State Farm Life Insurance Prices

Life insurance is an essential aspect of financial planning, providing peace of mind and security for individuals and their families. When it comes to choosing a life insurance provider, State Farm is a well-known and trusted name in the industry. State Farm offers a range of life insurance policies tailored to meet different needs and budgets. In this comprehensive guide, we will delve into the State Farm life insurance prices, exploring the various factors that influence the cost of their policies, and provide you with the insights you need to make an informed decision.

Understanding State Farm Life Insurance Prices

State Farm life insurance prices are influenced by several key factors, each playing a crucial role in determining the overall cost of your policy. By understanding these factors, you can better assess the value and affordability of State Farm’s life insurance offerings.

Policy Type and Coverage Amount

The type of life insurance policy you choose significantly impacts the price. State Farm offers a variety of policy types, including term life insurance and permanent life insurance options such as whole life and universal life insurance. Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years, and is generally more affordable than permanent policies. On the other hand, permanent life insurance offers lifelong coverage and builds cash value over time, making it a more comprehensive and potentially more expensive option.

Additionally, the coverage amount you select will directly affect the price. Higher coverage amounts provide greater financial protection but also result in higher premiums. It’s important to carefully consider your financial needs and goals when determining the appropriate coverage amount to ensure you have adequate protection without overspending.

Age and Health Factors

Your age and health are significant determinants of life insurance prices. Generally, younger individuals are offered lower premiums as they pose a lower risk to insurance companies. As you age, the cost of life insurance tends to increase, reflecting the higher likelihood of health issues and mortality.

State Farm considers your overall health when calculating premiums. Individuals with excellent health and no pre-existing conditions may qualify for preferred rates, while those with health complications or risky lifestyles may face higher premiums or even be declined coverage. It’s crucial to be honest and transparent about your health status during the application process to avoid any surprises later on.

Lifestyle and Risk Factors

State Farm assesses various lifestyle and risk factors when determining life insurance prices. These factors include your occupation, hobbies, and participation in high-risk activities. For example, individuals with hazardous jobs, such as firefighters or pilots, may face higher premiums due to the increased risk associated with their professions.

Additionally, certain hobbies or activities, such as skydiving or extreme sports, can also impact your insurance rates. State Farm takes these factors into account to accurately assess the level of risk you present and determine an appropriate premium. It’s important to provide accurate information about your lifestyle and risk factors to ensure fair pricing.

Policy Riders and Additional Benefits

State Farm offers a range of policy riders and additional benefits that can enhance your life insurance coverage. These optional features, such as accelerated death benefits or waiver of premium riders, can provide added protection and flexibility. However, these riders typically come at an additional cost, so it’s essential to carefully evaluate your needs and budget before opting for them.

| Policy Rider | Description | Potential Cost |

|---|---|---|

| Accidental Death Benefit | Provides an additional payout if death occurs due to an accident. | Varies based on coverage amount and policy type. |

| Waiver of Premium | Waives premium payments if you become disabled. | Varies depending on policy and disability criteria. |

| Terminal Illness Rider | Allows for an early payout if diagnosed with a terminal illness. | Dependent on coverage amount and policy type. |

State Farm Life Insurance Policy Options and Costs

State Farm provides a comprehensive range of life insurance policies to cater to different individual needs and preferences. Let’s explore some of their popular policy options and their associated costs.

Term Life Insurance

Term life insurance is a cost-effective option that provides coverage for a specific period, typically ranging from 10 to 30 years. It is ideal for individuals seeking temporary financial protection for their loved ones during their working years. State Farm offers term life insurance policies with various coverage amounts and term lengths.

The cost of term life insurance depends on several factors, including your age, health, and the chosen coverage amount. For example, a healthy 30-year-old male seeking a 500,000 coverage policy for a 20-year term may expect to pay an annual premium of approximately 250 to $300. However, these prices can vary based on individual circumstances and the chosen term length.

Permanent Life Insurance: Whole Life and Universal Life

Permanent life insurance policies, such as whole life and universal life insurance, provide lifelong coverage and build cash value over time. These policies offer more comprehensive protection and can be an excellent choice for individuals seeking long-term financial security and estate planning.

The cost of permanent life insurance policies is generally higher than term life insurance due to the lifelong coverage and cash value accumulation. For instance, a 40-year-old female opting for a 1,000,000 whole life insurance policy may pay an annual premium of around 2,000 to $3,000. Universal life insurance policies offer more flexibility in terms of premium payments and coverage amounts, making them a suitable option for those seeking customizable life insurance plans.

