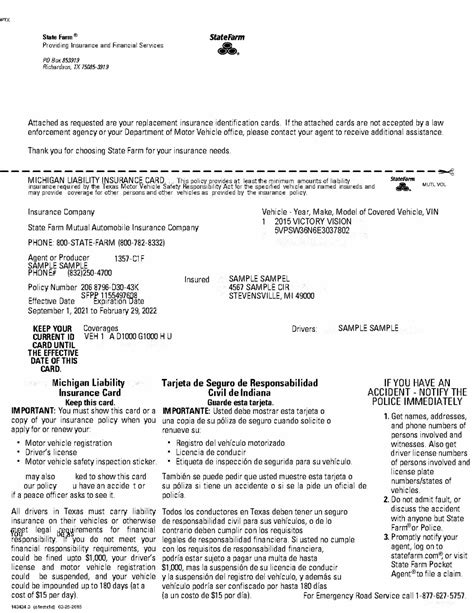

Insurance cards, often referred to as ID cards, serve as tangible proof of insurance coverage. They contain crucial information such as the policyholder’s name, policy number, effective dates, and details about the insured vehicle or property. These cards are essential in various situations, particularly when dealing with law enforcement, rental car agencies, or in the event of an accident or property damage.

In the United States, proof of insurance is a legal requirement for driving. Insurance cards play a vital role in ensuring compliance with state laws and providing peace of mind to policyholders. They offer a quick and accessible way to verify coverage, reducing potential liabilities and ensuring that individuals are protected in the event of an accident or unforeseen circumstances.

State Farm’s Print Insurance Card Service

State Farm, one of the leading insurance providers in the United States, understands the importance of insurance cards and offers a convenient service to its policyholders: the ability to print insurance cards directly from their online account.

State Farm's online platform, accessible through their official website, provides a user-friendly interface for policyholders to manage their insurance policies. One of the key features of this platform is the option to print insurance cards. Policyholders can log in to their account, navigate to the relevant section, and with just a few clicks, generate a print-ready insurance card.

The Process of Printing an Insurance Card

-

Account Login: Policyholders start by logging into their State Farm online account. This can be done via the State Farm website or through the State Farm mobile app.

-

Account Dashboard: Once logged in, the user is directed to their personalized dashboard, where they can view their active policies and manage various aspects of their insurance.

-

Policy Selection: Users then select the specific policy for which they need to print an insurance card. This could be an auto insurance policy, home insurance, or any other relevant coverage.

-

Print Option: State Farm provides a clear and prominent “Print Insurance Card” button or link on the policy page. Clicking on this option opens a new window or tab with the print-ready insurance card.

-

Card Preview: Before printing, policyholders can preview the insurance card to ensure all details are accurate and up-to-date. This step allows for a quick check of information such as policy numbers, effective dates, and insured vehicle or property details.

-

Printing: With the preview confirmed, users can proceed to print the insurance card. State Farm provides instructions on the optimal paper size and printer settings for the best print quality.

-

Storage: Once printed, it is advisable to store the insurance card in a safe and accessible location. This could be in the glove compartment of a vehicle, a wallet, or a dedicated insurance folder.

Benefits of State Farm’s Print Insurance Card Service

-

Convenience: Policyholders can print insurance cards from the comfort of their homes or offices, eliminating the need for physical visits to insurance offices or agents.

-

Accessibility: The online platform is accessible 24⁄7, allowing policyholders to print insurance cards at their convenience, whether it’s during regular business hours or late at night.

-

Quick Turnaround: The entire process, from logging into the account to printing the insurance card, can be completed in a matter of minutes, providing policyholders with immediate access to their proof of insurance.

-

Accuracy: By generating insurance cards directly from their online account, policyholders can ensure that the information is accurate and up-to-date. This is especially important when policy details or coverage limits change.

-

Cost-Effectiveness: State Farm’s print insurance card service is typically provided free of charge, saving policyholders the expense of ordering physical cards or paying for expedited delivery.

Best Practices for Utilizing Print Insurance Cards

-

Regular Updates: It is essential to print new insurance cards whenever there are changes to your policy, such as a renewal, addition of a new vehicle or driver, or any other updates to your coverage.

-

Multiple Copies: Consider printing multiple copies of your insurance card and storing them in different locations. This ensures that you always have a backup readily available, especially in emergency situations.

-

Digital Storage: In addition to physical cards, it is advisable to save a digital copy of your insurance card on your smartphone or computer. This can be easily accessed and displayed when needed, such as during online vehicle registration or when providing proof of insurance to rental car agencies.

-

Verification: Before relying on a printed insurance card, always verify its accuracy by comparing it with your policy documents or by contacting State Farm’s customer service. This ensures that you have the correct and valid insurance card.

-

Replacement: In case of loss or damage to your printed insurance card, simply log back into your State Farm online account and reprint a new one. This ensures that you always have a valid and up-to-date proof of insurance.

The Future of Insurance Cards

While print insurance cards remain a crucial component of the insurance industry, there is a growing trend towards digital solutions. Many insurance companies, including State Farm, are exploring innovative ways to provide digital proof of insurance, such as through mobile apps or digital wallets.

The development of digital insurance cards offers several advantages, including instant accessibility, reduced reliance on physical documents, and the ability to integrate with other digital services and platforms. However, it is important to note that digital solutions should not replace the need for physical insurance cards entirely, especially in regions where digital infrastructure is less developed or where internet connectivity is unreliable.

State Farm's approach to providing print insurance cards demonstrates their commitment to offering convenient and accessible services to their policyholders. By leveraging digital technology while maintaining the importance of physical proof of insurance, State Farm ensures that their customers have the necessary tools to comply with legal requirements and protect themselves in various situations.

Conclusion

Insurance cards, whether printed or digital, play a critical role in the insurance industry. They provide tangible proof of coverage, ensuring compliance with legal obligations and offering peace of mind to policyholders. State Farm’s print insurance card service exemplifies their customer-centric approach, making it convenient and efficient for policyholders to obtain and manage their proof of insurance.

As the insurance industry continues to evolve, the balance between digital innovation and traditional physical documents will remain a key consideration. By staying informed about the latest developments and best practices, policyholders can ensure they are prepared for any situation, whether it's pulling out a printed insurance card or displaying a digital version on their smartphone.

How often should I update my insurance card?

+It is recommended to update your insurance card whenever there are changes to your policy, such as renewals, additions of new vehicles or drivers, or any other updates to your coverage. Regularly checking and updating your insurance card ensures that you always have accurate and up-to-date proof of insurance.

Can I use a digital copy of my insurance card instead of a printed one?

+While a digital copy of your insurance card can be convenient and easily accessible, it is always a good idea to have a physical copy as well. Digital copies may not be accepted in all situations, especially in regions with limited digital infrastructure or unreliable internet connectivity. Having a printed insurance card provides an extra layer of assurance and ensures compliance with legal requirements.

What should I do if my printed insurance card is lost or damaged?

+If your printed insurance card is lost or damaged, you can easily reprint a new one by logging into your State Farm online account. Simply navigate to the policy page, select the “Print Insurance Card” option, and follow the steps to generate a new print-ready card. This ensures that you always have a valid and up-to-date proof of insurance.