Group Life Insurance

State Farm also offers group life insurance policies, typically provided through employers or professional organizations. Group life insurance policies are often more affordable than individual policies due to the larger pool of participants and the reduced administrative costs.

The cost of group life insurance policies varies based on the terms and conditions set by the employer or organization. Employees may have the option to purchase additional coverage beyond the basic group policy, which can result in higher premiums. It’s essential to review the specific details of your group life insurance policy to understand the coverage and costs involved.

Performance and Reputation of State Farm Life Insurance

State Farm is a well-established and highly regarded insurance provider with a strong track record in the life insurance industry. Their commitment to customer satisfaction and financial stability has earned them a solid reputation over the years.

State Farm’s life insurance policies have consistently performed well, providing reliable coverage and timely payouts to beneficiaries. The company maintains a strong financial position, with high ratings from reputable insurance rating agencies such as AM Best and Standard & Poor’s. This financial stability ensures that State Farm can honor its policy obligations and provides peace of mind to policyholders.

In addition to their financial strength, State Farm is known for its excellent customer service and claim processing efficiency. They offer a dedicated team of professionals who are readily available to assist policyholders with any inquiries or concerns they may have. State Farm’s focus on customer satisfaction has resulted in positive feedback and high customer retention rates.

Future Implications and Considerations

When considering State Farm life insurance prices, it’s important to look beyond the initial cost and assess the long-term value and flexibility of their policies. Here are some key considerations to keep in mind:

Policy Flexibility and Adjustability

State Farm offers flexible life insurance policies that can be adjusted to accommodate changing life circumstances. For instance, if your financial situation improves or your family grows, you can increase your coverage amount or add additional riders to enhance your policy’s benefits. This flexibility ensures that your life insurance coverage remains aligned with your evolving needs.

Inflation and Cost of Living Adjustments

Over time, the cost of living and inflation can impact the adequacy of your life insurance coverage. State Farm understands the importance of keeping pace with rising costs and offers options to adjust your policy to account for these factors. By periodically reviewing and updating your policy, you can ensure that your loved ones receive sufficient financial protection in the event of your untimely passing.

Long-Term Value and Return on Investment

When evaluating State Farm life insurance prices, it’s essential to consider the long-term value and return on investment. While life insurance is primarily a financial protection tool, certain types of policies, such as permanent life insurance, can also serve as investment vehicles. The cash value accumulated in these policies can be utilized for various purposes, including retirement planning or covering unexpected expenses.

State Farm’s permanent life insurance policies offer the potential for growth and financial flexibility. By carefully managing your policy and taking advantage of its investment features, you can maximize the long-term value and returns on your life insurance investment.

State Farm’s Competitive Position and Market Presence

State Farm maintains a strong competitive position in the life insurance market, offering a wide range of policy options and a solid reputation for customer satisfaction. Their extensive network of agents and customer service representatives ensures personalized support and guidance throughout the policy selection and claims process.

When comparing State Farm’s life insurance prices with those of other providers, it’s crucial to consider the overall value and benefits they offer. State Farm’s comprehensive coverage, financial stability, and customer-centric approach make them a reliable choice for individuals seeking life insurance protection.

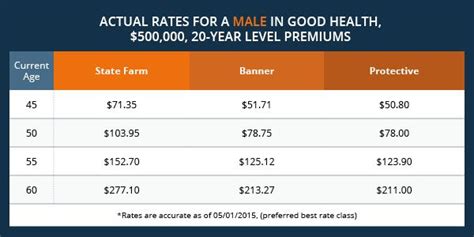

How do State Farm’s life insurance prices compare to other providers?

+

State Farm’s life insurance prices are competitive and often offer good value for money. However, it’s important to compare prices and policy features with other providers to ensure you find the best fit for your needs and budget.

Can I get a discount on State Farm life insurance premiums?

+

Yes, State Farm offers various discounts on life insurance premiums. These discounts may be available for healthy lifestyles, multiple policy purchases, or loyalty programs. It’s worth discussing potential discounts with your State Farm agent.

Are State Farm life insurance policies customizable?

+

Absolutely! State Farm understands that every individual has unique needs. Their life insurance policies can be tailored to your specific requirements, allowing you to choose coverage amounts, term lengths, and optional riders to create a personalized plan.

What happens if my health condition changes after purchasing a State Farm life insurance policy?

+

If your health condition changes significantly, it’s important to inform your State Farm agent. They can guide you through the necessary steps, which may include updating your policy or exploring alternative coverage options to ensure you have adequate protection.